Robinhood Class Action Settlement Reaches $2 Million: if you’ve seen that headline floating around and wondered if it affects you, you’re in the right place. Whether you’re a casual investor who tried out Robinhood during its early days or a pro who’s made thousands of trades, this article will help you figure out what’s going on, if you’re eligible, and how to file your claim step by step. We’re going to break this down in plain, honest language — the kind of tone you’d get from someone who’s walked the walk, not just talked the talk. It’s also structured for professionals, legal researchers, and retail traders who want the facts fast.

Table of Contents

Robinhood Class Action Settlement

The Robinhood $2 million class action settlement is a small but important victory for transparency and retail investor rights. If you traded stocks through Robinhood between September 2016 and September 2018, don’t leave money on the table — check your status and claim what’s rightfully yours. This case reminds us all: even when trades are “free,” there’s always a cost. As investors, we deserve to know when and how those costs show up.

| Topic | Details |

|---|---|

| Settlement Fund | $2 million total |

| Eligible Class Members | Robinhood U.S. customers who traded equities between Sept 1, 2016 – Sept 1, 2018 |

| Payout Estimate | ~$17.60 per valid claim (after fees and expenses) |

| Auto Payment | For active Robinhood accounts in good standing |

| Manual Claim | Required for closed/inactive accounts |

| Filing Deadline | July 13, 2026 or 60 days post-final court approval |

| Fairness Hearing | May 5, 2026 |

| Official Site | robinhoodorderflowsettlement.com |

Robinhood: The App That Changed the Game

When Robinhood launched in 2013, it flipped the script on traditional stock trading. Gone were the hefty commissions and clunky websites. Instead, the mobile-first platform made it easy for folks — especially millennials and Gen Z — to invest with just a few taps. It didn’t matter if you were buying one share of Apple or building a full-on ETF portfolio, Robinhood made it feel approachable.

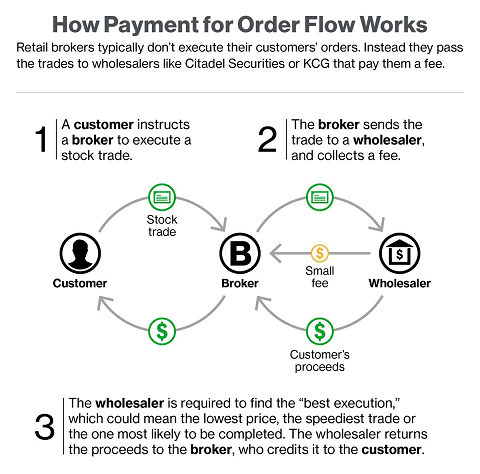

But with innovation came scrutiny. Robinhood didn’t charge commissions, so how did it make money? The answer: payment for order flow (PFOF). Robinhood would route your trades through market makers like Citadel Securities and get paid for it. Legal? Yep. Transparent to the average user? Not always.

The Lawsuit: What Sparked the Settlement?

The class action lawsuit — known formally as In re Robinhood Order Flow Litigation — was filed in the Northern District of California. The core claim? That Robinhood violated its duty to provide “best execution” of trades, meaning users didn’t always get the best possible prices when they bought or sold stocks.

Instead of routing orders to market makers offering price improvement for the customer, the suit alleges that Robinhood prioritized those paying the highest rebates to Robinhood itself. In plain terms: they got paid, while you might’ve lost a few cents on each trade.

The difference might not sound like much — a few pennies here and there — but with millions of trades, those numbers add up. Enough to draw regulatory attention, lawsuits, and this $2 million settlement.

Best Execution and Payment for Order Flow — Explained Simply

Let’s clear up some of the finance speak:

- Best Execution: A broker’s obligation to execute customer orders at the best available price.

- Payment for Order Flow: When a brokerage firm receives compensation for directing orders to different parties for execution.

- Price Improvement: Getting a better price than what was publicly quoted at the time of your trade.

In this case, the plaintiffs argued that Robinhood failed to meet its best execution obligations by putting profits ahead of customers. Robinhood denied wrongdoing but agreed to settle to avoid prolonged legal battles.

Who’s Eligible for the Robinhood Class Action Settlement?

To qualify, you must meet all of the following:

- You were a U.S.-based Robinhood customer between September 1, 2016, and September 1, 2018.

- You executed one or more equity trades (stock trades) during that time.

- Your trade(s) executed at prices worse than the NBBO (National Best Bid or Offer).

- The total difference in pricing across trades exceeds $5.

Even if your Robinhood account is closed or inactive today, you can still claim your payout — but you must file a manual claim.

How Much Can You Expect to Receive?

Let’s talk money. The $2 million fund will be reduced by:

- Attorneys’ fees (capped at 33% of the fund),

- Administrative costs,

- Any applicable taxes.

That leaves the rest for eligible claimants. Based on estimates, each person could receive around $17.60, though the exact amount depends on:

- How many people file valid claims,

- How much worse your trades were compared to the best prices,

- Whether your account was active or closed.

If the number of claims is low, payouts could go higher. If claims flood in, your slice of the pie shrinks.

Step-by-Step: How to File a Robinhood Class Action Settlement Claim

Step 1: Visit the Official Site

Start by heading over to the official portal:

https://www.robinhoodorderflowsettlement.com

All the forms, FAQs, and legal docs live there.

Step 2: Determine Your Status

- If your Robinhood account is active and in good standing, you may not need to do anything — your payout will be deposited automatically.

- If your account is closed, suspended, or otherwise inactive, you must file a claim to get paid.

Step 3: Submit Your Claim (If Required)

You’ll need to:

- Provide your contact info,

- Include details or your class member ID (if you received a notice),

- Choose how you want to receive your payout (e.g., ACH bank transfer),

- Certify that your information is accurate.

Step 4: Watch the Deadlines

- Claim Deadline: July 13, 2026 (or 60 days after court approval, whichever is later)

- Fairness Hearing: May 5, 2026

- Objection/Opt-Out Deadline: March 30, 2026

Don’t miss these — once they’re gone, so is your shot at the payout.

What Happens If You Do Nothing?

If your Robinhood account is active and qualifies, you’ll be automatically included and receive your payment.

But if your account is closed or flagged, doing nothing means you get nothing.

Want to sue Robinhood separately? You’ll need to opt out of the class action by March 30, 2026.

Why Robinhood Class Action Settlement Matters Beyond the $2 Million?

This lawsuit is about more than just money. It shines a light on how fintech companies monetize user trades, and how difficult it is for the average investor to spot these behind-the-scenes practices.

Robinhood’s business model — fast, slick, and “commission-free” — masked complex mechanisms that generated revenue. And while many users benefitted from zero fees, this case raises real questions:

- Are you really getting the best price for your trade?

- Should regulators do more to monitor PFOF practices?

- Do retail investors understand how their brokers make money?

In fact, SEC Chair Gary Gensler has publicly discussed revisiting rules around order routing and execution, making this case part of a larger conversation about transparency in U.S. markets.

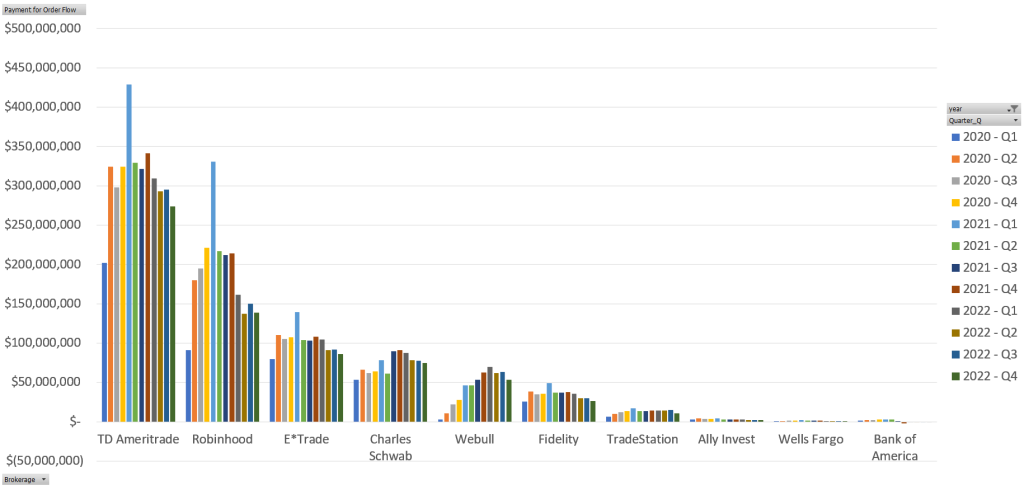

Comparison with Other Broker Settlements

Robinhood’s not alone here. Other major brokers have faced scrutiny and fines related to order routing and execution:

- TD Ameritrade was fined $10 million by the SEC in 2020 for similar failures in “best execution” obligations.

- Charles Schwab paid a $187 million settlement in 2022 for misleading investors on hidden costs tied to its robo-advisor service.

- Even E*TRADE faced regulatory fines for prioritizing revenue-generating routes over better execution for users.

Bottom line: This issue runs deeper than just Robinhood, and the financial world is watching closely.

Real-World Example: See How It Works

Let’s say in June 2017, you placed an order on Robinhood to buy 100 shares of Company XYZ for $25 each.

- At that moment, the NBBO (best market price) was actually $24.97.

- That means you paid $0.03 more per share, or $3 more than necessary.

Now imagine doing that across 20 different trades in a year. That could mean $50–$100 in missed savings. Multiply that by hundreds of thousands of users, and now you see why this lawsuit took off.

$2,500 Data Breach Settlement Claim Deadline – Final Chance to Seek From Six Insurers

FirstEnergy $249 Million Settlement – How This Agreement Could Affect Your Electric Bill

$7,500 AT&T Settlement Checks 2026 – Check Payments Dates, Amounts, and Eligibility Criteria