$2,000 Stimulus Check 2026: you’ve likely seen the headlines, heard rumors on social media, or even received an email claiming that a big federal payment is coming your way. But what’s the truth? Let’s cut through the noise and lay everything out clearly.

As of January 2026, there is no official $2,000 stimulus check approved by the U.S. government or being distributed by the IRS. While there’s growing public interest and political chatter about a “tariff dividend” or new round of economic relief, no law has passed and no payment system has been implemented. So, before you give out your personal info or share your bank details to claim a check — stop, read this first. This article breaks it all down: what’s real, what’s not, where things stand, and what you should actually be focusing on.

Table of Contents

$2,000 Stimulus Check 2026

To wrap it up: There is no $2,000 stimulus check currently approved, distributed, or scheduled by the IRS or the U.S. government. The so-called “tariff dividend” is a proposed political policy, not an actual benefit program. For now, your best path to getting money back from the government is by filing your taxes, claiming every credit available, and staying clear of misinformation. If a true stimulus is approved later in 2026 — you’ll hear it from trusted sources first, not chain messages or clickbait videos.

| Topic | Current Status (2026) |

|---|---|

| $2,000 Federal Stimulus | Not approved or scheduled |

| Tariff Dividend Proposal | Under discussion; not law |

| IRS 2026 Refunds | Active for 2025 tax returns |

| Social Security Increases | 2026 COLA applied |

| State-level Rebates | Varies by state |

What People Think Is Happening vs. What’s Actually Happening?

Let’s start by addressing the misinformation.

The Rumor Machine

In recent months, a wave of posts and videos on platforms like TikTok, Facebook, and YouTube have claimed that a $2,000 IRS stimulus check is “going out in January 2026.” Some say it’s based on new legislation, while others falsely claim the IRS has “already started direct deposit.”

These claims are not backed by any official IRS announcement or federal law.

Most of these rumors refer to either:

- Old pandemic-era stimulus programs that ended in 2021

- A proposed tariff rebate, called a “tariff dividend,” that hasn’t passed Congress

- Confusion over tax refunds and refundable credits

Stimulus Checks: A Quick History

The federal government did issue three rounds of Economic Impact Payments (aka stimulus checks) between 2020 and 2021:

- $1,200 per adult in March 2020 under the CARES Act

- $600 per adult in December 2020 under the COVID-Related Tax Relief Act

- $1,400 per adult in March 2021 under the American Rescue Plan Act

These checks were enacted during a global emergency and required explicit congressional authorization. Each was tied to income thresholds and distributed by the IRS through direct deposit, checks, and debit cards.

No similar emergency legislation or economic crisis exists right now that would justify a similar stimulus program — at least according to federal law as of January 2026.

What Is the “Tariff Dividend”?

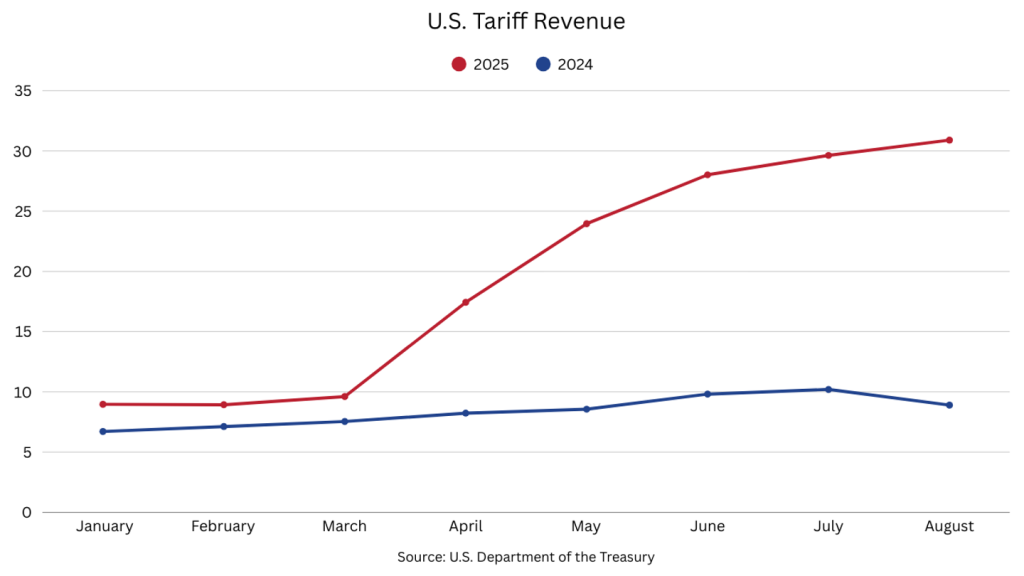

The tariff dividend is a proposed economic policy being discussed in political circles, mainly by former President Donald Trump and supporters of his trade agenda. The basic idea is simple: if the U.S. imposes tariffs on foreign imports (like goods from China), the revenue from those tariffs could be “returned” to Americans in the form of a direct cash payment, proposed to be $2,000 per person.

However, here’s the truth:

- No legislation has been passed to authorize or fund this.

- No funding mechanism exists to make it viable at this scale.

- The IRS has not been authorized to distribute any such payments.

- There is no official rollout, eligibility, or timeline.

According to the non-partisan Tax Foundation, U.S. tariff revenue collected annually is not nearly enough to fund universal $2,000 checks for millions of Americans — especially without deep cuts to other programs or new taxes.

In short, the “tariff dividend” remains a talking point, not a policy. And unless or until Congress passes something specific, there is no check coming under this concept.

Economic Context: Why There’s Pressure for a New Stimulus

Even though the economy has technically recovered from the pandemic and inflation has cooled compared to 2022–2023 highs, millions of Americans are still struggling with:

- Persistent housing costs

- Rising medical bills

- Student loan payments restarting

- Slow wage growth in key sectors like retail, education, and services

Consumer sentiment, while improving, remains shaky. According to a recent Pew Research Center survey in Q4 2025, nearly 52% of Americans say their household finances remain worse than pre-pandemic levels.

This has fueled political and public pressure for new forms of direct relief — hence the popularity of concepts like a “tariff dividend” or expanded Child Tax Credit (CTC). But again, popularity does not equal legality or funding.

What the IRS Is Doing in 2026?

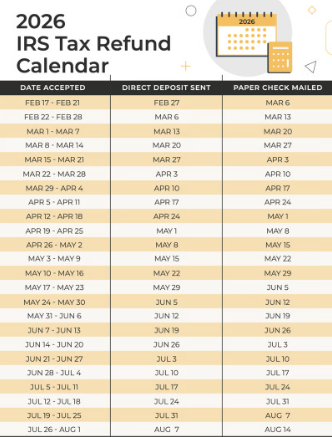

While there’s no $2,000 stimulus, the IRS is very much active — especially with the opening of the 2026 filing season (for 2025 tax year returns).

Key IRS Programs to Know

- Standard Tax Refunds: Based on how much you overpaid in taxes or qualify for credits.

- Earned Income Tax Credit (EITC): Up to $7,430 in 2026 for families with 3+ kids.

- Child Tax Credit (CTC): $2,000 per qualifying child under current law.

- Saver’s Credit and Education Credits: For qualified retirement and education expenses.

- Where’s My Refund?: IRS tool to track refund status after filing.

Filing Deadlines

- Tax Season Opens: January 26, 2026

- Filing Deadline: April 15, 2026

- Extension Deadline: October 15, 2026 (if requested)

State-Level Rebates and Benefits

Although the federal government hasn’t approved a new stimulus, several states are issuing rebates or credits based on surplus budgets or targeted legislation.

Here are a few examples:

- California: Middle Class Tax Refunds (MCTR) of $200–$1,050 were sent in 2023–2024, and a new housing rebate is under discussion.

- Colorado: Offers TABOR refunds when tax revenue exceeds spending limits — typically issued via direct deposit or check.

- New Mexico: State-level economic relief checks were approved in prior years and may return depending on budget outcomes.

These programs vary widely and are only available to state residents who meet eligibility criteria. Always verify with your state’s Department of Revenue or Comptroller’s Office.

Social Security and Fixed Income Payments

Another area people confuse with stimulus checks is the Social Security monthly payment increases.

In 2026, a new Cost of Living Adjustment (COLA) of approximately 2.8% was applied, increasing average monthly benefits for retirees to $1,848, up from $1,798 in 2025.

But again, this is a regular SSA adjustment — not a one-time bonus or stimulus.

What You Should Do Now?

While stimulus checks may not be a reality, here’s how you can stay ahead financially in 2026:

1. File Early

Get your tax return in early to speed up refunds. Most direct deposit refunds are issued within 21 days.

2. Use Free IRS Tools

- Free File for incomes under $79,000

- Interactive Tax Assistant to clarify credits

- Direct Pay to make tax payments safely

3. Avoid Scams

Ignore emails or texts telling you to “claim your $2,000 check.”

The IRS never sends links via email or social media to claim funds.

$2,503 Stimulus Check Confirmed for January 2026 – Check Eligibility & Payment Date

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

$1000 Trump Stimulus Check 2026: Who Could Qualify and When Payments Might Arrive