Social Security Payment Up to $5,181: In January 2026, Social Security recipients across the United States will receive their monthly benefits, with some individuals eligible for payments of up to $5,181. This is a significant update to benefits that can have a direct impact on retirees, individuals with disabilities, survivors, and low-income households. However, understanding who qualifies for the highest payments and how you can benefit from the upcoming 2.8% increase in Social Security payments is key to preparing for this change.

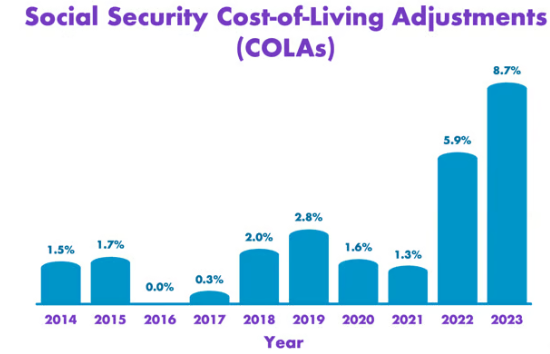

Social Security benefits are a vital source of income for many Americans, particularly for older adults or those who are unable to work due to disability. The Social Security Administration (SSA) issues payments to millions of individuals based on their earnings and the taxes they’ve paid throughout their careers. With the COLA increase in 2026, there will be more money available to eligible recipients. However, not all recipients will receive the maximum payment of $5,181. The amount of your monthly payment will depend on various factors, including your work history, when you start claiming benefits, and the amount you’ve paid into the system.

This article breaks down what this payment means, who qualifies for the maximum amount, and how the Social Security system works in terms that are easy to understand for everyone. Whether you’re a senior citizen preparing for retirement or someone curious about how Social Security impacts your community, we’ve got you covered.

Table of Contents

Social Security Payment Up to $5,181

The upcoming January 28, 2026 Social Security payment represents more than just a number — it’s part of a larger system that provides financial security for millions of Americans. Understanding how COLA increases work, how payments are calculated, and who qualifies for the maximum $5,181 will help you plan for a secure retirement or disability support.

Remember, while the 2.8% increase in 2026 may seem small, every dollar counts toward your financial future. Start planning now, consider your work history, and think about when you want to start claiming benefits. As always, stay informed with the latest updates from official resources like the Social Security Administration (SSA) to make the best decisions for your situation.

| Key Information | Details |

|---|---|

| Maximum Payment | Up to $5,181 per month for those qualifying under specific conditions. |

| Social Security COLA Increase | A 2.8% increase in payments for 2026, starting in January. |

| Payment Dates | Payments are issued on a set schedule based on your birth date. |

| Eligibility for Maximum Benefits | Earning a high income for 35 years and delaying retirement until age 70. |

| Official Reference | Social Security Administration |

Understanding Social Security Payment

What is Social Security?

Social Security is a federal program that provides financial assistance to people who are retired, disabled, or survivors of deceased workers. It’s funded through payroll taxes collected from workers and their employers, typically in the form of a 6.2% Social Security tax on income, which is matched by employers. The amount that a person is entitled to receive from Social Security depends on how much they earned throughout their career and how long they paid into the system.

When you work, you earn Social Security credits. These credits determine how much you will receive in benefits when you retire or if you become disabled. You need to accumulate 40 credits (generally the equivalent of 10 years of work) in order to qualify for Social Security retirement benefits. The amount of benefits you can receive depends on your lifetime earnings and when you choose to start claiming your benefits.

How Are Benefits Calculated?

Social Security benefits are calculated using a formula that considers your average indexed monthly earnings (AIME) over your highest-earning 35 years of work. This means that if you had a few low-earning years or gaps in employment, the SSA will take the highest-earning 35 years and average them out. The more you earned, the higher your monthly benefit will be.

However, even with higher lifetime earnings, your monthly Social Security benefit is capped at a certain amount. For 2026, the maximum monthly benefit will be $5,181 for someone who starts collecting at age 70. The maximum benefit is reached only under certain conditions, and as mentioned before, most beneficiaries will not qualify for this amount.

Who Will Receive the Social Security Payment Up to $5,181?

The headline “up to $5,181” refers to the maximum possible monthly payment for an individual in 2026. But don’t get too excited — this is the highest possible amount and not the standard payment.

Qualification for the Maximum Payment

To qualify for the maximum $5,181 per month, you would need to meet two key criteria:

- You must have worked and earned at or above the Social Security’s maximum taxable earnings for 35 years. The SSA taxes income up to a specific threshold each year, and in 2026, that limit will be $160,200. This means that if you earned $160,200 or more per year for 35 years, you would have met the earnings requirement.

- You must delay claiming benefits until age 70. Social Security offers an increase in benefits for every year you delay claiming, and the highest monthly benefit is achieved by waiting until you reach age 70. If you start claiming earlier, your monthly amount will be lower. For example, if you start receiving benefits at age 62, your payment will be reduced by approximately 30% compared to the full benefit you would receive at age 66 or 67, depending on your full retirement age.

Let’s break it down further:

- A worker who earned the maximum taxable earnings for 35 years and who waited until age 70 to begin receiving benefits can reach the maximum monthly payment of $5,181.

- Most Americans will not reach this maximum amount. In fact, the average Social Security retirement benefit for retired workers in 2026 will be around $1,790 per month.

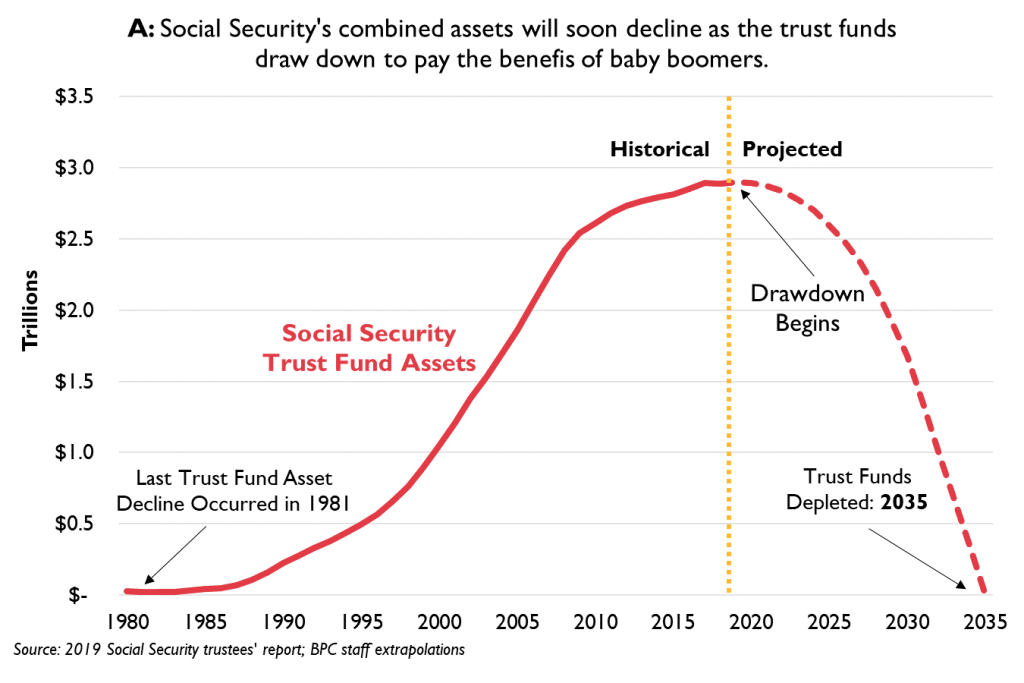

Understanding the COLA Increase in 2026

The Cost-of-Living Adjustment (COLA) is a change made annually to Social Security benefits to keep up with inflation. The COLA increase is determined by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This adjustment ensures that beneficiaries can maintain their purchasing power even as the cost of living rises.

In 2026, Social Security benefits will increase by 2.8%. This is a significant boost and will directly affect those who are receiving benefits. For instance, if your current benefit is $1,500 per month, after the 2.8% COLA increase, your monthly payment would increase by $42 (bringing it to $1,542).

While this increase may seem small, it’s important to remember that every little bit helps, especially for those who rely heavily on Social Security as their primary source of income. For retirees, a COLA increase can significantly help offset rising costs for necessities like food, healthcare, and housing.

The Social Security Payment Schedule for January 2026

Each year, Social Security payments are issued on specific days of the month, depending on your birth date. January 2026 is no different.

Here’s the typical payment schedule:

- 1st–10th of the month: People born on these days will get their payments around January 14.

- 11th–20th of the month: People born on these days will see payments around January 21.

- 21st–31st of the month: These recipients will see their checks or direct deposits on January 28, 2026.

SSI Payments

For those receiving Supplemental Security Income (SSI), your payments are generally sent earlier in the month and might be different from regular Social Security payments. SSI recipients will receive their payments on January 1, a day ahead of the regular schedule.

Practical Advice for Planning Your Social Security Payment Up to $5,181

1. Start Early – But Not Too Early

You don’t have to wait until 70 to start receiving Social Security benefits, but the earlier you claim, the less you’ll get each month. If you’re in good health and plan to keep working, it may make sense to wait as long as possible to increase your benefit amount.

For example:

- If you start receiving benefits at age 62, your payment will be 30% lower than if you wait until full retirement age (FRA), which is around 67 for most people.

- If you wait until age 70, your monthly benefit will be at its maximum, and you’ll also receive the 8% delayed retirement credit for each year you delay after your FRA.

2. Consider Your Life Expectancy

If you expect to live a long time, it might be worth it to delay benefits as long as possible because the longer you wait, the higher your monthly payment will be. For example, for each year you wait after full retirement age (around 66-67 for most people), your monthly payment increases by 8%. This can lead to a significantly higher monthly payment if you live into your 80s or beyond.

3. Factor in Your Other Sources of Income

Social Security is often not enough to live on, especially if you’re used to a higher income. Make sure to have other savings or pensions to back up your benefits. For those with health concerns or family obligations, Social Security might also serve as a vital supplement to other retirement savings.

Social Security 2026 Update – What’s Changing Next Year and How New Payment Dates Will Work

Social Security Payments 2026 – Why Higher Checks May Not Increase Take-Home Income

$5,181 Social Security Check – The Income Level You Must Reach in 2026 to Qualify