$2,000 Federal Deposit: In January 2026, taxpayers across the United States are eagerly awaiting their tax refunds and possible federal deposit payments. With recent discussions around $2,000 direct deposit payments circulating online, many are confused about whether these payments are official or if they’re simply rumors. The timing of tax refunds and federal deposits, however, is determined by a specific set of rules and regulations managed by the IRS (Internal Revenue Service). In this article, we’ll break down federal deposit timelines, why expectations around refunds are shifting, and what you should know to ensure you’re not caught up in the confusion. Let’s dive into the details and clear up any confusion.

Table of Contents

$2,000 Federal Deposit

Understanding federal deposit timelines and refund expectations in January 2026 is crucial for avoiding confusion and ensuring that you get your money as quickly as possible. While $2,000 stimulus payments aren’t on the horizon for 2026, many taxpayers will still receive their tax refunds by late February or early March. The key is to file early, choose direct deposit, and ensure your return is accurate to avoid delays. Keep in mind, that while the timeline and amount of your refund will vary, staying informed and prepared will help you avoid frustration and make the most out of the tax season.

| Key Takeaways | Details |

|---|---|

| What is the $2,000 deposit | There is no new $2,000 federal stimulus payment confirmed for January 2026. It’s likely linked to online rumors and previous stimulus checks. |

| Tax Refund Timelines | The IRS will begin processing tax refunds for 2025 returns starting January 26, 2026, with most refunds expected by late February or early March. |

| Why Refunds Vary | Refund amounts and timing depend on filing status, credits claimed, and whether the return is e-filed or paper filed. |

| Official Resources | For accurate IRS timelines and refund status, visit the official IRS website. |

| Avoid Scams | Be cautious of scam offers promising fast refunds or direct deposits. Always verify with the IRS. |

The Truth Behind the $2,000 Federal Deposit

There has been a lot of buzz recently about a $2,000 federal deposit supposedly arriving in January 2026. If you’ve heard this and were hoping for a big boost to your finances, it’s important to set the record straight. While large federal payments, such as stimulus checks, were issued in the past due to economic conditions like the COVID-19 pandemic, there has been no new legislation passed that would authorize a $2,000 federal deposit for all citizens.

These rumors often circulate on social media and from unverified sources, but nothing official from the IRS or the U.S. Treasury Department confirms the arrival of these funds. Many individuals mistake tax refunds for stimulus payments, leading to confusion. While some may receive $2,000 or more in refunds, these are not new, one-time government checks — rather, they are the standard tax refund process based on your individual filings.

Practical tip: Always verify the information before believing in viral claims. Avoid clicking on links or providing personal information in response to unsolicited offers of “stimulus” money.

How $2,000 Federal Deposit Timelines Work?

The IRS Refund Process

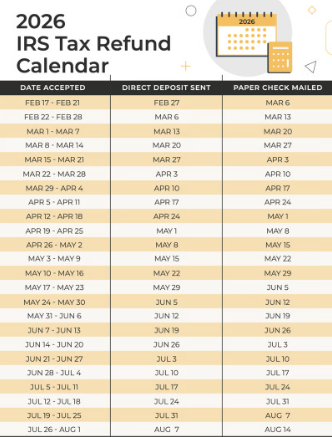

Refunds are typically issued based on the tax filing season, which generally begins in late January each year. For 2026, the IRS will officially start processing returns on January 26, 2026. Refunds will begin to be issued shortly after that, with most e-filed returns and direct deposit options processed within three weeks.

Here’s how it works:

- Filing Your Taxes: To get your refund, you’ll need to file your taxes with the IRS. This can be done either electronically (e-file) or by mail (paper filing). E-filing is the fastest way to get your tax return processed.

- Refund Processing: The IRS then checks your return for errors, verifies your information, and calculates the amount of your refund based on your income, withholding, and any credits you’re eligible for (like the Child Tax Credit or Earned Income Tax Credit).

- Receiving Your Refund: Once processed, the IRS issues your refund either via direct deposit to your bank account or by check in the mail. If you choose direct deposit, it’s faster — generally within 21 days of your return being accepted. Paper checks take longer, sometimes up to six weeks.

Why Refunds Can Vary

Your refund’s size and timing depend on several factors:

- Filing Method: E-filed returns are processed faster than paper returns.

- Claimed Credits: Certain credits, like the Child Tax Credit or Earned Income Tax Credit, may require additional verification, delaying your refund.

- Return Errors: If your return contains mistakes, the IRS will take longer to process it.

- Direct Deposit: Choosing direct deposit speeds up the process compared to waiting for a mailed check.

Refund Expectations in January 2026: What to Expect

While the $2,000 deposit is not coming from the federal government in the form of a stimulus, there are still many individual refunds expected by late February or early March 2026.

For most taxpayers, here’s what to expect:

- Taxpayers Who E-file Early: If you file your tax return early and use direct deposit, you can expect your refund within 3 weeks, as long as there are no issues with your return.

- Paper Filers: If you mail your tax return, be prepared for a longer wait — it could take six weeks or more before you get your refund.

- IRS Processing Delays: Keep in mind that delays may occur if the IRS is reviewing your return for any errors or discrepancies, especially if you’ve claimed certain credits.

Tariff Dividend Payments January 2026 – Reality Check on New Federal Payment Claims

Is a 4th Stimulus Check Coming in January 2026? Latest Updates

Trump’s $2,000 Tariff Dividend Check Update: What You Need to Know as 2025 Winds Down