Social Security February 2026 Schedule: All Official Payment Dates in One Place is your complete go-to guide if you or someone you care about relies on Social Security income in the United States. Whether you’re collecting retirement benefits, Supplemental Security Income (SSI), or helping someone budget their household, this article gives you the official February 2026 dates and all the background you need to plan wisely. We’re keeping it real — simple enough for anyone to understand, detailed enough for professionals. Whether you’re a retiree, working family caregiver, or financial planner, this guide helps you know exactly when the check’s coming in — and what to do about it.

Table of Contents

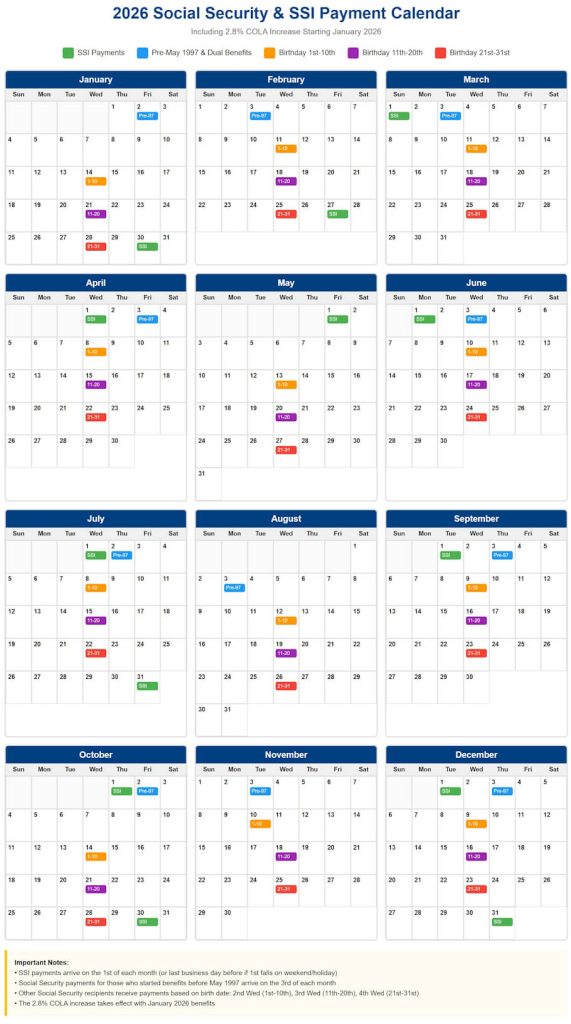

Social Security February 2026 Schedule

Whether you’re collecting SSI, retirement, spousal, or survivor benefits, the Social Security February 2026 payment schedule is predictable and easy to plan around — once you understand the rules. From the early Jan 30 SSI payment, to the Feb 3, 11, 18, and 25 regular deposits, knowing these dates helps you avoid late fees, manage expenses, and protect your peace of mind. Plus, with the 2.8% COLA boost in 2026, there’s a bit more breathing room. Being informed means being empowered. And in a world where costs keep rising, planning with confidence starts with knowing exactly when your money’s coming in.

| Topic | Official Info & Reference |

|---|---|

| Who Gets Paid | Retirees, SSI recipients, disabled workers, survivors, dependents |

| Payment Basis | Birth date (for regular benefits) or fixed-date (for SSI/pre-1997 recipients) |

| SSI Payment Date | Friday, Jan 30, 2026 (because Feb 1 is a Sunday) |

| Social Security Dates | Feb 11, Feb 18, Feb 25 — based on birth date |

| Legacy Payment Group | Feb 3, 2026 for pre-May 1997 or concurrent SSI/SSA recipients |

| COLA Increase | 2.8% boost in 2026 benefits |

| Payment Method | Direct deposit or Direct Express card (paper checks rare) |

| Official SSA Calendar | ssa.gov/pubs/EN-05-10031-2026.pdf |

What is Social Security and SSI?

Social Security is a federal benefit program run by the Social Security Administration (SSA). It includes retirement, disability (SSDI), survivor, and spousal benefits for workers and their families. Over 70 million Americans receive Social Security payments each month. The system is funded by FICA payroll taxes and is a major source of income for older Americans.

Supplemental Security Income (SSI) is a separate program designed to help people who are 65 or older, blind, or disabled and have limited income and resources. SSI is paid from general tax revenues — not Social Security trust funds — and comes with different payment rules.

The key difference? Social Security is earned through work history, while SSI is need-based.

Official Social Security February 2026 Schedule

The SSA follows strict rules when it comes to payment schedules, and February 2026 is no exception. Let’s break it down:

1. SSI Payment Date – Arrives Early

- Payment Date: Friday, January 30, 2026

Even though this is the February SSI check, it’s paid out before the month begins because February 1, 2026 falls on a Sunday. The SSA never issues payments on weekends or federal holidays. So, when that happens, payments are bumped to the last business day of the prior month.

That means for millions of SSI recipients, funds hit accounts on January 30, just before the weekend. This applies to individuals getting only SSI, not those receiving both SSI and Social Security.

2. Social Security Retirement, Disability, and Survivor Benefits

For folks who started receiving Social Security after May 1997, payment dates are based on the day of the month you were born:

| Birthday Range | February 2026 Payment Date |

|---|---|

| 1st – 10th | Wednesday, Feb 11, 2026 |

| 11th – 20th | Wednesday, Feb 18, 2026 |

| 21st – 31st | Wednesday, Feb 25, 2026 |

This system ensures payments are staggered, preventing system overload and reducing delays for banks and recipients.

3. Legacy Recipients (Pre-May 1997 or SSI + SSA)

If you started receiving Social Security before May 1997, or if you receive both Social Security and SSI, your check will arrive on:

- Tuesday, February 3, 2026

This group has not been transitioned to the birthday-based system, so your date remains consistent each month. This allows retirees and dual beneficiaries to plan their cash flow with confidence.

COLA Increase – 2.8% More in 2026

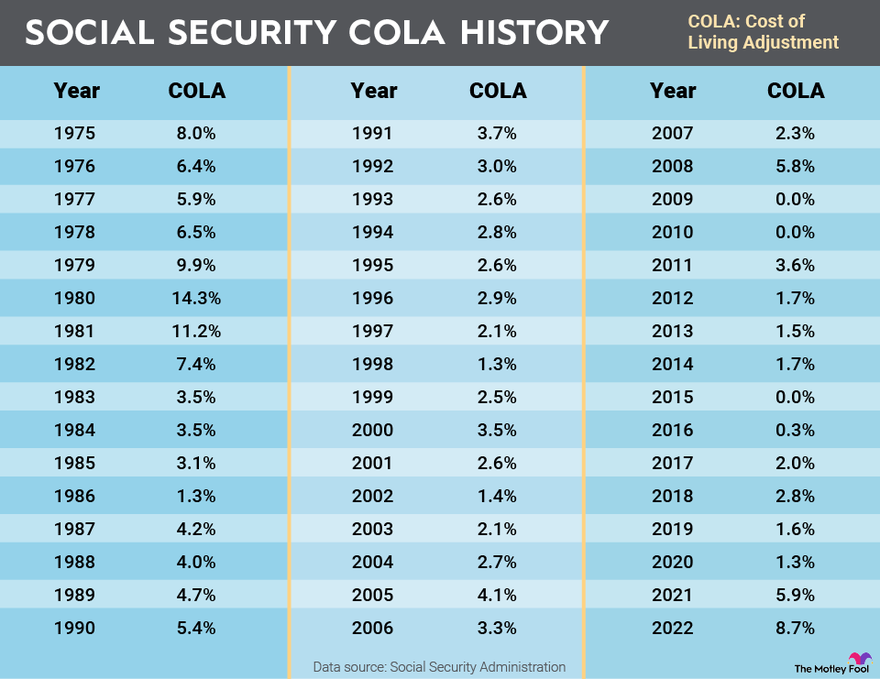

In January 2026, all Social Security and SSI benefits rose by 2.8% due to the Cost-of-Living Adjustment (COLA). The SSA calculates this based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Here’s how it affects you:

- Average retiree benefit (individual): increased to $2,071/month

- SSI federal benefit rate (individual): increased to $994/month

- SSI federal benefit rate (couple): now $1,491/month

This bump might not feel huge, but for fixed-income households, every dollar counts — especially with rent, groceries, and utilities still on the rise in many areas.

Payment Methods – Direct Deposit vs. Direct Express

Almost all Social Security and SSI recipients are paid electronically, per a rule implemented in 2013:

- Direct Deposit: Funds go directly into your checking or savings account — safest and fastest.

- Direct Express Debit Mastercard: For those without a bank account, SSA offers this prepaid card where your benefit is loaded monthly.

- Paper Checks: Extremely rare. Only a handful of approved hardship exemptions allow for mailed checks.

If you’re still receiving checks in the mail and want faster access, switch to direct deposit through your mySocialSecurity account.

What If My Social Security is Late?

Even though most payments arrive like clockwork, delays can happen. Here’s what to know:

- Wait at least 3 business days after the scheduled date before contacting SSA.

- Check your bank account and Direct Express app (if applicable).

- Log in to your mySocialSecurity account to confirm deposit details.

- If missing, call 1-800-772-1213 or contact your local SSA office.

Late payments may result from bank issues, account changes, or address errors. Be sure to notify SSA if you move or switch banks.

What Are State SSI Supplements?

Many states provide additional money to people receiving SSI. These are known as state supplemental payments, and eligibility varies by location.

Examples:

- California adds up to $219/month for individuals.

- New York adds $87/month for individuals.

- Some states (like Arizona or Mississippi) offer no supplement.

To learn if your state offers an SSI supplement, check ssa.gov

These payments are often included with your federal SSI, but in some states, they come from a different agency.

Spousal & Survivor Benefits — What You Need to Know

Spousal and survivor benefits play a huge role in household retirement planning.

- Spouses can receive up to 50% of their partner’s full benefit (at full retirement age).

- Widows/widowers can receive up to 100% of the deceased spouse’s benefit.

- Ex-spouses (if marriage lasted 10+ years) may qualify too.

These benefits don’t stack — you only receive one benefit at a time: your own or your spouse’s, whichever is higher.

Budgeting Around the Social Security Schedule

Here’s how to use this information to improve your financial stability:

- Mark your pay date on a calendar each month — especially if it shifts due to weekends/holidays.

- Schedule automatic bill payments after your benefit arrives to avoid overdraft fees.

- Use early SSI payments (like Jan 30) to prep for monthly groceries or medication needs before February begins.

- Track COLA increases year-to-year to adjust your budget accordingly.

- Check your “my Social Security” portal monthly to catch any irregularities or changes.

Being proactive helps avoid financial stress — especially when every dollar matters.

Social Security Planning 2026 – 8 Practical Moves That Can Help You Secure Higher Lifetime Benefits

Social Security Benefits January 2026: How Much Will Your Payments Increase?

Social Security Payment Up to $5,181 Coming on January 28, 2026 – See If You Qualify!