IRS Refund 2026: The phrase IRS Refund 2026 is popping up in households, offices, coffee shops, and group chats across America. That tax refund — whether it’s a couple hundred bucks or several thousand — can make a big difference. Whether you’re paying down debt, handling bills, or taking a well-earned vacation, your refund matters. But here’s the thing: understanding how to track your tax refund online — and more importantly, how to avoid delays — can be the key to getting that money faster and with fewer headaches. This guide walks you through every step of the process, in plain English, and shows you how to stay ahead of any refund issues.

Table of Contents

IRS Refund 2026

The IRS Refund 2026 process doesn’t have to be stressful. Filing early, checking your information, and using the official IRS tools can make all the difference in getting your money faster and avoiding delays. Most refunds arrive in about three weeks — but knowing what to do if yours is delayed puts you in control. With a little prep and patience, you can make tax season smoother, smarter, and maybe even a little more rewarding.

| Topic | 2026 IRS Refund Facts & Tools |

|---|---|

| Filing Season Start | Opens January 26, 2026 |

| Estimated Returns | ~164 million expected |

| Typical Refund Time | ~21 days for e‑file + direct deposit |

| Credits that Delay Refunds | Earned Income Tax Credit (EITC) & Additional Child Tax Credit (ACTC) held until mid‑Feb / early March |

| Tracking Tools | Where’s My Refund?, IRS2Go, IRS Online Account |

| Important Rule Change | IRS has phased out most paper refund checks — direct deposit preferred |

| Official IRS Refund Website | https://www.irs.gov/refunds |

What Is a Tax Refund?

A tax refund is money the government gives back when you’ve paid more in taxes during the year than you actually owed. It’s not a bonus or a gift — it’s your money, just coming back to you. Most Americans get a refund because their employers take taxes out of each paycheck all year long, and often it ends up being more than necessary.

Your refund can feel like a reward, but it’s really just a correction. If you’ve been waiting for yours, you’re not alone — and knowing how to track it can give you peace of mind.

The IRS Refund 2026 Process, Step-by-Step

Understanding how the IRS handles your return makes it easier to know what’s going on with your refund.

1. Return Filed and Received

You submit your tax return, either electronically (which is fastest) or by mail (which takes longer). Once the IRS receives it, it enters their system.

2. Return Accepted

If there are no major red flags (like wrong Social Security Numbers or missing forms), the IRS officially “accepts” your return. This usually happens within 24–48 hours for electronic filings.

3. Refund Approved

After your return is reviewed, the IRS approves the refund amount. This means they agree with your math and documentation.

4. Refund Sent

The final step: the refund is either deposited into your bank account or mailed (if you didn’t select direct deposit). This can take 1–5 days for bank deposits or weeks for mailed checks.

How to Track Your IRS Refund 2026?

Step 1: Gather Your Info

Before you track your refund, you’ll need:

- Your Social Security Number (SSN) or ITIN

- Your filing status (like single, married filing jointly, etc.)

- The exact amount of your refund, rounded to the dollar

Having this information ready ensures that the IRS tool can match your return in their system.

Step 2: Use the Official Tools

The IRS provides three secure ways to track your refund:

- Where’s My Refund? tool on the IRS website

- IRS2Go mobile app

- IRS Online Account

Each of these is updated once every 24 hours, usually overnight. That means checking multiple times a day won’t get you new information.

Step 3: Enter the Details Exactly

Even one small typo in your Social Security Number or refund amount can throw things off. Double-check everything as you enter it into the tool.

Step 4: Read the Status

The tracker shows one of three main statuses:

- Return Received: IRS has your return but hasn’t reviewed it yet.

- Refund Approved: Your refund is being processed.

- Refund Sent: It’s on its way — watch your bank account.

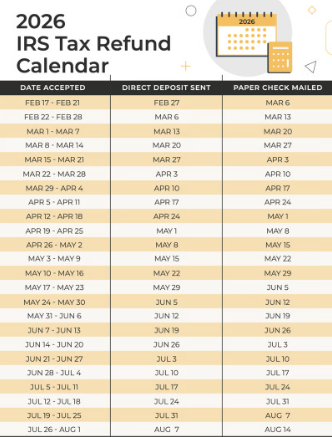

How Long Does It Take to Get My IRS Refund 2026?

This depends heavily on how you file and how you choose to receive your refund.

E-File + Direct Deposit (Fastest)

Most people who e-file and choose direct deposit receive their refund in about 21 days — sometimes sooner.

E-File + Paper Check

This takes longer because printing and mailing add a few extra days to the process. Expect 3–5 weeks minimum.

Paper Return + Paper Check (Slowest)

Paper returns take longer to process, and you’re adding mailing time on both ends. This could take 6–8 weeks or more.

Refunds Delayed by Law: EITC and ACTC

If you claim the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), there’s a mandatory delay built in by federal law. The IRS is not allowed to issue refunds involving these credits until mid-February, and often they don’t start hitting accounts until late February or early March.

This delay is in place to give the IRS time to confirm income and prevent fraudulent claims.

Common Reasons Refunds Get Delayed

Even if you filed everything correctly, some refunds take longer than others. Here are some of the top causes:

Errors on Your Tax Return

A missing form, incorrect Social Security number, or even a math mistake can flag your return for manual review. That slows everything down.

Incorrect Direct Deposit Information

If you accidentally put in the wrong bank account or routing number, your refund may bounce back. That adds weeks to the timeline.

Identity Verification

If the IRS thinks someone might be using your info to file a fraudulent return, they’ll freeze the refund and send you a letter asking you to verify your identity.

Refund Offset for Debts

If you owe certain debts — like federal student loans, child support, or past tax bills — your refund may be partially or fully used to pay those. The rest (if any) will be sent to you.

How to Avoid Refund Problems?

File Early

The earlier you file, the fewer returns are in the system, and the quicker the IRS can process yours. Plus, you beat the fraudsters to the punch.

Double-Check Your Info

Take time to carefully verify:

- Names

- SSNs

- Bank account numbers

- Addresses

- Refund amount

Even small errors can cause big delays.

E-File and Use Direct Deposit

Electronic filing is the gold standard. Combine that with direct deposit and you’ve got the fastest, safest path to getting your refund.

Respond Quickly to IRS Letters

If the IRS sends you a notice (like a CP05 or 4883C letter), respond immediately. Delays in replying can hold up your refund indefinitely.

What If It’s Been More Than 21 Days?

If your return was e-filed and it’s been more than 21 days with no update, you should:

- Check your status using the IRS tool.

- Look out for any IRS letters in the mail.

- Consider calling the IRS if the tool says to do so.

Delays can be caused by fraud checks, missing forms, or special credits. The IRS will usually notify you if anything’s wrong, but it’s okay to follow up after three weeks.

Avoid Refund Scams and Identity Theft

Each year, thousands of taxpayers are targeted by refund-related scams. Here’s how to stay safe:

- The IRS never contacts by email or text to request personal information.

- Never click on suspicious links that claim to offer refund status.

- Secure your personal information when filing, especially if using shared computers or public Wi-Fi.

Using a trusted tax professional or reputable tax software helps avoid many of these issues.

What to Do with Your Refund?

It’s tempting to blow your refund on fun stuff — and hey, a little splurge is fine. But financial experts recommend:

- Paying off high-interest debt (like credit cards)

- Building or adding to your emergency fund

- Investing in a retirement account

- Funding home improvements or business goals

Even if you treat yourself a little, try to make smart money moves with the rest.

$2,000 Stimulus Check 2026: Approval Status and Official IRS Updates

IRS Tax Refund 2026 Schedule: Check Amount & Estimated Dates for Refund Payments

Federal Tax Refund Tracking – Simple Steps to Check Where Your IRS Refund Is Right Now