Social Security Planning 2026: Social Security Planning 2026 is top of mind for millions of Americans — whether you’re approaching retirement, already receiving benefits, or helping a loved one plan their future. With new rules, updated cost-of-living adjustments, and shifting economic conditions, your claiming strategy in 2026 can significantly impact your lifetime income. This guide gives you everything you need to know to make smarter, more confident decisions — with plain-English explanations, real-world examples, and trusted advice rooted in experience and expert data.

Table of Contents

Social Security Planning 2026

Social Security Planning in 2026 is not just about when to start collecting — it’s about understanding how the system works, how new rules affect you, and how to build a broader retirement strategy that fits your life. These eight moves — from timing your claim and increasing your earnings record to tax-smart withdrawals and coordinating spousal benefits — can unlock thousands more in lifetime income. Take the time now to run the numbers and build the confident retirement you’ve worked so hard for.

| Topic | Key Facts |

|---|---|

| COLA Increase | 2.8% boost (~$56/month average) |

| Average Monthly Benefit | $2,071 for retired workers |

| Max Monthly Benefit | $5,181 at age 70 |

| Full Retirement Age (FRA) | 67 (for those born in 1960 or later) |

| Early Claim Reduction | Up to 30% less at age 62 |

| Earnings Limit (Under FRA) | $24,480 in 2026 |

| Earnings Limit (Year FRA Reached) | $65,160 |

| Taxable Wage Base | $184,500 |

| Official Website | ssa.gov |

Why Social Security Planning 2026 Matters More Than Ever?

Social Security is the largest retirement income source for most Americans. About 67 million people currently receive monthly benefits, and nearly nine out of ten people aged 65 and older rely on it for at least part of their income. In fact, for about half of retirees, Social Security represents 50% or more of their total income. (SSA.gov)

But here’s the thing — what you get out of Social Security depends heavily on how you plan. Starting benefits too early, missing key credits, or underestimating taxes could cost you tens of thousands of dollars over your lifetime.

And 2026 introduces new numbers, new limits, and new opportunities. If you want to make sure you’re getting every dollar you’ve earned, now is the time to act.

What Changed in Social Security Planning 2026?

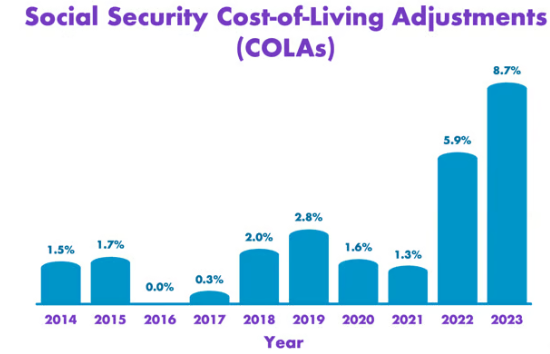

1. COLA Increase: The Social Security Administration announced a 2.8% Cost-of-Living Adjustment for 2026. That means checks are bigger, helping retirees keep up with inflation. But with food, housing, and medical costs rising even faster, planning remains essential.

2. Higher Earnings Limits: In 2026, the earnings threshold for working while receiving benefits increased to $24,480 if you’re under FRA. If you exceed that, $1 is withheld for every $2 over the limit. If you’re in the year you reach FRA, the limit is $65,160, and the penalty is $1 for every $3 earned.

3. Max Benefit and Taxable Wage Base: High earners see higher caps, too. The maximum monthly benefit at age 70 is up to $5,181, and income subject to Social Security tax climbs to $184,500.

8 Practical Moves to Maximize Lifetime Benefits

1. Delay Claiming if You Can

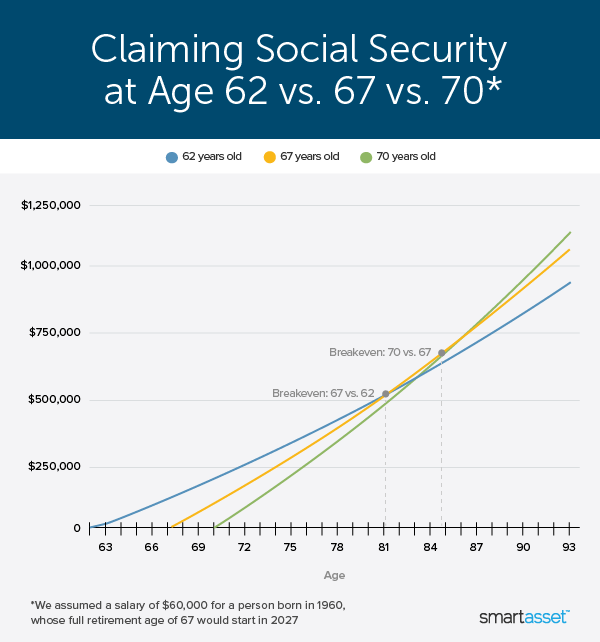

You can start benefits at age 62, but your checks will be permanently reduced. Waiting until your Full Retirement Age (FRA) — which is 67 for those born in 1960 or later — gives you 100% of your benefit. Wait until age 70, and you’ll get 8% more per year in delayed retirement credits.

Example:

If your FRA benefit is $2,500/month:

- At 62: ~$1,750 (30% less)

- At 67: $2,500 (100%)

- At 70: ~$3,100–$3,250 (about 32% more)

That extra $1,500–$1,800 a year can make a huge difference, especially if you live into your 80s or 90s.

2. Work Longer to Improve Your Earnings Record

Social Security calculates your benefit based on your highest 35 years of earnings. If you worked part-time, took time off, or had lower earnings early in your career, those years can drag down your average.

By continuing to work — even part-time — in your 60s, you can replace lower-earning years with higher ones, raising your benefit.

Tip:

Use your my Social Security account to review your earnings history. Correct any missing years or errors.

3. Leverage Spousal and Survivor Benefits

Spousal and survivor benefits can be a game-changer for couples and divorced individuals. Here’s how they work:

- A spouse may receive up to 50% of their partner’s benefit at FRA.

- If one spouse passes away, the survivor may receive 100% of the deceased partner’s benefit.

- Divorced? If your marriage lasted at least 10 years, you may qualify for spousal benefits based on your ex-spouse’s record.

Strategy: Coordinate when each spouse claims to maximize total household income. Often, one spouse claims early while the higher earner delays to increase the survivor benefit later.

4. Watch Out for the Earnings Test

If you start collecting Social Security before FRA and you’re still working, your benefits may be temporarily reduced if you earn more than $24,480 in 2026.

But don’t panic — you don’t lose that money forever. SSA adjusts your benefit upward once you reach FRA to compensate for withheld payments.

Pro Tip: If your income is near the limit, consider reducing hours or delaying your claim by a few months to avoid the penalty.

5. Understand How Benefits Are Taxed

Social Security benefits can be taxed at the federal level depending on your total income:

- If you’re single and make over $25,000, or married filing jointly with over $32,000, you’ll pay tax on up to 85% of your benefit.

Many people are surprised by this, especially when withdrawing from IRAs or 401(k)s.

Planning Tip:

Work with a tax advisor to time your withdrawals or consider Roth conversions before you claim benefits to reduce taxable income in retirement.

6. Consider Medicare and IRMAA Surcharges

Turning 65 means Medicare enrollment — and your income affects how much you pay for Medicare Part B and Part D premiums.

If your income exceeds certain thresholds (starting around $103,000 for individuals or $206,000 for couples), you’ll owe an Income-Related Monthly Adjustment Amount (IRMAA).

Strategy: Time your Social Security and retirement account withdrawals to stay under IRMAA thresholds, if possible.

7. Build a Supplemental Income Plan

Social Security was never meant to cover all your expenses. It replaces only about 40% of your pre-retirement income — and that’s if you’re an average earner.

To live comfortably, most experts recommend aiming for 70–80% of your pre-retirement income. That means you’ll need:

- 401(k), IRA, or Roth IRA savings

- Rental or business income

- Health savings accounts (HSAs)

- Emergency funds and annuities

The stronger your personal savings, the less pressure you’ll feel to claim Social Security early.

8. Use Official SSA Tools to Run the Numbers

The Social Security Administration offers free online calculators to help you estimate your benefits based on your own record.

Visit ssa.gov/benefits/calculators/ and try:

- Retirement Estimator

- Quick Calculator

- Life Expectancy Calculator

Running different “what-if” scenarios (claiming at 62 vs 67 vs 70) gives you the clarity and confidence to make the right move.

Bonus Tip: Don’t Go It Alone

If you have complex income sources, are divorced, or want to optimize your tax strategy, a fiduciary financial planner can help you build a claiming strategy that works for your exact situation.

This is especially important if:

- You have a government pension (WEP/GPO rules may apply)

- You own a business or rental property

- You’re in a blended family

You’ve paid into Social Security for decades — you deserve to get every dollar possible.

Social Security Income $2,071 in 2026 – Why Taxes Could Reduce Most of Your Payment

Social Security Payments January 21, 2026 – See Which Beneficiaries Get Paid This Week

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000