Social Security January 2026 Payments Confirmed: that’s the phrase thousands of Americans are typing into Google right now. If you’re one of them, you’re not alone. Whether you’re a retiree living on a fixed income, a caregiver for an elderly parent, or a working adult supporting someone who depends on Supplemental Security Income (SSI), it’s crucial to know exactly when money is coming in.

In 2026, the U.S. Social Security Administration (SSA) made it official: SSI payments for February will be delivered on Friday, January 30, 2026, a couple of days ahead of schedule. This shift might seem like a small tweak in the calendar — but for those who rely on these benefits, it’s a big deal that affects monthly budgeting, medication purchases, utility bills, and even meal planning.

This article gives you the full breakdown, with plain-English explanations, real-life scenarios, expert insight, and the historical backdrop of why early SSI payments happen. Whether you’re new to the system or have been drawing benefits for decades, this guide will help you plan, understand the rules, and avoid surprises.

Table of Contents

Social Security January 2026 Payments

In summary, Social Security January 2026 Payments Confirmed: Who Gets Paid on January 30 isn’t just a trending topic — it’s essential knowledge for millions of Americans. The early arrival of February’s SSI payment on January 30 is based on a longstanding SSA policy that ensures no one is left waiting for benefits due to weekends or holidays. There’s no extra check in February. The money coming on January 30 is your regular SSI payment for February. Knowing this helps prevent confusion, overspending, and financial hardship later in the month. And with a 2.8% COLA increase in place, understanding the full picture can make a meaningful difference for those living on fixed incomes. Whether you’re a recipient, a family member, or a professional in healthcare, finance, or public service, staying up to date on Social Security policy helps protect your well-being — and keeps our communities stronger and better informed.

| Topic | Detail / Official Source |

|---|---|

| Primary Keyword | Social Security January 2026 Payments Confirmed: Who Gets Paid on January 30 |

| Confirmed Early Payment Date | January 30, 2026 |

| Reason for Early Payment | February 1, 2026 falls on a Sunday |

| Program Impacted | Supplemental Security Income (SSI) |

| SSA 2026 Payment Schedule | Refer to SSA’s official calendar |

| 2026 Cost-of-Living Adjustment (COLA) | 2.8% |

| Maximum Federal SSI Payment (Individual) | $994/month |

| Maximum Federal SSI Payment (Couple) | $1,491/month |

| Extra Payment? | No — this is February’s benefit paid early |

| Advice for Beneficiaries | Budget accordingly; no second SSI check in February |

Understanding Social Security and SSI

Social Security and SSI are not the same thing, although they’re both administered by the SSA. Social Security is earned through payroll tax contributions, while SSI is a needs-based program funded by general tax revenues.

Social Security includes:

- Retirement benefits

- Disability insurance (SSDI)

- Survivor benefits for spouses and children

These benefits are tied to how long and how much you’ve paid into the system through work.

Supplemental Security Income (SSI), on the other hand, is designed for:

- Individuals aged 65 or older with low income

- Blind or disabled individuals, regardless of work history

- Children with disabilities in low-income households

The important difference? SSI doesn’t require a work history, and the benefit amounts are typically smaller than Social Security retirement or disability benefits.

In 2026, approximately 7.5 million people are expected to receive SSI, with many relying on this monthly check as their primary or only income source. That’s why every shift in timing matters.

Why the Early Payment on January 30?

The SSA uses a consistent rule for SSI payments: checks are typically issued on the 1st of each month, unless that day falls on a weekend or federal holiday. In those cases, the payment is moved earlier to ensure timely delivery.

In 2026, February 1 falls on a Sunday. Since government payments can’t be issued on weekends, the SSA will send out February’s SSI payment on Friday, January 30, 2026 — the last business day before February begins.

This happens multiple times a year due to how the calendar lines up. For example:

- In March 2026, March 1 falls on a Sunday again, so payments will be made February 27, 2026

- In November 2026, November 1 falls on a Sunday, so SSI checks will arrive October 30, 2026

So, this isn’t new — but it’s important to mark your calendar to avoid confusion when your check shows up earlier than usual.

What the COLA Increase Means in 2026?

A major update for 2026 is the 2.8% cost-of-living adjustment (COLA) applied to both Social Security and SSI benefits. COLA is calculated annually to keep pace with inflation — based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

For SSI recipients, this means a modest boost:

- Individual recipients will see a maximum monthly benefit of $994, up from $967 in 2025.

- Eligible couples will receive up to $1,491, up from $1,453 in 2025.

While this increase may not fully offset rising rent, food, and energy costs, it does help cushion the impact of inflation on those with the tightest budgets.

Professionals in finance, elder care, and nonprofit advocacy groups often advise clients to account for COLA changes when reviewing annual budgets, especially in years with higher-than-average inflation.

Who Gets Paid Social Security January 2026 Payments?

To clarify: not everyone receiving Social Security benefits will be paid on January 30. This date is only relevant to SSI recipients and a few who receive both SSI and Social Security.

You will be paid on January 30 if:

- You currently receive SSI only

- You receive both SSI and Social Security — your SSI portion comes early, and Social Security comes later in the month

You will not be paid on January 30 if:

- You only receive Social Security retirement, SSDI, or survivor benefits

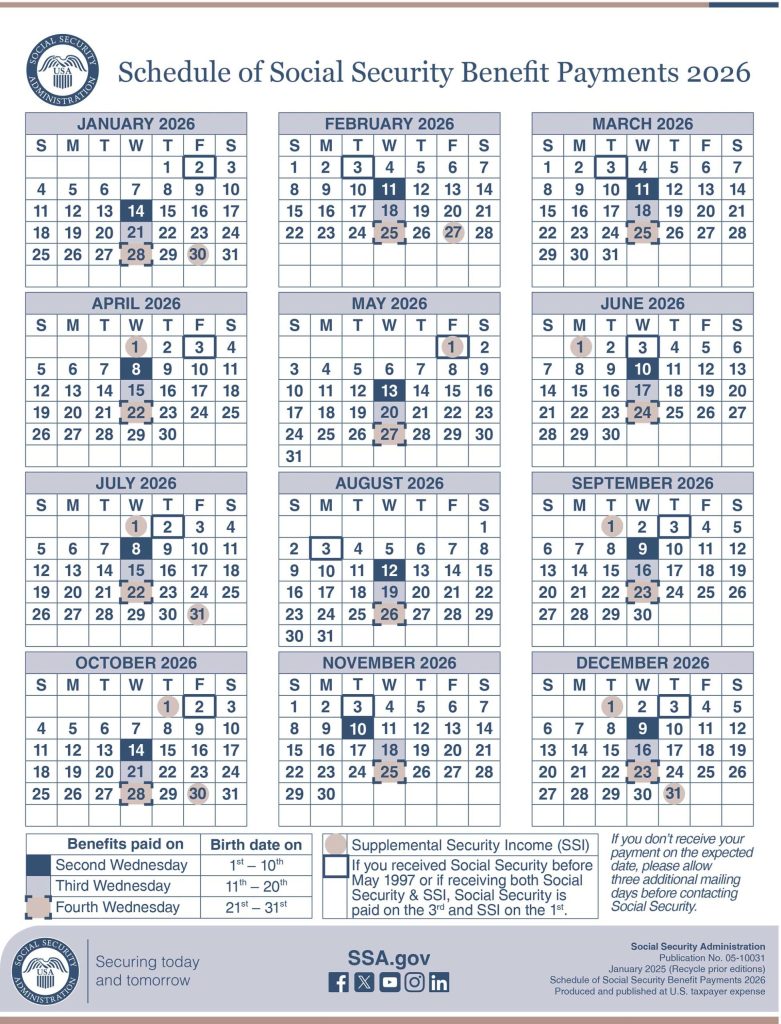

These other types of Social Security benefits follow the standard birthdate-based schedule:

- Birthdays on 1st–10th: 2nd Wednesday (January 14, 2026)

- Birthdays on 11th–20th: 3rd Wednesday (January 21, 2026)

- Birthdays on 21st–31st: 4th Wednesday (January 28, 2026)

Knowing which category you fall into can help avoid unnecessary stress and confusion.

How to Prepare for the Social Security January 2026 Payments?

If you receive your SSI on January 30, remember: that money is meant for February expenses. You won’t receive another payment on February 1. This creates a longer gap between January’s and March’s SSI payments, which could stretch over five weeks.

Practical tips:

- Budget with the full month in mind: Create a spending plan that carries your check through the end of February.

- Track recurring expenses: Mark rent, groceries, medication, and utilities on a calendar to avoid overspending early in the month.

- Avoid impulse purchases: It’s tempting to treat an early check as a windfall. Resist — it’s the same money, just arriving sooner.

- Use autopay or alerts: For utilities and rent, consider setting up automatic reminders or withdrawals close to their due dates.

Many community centers and nonprofit aid organizations offer free financial coaching tailored to seniors and low-income adults. It’s worth seeking out if you need help stretching your budget.

Expert Insight: Historical Context of SSI and Payment Changes

The Supplemental Security Income program began in 1974, replacing a patchwork of state-based welfare programs for the elderly and disabled. Since then, SSI has provided a critical safety net, especially for those who fall through the cracks of other federal programs.

Historically, early payments have caused confusion — especially when recipients believe they’ve received extra money, only to discover they won’t get paid again until the following month.

This has prompted advocacy from financial educators, senior advocates, and SSA staff to educate recipients on the calendar shifts. In recent years, the SSA has improved its communication, offering official payment calendars online, email alerts, and clear FAQ resources to reduce confusion.

Still, mistakes happen — and many people don’t know their exact payment schedule. That’s why staying informed is one of the best things you can do to maintain financial stability.

How to Check Your Own Payment Schedule?

To stay ahead of the game, here’s how to check your own payment status:

- Set up a “my Social Security” account on the SSA’s official website. It’s secure, free, and lets you:

- View your next payment date

- See your exact benefit amount

- Update your direct deposit information

- Download the official 2026 SSA Payment Calendar. This calendar outlines all payment dates by program and birthdate. Keeping a printed copy on your fridge or planner can save you from guessing.

- Call the SSA if needed: If your payment is late or you’re unsure of your benefits, you can call the SSA’s toll-free number. Wait times may be long, so try calling early in the morning or later in the week for faster service.

Final Advice for Beneficiaries and Professionals

If you work with older adults, disabled individuals, or low-income households — whether as a caseworker, financial advisor, or caregiver — helping them understand these payment shifts is part of your role. Misinformation spreads fast, especially on social media or through word of mouth. Clear, official information from the SSA is the best defense.

Consider doing the following:

- Remind clients to set calendar reminders for payment dates

- Help them distinguish between SSI and Social Security payments

- Provide printed or digital copies of the SSA payment calendar

- Offer support in creating basic monthly budgets to account for long gaps between payments

Social Security Benefits January 2026: How Much Will Your Payments Increase?

Working While Collecting Social Security 2026 – The Earnings Limit That Keeps Your Benefits Safe

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000