IRS Confirms Tax Filing Start Date: The IRS confirms the tax filing start date for 2026 as Monday, January 26, 2026, officially kicking off the tax season for 2025 income. With new tax law updates under the One Big Beautiful Bill Act (OBBBA), this year’s tax season is expected to bring larger refunds and simplified deductions for many Americans. If you’re hoping for some relief this year, you’re not alone — and for once, the odds may actually be in your favor. Whether you’re a college grad filing your first return, a seasoned taxpayer, or a self-employed side hustler, this guide will help you file smarter, understand what’s new, and hopefully, walk away with a bigger check from Uncle Sam.

Table of Contents

IRS Confirms Tax Filing Start Date

The IRS has officially confirmed that the 2026 tax filing season begins January 26, 2026 — and it could be the most financially rewarding in years. Thanks to fresh changes in the One Big Beautiful Bill Act, many taxpayers will see larger refunds, more flexible deductions, and simplified filing. Take the time to get organized, file early, and lean into new tax breaks that could benefit you and your family. It’s not just about getting it done — it’s about getting back what’s yours.

| Topic | Details |

|---|---|

| Filing Start Date | January 26, 2026 — IRS begins accepting 2025 tax returns. |

| Filing Deadline | April 15, 2026 — Tax Day. |

| Major Tax Law | One Big Beautiful Bill Act (OBBBA) introduced new deductions and credits. |

| Refund Outlook | Refunds could be hundreds to thousands of dollars higher. |

| Average Refund (Est.) | $3,150 (IRS projection for 2025 returns). |

| Free Filing Threshold | IRS Free File available for incomes under $79,000. |

| IRS Help Tools | “Where’s My Refund?”, IRS2Go App, Free File, IRS Direct Pay. |

| Official Website | https://www.irs.gov |

What’s New for the 2026 Tax Season?

Let’s break it down. The One Big Beautiful Bill Act, passed in mid-2025, brings some of the most sweeping changes to personal income taxes in over a decade. While much of it mirrors past tax reform efforts, it includes specific deductions and credits aimed at everyday working Americans.

Key New Deductions:

- Overtime and Tip Income Deduction: Up to $25,000 in overtime or tip income may be excluded from taxable income.

- Auto Loan Interest Deduction: Deduct up to $10,000 in interest from qualifying car loans.

- Senior Income Exclusion: Individuals over 65 may deduct an additional $6,000 from taxable income.

- Expanded Child Tax Credit: Increased to $3,000 per child under 17.

- Student Loan Refinancing Credit: Up to $2,500 in tax credits for refinancing at lower interest rates.

These new rules are designed to reduce taxable income, potentially increasing the average refund by hundreds — or even thousands — of dollars for qualifying individuals and families.

IRS Confirms Tax Filing Start Date

| Date | Event |

|---|---|

| January 26, 2026 | IRS begins accepting returns. |

| February 1, 2026 | Deadline for employers to send W-2s and 1099s. |

| March 1, 2026 | Paper filers should send returns by this date to avoid backlogs. |

| April 15, 2026 | Tax Day — last day to file or request an extension. |

| October 15, 2026 | Final deadline for those who filed an extension. |

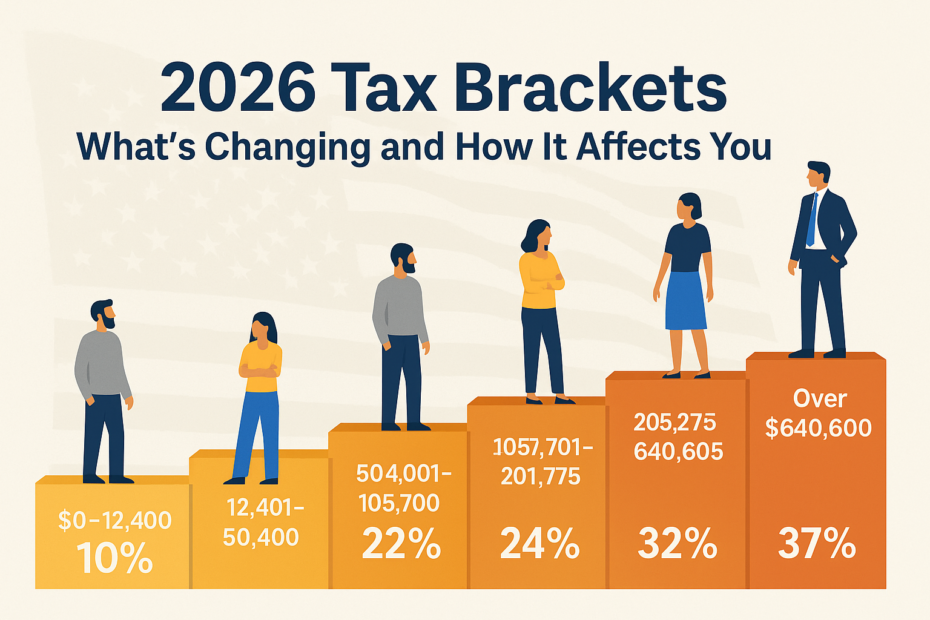

2025 Federal Tax Brackets (Filed in 2026)

Understanding your tax bracket helps estimate how much you owe — or how much you’ll get back.

| Tax Rate | Single | Married Filing Jointly |

|---|---|---|

| 10% | Up to $11,500 | Up to $23,000 |

| 12% | $11,501–$44,000 | $23,001–$88,000 |

| 22% | $44,001–$95,000 | $88,001–$190,000 |

| 24% | $95,001–$182,000 | $190,001–$364,000 |

| 32%+ | Over $182,000 | Over $364,000 |

These brackets are inflation-adjusted annually, which helps reduce your taxable burden.

Inflation, COLA, and Your Taxes

Inflation may feel like a bad word at the grocery store, but when it comes to taxes, it can work in your favor.

Each year, the IRS adjusts standard deductions and income brackets to account for inflation. In 2025, this adjustment was nearly 7% across the board — helping families move into lower tax brackets and potentially pay less overall.

This also means that:

- Earned Income Tax Credit (EITC) thresholds went up.

- Retirement contribution limits increased.

- Standard deductions became more generous.

IRS Confirms Tax Filing Start Date: Filing Tips for First-Timers

If 2026 will be your first tax season, congrats — and don’t worry, it’s not as scary as it seems. Here are some tips:

- Gather all your income forms (W-2, 1099, etc.) and keep them in one place.

- Check if you’re a dependent. If someone else claims you, your filing options are different.

- Use the IRS Free File program if you make less than $79,000.

- Triple-check your Social Security number — typos here are the number one cause of refund delays.

State Tax Returns: Don’t Forget These

While the IRS handles federal taxes, most states also require a separate return. Here are a few reminders:

- 41 states tax income. The exceptions: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

- Each state has its own forms and deadlines. Use software like TurboTax or Credit Karma Tax to file both federal and state together.

- Some states offer their own free file programs, especially for low-income filers.

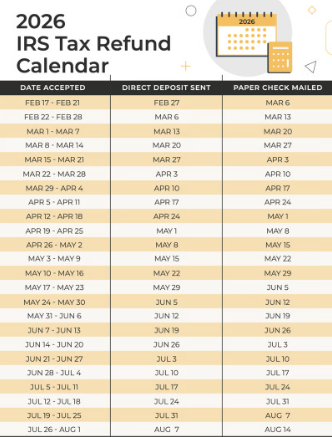

IRS Refund Processing: When Will You Get Your Money?

If you file electronically and choose direct deposit, you could get your refund in as little as 7–21 days. But there are a few things that slow it down:

What Delays a Refund?

- Filing before January 26 (the IRS will hold early-filed returns until opening day).

- Missing W-2s or incorrect SSNs.

- Claiming the Earned Income Tax Credit (subject to extra verification).

- Filing a paper return (these take 4–6 weeks or more).

- Refund offset due to debts (e.g. child support, student loans, taxes owed).

Special Guidance for Seniors and Military Families

Seniors:

- Eligible for an additional standard deduction (up to $6,000).

- Can claim medical expenses above 7.5% of AGI.

- RMDs (Required Minimum Distributions) from retirement accounts still apply if you’re 73+.

Military Families:

- Combat pay may be partially or fully excluded.

- You may qualify for military-specific deductions, like moving expenses.

- Tax filing deadlines may be extended during active deployment.

IRS Confirms Tax Filing Start Date: Common Tax Filing Mistakes to Avoid

Nobody wants to get a letter from the IRS in July. Here’s what to double-check:

- Name matches Social Security records

- Bank account info for direct deposit

- Correct filing status (Single, Head of Household, etc.)

- Claimed credits (Child Tax Credit, EITC) are properly documented

- Use a reliable platform or hire a professional

Mistakes can delay your refund or result in penalties — don’t rush!

Tax Breaks and Credits to Maximize

For Families:

- Child Tax Credit: $3,000 per child under 17

- Dependent Care Credit: Up to $4,000 for daycare or after-school expenses

For Low-Income Households:

- Earned Income Tax Credit (EITC): Up to $7,000 for families with three kids

For Students:

- American Opportunity Credit: Up to $2,500 for tuition and fees

- Lifetime Learning Credit: Up to $2,000 for part-time courses

For Homeowners:

- Mortgage Interest Deduction

- Home energy credits for solar and weatherization

IRS Tax Refund 2026 Schedule: Check Amount & Estimated Dates for Refund Payments

$1,776 Warrior Dividend – IRS Confirms Tax-Free Payment: Check Eligibility Criteria

IRS Filing Deadline Extension – What Taxpayers Need to Know Right Now