Social Security Paper Checks: If you’ve heard the chatter that Social Security paper checks are going away, you’re not alone. From front porch talk to online posts and media buzz, the rumor mill is running hot. Many Americans are asking, “Am I still going to get my check in the mail next month?” or “Is the government forcing me to go digital?” Let’s clear it up with truth, facts, and some good ol’ fashioned common sense. The reality? Social Security paper checks are not being eliminated entirely. While the federal government is actively encouraging people to switch to electronic payments, paper checks will still be issued in specific cases — especially for those who need them most.

Table of Contents

Social Security Paper Checks

Don’t let headlines scare you. Social Security paper checks are still part of the system, even as most of the country goes digital. The shift toward electronic payments is real — and mostly beneficial — but it won’t leave behind those who truly need an alternative. Whether you’re an elder on the rez, a retiree in a small town, or a busy caregiver managing a loved one’s benefits — rest easy. With the right knowledge and support, you’ll still get your benefits — your way. Stay informed, stay empowered, and most of all — don’t be afraid to speak up for what you need.

| Topic | Summary |

|---|---|

| Are paper checks ending? | No — they’re being reduced, not eliminated. |

| Who’s affected? | New and existing Social Security beneficiaries |

| Who can still get checks? | People without bank accounts, seniors, rural residents, individuals with disabilities |

| Why the push for digital? | Security, cost, speed, fraud prevention |

| Transition date? | September 30, 2025 (goal, not final deadline) |

| SSA Official Info | ssa.gov |

Why All the Confusion About Social Security Paper Checks?

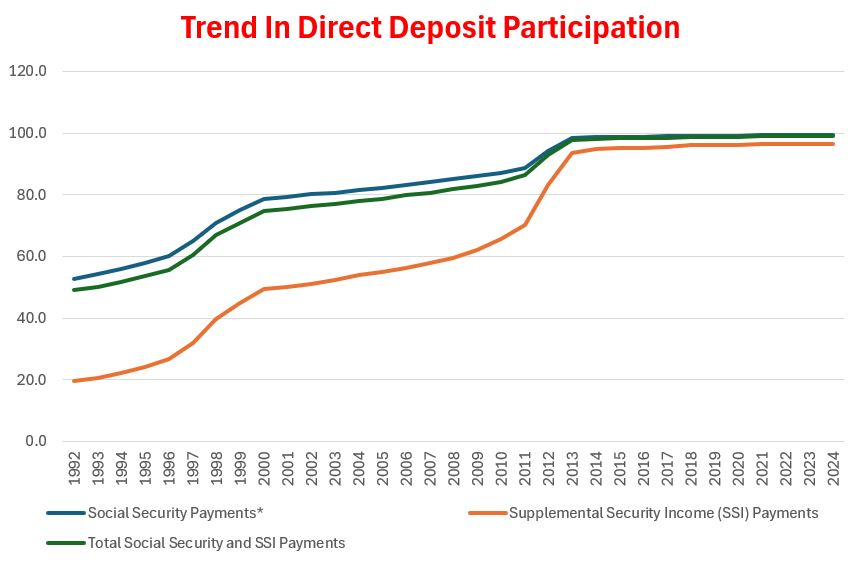

This confusion didn’t come out of thin air. Over the past few years, the Social Security Administration (SSA) and U.S. Treasury have made a concerted effort to encourage the use of Direct Deposit and the Direct Express® card.

So when updates in 2023 and 2024 emphasized transitioning most beneficiaries to digital methods by September 30, 2025, many took it to mean the end of paper checks. That’s not the case.

It’s more of a “soft transition” — a strong recommendation, but not a universal mandate.

The Push Toward Electronic Payments: What’s Really Going On?

Government agencies, like private businesses, are adapting to the digital age. The shift isn’t arbitrary — there are real benefits behind it:

1. Fraud Reduction

Paper checks are vulnerable. From mail theft to check washing scams, printed checks are a target for criminals. The U.S. Postal Inspection Service reported a steady rise in mail fraud complaints in recent years — many involving Social Security and federal benefit checks.

In 2022 alone, over 680,000 mail theft complaints were filed. Digital payments reduce these risks significantly.

2. Lower Processing Costs

According to the U.S. Treasury Department, mailing a paper check costs around $1.04 per payment. Direct deposits, by contrast, cost less than 10 cents. Multiply that by millions of recipients, and we’re talking hundreds of millions in annual savings.

3. Faster Delivery

While paper checks can take up to 7 days to arrive — longer if there are postal delays, weather events, or holidays — direct deposits hit accounts on time, often by midnight on the scheduled day.

Historical Context: How Did We Get Here?

Let’s rewind the tape a bit.

- 1996: Congress passes a law requiring most federal payments to be made electronically.

- 1999: The U.S. Treasury starts pushing the EFT (Electronic Funds Transfer) system for Social Security.

- March 1, 2013: New Social Security and SSI applicants are automatically enrolled in Direct Deposit or Direct Express, unless exempt.

- 2023–2025: Renewed efforts to “complete” the transition by encouraging all beneficiaries to go digital.

Despite this, exemptions have always existed — and they’re still available.

Who Can Still Receive Social Security Paper Checks?

There are folks in every corner of this country who, for valid reasons, cannot use digital payment systems. The government recognizes this.

You may still qualify for paper checks if:

- You don’t have a bank account

- You live in a remote, rural, or Tribal area with unreliable internet or phone access

- You’re elderly or disabled, and unable to navigate digital systems

- You’re under legal guardianship, or have a mental health condition

- You simply have a compelling hardship as determined by the SSA

These exceptions are processed through waiver requests.

Pro Tip: Don’t assume you’re automatically removed from paper checks. SSA will notify you if a change is needed, and you’ll be given time and options to respond.

How to Apply for a Waiver (and Keep Getting Paper Checks)?

If you’re in a position where digital payments aren’t viable, here’s what you can do:

Step 1: Understand the Requirement

Since 2013, all new applicants are automatically enrolled in Direct Deposit or Direct Express®. If you’re already on paper checks, you may be contacted to switch — but you can still request to continue receiving them if you qualify.

Step 2: Contact the SSA

Call 1-800-772-1213 (TTY: 1-800-325-0778) or visit your local Social Security office. Explain your situation and ask about waiver options.

You may be required to fill out Form SSA-3288, or provide a written statement documenting your reason for requesting an exemption.

Step 3: Provide Supporting Documents (If Applicable)

In some cases, SSA may ask for documentation such as:

- Proof of living in a remote area

- Evidence of lack of access to banking

- Medical statements verifying disability or impairment

- Letters from caregivers or legal representatives

Understanding Your Options: Electronic vs. Paper

| Feature | Paper Check | Direct Deposit | Direct Express® Card |

|---|---|---|---|

| Speed | 5–10 days | Same day | Same day |

| Fraud Risk | High | Low | Medium |

| Requires Bank Account? | No | Yes | No |

| Physical Delivery? | Yes | No | No |

| Monthly Fees? | No | No | No (unless ATM fees apply) |

For many Americans — especially those comfortable with online banking — direct deposit offers the safest and most convenient option. For others, particularly the elderly or rural communities, the Direct Express® card is a solid middle ground.

What Is the Direct Express® Card?

The Direct Express® Debit Mastercard® is a prepaid debit card issued by Comerica Bank. It was designed specifically for people without traditional bank accounts.

- Your benefits are automatically loaded each month

- You can use it anywhere Mastercard is accepted

- Withdraw cash at ATMs or banks

- No sign-up fees and no minimum balance required

Real-Life Stories

Henry, 76, a veteran from Oklahoma, shared:

“I’ve had my check mailed to me for years. I don’t trust banks, and I live two hours from the nearest one. The SSA let me stay on paper checks after I explained my situation. Respect to them for that.”

Marisa, a caregiver from Florida, said:

“My mom has dementia, and direct deposit confused her. We switched to Direct Express — it’s been a lifesaver. She can buy groceries and pay bills without stress.”

Legal Rights and Advocacy

If you feel pressured or denied access to your preferred method without due process, know your rights.

Legal Protections:

- Americans with Disabilities Act (ADA): Guarantees reasonable accommodations for people with disabilities.

- Civil Rights Act: Prohibits discrimination in federal benefit programs.

- E-Government Act of 2002: Encourages electronic access, but not at the expense of accessibility or equity.

Organizations like the National Council on Aging, AARP, and Legal Aid provide resources to help people navigate these transitions.

How Professionals and Advisors Should Respond?

If you’re a social worker, financial advisor, or attorney assisting Social Security beneficiaries, here’s what you should do:

- Educate clients about payment options

- Identify tech or literacy barriers early

- Help clients apply for waivers when justified

- Advocate with local SSA offices on behalf of clients

- Provide translation or accessibility services for those with language or cognitive challenges

Social Security Abroad Rules – Countries Where Payments Are Restricted in 2026

Average Social Security Benefits 2026 – New Monthly Payment Amounts by Retirement Age

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000