$4983 Direct Deposit Coming: Have you seen the buzz about a $4,983 direct deposit heading your way in January 2026? There’s a lot of chatter online, and it’s easy to get excited about the idea of a big, government-issued windfall. But before you start counting the dollars, it’s important to dig deeper into what’s actually going on with these direct deposits. Is it real? Who’s eligible? And, most importantly, what should you know to avoid falling for misinformation? Let’s break it down so you can be well-informed and prepared.

Table of Contents

$4983 Direct Deposit Coming

To sum it up, while the $4,983 direct deposit claim circulating online sounds exciting, it’s important to separate fact from fiction. There is no universal $4,983 payment coming for everyone in January 2026. However, certain groups, particularly Social Security beneficiaries, may see increased payments or retroactive payments during this time. Understanding the real factors at play — such as COLA adjustments and retroactive corrections — will help you keep your expectations in check.

| Key Point | Details |

|---|---|

| $4,983 Payment | There is no universal $4,983 direct deposit for everyone. |

| Eligibility | Only specific groups like Social Security recipients may see large deposits. |

| Retroactive Payments | Some people may get large payments if there are corrections to past benefits. |

| Payment Dates | Social Security COLA adjustments affect payment amounts in January. |

What’s Going On with the $4983 Direct Deposit Coming?

The rumor of a $4,983 direct deposit that’s supposedly coming for everyone in January 2026 has been circulating online, creating confusion and excitement. Let’s get real: there’s no official announcement or program guaranteeing this amount will land in your bank account. But there are certain circumstances in which large payments like this could show up for specific individuals, like Social Security beneficiaries. However, the $4,983 figure is not a magic number for every single American.

Is There a $4,983 Direct Deposit Coming for Everyone?

The quick answer is no—there’s no universal, across-the-board $4,983 direct deposit for everyone in January 2026. So, if you’ve been seeing social media posts or clickbait headlines about a large payment being sent to all Americans, take a deep breath.

Where does the confusion come from? Well, $4,983 is sometimes connected to the maximum Social Security benefit. For those who have worked for decades and reached full retirement age, their monthly payout can approach this number. But that’s specific to Social Security recipients, not the general public.

So, let’s clear up the air: this isn’t a stimulus check or a one-time payment for all. Instead, it could be related to adjustments in Social Security benefits or retroactive payments for a smaller group of people. Let’s dig into that more.

Where Does the $4983 Direct Deposit Figure Come From?

The $4,983 figure often gets tied to Social Security. For example, the maximum monthly Social Security retirement benefit for someone who starts at full retirement age in 2026 could be close to $4,983. But keep in mind, only a small percentage of people are actually receiving that kind of payout.

In most cases, people who’ve paid into the system the longest, earning at or above the maximum taxable income during their careers, will have the highest benefits. However, it’s not a figure that everyone will see. In fact, according to Social Security Administration data, the average monthly Social Security benefit in 2025 is around $1,800, far below the $4,983 mark.

What Does This Mean for You?

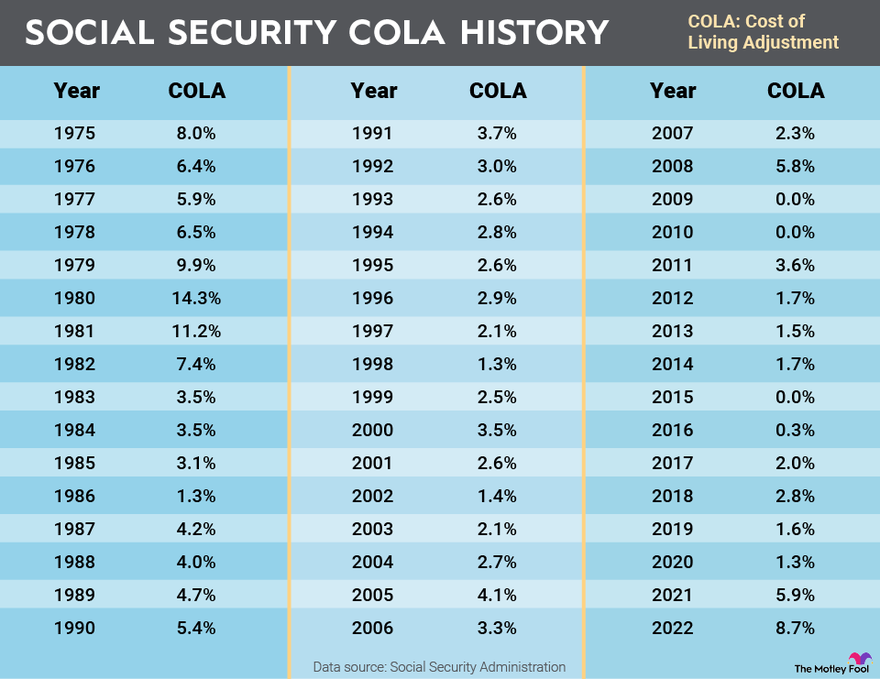

If you’re not one of the lucky few with that maximum payout, don’t expect a check for $4,983 in your bank account anytime soon. Instead, if you qualify for Social Security benefits, you will see adjustments based on the Cost-of-Living Adjustment (COLA) for 2026. This could lead to an increase in your regular monthly payment, but it won’t suddenly give you a lump sum of $4,983 unless you have retroactive payments due.

Why Is January 2026 the Key Date?

Why the focus on January 2026? The start of each year brings new adjustments to Social Security benefits. Every year, the Social Security Administration (SSA) evaluates changes in the cost of living, and COLA increases are made to help benefits keep up with inflation. So, come January 2026, eligible individuals will see higher monthly payments due to these adjustments.

In addition, if someone was eligible for retroactive payments (for example, for past benefit errors or delayed payments), they might see a large sum deposited into their accounts in January 2026. But this is very specific and not something that happens automatically for everyone.

Practical Guide: Who Might Get a Large Deposit?

If you’re wondering if you might qualify for a larger-than-usual deposit in January 2026, here’s a breakdown of scenarios in which this might apply:

1. Social Security Beneficiaries

If you’re already receiving Social Security benefits, you may see an increase in your monthly payments due to COLA. In January 2026, this could be anywhere from 1% to 3% of your monthly benefit, depending on inflation rates.

However, this will not result in a lump-sum $4,983 payment. If you’re receiving monthly Social Security payments, this will just be a slight boost in what you’re already getting.

2. Retroactive Payments

In some cases, retroactive Social Security payments may be issued for people whose benefits were delayed or underpaid in the past. For example, if someone was eligible for Social Security but their payments were delayed for some reason, they may receive a lump-sum payment to cover the missed months.

If you’re in this situation, you could receive a larger deposit — but only for the specific back payments due to you. This is not a “gift” or a “bonus” but rather a correction to your previous payment schedule.

3. Individuals with Errors in Their Benefits

Another group who might see large payments are individuals whose benefits were miscalculated or errors were found in their payment history. If the SSA or IRS determines that you were underpaid, they may issue a corrective payment.

4. Other Specific Situations

There are other, rarer situations that could result in a large direct deposit. For example, if someone recently received a disability benefit approval after a lengthy review process, they might get a retroactive payment for the months they were waiting for approval.

$4983 Direct Deposit 2026 for Everyone: Latest Updates and What’s True?

January 2026 Stimulus Payment Update – IRS Direct Deposits and Tariff Dividend Facts

When Will Your February 2026 Social Security Payment Arrive? Find Out Now