Social Security Payment Schedule for February 2026: that’s our topic today, and we’re going to make it clear, friendly, and trustworthy. Whether you’re a seasoned professional, new retiree, or just keeping tabs on what to expect in 2026, this article gives you the full picture of how your Social Security benefits work, what changes you’ll see in 2026, and how to plan like a pro. Straight from the Social Security Administration (SSA) and other trusted sources, this guide uses simple language, official data, and expert-level insights to ensure you know exactly when and how much you’ll get paid — and what you can do to protect your benefits.

Table of Contents

Social Security Payment Schedule for February 2026

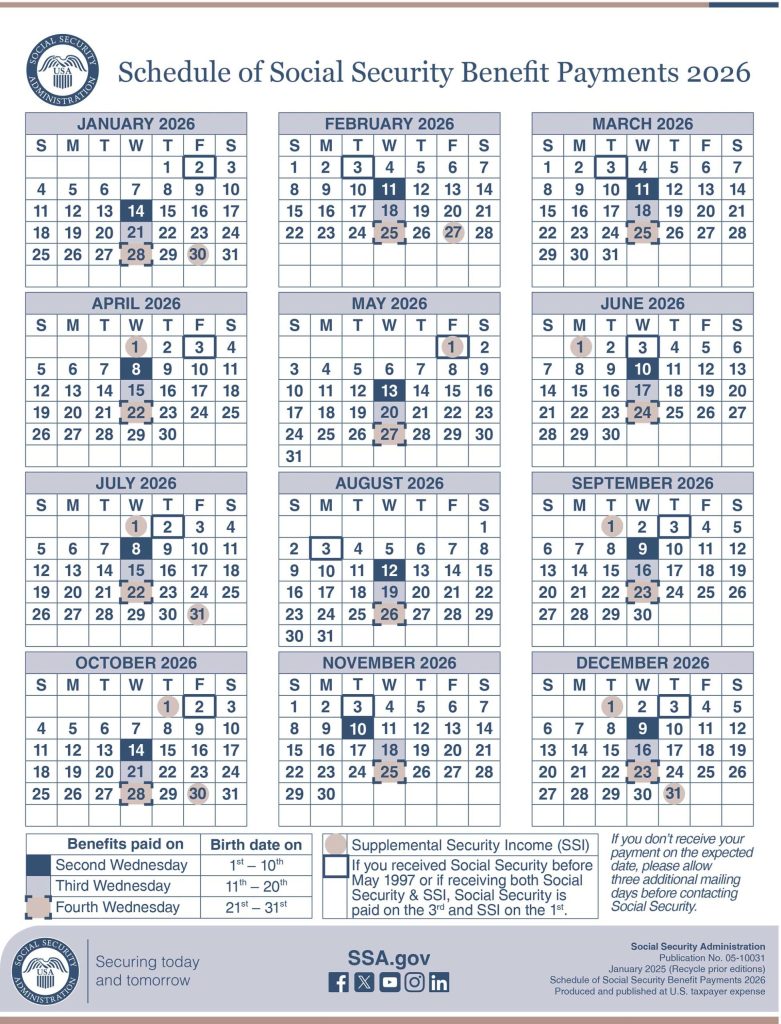

The Social Security Payment Schedule for February 2026 follows the same dependable structure: payments on the 2nd, 3rd, or 4th Wednesday based on birth dates, with SSI paid early due to the weekend. A 2.8% COLA increase brings some extra cushion, but be sure to account for Medicare premiums and possible federal or state taxes. Understanding your benefit dates, net payments, and annual changes gives you confidence and control — whether you’re managing a tight budget or planning for the long haul.

| Topic | Details & Stats |

|---|---|

| SSA Official Website | https://www.ssa.gov/ |

| February 2026 Payment Dates | Feb 11, 18, 25 based on birth date |

| SSI February Payment | Jan 30, due to Feb 1 being a Sunday |

| COLA Increase | 2.8% |

| Avg Monthly Increase | ~$56 for retirees |

| SSI Max in 2026 | $994 (individual), $1,491 (couple) |

| Medicare Part B Premium (2026) | $202.90/month |

| Taxable Wage Base (2026) | $184,500 |

| Tools & Resources | my Social Security account, SSA calculators |

Social Security Payment Schedule for February 2026

The Social Security Administration pays benefits on a specific schedule, depending on the type of benefit you receive and your birth date.

For Retirement, Disability (SSDI), and Survivor Benefits

If you receive Social Security Retirement, SSDI, or Survivor Benefits, your payment will arrive on one of the following dates based on your birthday:

- Born 1st–10th → February 11, 2026 (2nd Wednesday)

- Born 11th–20th → February 18, 2026 (3rd Wednesday)

- Born 21st–31st → February 25, 2026 (4th Wednesday)

If you started receiving benefits before May 1997, or if you get both Social Security and SSI, your benefits are paid on the 3rd of each month. For February 2026, this is Tuesday, February 3.

For SSI (Supplemental Security Income)

SSI is normally paid on the 1st of each month. However, if the 1st falls on a weekend or holiday, it is paid on the last business day before that. Since February 1, 2026 is a Sunday, SSI will be paid on Friday, January 30, 2026.

What Is the COLA and What’s Changing in 2026?

The Cost-of-Living Adjustment (COLA) ensures Social Security benefits keep up with inflation.

2026 COLA: A 2.8% Boost

The SSA announced a 2.8% COLA for 2026, which increases benefits automatically. That means:

- The average retirement benefit increases from about $2,015 to $2,071, a $56 monthly gain.

- SSI maximums rise to $994/month for individuals and $1,491/month for couples.

This adjustment helps retirees and other recipients maintain their purchasing power despite inflation, which has remained relatively high in recent years.

COLA Over the Years

Here’s how COLA has changed recently:

- 2023: 8.7% (record-breaking)

- 2024: 3.2%

- 2025: 2.5%

- 2026: 2.8%

Though smaller than 2023’s spike, the 2026 adjustment still reflects modest inflation expectations.

Benefit Types Covered by This Schedule

Here’s a breakdown of what types of benefits follow this schedule and how they differ:

1. Retirement Benefits

The standard benefit for retirees, calculated based on your 35 highest earning years. You can claim as early as 62, but full benefits kick in around age 67.

2. SSDI (Social Security Disability Insurance)

Paid to those who become disabled before retirement age and have worked enough quarters to qualify. SSDI uses the same payment schedule as retirement benefits.

3. Survivor Benefits

Paid to family members of deceased workers. Includes widows, widowers, and minor children.

4. Spousal Benefits

Eligible spouses may claim up to 50% of their partner’s full benefit amount. Payments follow the same birth-date schedule.

5. SSI (Supplemental Security Income)

Separate from Social Security, this program supports people with limited income and resources. It follows a different payment schedule (usually the 1st of the month).

How to Receive or Change Your Social Security Payment?

Most benefits are paid via direct deposit. If you haven’t signed up yet or want to change your deposit account:

- Log in to my Social Security account at ssa.gov/myaccount

- Choose “Direct Deposit”

- Update or add your bank details

If you prefer to use the Direct Express® Debit Mastercard®, benefits are automatically loaded onto your card each month.

For paper checks, note that mail delivery may delay payments by a few days. The SSA strongly encourages electronic payments for security and speed.

Medicare Premiums and Net Benefit Changes

Social Security COLA increases your gross benefit, but don’t forget: Medicare Part B premiums are deducted from your monthly check.

In 2026:

- Medicare Part B Premium: $202.90/month

- Medicare Part B Deductible: $283/year

This means your net benefit may increase by less than the COLA if Medicare costs go up at the same time — which they typically do.

Taxes and Earnings Limits

Are My Social Security Benefits Taxed?

Yes — if your income is above certain levels.

For single filers:

- $25,000–34,000 → up to 50% of your benefits taxed

- $34,000+ → up to 85% taxed

For married couples:

- $32,000–44,000 → up to 50% taxed

- $44,000+ → up to 85% taxed

This is based on combined income, which includes adjusted gross income + nontaxable interest + half of your Social Security benefits.

Earning Limits If You’re Still Working

If you’re collecting benefits before your Full Retirement Age (FRA) and still working:

- You can earn up to $22,320/year in 2026 before your benefits are reduced.

- Beyond that, $1 is withheld for every $2 earned over the limit.

In the year you reach FRA, the limit rises and the penalty drops. After FRA, there’s no earnings limit at all.

State Taxation: Are My Benefits Safe?

While the federal government may tax your benefits, most states do not. However, the following states still tax Social Security to some extent:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

Each state has different rules — some offer exemptions or income-based limits. Check your state’s tax website for specifics.

How to Appeal a Social Security Decision?

If your application was denied or your benefit calculation seems off, you can appeal:

- Reconsideration: Ask SSA to review the decision.

- Hearing: Request a hearing with an administrative law judge.

- Appeals Council Review: Further appeal if denied again.

- Federal Court: As a last resort, file a federal lawsuit.

Reporting Changes to the SSA

Keep your information up to date. You must report changes like:

- Change of address or bank

- Changes in income or resources (especially for SSI)

- Work activity (if you’re on SSDI)

- Marital status changes

Failure to report these could result in overpayment, which the SSA will recover later — sometimes aggressively.

Report changes through your my Social Security account or by calling 1‑800‑772‑1213.

Social Security February 3 Payments – Who Will Receive Benefits on This Date and Why

Social Security Paper Checks Explained – Why They Aren’t Ending Despite the Confusion

Average Social Security Benefits 2026 – New Monthly Payment Amounts by Retirement Age