Minnesota Stimulus Payment: In 2026, Minnesota made headlines with a bold move that’s changing lives and livelihoods. The state launched a powerful new initiative called the Paid Family and Medical Leave (PFML) program — offering up to $1,423 per week to eligible workers who need time off for major life events like childbirth, serious illness, or family caregiving. So, while folks have been calling it a “Minnesota stimulus check,” let’s be clear — it’s not a federal stimulus or a one-time handout. It’s a worker-funded, state-run wage benefit that protects your income and your job when you need time off for real-life stuff.

Let’s break it all down: who qualifies, how to apply, how much you’ll get, what employers need to know, and why this matters for every Minnesotan. Whether you’re a parent, a caregiver, a healthcare worker, or a small business owner — this guide has what you need.

Table of Contents

Minnesota Stimulus Payment

The Minnesota PFML program is one of the boldest moves in state-level worker policy in decades. It empowers employees to care, recover, bond, and breathe — without sacrificing income or security. With weekly payments up to $1,423, job protection, and a streamlined application process, it puts people first, without putting small businesses last. This isn’t just policy. It’s progress.

| Feature | Details |

|---|---|

| Program Name | Minnesota Paid Family & Medical Leave (PFML) |

| Website | https://paidleave.mn.gov |

| Launch Date | January 1, 2026 |

| Max Weekly Payment | $1,423 |

| Average Payment (So Far) | ~$1,153/week |

| Eligible Workers | Most employees in MN; part-time, full-time, seasonal |

| Leave Duration | Up to 20 weeks annually (12 weeks per qualifying event) |

| Funding Source | Payroll premiums (split by employers & employees) |

| Application Format | Online at paidleave.mn.gov |

| When Paid | Weekly once claim is approved |

What Is the PFML Program and How Is It Different from a Stimulus Check?

The PFML program offers income support when life demands time away from work — like a newborn, a major surgery, or caring for a sick family member. You don’t have to quit your job. You don’t have to lose sleep about paying rent or buying groceries.

Unlike stimulus payments that were temporary, lump-sum checks during the COVID-19 pandemic, PFML is ongoing. It’s:

- Funded by payroll deductions

- Available to most Minnesota workers

- Paid weekly, not all at once

- Tied to medical or family life events, not income thresholds

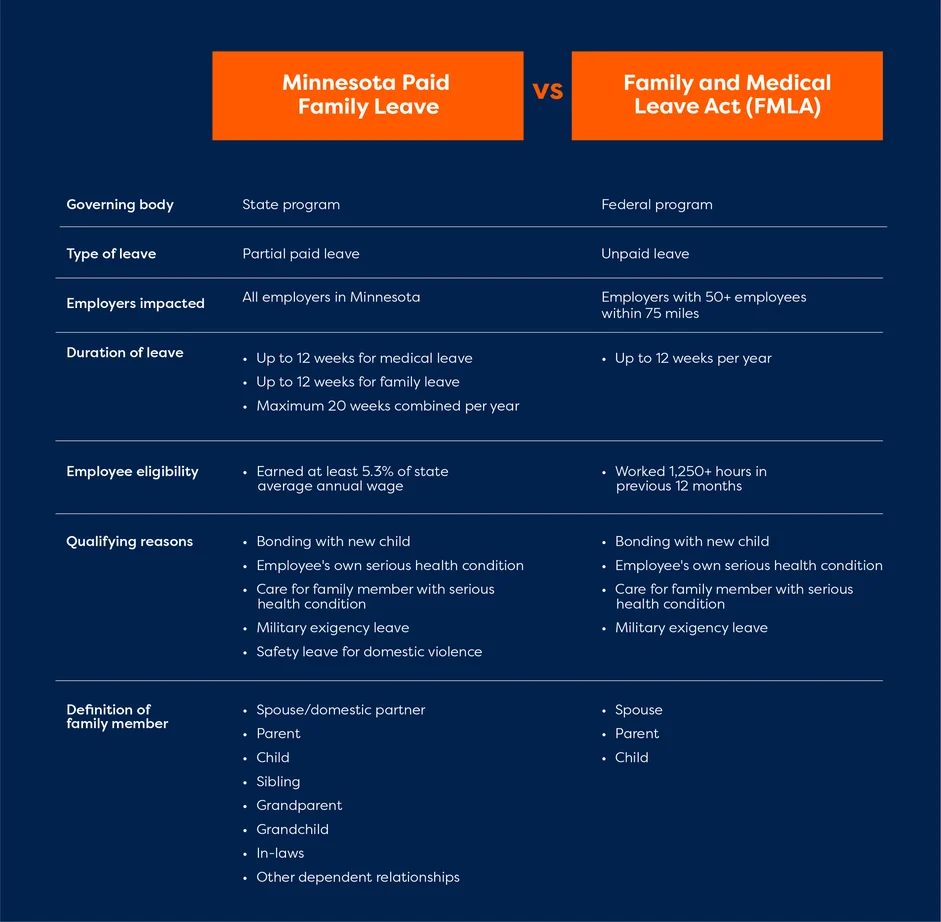

This is about long-term stability — not emergency aid. And unlike unpaid leave laws like FMLA (which offers job protection but no money), PFML pays you while you’re out.

Who Qualifies for Minnesota Stimulus Payment?

The program is designed to be inclusive and practical. Here’s the breakdown of who’s covered and who’s not.

You Qualify If:

- You’re employed in Minnesota, either full-time, part-time, or seasonal

- You’ve earned at least $3,900 in wages over the last year

- You need time off for:

- Bonding with a newborn, adopted, or foster child

- Your own serious health condition

- Caring for a family member with a serious health condition

- Safety leave (domestic violence, stalking, etc.)

- Military family-related events

You do not need to work a minimum number of hours, and you’re eligible even if you change jobs — as long as you’ve worked in Minnesota.

You May Not Qualify If:

- You’re a federal or tribal employee

- You work outside Minnesota with no MN-based hours

- You’re self-employed or a gig worker and haven’t opted into the program

- You’re paid only in cash with no reported wages

How Much Will You Get? Understanding the $1,423 Maximum

The maximum weekly benefit is $1,423 in 2026, tied to the state’s average weekly wage.

But not everyone gets the max. Your actual payment depends on how much you usually earn. Here’s the formula:

- Up to 90% of your wages if you’re a low-wage worker

- Between 55% to 66% for mid-to-high wage earners

- Capped at $1,423 per week

Example Scenarios

- Maria earns $900/week: She could get about $810/week (90%)

- James earns $1,700/week: He may get ~$1,100/week (65%)

- Lena earns $2,500/week: She’ll hit the cap and get $1,423/week

This structure ensures equity and sustainability — folks with lower incomes get higher replacement, and no one earns more than the maximum.

How Long Can You Get Paid Leave?

Under PFML, you can take:

- 12 weeks per qualifying event, and

- Up to 20 weeks total per year if you face multiple events (e.g. giving birth and needing surgery)

Leave can be:

- Continuous (all at once)

- Intermittent (a few days per week)

- Reduced schedule (e.g. part-time while recovering)

The flexibility helps workers recover or care without being forced to rush back.

When Will You Get Minnesota Stimulus Payment?

The PFML system began processing claims in January 2026 and started sending weekly payments by mid-January. Once approved:

- Payments are made weekly

- You can choose direct deposit or debit card

- There’s no lump sum; it flows like a regular paycheck

Average processing times are 1–3 weeks, depending on documentation and eligibility review.

How Is the Program Funded?

Unlike stimulus checks funded by federal debt, Minnesota’s PFML is self-funded by:

- A 0.88% payroll premium, split equally between employer and employee

- Employers submit the premium quarterly to the Minnesota Department of Employment and Economic Development (DEED)

Example:

- If you earn $1,000/week, you pay $4.40/week, and your employer pays the same

That’s less than a streaming subscription, yet it funds a life-changing safety net.

Small businesses with fewer than 30 employees may qualify for reduced premium rates. Employers can also apply for grants to cover temp worker costs.

How to Apply for Minnesota Stimulus Payment: A Step-by-Step Guide

- Check Eligibility

Head to paidleave.mn.gov and review the criteria - Create an Account

Use the online PFML portal - Submit Documents

Provide:- Wage info (automatically pulled if reported)

- Medical provider or birth/adoption verification

- Proof for safety or military leave

- Choose Leave Dates

Whether full-time or partial leave, you select start and end dates - Wait for Approval

You’ll get updates in your portal or by mail - Start Getting Paid Weekly

Direct deposit is fastest

Job Protection and Rights

Once you’ve been with your employer for at least 90 days, you’re protected. Employers must:

- Reinstate you to the same or similar position

- Continue your health insurance coverage

- Not fire, discipline, or retaliate against you

This applies even if your employer offers other leave benefits, so long as you’re using PFML.

If you’re denied, you have the right to appeal — and legal protections support your claim.

How Does Minnesota’s Program Compare Nationally?

Minnesota is now among a growing number of U.S. states with paid leave. But its model stands out:

| State | Max Weekly Benefit | Program Status |

|---|---|---|

| California | $1,620 | Active since 2004 |

| Washington | $1,456 | Active |

| Massachusetts | $1,149 | Active |

| Minnesota | $1,423 | Launched Jan 2026 |

Minnesota’s benefit levels are among the highest and more inclusive — especially for part-time and seasonal workers.

Long-Term Impact of Minnesota Stimulus Payment: Why It Matters

Experts expect PFML to:

- Boost maternal and child health outcomes

- Increase labor force retention

- Reduce worker burnout

- Level the playing field for small businesses and low-income workers

Plus, access to paid leave reduces turnover, saving employers money in rehiring and training.

By 2030, Minnesota expects the program to cover hundreds of thousands of workers annually — offering both economic security and emotional peace of mind.

$1,776 Warrior Dividend – IRS Confirms Tax-Free Payment: Check Eligibility Criteria

Is a 4th Stimulus Check Coming in January 2026? Latest Updates

First Social Security Stimulus Payment 2026 with COLA Adjustment: What Retirees Should Expect