Stimulus Check Update 2026: if you’ve been scrolling through your Facebook feed, TikTok, or even checking your email lately, chances are you’ve seen someone saying “$2,000 is on the way!” or “Big direct deposits are hitting this month!” Let’s clear the air and break this down so everyone — from grandma to your 10-year-old nephew — knows what’s real and what’s internet fluff.

Here’s the honest truth: As of January 2026, there is no official federal stimulus check being sent to all Americans. While some individuals are receiving IRS payments (and a lot of rumors are floating around), these are not federal stimulus checks like we saw during the COVID-19 era. Instead, what’s happening involves tax refunds, expanded tax credits, proposed legislation, and state-level payments. To make sure you’re not caught off guard or misled, we’ve broken down everything you need to know — from facts and proposals to tax changes and payment schedules — in this easy-to-understand but deeply informative guide.

Table of Contents

Stimulus Check Update

Let’s wrap it up with straight talk: If someone tells you a stimulus check is dropping this week — hit pause and check the source.

Right now:

- There’s no federal stimulus law approved.

- Some taxpayers are receiving large refunds — but these are from filings, not federal relief.

- State-level rebates and Social Security adjustments are real — but different from the stimulus programs of 2020–2021.

| Topic | Status / Explanation |

|---|---|

| Federal Stimulus Check | Not currently approved |

| $2,000 Tariff Dividend | Proposed, not law |

| IRS Refunds & Tax Credits | Happening now |

| IRS Filing Season | Began Jan 26, 2026 |

| Social Security COLA 2026 | 2.8% increase |

| State Tax Rebates (e.g., CO TABOR) | Active in some states |

| Inflation Adjustments (Tax Law) | New deductions & brackets |

| IRS Phasing Out Paper Checks | Ongoing |

No Federal Stimulus Check in 2026 — Here’s Why

Let’s be blunt: a real stimulus check — like those $1,200 or $1,400 payments during the pandemic — can only happen if Congress passes a law. As of now, no such law exists for 2026.

- There’s no new Economic Impact Payment (EIP).

- There’s no IRS schedule for mass stimulus deposits.

- There’s no universal one-time relief check approved by Congress.

These kinds of payments require:

- Legislative approval (via the House and Senate),

- The President’s signature,

- IRS and Treasury Department implementation.

Until those steps happen, any talk of “stimulus checks landing next week” is either miscommunication or hype.

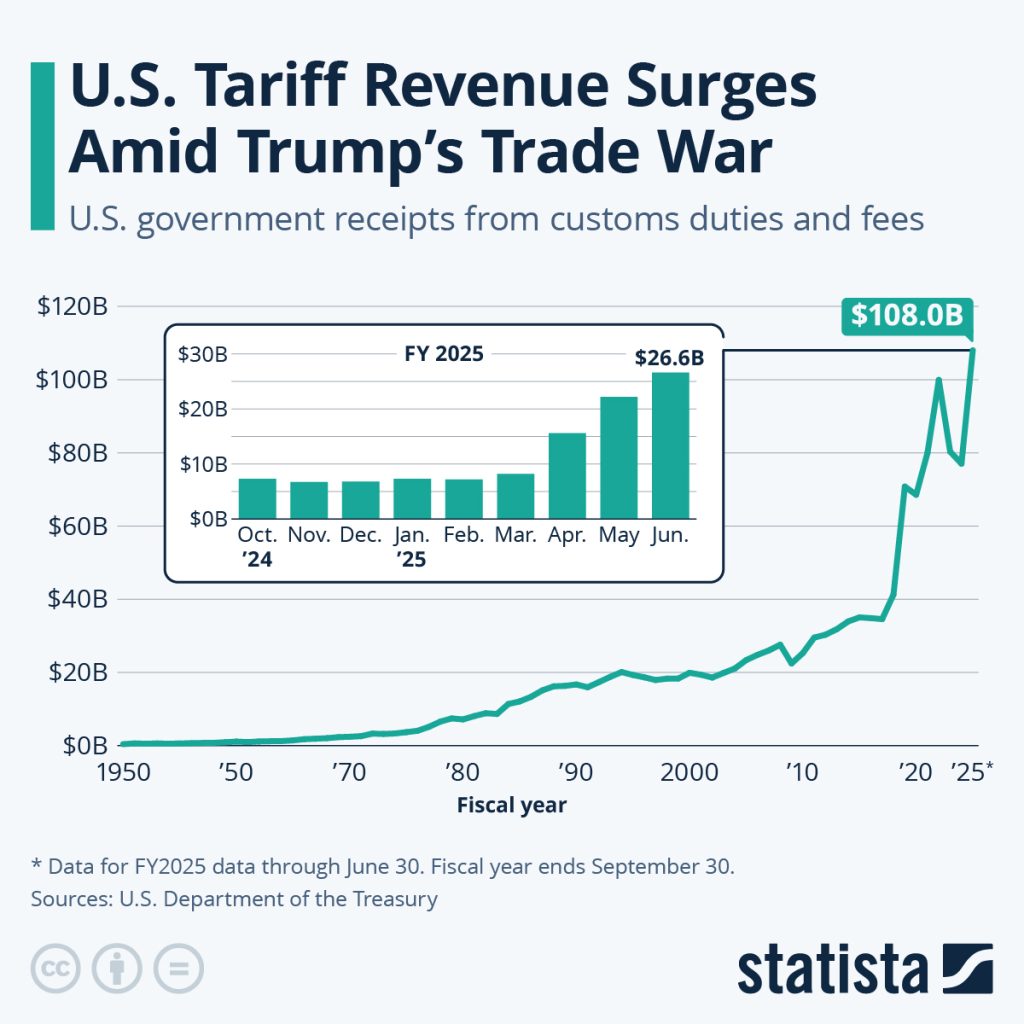

The $2,000 Tariff Dividend – What’s the Real Deal?

You may have heard chatter about the $2,000 “Tariff Dividend” or “Trump Tariff Check” being sent to American households. Let’s unpack it.

This proposal suggests that revenue collected from tariffs on foreign imports would be redistributed as a one-time dividend to U.S. citizens. It’s being floated as a bold way to return money to American taxpayers while shifting tax burdens onto foreign sellers.

Here’s the catch:

- This plan has NOT been approved by Congress.

- It is currently just a political proposal, with no legal framework.

- Many legal experts argue that Congress must authorize such payments, even if the Executive Branch supports the concept.

So while the tariff dividend might gain momentum, there is no IRS mechanism right now issuing this $2,000 check. Until legislation is passed, it’s just a “maybe someday” idea.

Why Some Americans Are Receiving $1,500–$2,000 Checks Anyway

Here’s where confusion begins. Many taxpayers have received or are expecting IRS deposits in that $1,500–$2,000 range.

But these aren’t stimulus checks — they’re regular tax refunds, often boosted by refundable tax credits like:

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Education Credits

- Recovery of overpaid taxes

- New tax law adjustments from the 2025 reform bill

So yes — people are seeing payments in that range, but it’s based on:

- Their 2025 income tax filings, and

- The credits and deductions they qualify for.

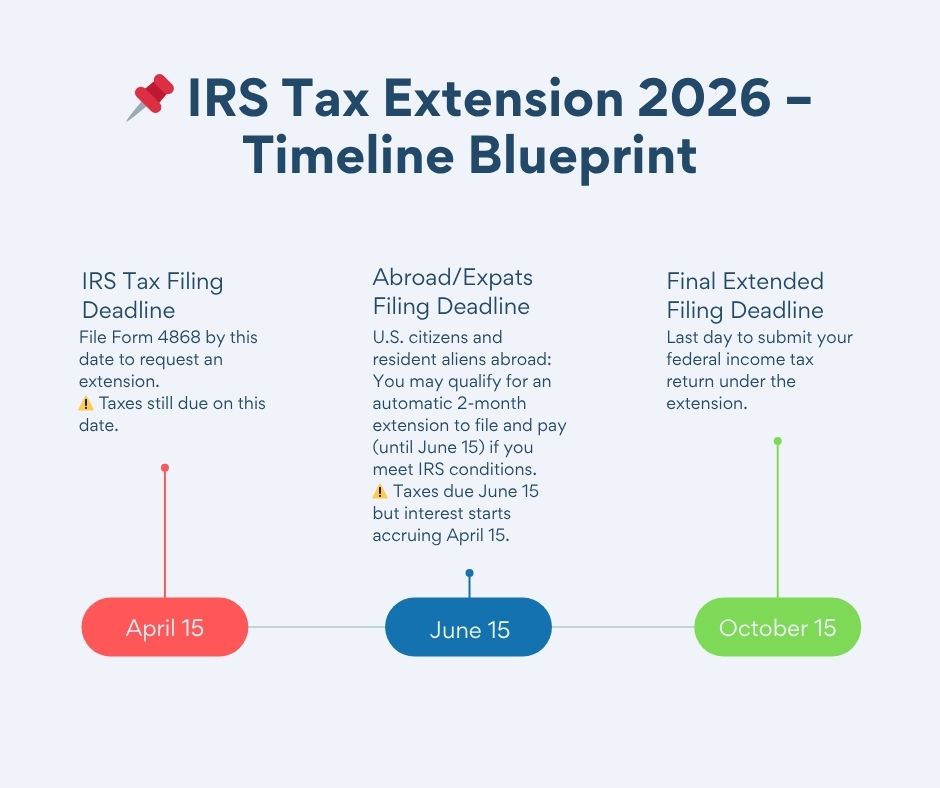

The IRS opened tax season on January 26, 2026, and if you filed early and used direct deposit, you may already have received your refund. Some refund totals are higher this year because of changes passed in 2025’s tax reform legislation known as the One Big Beautiful Bill.

This bill raised:

- Standard deductions (e.g., $16,100 for single filers),

- Child Tax Credit amounts (back up to $2,000 per child),

- Phase-out income thresholds, meaning more Americans qualify.

IRS Changes in 2026 That Could Affect Your Payment

In addition to standard refunds and credits, the IRS made several key changes in 2026:

1. Phasing Out Paper Checks

Starting in 2026, the IRS is encouraging all taxpayers to switch to direct deposit for faster, more secure refunds. Paper refund checks will gradually be phased out — a move meant to reduce fraud and cut processing time.

If you haven’t already, update your direct deposit information through:

- IRS “Where’s My Refund” tool, or

- Your 2025 tax return with your current banking details.

2. Inflation Adjustments to Tax Brackets

Due to high inflation, 2026 brackets were adjusted:

- The 22% tax bracket now starts at $48,300 for single filers.

- Standard deductions increased across the board.

- Mileage, savings credit, and EITC limits were adjusted to match inflation, providing more room for refund growth.

What About State-Level “Stimulus” Checks?

Some states are running independent rebate or refund programs, which often get confused with federal stimulus checks.

Example: Colorado’s TABOR Refund

- Under the Taxpayer’s Bill of Rights (TABOR), Colorado must return surplus revenue to residents.

- In 2026, eligible Coloradans are expected to receive refunds of up to $1,130.

- This is not a stimulus check, but it feels like one.

Other states (like California, Pennsylvania, and New Mexico) have occasionally issued “inflation relief” or gas rebates — again, state-driven, not federal.

Always check your state revenue department or state treasurer’s website to verify what you may qualify for.

Social Security, SSI, and Federal Benefits in 2026

If you’re a retiree, veteran, or receiving disability assistance, here’s what’s happening:

- The Social Security Administration approved a 2.8% Cost-of-Living Adjustment (COLA) for 2026.

- This affects:

- Retirement benefits

- Supplemental Security Income (SSI)

- SSDI and survivors’ benefits

The average Social Security recipient will now receive about $2,071 per month, up from $2,015 in 2025. (ssa.gov)

Note: This increase is not a stimulus — it’s a standard COLA to offset inflation.

Step-by-Step Guide to Understanding Stimulus Check Update 2026

Step 1 — Know What’s Real

- Stimulus checks must be approved by Congress.

- Tax refunds are based on your 2025 return.

- Tariff dividends are still just proposals.

Step 2 — File Your Taxes Early

Early filers with direct deposit receive refunds faster. The IRS recommends e‑filing and using IRS Free File tools.

Step 3 — Claim All Available Credits

Don’t leave money on the table! Check:

- EITC eligibility

- Child Tax Credits

- Education credits

- Saver’s credit

Step 4 — Avoid Scams

Never click on a random link promising “Get your $2,000 now!” The IRS will never contact you via text or social media for payments.

$2,503 Stimulus Check Confirmed for January 2026 – Check Eligibility & Payment Date

$1,000 Stimulus Payment Confirmed for January 2026 — Check Eligibility and Deposit Dates Now

$1,153 Stimulus Checks in 2026 – Are You Eligible? See If You Qualify Today!