USA Minimum Wage Increase: USA Minimum Wage Increase 2026 is the talk of the town this January. From small towns in Nebraska to bustling boroughs in New York, millions of workers across America are starting the new year with something a little sweeter — a raise in their hourly pay. But it’s more than just extra dollars in your pocket. It’s a shift in policy, an update in economic thinking, and a sign that states are taking cost of living seriously. Whether you’re 16 and scooping ice cream or 56 and supervising at a warehouse, this update affects your wallet, your job, or your business. Let’s break it down clearly and thoroughly.

Table of Contents

USA Minimum Wage Increase

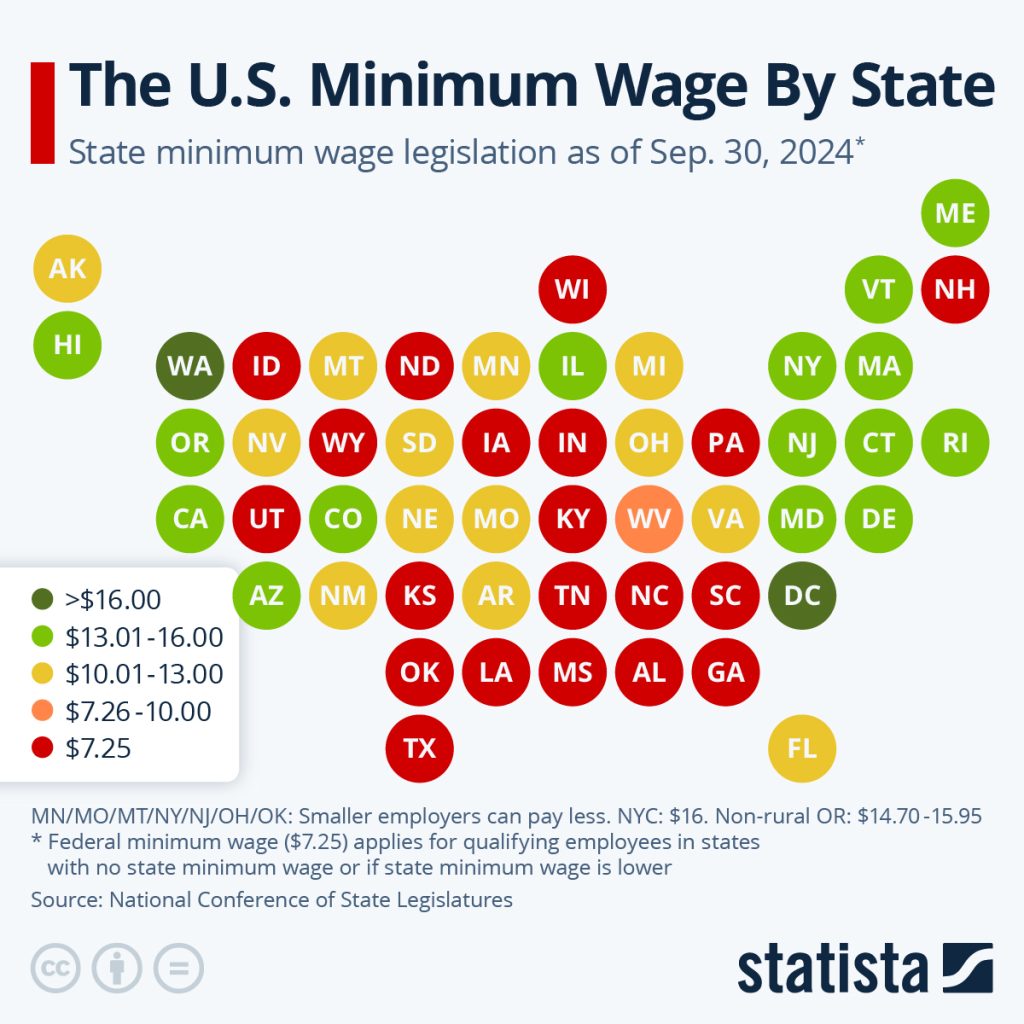

2026 is a watershed moment for wage earners across America. While the federal minimum wage stays frozen at $7.25, over 19 states — and several major cities — have taken it upon themselves to raise the bar for working people. Whether you’re clocking in your first job or managing a team of 500, the shift in wage laws affects payroll, morale, the economy, and the lives of everyday Americans. More money in workers’ pockets isn’t just good ethics — it’s good business. Staying informed is step one. Acting on it is step two. And building a fairer economy — that’s step three.

| Category | Details |

|---|---|

| Federal Minimum Wage (2026) | $7.25/hr — unchanged since 2009 (FLSA: Fair Labor Standards Act) |

| States with Increased Minimum Wage Jan 1, 2026 | 19+ states boosted their wage floors, affecting millions of workers |

| Workers Benefiting Nationwide | 8.3+ million workers are seeing raises as wage laws kick in |

| Highest State/Local Minimum Wage (2026) | Washington, D.C.: $17.95, Washington State: $17.13 |

| Common $15+ Threshold States | Arizona, California, Colorado, Maine, Missouri, Nebraska, New Jersey |

| Official Minimum Wage Resource | U.S. Department of Labor – State Minimum Wage Laws: https://www.dol.gov/agencies/whd/minimum-wage/state |

What Is Minimum Wage and Why Should You Care?

The minimum wage is the lowest legal hourly rate an employer can pay an employee. It’s often the starting point for new workers, part-time earners, and folks in lower-income roles. But it’s not just about numbers — it represents how a society values its workers.

The federal minimum wage is $7.25 per hour, and has been frozen at that level since July 24, 2009. That’s over 17 years of no movement, even while prices for rent, food, fuel, and utilities have ballooned.

States can (and many do) pass their own laws to require higher minimum wages. If you’re in a state or city with a higher local wage, your employer must pay that higher rate — not just the federal one. That’s why in 2026, dozens of states have adjusted their wage floors, making this year one of the most impactful for wage earners in over a decade.

Why USA Minimum Wage Increase Matter More Than Ever?

You’re probably thinking, “This happens every year, right?” Well, yes and no.

Many states schedule annual minimum wage increases, especially those that tie their wages to inflation — meaning they rise with the Consumer Price Index. But in 2026, the stakes feel higher:

- Inflation has eaten into household budgets.

- Housing and childcare costs are climbing across the board.

- And public support for wage reform is gaining traction in both red and blue states.

This year, more people than ever live in states with $15 or higher wage floors. That’s a symbolic and financial milestone.

Real Stories: How Workers Benefit

Let’s take a real-world look:

Marisol, a grocery clerk in New Jersey, used to earn $14.50 per hour. With the new 2026 minimum of $15.92/hr, she now takes home an extra $57.68 per week — over $230 a month — just by working her regular hours.

Trent, who manages a coffee shop in Seattle, had to raise his starting wage to $17.13/hr. But he noticed something interesting: applications doubled. Higher wages made the job more competitive, which improved his ability to hire and retain workers.

It’s not just about money — it’s about stability, confidence, and planning for the future.

The State-by-State Breakdown

Let’s look at what some states are doing in 2026:

- Washington State: $17.13/hr — tops the national list for state minimums.

- California: $16.90/hr — nearly triple the federal rate.

- New York (NYC, Long Island, Westchester): $17.00/hr — showing that urban costs matter.

- New Jersey: $15.92/hr — surpassing the $15 milestone.

- Maine: $15.10/hr — with cost-of-living adjustments.

- Colorado: $15.16/hr — indexed to inflation.

Some smaller states and cities even outpaced the giants. Washington, D.C., for example, set its 2026 rate at a whopping $17.95/hr. That’s the highest minimum wage in the country, reflecting high metro living costs.

How We Got Here: A Bit of History

The federal minimum wage was introduced in 1938, during the Great Depression, at just $0.25 per hour. It was created under the Fair Labor Standards Act (FLSA) to ensure workers weren’t exploited.

In the decades since, the wage was increased multiple times — but since 2009, Congress has failed to pass a raise, even though the cost of living has soared. What once bought groceries for a week might now buy a single bag of groceries.

That’s why states have taken matters into their own hands, and that’s how we’ve landed where we are in 2026.

Minimum Wage vs. Living Wage

It’s important to understand the difference between a minimum wage and a living wage.

- Minimum wage is the legal minimum an employer must pay.

- Living wage is the amount a worker needs to cover basic expenses like rent, food, transportation, and childcare — without needing public assistance.

In many areas, the minimum wage still falls short of the local living wage. In fact, research shows that in no U.S. state can a worker earning the federal minimum afford a modest two-bedroom apartment without spending more than 30% of their income on rent.

That’s why increasing the minimum wage is such a big deal — it helps bridge that gap.

What Employers Need to Know About USA Minimum Wage Increase

If you run a business or manage a team, this affects you, too. Here’s your 2026 to-do list:

- Update your payroll systems — The new wages are effective January 1. Failing to update on time could result in fines or lawsuits.

- Know your location’s rate — Your city or county may have a higher wage than your state. Always follow the highest applicable wage.

- Adjust job offers and hiring plans — Your entry-level offers should reflect the new market rates.

- Post updated notices — Labor law posters must reflect current wages in breakrooms or digital spaces.

- Plan for ripple effects — When minimum wage goes up, sometimes your experienced staff expects a raise too. It’s time to re-evaluate pay structures.

These changes might feel like a pinch at first, but studies suggest higher wages reduce turnover, improve morale, and can even increase customer satisfaction.

Understanding the Tipped Wage Gap

Tipped workers — like servers and bartenders — are often paid a lower base wage, with the expectation that tips make up the rest. In some states, that base wage is still as low as $2.13/hr. If tips don’t add up to the full minimum wage, employers must make up the difference.

However, many states now require tipped workers to earn the full minimum wage before tips — and that number is rising in 2026. Make sure you know your state’s policy.

Industries Most Affected by the Wage Bump

Certain sectors will feel the impact more directly:

- Hospitality: Restaurants, hotels, and cafes rely on hourly, tipped, and part-time workers.

- Retail: Stores are re-evaluating pay and benefits to stay competitive.

- Home care: Personal aides, nannies, and elder care professionals often earn near-minimum wages.

- Gig economy: Though not always covered by wage laws, pressure is mounting to classify and compensate gig workers fairly.

Maine increases minimum wage in 2026: Check the amount and date

It’s Official: New York Announces 2026 Minimum Wage Hike; Here’s Who Benefits Most