IRS Confirms $2,000 Direct Deposit: Let’s set the record straight: there is no confirmed $2,000 direct deposit from the IRS scheduled for February 2026. Despite the viral posts and “breaking news” headlines making the rounds on TikTok, YouTube, and social media, the IRS has not issued any official statement promising a $2,000 stimulus payment to all Americans. What’s really going on? Some folks may see around $2,000 in their tax refund this February — which is absolutely legit if they filed their taxes early and qualified for refundable tax credits. But that’s not the same as a government-wide $2,000 direct payment like the ones issued during COVID-19. Let’s break this down in plain English — with clear facts, helpful tools, and expert-backed advice that even a 10-year-old can follow. Whether you’re a student, parent, tax pro, or working-class hero, here’s what you need to know.

Table of Contents

IRS Confirms $2,000 Direct Deposit

Let’s recap this plain and simple:

- There is NO official $2,000 stimulus payment confirmed for Feb 2026

- Real payments come through tax refunds, credits like EITC/CTC, and past stimulus claims

- Always verify IRS news through official government sources

- File early, file accurately, and use Direct Deposit to get your money faster

Don’t fall for the hype. Stay informed, file smart, and secure your refund the right way.

| Topic | Details |

|---|---|

| $2,000 Direct Deposit | No official confirmation for February 2026 |

| Tax Refunds | Refunds up to or over $2,000 possible depending on credits and withholdings |

| EITC (Earned Income Tax Credit) | Refundable credit up to $7,430 for eligible families |

| Tax Season Start | Tax filing for TY2025 begins Jan 26, 2026 |

| Direct Deposit | IRS urges e-filers to use Direct Deposit for faster payouts |

Where Did This $2,000 Direct Deposit Rumor Start?

There are a few places this all-too-common rumor keeps bubbling up from:

- Old Stimulus Memory: During the COVID-19 pandemic, Congress passed three rounds of stimulus checks — $1,200, $600, and $1,400 — under emergency legislation. Many Americans now associate February as “stimulus season,” even though no such law exists in 2026.

- Misleading Headlines: Content creators often use clickbait titles like “$2,000 Direct Deposit Confirmed!” to get views — even when the actual article says no such thing.

- Political Proposals: In recent election cycles, some candidates floated “tariff dividend” proposals — promising citizens a payment funded through tariffs. However, no such legislation has passed Congress or been signed into law.

Real IRS Programs That Could Lead to $2,000+ in Your Bank Account

Although there’s no flat-out stimulus check, many working-class Americans can still receive over $2,000 if they qualify for the right programs. Here’s how.

Tax Refunds (Varies by Taxpayer)

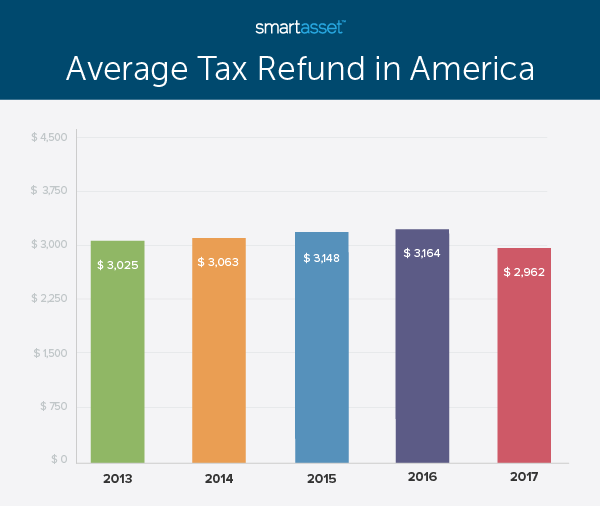

- If you had too much withheld from your paycheck in 2025, you’re due for a refund in 2026.

- Average refunds in past years have ranged between $1,800–$3,000, depending on income and family status.

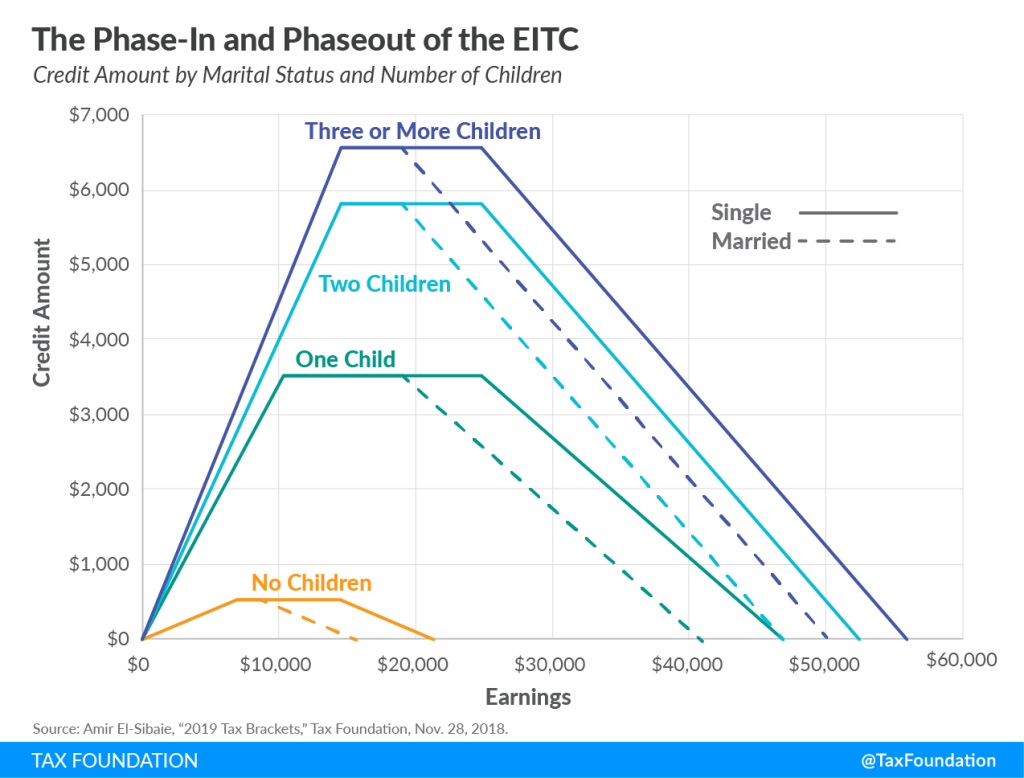

Earned Income Tax Credit (EITC)

- EITC can boost your refund by up to $7,430 for low-to-moderate-income families with three or more kids.

- Even if you made less than $60,000/year, you might qualify.

- EITC is a refundable credit, meaning you get it even if you owe no taxes.

Child Tax Credit (CTC)

- Worth up to $2,000 per qualifying child under age 17

- $1,500 of that may be refundable, even if you owe no taxes

- Must have earned income of at least $2,500

Recovery Rebate Credit

- Missed out on past stimulus payments? You might still qualify through a Recovery Rebate Credit on older tax returns.

- IRS allows backfiling for up to 3 years — ask a tax pro or use IRS Free File.

How IRS Confirms $2,000 Direct Deposit Work?

Direct Deposit is hands-down the fastest way to get your refund or credit payout. Here’s what you should know:

- You can split your refund across up to three bank accounts

- Use Form 8888 if you want to allocate refunds to savings or IRAs

- Avoid prepaid cards or sketchy tax refund “advance” services unless you fully understand the fees

Pro tip: IRS never uses Venmo, Cash App, or Zelle to send payments. It’s always either direct deposit or paper check.

IRS 2026 Filing Season Timeline

Here’s what the season will look like:

| Date | Event |

|---|---|

| Jan 26, 2026 | IRS opens for e-filing |

| Feb 15–20, 2026 | First wave of refunds for early filers (w/o EITC/ACTC) |

| Early March 2026 | Refunds begin for EITC/ACTC claims |

| April 15, 2026 | Standard filing deadline |

| Oct 15, 2026 | Final day for extended returns |

What Are Your Rights as a Taxpayer?

Many Americans don’t know this, but the IRS has a Taxpayer Bill of Rights. You have the right to:

- Be informed

- Quality service

- Pay no more than the correct amount of tax

- Challenge the IRS’s position

- Appeal IRS decisions

How to Verify Real IRS Payments & News?

Before you assume money is coming your way, follow these steps to verify any IRS-related news:

- Check the IRS Newsroom: https://www.irs.gov/newsroom

- Never trust screenshots or social posts without a source link

- Use official tools only

Spotting and Avoiding IRS Scams

If it seems too good to be true — it probably is. These are the red flags:

- “Click to claim your $2,000 IRS deposit!”

- Text messages from unfamiliar numbers about IRS payments

- Emails with fake IRS logos or broken English

The IRS never contacts taxpayers by:

- Text

- Social media DMs

- Random phone calls requesting SSNs or bank info

$4983 Direct Deposit 2026 for Everyone: Latest Updates and What’s True?

$2,000 Stimulus Check 2026 – Current Status of Trump Tariff Refunds Explained Clearly

IRS Refund Rules – You Can Still Pay by Check, but Refunds Now Come by Direct Deposit