$2,000 checks in 2026: If you’ve been hearing about $2,000 checks being handed out in 2026 — funded by U.S. tariffs — you’re probably wondering: Is this real or just political talk? Well, here’s the truth: The idea is real, but it’s far from guaranteed. And whether you’re a curious voter, working parent, business owner, or just trying to stay informed, you deserve a clear, no-spin breakdown of what’s really going on. This guide dives deep into the tariff dividend proposal, a plan floated by former and current President Donald Trump, which aims to give everyday Americans a rebate check funded by import taxes (tariffs). We’ll walk you through the facts, data, legal status, risks, and real-world implications — all in plain English, with expert insight baked in.

Table of Contents

$2,000 Checks in 2026

The idea of $2,000 tariff-funded checks is a bold one — and it reflects real concerns about trade, inflation, and economic equity. But for now, it’s just that: an idea. There’s no legislation, no funding guarantee, and no clarity on who qualifies or when. It may still be debated, amended, or even forgotten depending on political winds, court decisions, and global trade developments. Stay informed. Track Congressional actions. Watch the courts. But don’t spend that $2,000 just yet.

| Topic | Current Status / Data | Notes |

|---|---|---|

| Proposal Name | Tariff Dividend / $2,000 Checks | Still a proposal |

| Proposed By | Donald Trump, 2024–2026 | First mentioned in 2024 |

| Funding Source | U.S. Tariff Revenue | Tax on imported goods |

| Revenue Generated (2025) | $148.3 billion | Source: Wharton Budget Model |

| Projected Cost | $500–600 billion | If most Americans qualify |

| Legal Status | Not law | Requires congressional approval |

| Target Timeline | Late 2026 (tentative) | No official date or rollout plan |

| Eligibility Rules | Not finalized | Trump suggests excluding high earners |

| Congressional Support | Mixed | Resistance among fiscal conservatives |

| Legal Hurdles | Supreme Court review pending | May affect legality of tariff source |

What Are $2,000 Checks in 2026?

The concept, often referred to as the “tariff dividend,” is fairly simple at face value: The U.S. government collects billions of dollars from tariffs — taxes imposed on foreign goods entering the country. The Trump administration proposed that instead of keeping all that money in the federal treasury, some of it should be returned directly to American citizens in the form of $2,000 rebate checks.

While it might sound similar to the COVID-era stimulus checks, this isn’t technically a stimulus — it’s marketed as a rebate funded by trade policy, not deficit spending.

But while the idea is catchy and has strong political appeal, there’s no law yet, no official program, and no checks in the mail — at least not yet.

How Tariffs Work — And Why This Matters

A tariff is a government-imposed tax on goods imported from another country. The main idea is to make foreign goods more expensive, encouraging Americans to buy domestic products instead. When a U.S. business imports sneakers from China, for example, the government may charge a 10% tariff. That extra cost is usually passed on to consumers — you and me — as higher prices at the store.

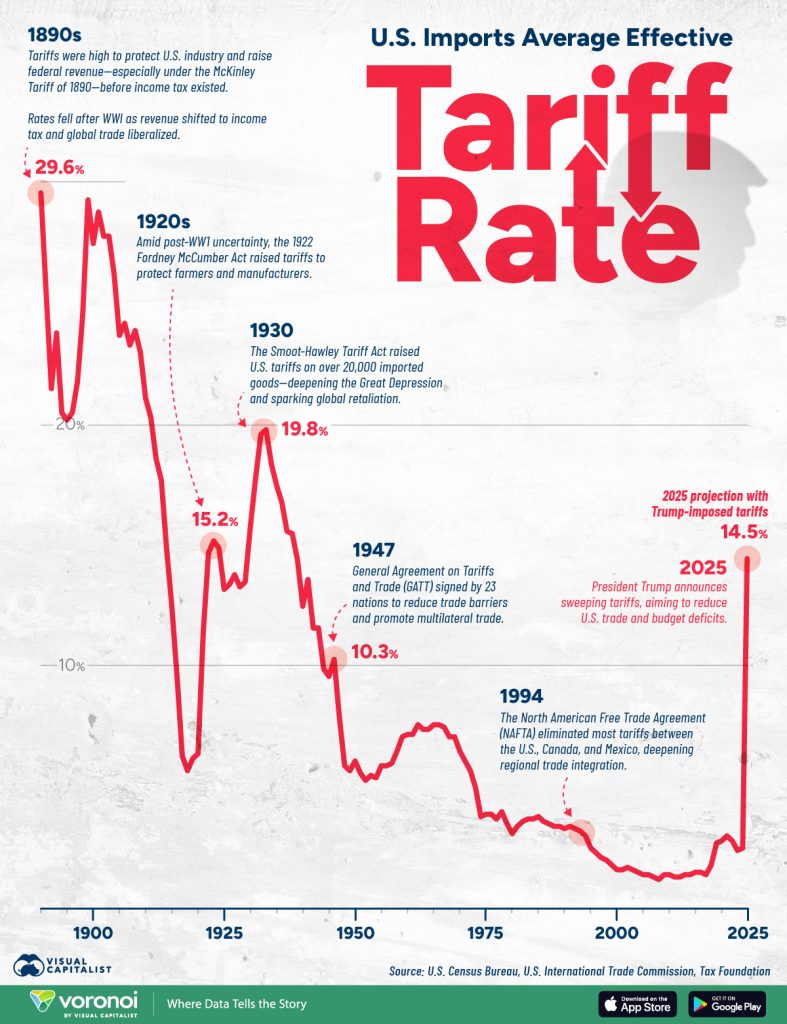

Tariffs aren’t new. The U.S. has been using them since its founding. But they’ve become more controversial in modern times due to their impact on supply chains, inflation, and trade wars.

Under the Trump and Biden administrations, tariff policies expanded significantly — especially targeting imports from China, steel, aluminum, solar panels, and even some tech products.

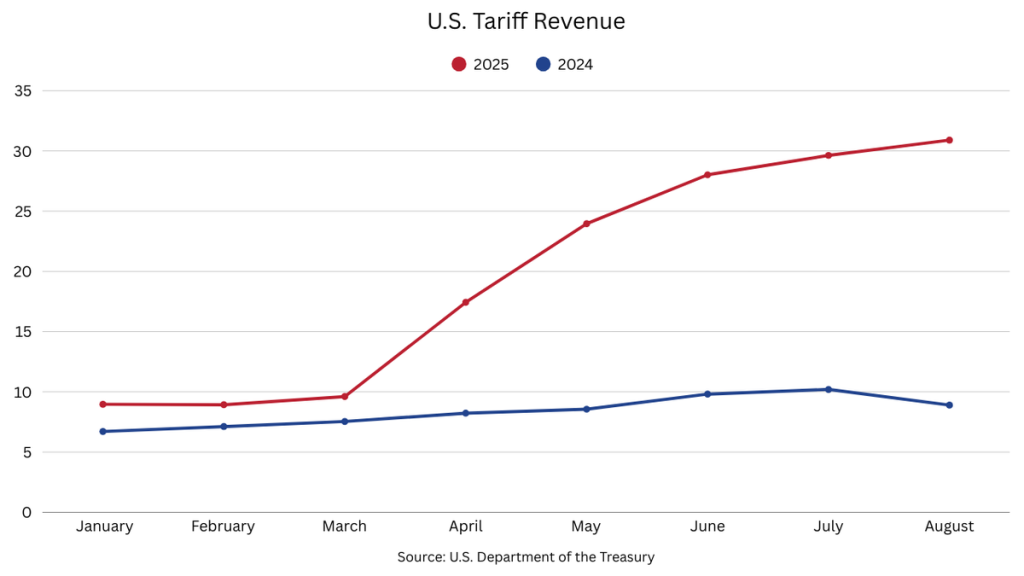

Total tariff revenue hit nearly $148.3 billion in 2025 — a massive sum, though still only a slice of the federal budget pie. Supporters of the dividend idea argue that money should benefit working families directly. Critics say the money isn’t enough, and that the policy could backfire.

What is the $2,000 Checks in 2026 Proposal?

The proposal, as discussed on the campaign trail and in recent interviews, is simple in theory:

- Tariff money is collected at the border.

- Instead of being absorbed into the federal budget, some of it is distributed to Americans as a rebate check — estimated at $2,000 each.

Trump has described this idea as a “big, beautiful bonus” for U.S. workers who are paying higher prices due to tariffs. He’s also claimed this would offset the impact of inflation and protect American industries.

But here’s the key: The proposal has not gone through any formal government channels. No legislation has been passed. No payment systems are in place. There’s no IRS plan or Treasury Department memo preparing for distribution.

Why $2,000 Checks in 2026 Isn’t a Done Deal?

There are several big reasons why this proposal may never come to life — or may be dramatically altered:

1. Congress Controls the Money

Under the U.S. Constitution, Congress holds the “power of the purse.” That means any large-scale government expenditure — including direct payments to Americans — must be authorized by law. Even if a president promises payments, they can’t be legally issued without a bill that passes both the House and Senate.

Many Republican lawmakers, especially fiscal conservatives, have expressed skepticism over the price tag of this program. While they may support tariffs as a policy tool, they oppose large, non-budgeted cash giveaways that could increase the deficit.

2. Tariff Revenue Isn’t Enough

Here’s the math problem: While the U.S. did collect over $148 billion from tariffs in 2025, giving $2,000 to 250 million eligible Americans would cost over $500 billion. That’s a massive shortfall.

Trump’s team argues that expanded tariffs — especially on more categories of Chinese goods — could raise enough revenue. But critics say it’s unrealistic, and could raise prices across the board, causing inflation and economic strain.

According to the Committee for a Responsible Federal Budget, even doubling tariff rates wouldn’t sustainably fund a recurring $2,000 dividend program.

3. The Courts Are Watching

A number of legal challenges are already underway questioning whether the executive branch has overstepped its authority by implementing certain tariffs without Congressional approval. If the Supreme Court rules that the tariffs were unlawful, the government might be forced to refund money — which could completely eliminate the tariff revenue that was earmarked for the dividend program.

That means the entire concept hinges not just on politics and economics — but also on how the courts interpret trade laws.

Historical Comparisons: Has This Ever Happened Before?

While the exact proposal is new, there are historical precedents that help us understand the idea.

- Alaska Permanent Fund: Alaska gives residents annual dividend checks funded by oil revenue. The idea is similar — convert resource wealth into public benefit.

- George W. Bush Tax Rebates (2001): A $300–$600 tax rebate was issued to taxpayers as an economic boost.

- COVID-19 Stimulus Checks (2020–21): The U.S. issued three rounds of direct checks during the pandemic, ranging from $600 to $1,400 per person.

But in all of these cases, there was clear legislation, a funding mechanism, and Congressional approval. The tariff dividend is more complicated because it involves both trade policy and direct fiscal transfers — two issues that normally operate separately.

The Politics of the $2,000 Checks in 2026 Proposal

The tariff dividend has become a symbolic issue in the ongoing political debate about how best to support working-class Americans. Supporters say the program is:

- A patriotic way to share economic benefits

- A fair response to inflation caused by global trade

- A form of “America First” policy rooted in economic nationalism

Opponents argue:

- It’s a politically motivated promise without real funding

- It could trigger retaliation from trade partners

- It undermines fiscal responsibility and the federal budget

Some Democrats have called the proposal “bribery by rebate,” while others have asked whether such a program could be redirected into more targeted tax relief or education support.

Who Would Get the $2,000 Checks in 2026?

That’s still unclear.

President Trump has mentioned that the checks might go to “hard-working Americans,” potentially excluding the top income earners. But without an official eligibility framework, it’s impossible to know how the program would work.

Key questions include:

- Will children qualify, as they did in past stimulus programs?

- Will retirees or people on disability be eligible?

- Will there be income cutoffs?

- How will the IRS or Treasury identify recipients?

Until these details are worked out and written into law, everything remains speculative.

International Impact: Could This Spark a Trade War?

Economists and diplomats have warned that a major shift in U.S. tariff policy — especially if used to fund domestic payments — could provoke retaliation from trade partners like China, the European Union, and Canada.

Historically, tariff hikes have led to counter-tariffs, which hurt American farmers, manufacturers, and exporters. A payment program tied directly to tariffs might be seen by foreign nations as a hostile act — turning trade tools into domestic cash programs.

This is especially risky at a time when global supply chains are still recovering from pandemic disruptions and geopolitical tensions.

Tariff Dividend Payments January 2026 – Reality Check on New Federal Payment Claims

Is a 4th Stimulus Check Coming in January 2026? Latest Updates

Trump’s $2,000 Tariff Dividend Check Update: What You Need to Know as 2025 Winds Down