Is Social Security Running Out for Baby Boomers: Is Social Security running out for Baby Boomers? That’s the big question you’ve probably seen in headlines, heard on cable news, or maybe even discussed around the dinner table. But what’s the actual story behind the buzz? Are benefits really drying up? And if so, when — and what can you do about it? In this in-depth guide, we’ll break it all down in plain English, with accurate data, official sources, and some real-talk advice you can actually use. Whether you’re already retired or just planning your exit from the workforce, this article will give you everything you need to understand where Social Security stands — and what’s next.

Table of Contents

Is Social Security Running Out for Baby Boomers

So, is Social Security running out for Baby Boomers? Not quite. The trust funds may be depleted around 2034, but the program won’t disappear — and retirees will still receive payments, albeit potentially smaller ones if Congress doesn’t act. There are multiple solutions on the table, and experts say it’s not too late to fix the problem. But while policymakers debate, your best bet is to take personal action: delay benefits, save more, diversify your income, and plan for leaner benefits just in case. Social Security has been a lifeline for millions of Americans for nearly 90 years — and with the right reforms and some smart personal planning, it’ll continue to be there for generations to come.

| Topic | Summary | Data & Stats |

|---|---|---|

| Projected Trust Fund Depletion | Social Security Trust Funds expected to run short by 2034 if no reforms are made. | Benefits could be reduced by ~20% thereafter. |

| Current Solvency | Trust funds still solvent, paying full benefits through early 2030s. | Combined OASI and DI funds deplete in 2034. |

| After Depletion | Program would rely solely on payroll tax income. | Can pay ~81% of scheduled benefits. |

| Primary Causes | Aging population, longer life spans, fewer workers per retiree. | 3 workers per retiree (down from 16 in 1950s). |

| Fixes Available | Congress can act to strengthen solvency. | Options: tax adjustments, retirement age increases, benefit changes. |

What Is Social Security and How Does It Work?

Social Security is America’s largest government benefits program. It was signed into law in 1935 during the Great Depression to serve as a safety net for workers who retired, became disabled, or died — helping ensure that older Americans and their families could live with dignity.

You pay into Social Security through payroll taxes (FICA) during your working life. In return, when you retire or become disabled, you get monthly payments based on how much you earned and how long you worked.

Here’s what’s important: Social Security was never meant to be your only income in retirement. It’s more like a foundation — something to build the rest of your financial plan on.

Why Is Social Security Running Out for Baby Boomers?

The short version? The system is spending more than it’s taking in.

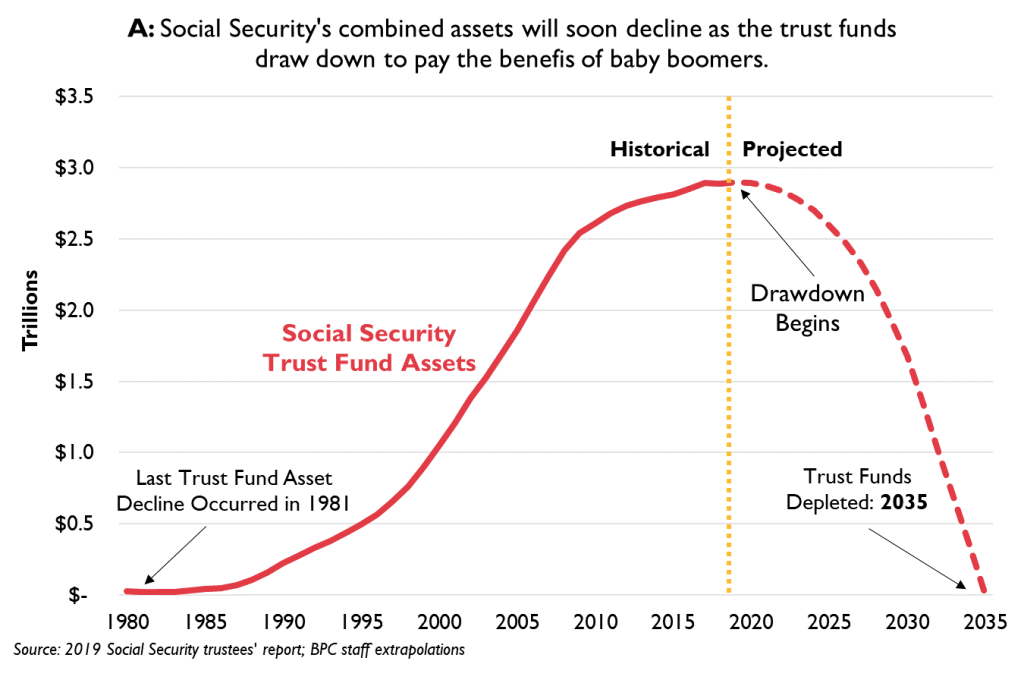

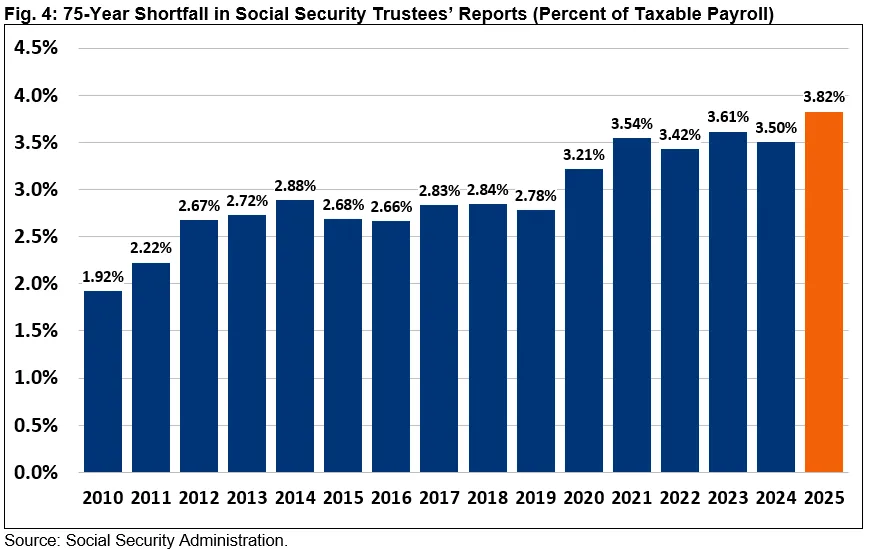

Every year, payroll taxes from workers help fund benefits for current retirees. But the amount coming in no longer covers everything going out. Since 2021, Social Security has been tapping into its trust fund reserves to make up the difference. Those reserves are what might “run out.”

According to the 2025 Social Security Trustees Report, if nothing changes:

- The Old-Age and Survivors Insurance (OASI) trust fund will be depleted in 2033.

- The combined trust funds (OASI + Disability Insurance) will be depleted in 2034.

At that point, the program will still collect payroll taxes — enough to cover roughly 81% of scheduled benefits. But unless Congress steps in, there would be an automatic across-the-board reduction of about 19%–23%.

So no, Social Security won’t disappear. But your full monthly check? That might shrink.

Why Is Is Social Security Running Out for Baby Boomers Happening?

There’s no single villain here — just a bunch of economic and demographic trends colliding at once.

1. Baby Boomers Are Retiring

Roughly 76 million Baby Boomers (those born between 1946 and 1964) are either retired or retiring soon. That’s a whole lot of people collecting benefits — and not paying into the system anymore.

2. People Are Living Longer

Life expectancy in the U.S. has increased dramatically since Social Security began. That’s good news for your birthday candles — but it also means benefits have to last longer, stretching the program thin.

3. Fewer Workers Per Retiree

Back in 1960, there were 5.1 workers supporting every Social Security beneficiary. Today, that number is down to just 2.7. By 2035, it’s projected to be 2.3. That means fewer dollars coming in per person collecting benefits.

4. Birth Rates Are Lower

Younger generations aren’t having as many kids. Lower birth rates mean a smaller future workforce, and that spells trouble for the pay-as-you-go model Social Security depends on.

What Happens If Nothing Changes?

If Congress fails to act by the time the trust funds run dry, here’s what could happen:

- Monthly benefits would be cut by up to 20%.

- Retirees would still get paid, but not the full amount promised.

- Disability and survivor benefits could also see reductions.

- The cuts would be automatic — baked into current law.

For someone receiving $2,000 per month, that’s a drop to about $1,600 — a big hit, especially for low- to middle-income retirees who rely heavily on Social Security.

How Will Is Social Security Running Out for Baby Boomers Impact Baby Boomers?

If you’re a Baby Boomer (currently aged 60–80), this will affect you differently depending on when you retire:

- Already retired? You’re probably safe for the next 8–10 years. Full benefits should continue during that time.

- Retiring around 2033–2035? You could be among the first to feel benefit reductions if Congress doesn’t act in time.

- Still working? Now’s the time to plan ahead and protect your future income.

Keep in mind, many Boomers already face financial insecurity — about 40% rely on Social Security for 90% or more of their income. So a cut could be devastating without other savings in place.

What Can Congress Do to Fix It?

Despite the dire headlines, this isn’t a doom-and-gloom story. There are multiple ways to strengthen Social Security. Congress just has to choose one (or more).

Option 1: Raise the Payroll Tax

Currently, workers and employers each pay 6.2% of wages up to $168,600 (as of 2025). Raising that rate slightly — say to 7% — could add decades of solvency.

Option 2: Lift the Tax Cap

Only income below $168,600 is taxed for Social Security. Lifting or removing that cap (so higher earners pay on all income) could generate significant revenue.

Option 3: Raise the Retirement Age

Some proposals suggest gradually increasing the full retirement age to 68 or 69 to reflect longer life expectancies. This would lower payouts over time.

Option 4: Adjust the Benefit Formula

Another idea is to reduce benefits slightly for high-income earners while protecting lower-income retirees.

Option 5: Introduce New Revenue Sources

Some experts support using alternative revenue sources (such as investment taxes or general income taxes) to supplement Social Security funding.

In fact, the last major reform to Social Security happened in 1983, under President Reagan and Speaker Tip O’Neill — a bipartisan deal that kept the system solvent for over 40 years. It’s been done before. It can be done again.

What Should You Do to Prepare?

If you’re nearing retirement or already there, here’s how you can take charge of your own future — regardless of what Congress does.

1. Don’t Count on 100% of Your Projected Benefit

The smart move? Run your retirement numbers assuming you might get only 75%–80% of what your Social Security statement says today.

2. Delay Claiming if Possible

If you wait until age 70 to start collecting benefits, your monthly check could be up to 32% higher than if you claimed at 66.

3. Save More Independently

Max out your 401(k), IRA, or Roth IRA if you can. Even small monthly contributions can add up big over time.

4. Diversify Your Retirement Income

Social Security should be one piece of your income puzzle. Consider rental income, annuities, part-time work, or dividend-paying investments.

5. Stay Informed

Social Security policy evolves slowly, but you’ll want to stay plugged into the latest discussions.

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000

Average Social Security Benefits 2026 – New Monthly Payment Amounts by Retirement Age

Social Security Payment Schedule for February 2026 and COLA Increase Explained