Social Security Increase 2026: If you’re one of the 70+ million Americans relying on Social Security to make ends meet, you’ve probably heard the rumor: “Social Security is going up by $200 a month in 2026!” Sounds like a pretty sweet deal, right? But what’s real and what’s just political talk? This article lays it all out clearly and accurately—using official sources like the Social Security Administration, AARP, and trusted economic data. Whether you’re retired, on disability, a caregiver, or just planning for the future, you’ll walk away with practical knowledge and tools to make smart financial decisions in 2026 and beyond.

Table of Contents

Social Security Increase 2026

Social Security benefits will increase by 2.8% in 2026, giving retirees about $56 more per month. But is the viral $200 monthly boost real? We break down the facts, official SSA numbers, inflation impact, and what’s still just a proposed bill. Learn what’s changing with COLA, Medicare premiums, taxes, and how to prepare with this complete guide for professionals, seniors, and everyday Americans.

| Topic | Details |

|---|---|

| Official COLA for 2026 | 2.8% increase |

| Average Monthly Benefit Increase | ~$56/month |

| Implementation Dates | SSI: Dec 31, 2025; SSA: Jan 2026 |

| $200 Boost | Still a proposed bill; not law |

| Max Taxable Earnings | $184,500 |

| COLA Calculation Method | Based on CPI-W data from Q3 2025 |

| Official Source | SSA.gov COLA 2026 |

What Is the 2026 COLA and Why Does It Matter?

The Cost-of-Living Adjustment (COLA) is the mechanism the Social Security Administration (SSA) uses to ensure benefits keep pace with inflation. Think of it as a yearly raise tied to the actual cost of living in America.

The 2026 COLA is officially set at 2.8%, announced by the SSA in October 2025. That means your Social Security check will grow by nearly 3% in the new year to help offset rising prices on food, gas, rent, and medical care.

Example:

If you receive $2,015 a month now, your new check will be approximately $2,071, giving you an extra $56 per month, or $672 per year.

This increase applies to all forms of benefits under SSA, including:

- Retirement benefits

- SSDI (Social Security Disability Insurance)

- SSI (Supplemental Security Income)

- Survivors benefits

How Is the COLA Calculated?

COLA isn’t random—it’s based on real data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), published by the Bureau of Labor Statistics.

Here’s how it works:

- The government tracks prices from July to September 2025.

- They compare those prices to the same period from the prior year.

- The percentage difference becomes the new COLA for 2026.

In 2025, inflation remained moderate, so the 2.8% increase reflects real but modest cost-of-living growth.

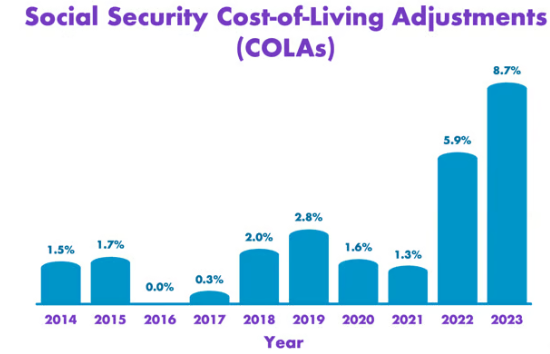

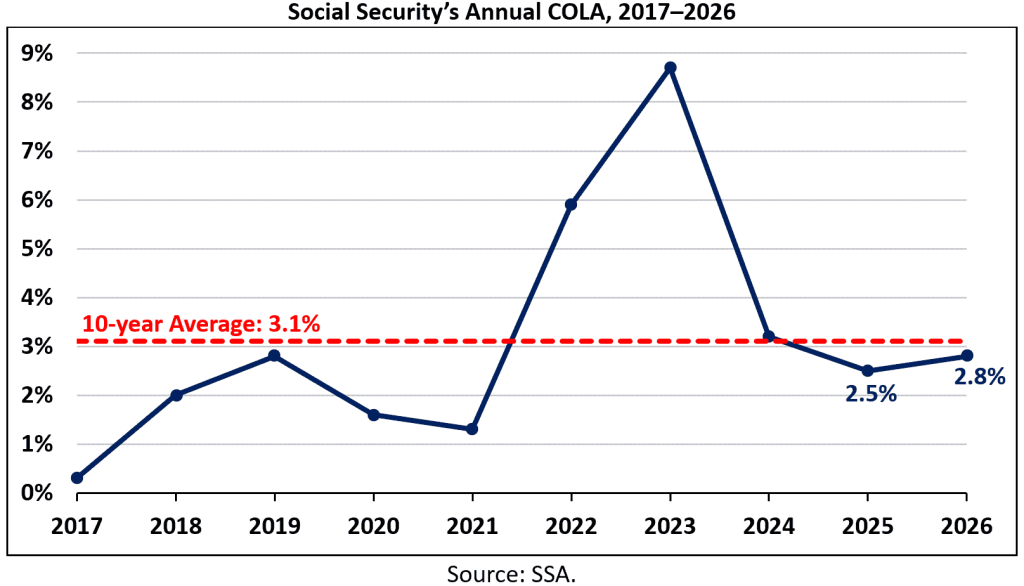

A Look Back: How 2026 Compares to Previous Years

| Year | COLA % |

|---|---|

| 2023 | 8.7% (record-setting) |

| 2024 | 3.2% |

| 2025 | 3.2% |

| 2026 | 2.8% (official) |

The trend shows a cooling economy, at least in terms of inflation. But remember, even small annual raises can make a big difference over time, especially for those on fixed incomes.

The $200 Monthly Boost — What’s Real, What’s Not

Let’s address the elephant in the room: Is everyone getting $200 more per month in 2026?

Short answer: No, not yet.

This idea comes from a proposed bill in Congress — the Social Security Expansion Act — backed by several progressive lawmakers. The bill includes a $200/month bonus for all Social Security recipients and aims to:

- Expand benefits

- Keep the trust fund solvent by taxing high earners

- Provide immediate inflation relief to seniors

Here’s the catch:

- The bill has not been passed.

- It’s still being debated and needs majority support in both the House and Senate.

- Even if passed, it’s unclear whether the $200 boost would be temporary or permanent.

Until Congress acts, the $200 figure is just a proposed benefit, not an official part of Social Security for 2026.

Why a Social Security Increase 2026 Is Even Being Considered?

Social Security COLA increases help—but many older Americans say they’re not enough.

According to the Senior Citizens League and AARP:

- Average healthcare costs for seniors have risen nearly 4-6% annually.

- Housing costs continue to spike in retirement-heavy areas.

- Prescription drugs have gone up by double digits in recent years.

So, while COLA raises are nice, they don’t always keep up with real-life inflation for seniors.

The proposed $200 boost aims to close that gap, at least temporarily. But passing such legislation in a divided Congress will be tough without broad bipartisan support.

Tax Implications & Income Thresholds for 2026

1. Higher Income Limits for Workers

The maximum taxable earnings cap will increase to $184,500 in 2026 (up from $176,200 in 2025). This means higher-earning workers will pay Social Security taxes on more of their income.

For employers and self-employed individuals, this change means:

- Employers: higher payroll taxes

- Self-employed: increased self-employment tax contributions

2. Taxation of Benefits

Social Security benefits may be taxable if your income exceeds:

- $25,000 (single)

- $32,000 (married filing jointly)

This threshold hasn’t been adjusted in decades, and with COLA increases pushing up benefits, more retirees fall into the taxable range each year.

Tip: Talk to a tax advisor to plan ahead and minimize surprises at tax time.

How To Prepare for the Social Security Increase 2026?

Whether you’re new to Social Security or a longtime recipient, here are practical steps to take now:

1. Check Your COLA Letter Online

Visit ssa.gov/myaccount to log in or sign up. You’ll get early access to:

- Your COLA notice

- Updated benefit amount

- Any deductions (e.g., Medicare Part B)

2. Watch for Medicare Changes

Medicare premiums (especially Part B) are typically deducted directly from your Social Security check. These premiums could rise in 2026 and offset part of your COLA increase.

The official Medicare premium announcement will be released in November 2025 at Medicare.gov.

3. Beware of Scams

Scammers ramp up around benefit changes. The SSA will:

- Never call, email, or text you for your Social Security number

- Never demand gift cards or wire transfers

- Always contact you via official letters or your online portal

Social Security Income $2,071 in 2026 – Why Taxes Could Reduce Most of Your Payment

Social Security Benefits January 2026: How Much Will Your Payments Increase?

Social Security Benefits at 62, 65 & 70 – Average Monthly Checks Explained Side by Side