SNAP Payment Chart 2026: SNAP Payment Chart 2026 is your go-to guide for understanding how much food assistance you or someone you know might receive from the Supplemental Nutrition Assistance Program this year. In a country where inflation, grocery prices, and job instability are pressing issues, SNAP plays a critical role in helping families put food on the table. In this in-depth guide, we’ll break down everything you need to know—from how benefits are calculated, to 2026 updates, eligibility, real-life examples, how to apply, and more. Whether you’re a first-time applicant, social worker, or professional looking for current data, this article provides trusted, easy-to-digest answers—written in a clear, friendly, and informative tone.

Table of Contents

SNAP Payment Chart 2026

The SNAP Payment Chart 2026 is more than a table of numbers—it’s a powerful tool for food security in America. Whether you’re a family in need, a policy advocate, or a helping professional, understanding how SNAP works in 2026 can mean the difference between food on the table or going without. With rising food prices and growing need, SNAP remains an essential lifeline. The more informed you are, the better you can navigate the process and get the support you deserve.

| Topic | Details |

|---|---|

| Program Name | SNAP (Supplemental Nutrition Assistance Program) |

| Administered By | USDA Food and Nutrition Service (FNS) |

| 2026 Max Benefit (Household of 4) | $994/month |

| Minimum Benefit | $24/month for 1–2 person households |

| Eligibility | Based on household size, income, and allowable deductions |

| Application Time | Approval in ~30 days; expedited in 7 days for emergencies |

| Where to Apply | USDA SNAP State Directory |

| Benefit Delivery | EBT (Electronic Benefit Transfer) card |

What Is SNAP?

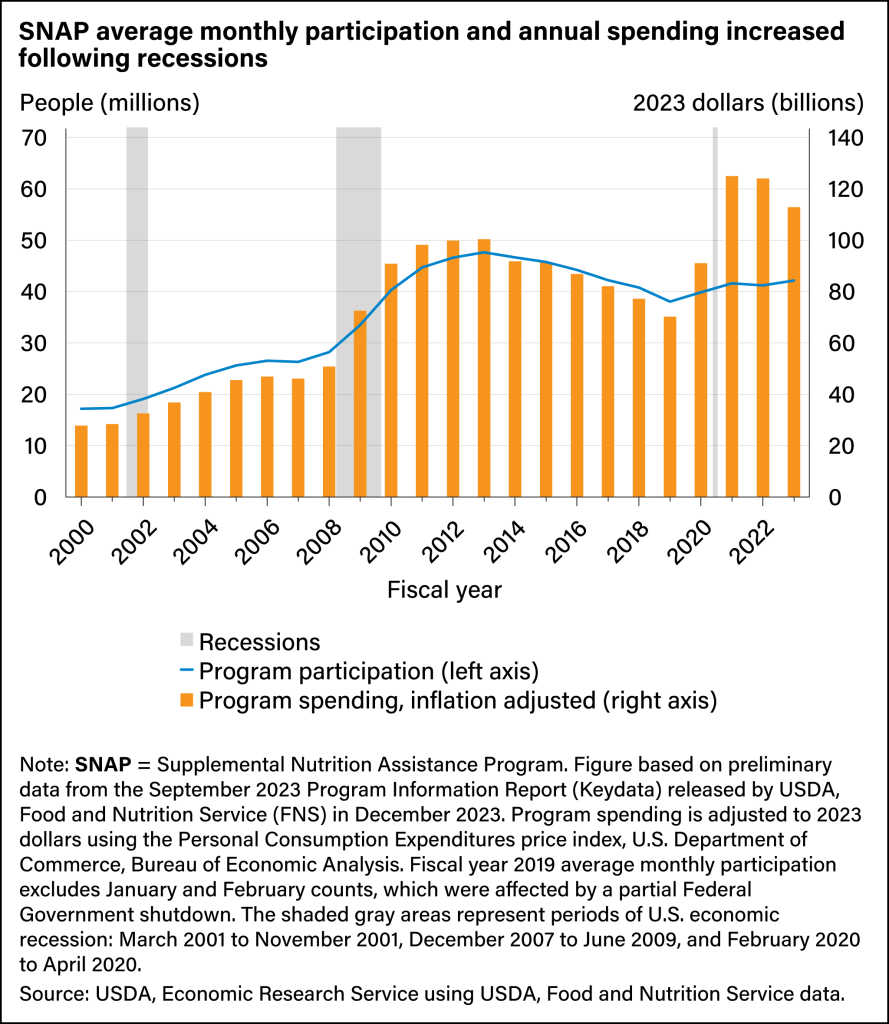

SNAP, formerly known as food stamps, is the largest federal nutrition program in the U.S. It helps low-income individuals and families afford nutritious food. SNAP is not a handout—it’s an economic safety net designed to support people during periods of financial difficulty, unemployment, or underemployment.

As of early 2026, over 42 million Americans are enrolled in the program. These include working families, single parents, seniors, people with disabilities, veterans, and increasingly, students and gig workers.

The goal? Provide equitable access to healthy food and reduce food insecurity.

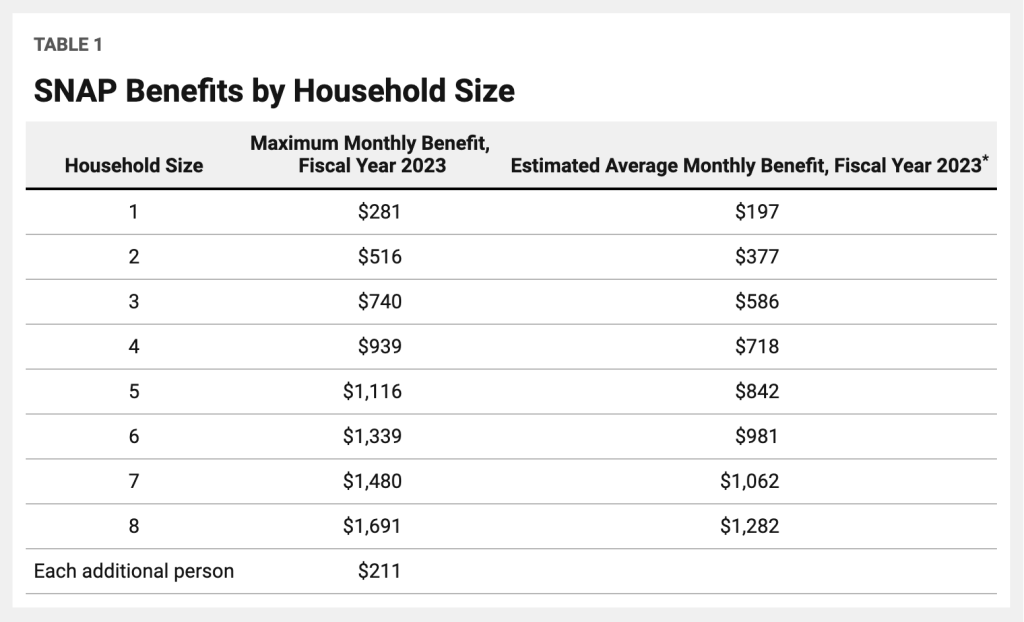

SNAP Payment Chart 2026: Maximum Monthly Benefit by Family Size

This chart shows the maximum benefit a household can receive. Your actual benefit will likely be less, depending on your income and expenses.

| Household Size | Max Monthly Benefit (48 States & DC) |

|---|---|

| 1 | $298 |

| 2 | $546 |

| 3 | $785 |

| 4 | $994 |

| 5 | $1,183 |

| 6 | $1,421 |

| 7 | $1,571 |

| 8 | $1,789 |

| Each Add’l Person | +$218 |

These amounts are based on the Thrifty Food Plan, updated annually by the USDA to reflect food costs.

Note: Alaska, Hawaii, Guam, and the U.S. Virgin Islands have higher maximum allotments due to their unique food pricing environments.

SNAP Benefits: What Changed in 2026?

Each year, the USDA adjusts SNAP benefits based on the Cost of Living Adjustment (COLA). For FY 2026, the COLA resulted in:

- An average 2.8% increase in benefits across all household sizes.

- Expansion of the online EBT purchasing program to include more retailers and states.

- Additional work requirements for able-bodied adults without dependents (ABAWDs) under age 53.

- Increased outreach and funding for nutrition education to help families make healthy choices on a budget.

The 2026 changes aim to keep pace with inflation and address modern needs, such as online food access and growing populations needing assistance.

How SNAP Payments Are Calculated?

Your benefit isn’t just determined by how many people are in your household. It’s based on a formula that subtracts part of your income from the maximum benefit.

Here’s how it works:

- Start with the maximum allotment for your household size.

- Calculate your net income (gross income minus deductions).

- Multiply your net income by 0.3 (SNAP assumes you’ll spend 30% of it on food).

- Subtract that amount from the max benefit.

The result is your monthly SNAP benefit.

Allowable deductions include:

- Standard deduction (varies by household size)

- 20% earned income deduction

- Excess shelter costs

- Childcare expenses

- Medical expenses (over $35/month for elderly or disabled members)

- Utility allowances

Even people with moderate income and high living costs may qualify due to these deductions.

2026 SNAP Income Eligibility Guidelines

To qualify, households must meet income limits based on the federal poverty level. Here are the 2026 limits for the 48 contiguous states and D.C.:

| Household Size | Gross Monthly Income Limit (130% FPL) | Net Monthly Income Limit (100% FPL) |

|---|---|---|

| 1 | $1,696 | $1,305 |

| 2 | $2,292 | $1,763 |

| 3 | $2,888 | $2,221 |

| 4 | $3,483 | $2,680 |

| 5 | $4,079 | $3,138 |

| 6 | $4,675 | $3,596 |

| 7 | $5,271 | $4,055 |

| 8 | $5,866 | $4,513 |

| Add’l Member | +$596 | +$459 |

Note: Gross income is your total income before deductions. Net income is what’s left after allowable expenses. You must meet both limits unless your household has a senior or disabled member.

Who Can Get SNAP?

You may qualify if you:

- Are a U.S. citizen or legal resident

- Meet income and resource requirements

- Have less than $2,750 in countable assets ($4,250 if household includes a senior or disabled person)

- Are working, unemployed, or receiving government benefits

- Are a student meeting certain exemptions (e.g. work-study, parenting, receiving TANF)

Many people assume they won’t qualify because they work—but SNAP is designed for low-income working families, too.

How to Apply for SNAP in 2026?

Applying for SNAP is easier than ever, and most states let you apply online. Here’s how:

- Visit your state’s SNAP website. Use the USDA directory: SNAP State Directory

- Fill out an application with your income, expenses, and household info.

- Submit documents like pay stubs, rent receipts, utility bills, and ID.

- Complete an interview, usually by phone.

- Get a decision within 30 days (7 days if expedited).

Once approved, you’ll receive an EBT card loaded monthly with your benefits. It works like a debit card at most major grocery stores, some farmers markets, and many online stores.

SNAP Benefits: What Can You Buy?

Approved SNAP purchases include:

- Fruits and vegetables

- Bread, cereal, rice, and pasta

- Meat, poultry, and fish

- Dairy products

- Snack foods, non-alcoholic beverages

- Seeds and plants to grow food

You cannot use SNAP for:

- Alcohol or tobacco

- Pet food

- Household supplies (soap, toilet paper, etc.)

- Vitamins or supplements

- Hot prepared foods (except in states with restaurant programs)

State-Specific Differences

While SNAP is federally funded, it’s state-administered. That means some things differ by state, including:

- Application process

- Income verification tools

- EBT issuance schedule

- Availability of restaurant or hot food programs

- State waivers for time limits and work rules

Be sure to check your state’s SNAP office for customized rules that apply to your location.

Real-Life Examples

Example 1: Single Working Mom

Lisa, a single mother of two, earns $2,000/month. After childcare and housing deductions, her net income drops to $1,400. Her family qualifies for SNAP and receives around $680/month in benefits—helping to cover essential groceries.

Example 2: Retired Couple

Jim and Carol are retired and living on Social Security. Their combined income is $1,900/month, but high medical costs reduce their net income. They qualify for around $400/month in SNAP benefits, easing the burden of food expenses on a fixed income.

Tips for Professionals and Caseworkers

- Always review deductions—many clients underreport eligible expenses like utilities or child care.

- Encourage clients to use pre-screening tools such as mRelief or SNAP Screener to estimate their eligibility before applying.

- Educate clients on recertification deadlines to prevent loss of benefits.

- Promote use of Farmers’ Market Nutrition Programs or Double Up Food Bucks, where available.

Mortgage Rates January 18, 2026 – Today’s Home and Refinance Rates Explained

SNAP Benefits January 2026 Schedule – Check State-By-State Payment Dates You Should Check Now

IRS Tax Refund 2026 Schedule: Check Amount & Estimated Dates for Refund Payments