Federal $2000 Relief Payment: The phrase Federal $2000 Relief Payment has been circling all over social media like wildfire. It’s popping up on TikTok feeds, sliding into inboxes, and showing up in group chats with headlines like, “$2,000 checks landing in bank accounts this week!” But hold up — before you celebrate or worry you missed something big, let’s clear the air with verified facts straight from the source. If you’re looking for truth, not rumors, this guide will walk you through:

- What’s real and what’s not about the $2000 relief payment

- Why this rumor is gaining steam

- What kind of government payments you can expect in 2026

- How to avoid scams

- Step-by-step timeline of when to file, how to claim, and what to watch for

So, let’s get into it — in plain English, from a voice you can trust.

Table of Contents

Federal $2000 Relief Payment

Let’s keep it simple and truthful: as of early 2026, there is no Federal $2000 Relief Payment on the table. No law has passed. No money is being mailed or deposited just because the internet says so. But millions of Americans will get paid through legitimate IRS processes like tax refunds and credits — some of those deposits will total around $2,000 or more. If that’s what you’re eligible for, great! Just don’t confuse it with a government giveaway.

| Topic | Fact / Status |

|---|---|

| $2000 Federal Relief Payment | Not passed or authorized by Congress |

| Stimulus Programs Active in 2026 | None confirmed at this time |

| Political Proposals (e.g., Tariff Dividend) | Discussed, but not enacted into law |

| Refunds & Credits Available | EITC, CTC, standard tax refunds for 2025 filings |

| Scam Risk | High — fake websites, emails, and messages circulating |

What Is the Federal $2000 Relief Payment Everyone’s Talking About?

Let’s start by getting this out of the way: there is currently no $2,000 federal relief payment being issued in January or February 2026. If you’re seeing blog posts or videos that say otherwise, they are either:

- Misinterpreting real IRS programs like tax refunds

- Referring to a proposal that has not become law

- Purposely trying to mislead people for clicks or scams

No press release from the IRS, U.S. Treasury, or White House has confirmed a $2,000 stimulus for the general public this year. There’s no budget approved by Congress for such a payment, and nothing on the books about sending every American a flat check.

So where is this rumor coming from?

The Root of the Rumor: Hope, Headlines, and History

You can’t blame people for hoping it’s true. After all, the memory of COVID-era stimulus checks is still fresh. Between 2020 and 2021, Americans received:

- $1,200 in April 2020 (CARES Act)

- $600 in January 2021 (Consolidated Appropriations Act)

- $1,400 in March 2021 (American Rescue Plan)

These Economic Impact Payments totaled up to $3,200 per person and were deposited directly into bank accounts. So now, anytime the economy gets bumpy or an election season rolls in, people start expecting a fourth check.

In 2025 and 2026, chatter has focused on a few proposals — most notably:

- Tariff Dividend — a suggestion from political figures to send Americans money collected from tariffs on imports

- Universal Basic Income (UBI) trials — floated by some states, not the federal government

But again, these are ideas — not policies. You won’t find a single line item in the 2026 federal budget confirming a new $2000 payment to citizens.

How Real IRS Payments Work in 2026?

Although there’s no standalone stimulus check, millions of Americans will receive money this year from the IRS — just not from a relief program.

Here’s how those funds actually get delivered:

1. Federal Tax Refunds

If you overpaid on your taxes in 2025, the IRS will send you the balance — usually within 2 to 6 weeks of filing, if you opt for direct deposit.

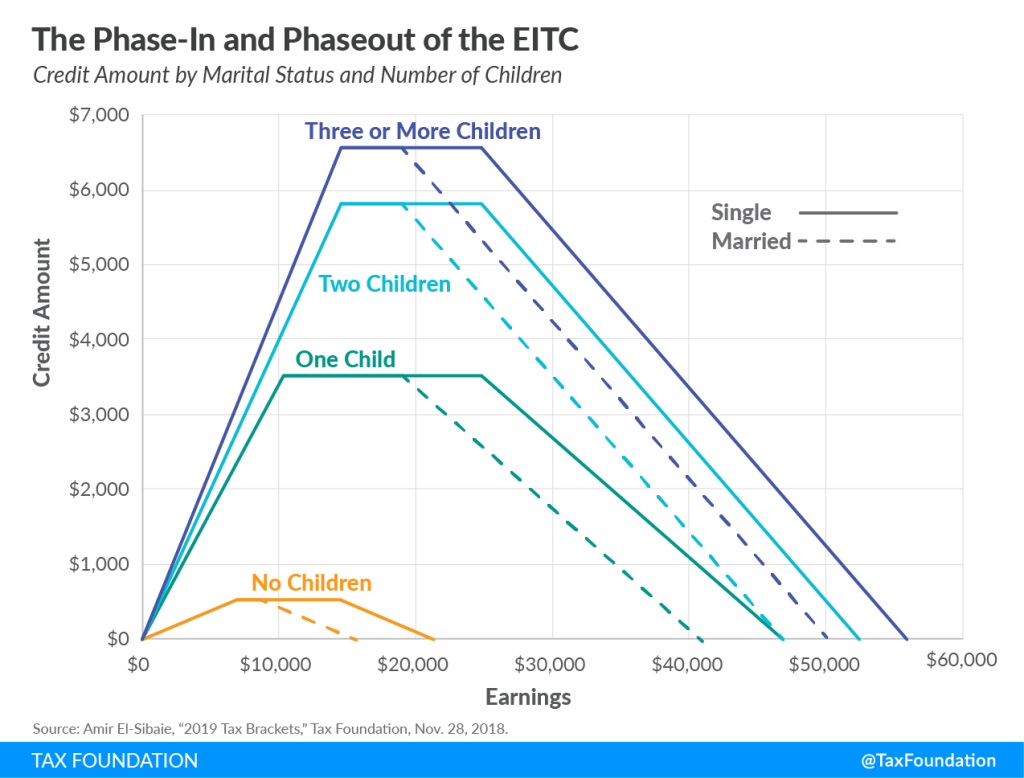

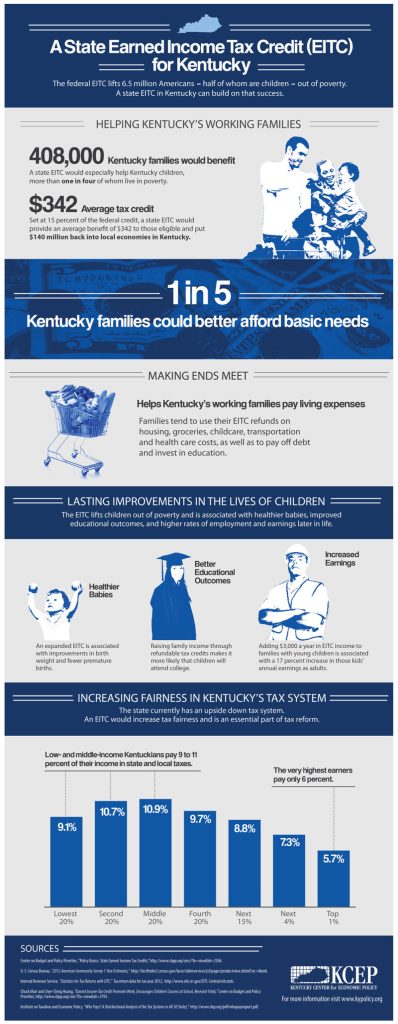

2. Earned Income Tax Credit (EITC)

Designed for low-to-moderate income earners, EITC can provide up to $7,430 for families with three or more children. The average refund is around $2,000 to $2,500 depending on income and dependents.

3. Child Tax Credit (CTC)

If you have qualifying children under 17, you may receive up to $2,000 per child, depending on your income. Portions of this may be refundable, meaning even if you owe no taxes, you can still get money back.

4. Other Refundable Credits

The American Opportunity Credit (for students), Saver’s Credit (for retirement contributions), and premium tax credits (from the ACA marketplace) all add to your potential return.

Together, these legitimate programs explain why some people may receive a deposit around $2,000 — but it’s not from a new relief program.

Step-by-Step Timeline: From Filing to Federal $2000 Relief Payment

Let’s walk through the realistic path for money showing up in your account this year:

January 2026

- IRS opens tax season in late January

- W-2s and 1099s begin arriving from employers and clients

February 2026

- Early filers start receiving refunds (especially with direct deposit)

- EITC and Additional Child Tax Credit recipients may experience delays due to fraud checks (as required by law)

March – April 2026

- Peak refund distribution

- Most returns are processed within 21 days if filed electronically

May – December 2026

- Late filers, amended returns, and manual processing cases

- Ongoing tax credit adjustments (e.g., ACA reconciliation)

Pro Tip: Use the IRS Where’s My Refund? tool on their website or via the IRS2Go app to check your refund status within 24 hours of e-filing.

Who Would Qualify if a Federal $2000 Relief Payment Became Law?

Let’s say Congress did authorize a new round of relief — here’s how eligibility usually works:

- Must have a valid Social Security number

- Must have filed a recent tax return

- Income thresholds apply — generally under $75,000 for individuals, $150,000 for couples

- Dependents may affect the total amount

- No payment to incarcerated individuals or nonresident aliens (with few exceptions)

Each round of past stimulus payments included specific rules, so no one should assume that “everyone gets it” unless the law says so.

Why Scams Are Spiking — and How to Stay Safe

Whenever there’s buzz about free government money, scammers start circling. And in 2026, they’re slicker than ever — mimicking IRS language, logos, and domains.

Here’s how to spot a scam:

- You’re asked to pay a “processing fee” to claim your payment

- A text message says “your IRS check is ready” and includes a link

- You get an email from irs-get2026@outlook.com (the IRS never uses personal email addresses)

- The website you’re directed to doesn’t end in .gov

Important: The IRS will never text, call, or email you asking for personal info without prior written communication via postal mail.

What You Can Do Now to Get the Most Money Back?

Whether it’s relief, refund, or credits — money is money. Here’s how to keep more of it in 2026:

File Early

Early filers are first in line for refunds. Plus, filing early gives you more time to fix errors and avoid ID theft.

Use Direct Deposit

It’s the fastest and safest way to get your money. The IRS deposits into three accounts max — even if you split your refund.

Double-Check for Credits

Don’t leave money on the table. Use tools like the IRS EITC Assistant or a trusted tax pro to review all options.

Avoid Filing Through Suspicious Apps

Only use trusted software brands or the IRS Free File tool (for those under certain income limits).

Social Security Stimulus Payment 2026 – First COLA-Adjusted Payment Date and Who Qualifies

$1702 Stimulus Payment 2026: Is It Really Confirmed?

$1,000 Stimulus Checks for All – 2026 Full Payment Schedule for Seniors