Social Security COLA Increase: The Social Security COLA increase 2026 is officially in effect, and it’s putting a bit more cash in the hands of over 70 million Americans. Starting in January 2026, retirees, disability recipients, survivors, and SSI beneficiaries will notice a bump in their benefits — all thanks to the Cost-of-Living Adjustment (COLA). While this increase won’t make anyone rich, it helps protect your purchasing power in an economy where prices keep climbing. If you’re wondering how much more you’ll get, why this is happening, and what it means for your budget, this comprehensive guide breaks down everything you need to know — with clear language, accurate data, and expert insights you can trust.

Table of Contents

Social Security COLA Increase

The 2026 Social Security COLA Increase is a 2.8% rise in benefits that offers some relief in the face of persistent inflation. While it doesn’t go far enough for many seniors — especially once Medicare and taxes are factored in — it’s a vital part of keeping your benefits from falling behind. Social Security remains a key income source for most older Americans, and even small changes to your monthly check deserve smart planning. Whether you’re already receiving benefits or approaching retirement, understanding how COLA works can help you make better financial decisions.

| Topic | Summary | Figures & Facts |

|---|---|---|

| 2026 COLA Increase | Boost to monthly Social Security payments | 2.8% increase |

| Who It Affects | Retirees, disability recipients, survivors, SSI | ~75 million Americans |

| Average Benefit Hike | Approximate monthly gain | $56/month (avg) |

| SSI Recipients | Receive COLA earlier | Dec 31, 2025 |

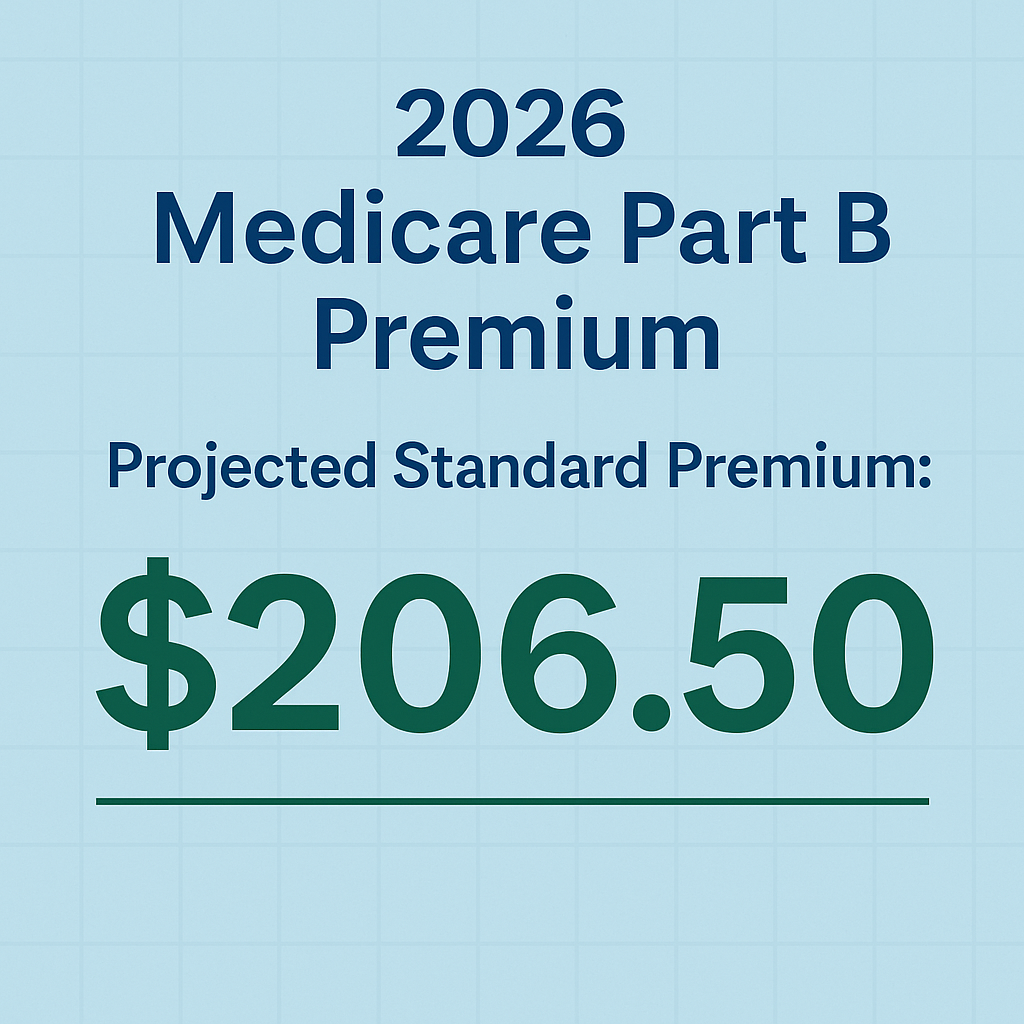

| Medicare Premium Impact | Higher Part B premiums | $202.90/month in 2026 |

| Taxable Income Limit | For higher earners | $184,500 (taxable wage base) |

| Work Income Limits | Before FRA (full retirement age) | $24,480; $65,160 for FRA year |

What Is COLA and Why Does It Matter?

COLA stands for Cost-of-Living Adjustment — a built-in mechanism designed to ensure that Social Security payments don’t lose value due to inflation. It’s like a built-in raise to help you keep up when things like rent, food, and healthcare get more expensive.

Every year, the Social Security Administration (SSA) calculates COLA based on data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), as provided by the Bureau of Labor Statistics (BLS). If prices rise, benefits go up. If inflation is flat or negative, the COLA may be zero.

For 2026, the SSA announced a 2.8% increase, effective January. This translates to a higher monthly benefit amount for retirees and others receiving Social Security benefits.

And the best part? You don’t need to apply or fill out any forms — the increase is automatic.

How Much More Will You Get?

The average retired worker will receive about $2,071 per month, up from $2,015 — a $56 increase each month. Over a year, that’s around $672 in added income.

Other groups also benefit:

- Disabled workers: From $1,537 to approx. $1,580/month

- Widows/widowers with children: Around $3,654 total household benefits

- Supplemental Security Income (SSI) recipients: Individual monthly federal payment rises from $943 to $969

Historical Perspective: How 2.8% Compares

Let’s put 2.8% in context with past COLAs:

| Year | COLA (%) |

|---|---|

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 1.6% |

| 2026 | 2.8% |

While it’s not as high as the record-breaking 8.7% increase in 2023 (driven by inflation spikes), it’s a decent boost in line with long-term trends.

Some years — like 2010, 2011, and 2016 — saw zero COLA. So, any increase should be viewed as a positive move for purchasing power.

The Catch: Medicare Premiums Could Reduce Your Net Gain

Here’s where things get tricky.

If you’re enrolled in Medicare Part B, your premium is automatically deducted from your Social Security check. For 2026, the standard premium jumps to $202.90, up from $185. This increase alone could eat up nearly a third of your COLA increase.

That means if you were expecting an extra $56/month, after Medicare deductions, you might see closer to $38/month.

Additionally, higher-income retirees may also face Income-Related Monthly Adjustment Amounts (IRMAA), meaning they pay even more for Medicare Parts B and D.

Tax Implications: COLA Could Trigger Social Security Taxes

Many retirees are surprised to learn that Social Security benefits can be taxed — depending on your provisional income, which includes:

- Adjusted gross income

- Nontaxable interest (like municipal bonds)

- Half of your Social Security benefits

Here’s how it breaks down:

| Filing Status | Income Range | % of Benefits Taxed |

|---|---|---|

| Single | $25,000–$34,000 | Up to 50% |

| Single | Over $34,000 | Up to 85% |

| Joint | $32,000–$44,000 | Up to 50% |

| Joint | Over $44,000 | Up to 85% |

Even a modest COLA can push some retirees into higher tax brackets — so it’s wise to review your tax plan, especially if you’re drawing from IRAs or 401(k)s too.

Planning Advice: How to Make the Most of Your Social Security COLA Increase

While COLA isn’t a huge increase, smart planning can help you get the most out of it.

- Update Your Monthly Budget

- Reflect the new income, but consider Medicare and taxes to estimate your actual increase.

- Adjust spending categories like utilities, prescriptions, or groceries.

- Review Your Tax Withholding

- Use IRS Form W-4V to voluntarily withhold taxes from your Social Security check.

- Avoid surprises at tax time by adjusting withholding early in the year.

- Coordinate With Other Income

- If you have a pension, annuity, or retirement withdrawals, manage how these interact with your benefits.

- Strategic withdrawals from tax-deferred accounts can reduce your taxable Social Security exposure.

- Check Your SSA Earnings Record

- Mistakes in your reported earnings could lower your benefit.

- Log in to your My Social Security account to review.

- Rebalance Your Investments

- Talk to a financial advisor about asset allocation to reflect updated income and risk tolerance.

Common Misconceptions About COLA

Let’s clear up a few myths:

Myth 1: COLA is guaranteed to match inflation.

False. It’s based on CPI-W, which doesn’t always reflect seniors’ actual costs — especially medical care and housing.

Myth 2: Everyone gets the same increase.

Partially true. The 2.8% is across the board, but the dollar amount varies depending on your current benefit.

Myth 3: COLA makes Social Security more generous.

Not really — it’s designed to maintain, not grow, your buying power.

What Pre-Retirees Should Know?

If you’re still working and planning to retire soon, here are key points to keep in mind:

- Work Earnings Test: If you claim Social Security before full retirement age and earn more than $24,480/year, some benefits may be temporarily withheld.

- Full Retirement Age (FRA): The FRA varies based on your birth year — for many current workers, it’s 67.

- Higher Lifetime Earnings = Higher Benefit: Your benefit is based on your highest 35 years of earnings. Working a few more years can increase your payout.

- Delaying Past FRA: Each year you delay benefits past FRA up to age 70 increases your monthly benefit by ~8% annually.

Average Social Security Benefits 2026 – New Monthly Payment Amounts by Retirement Age

SNAP Benefits February 2026 – Full Payment Schedule and Key Changes You Should Know

Social Security Planning 2026 – 8 Practical Moves That Can Help You Secure Higher Lifetime Benefits