$2,000 Tariff Checks 2026: There’s a lot of talk on social media and news outlets about $2,000 tariff checks in 2026. Whether you saw it on TikTok, heard it from a neighbor, or caught it during a political rally, the idea sounds exciting: every American receiving $2,000 funded by tariffs on imported goods. But is this actually happening? Where’s the money coming from? And what are the facts — not just the headlines? Let’s dive in.

Table of Contents

$2,000 Tariff Checks 2026

The $2,000 tariff checks in 2026 may be one of the most talked-about proposals in politics right now — but talk is not the same as action. Right now, there is:

- No law

- No official budget

- No defined timeline

- And no way to apply

It’s a political idea — and one that may gain traction or fade out, depending on what happens in Congress, the courts, and the economy. Until then, Americans should stay informed, cautious, and skeptical of rumors.

| Topic | Status | Details |

|---|---|---|

| $2,000 Tariff Check Proposal | Publicly proposed | Touted by former President Trump as a “tariff dividend” |

| Legislation Passed | Not yet | No bill signed into law |

| Payment Timeline | Unknown | Some mention of “late 2026” — but no official schedule |

| Who Qualifies | Not defined | Likely income-based eligibility similar to past stimulus |

| Estimated Cost | $500–$600 Billion | Would require funding far beyond current tariff revenue |

| Tariff Revenue (2025) | $98.3 Billion | Nowhere near enough for full coverage |

| Congressional Action Needed? | Yes | Must pass legislation and appropriate funds |

| Court Challenges Pending? | Yes | Supreme Court to rule on legality of key tariffs |

| Government Links | IRS.gov |

What Are Tariff Checks, and Where Did This Idea Come From?

A tariff is a tax the government charges on goods coming into the U.S. from abroad. Think of it as a kind of toll foreign companies must pay to sell products in American markets. The idea behind tariff checks is that this revenue could be shared directly with U.S. citizens in the form of $2,000 payments.

Former President Donald Trump floated this idea as part of his 2024–2025 campaign messaging. His team called it a “patriotic dividend,” where Americans get to benefit from revenue raised through “America First” trade policies.

“We’re collecting so much from tariffs, we can give it back to the people,” Trump has said.

But as simple as that sounds, there’s a long road between idea and reality.

How Much Tariff Revenue Is There? Let’s Do the Math

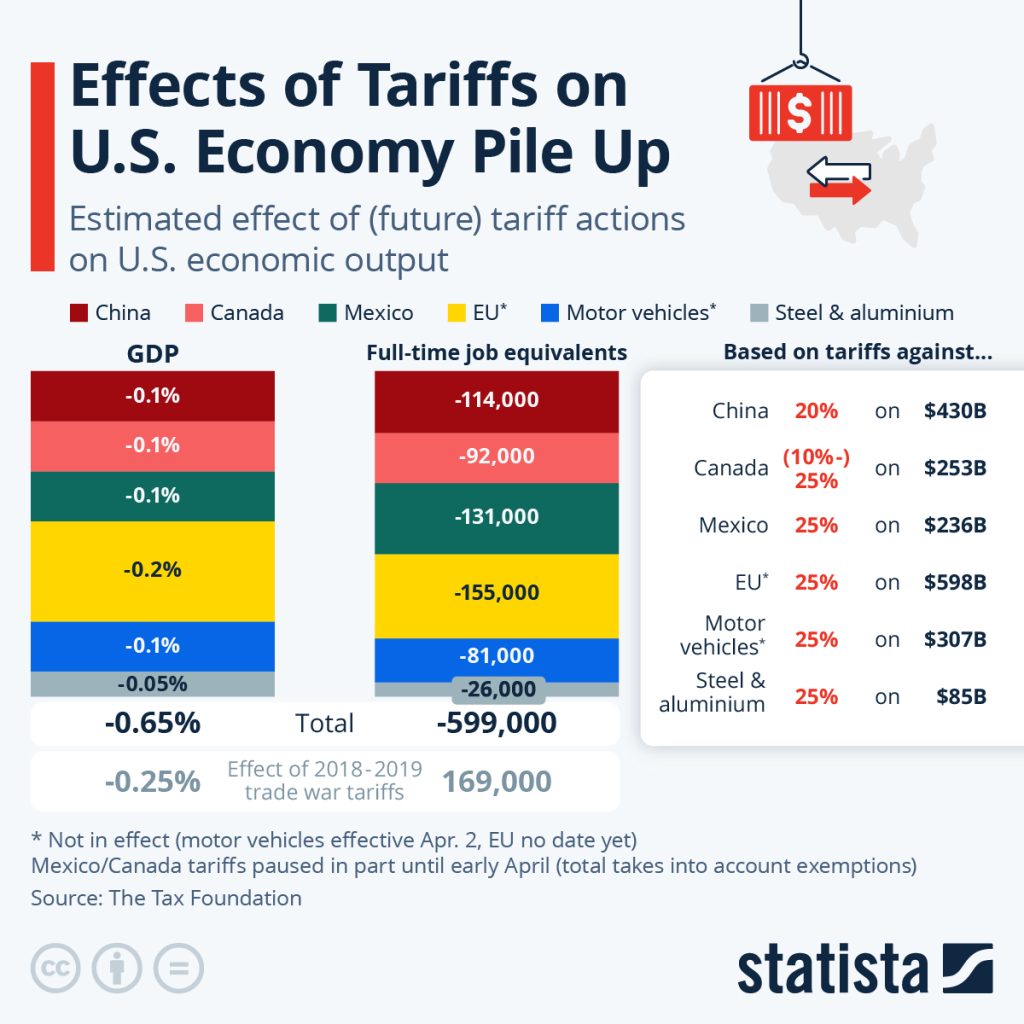

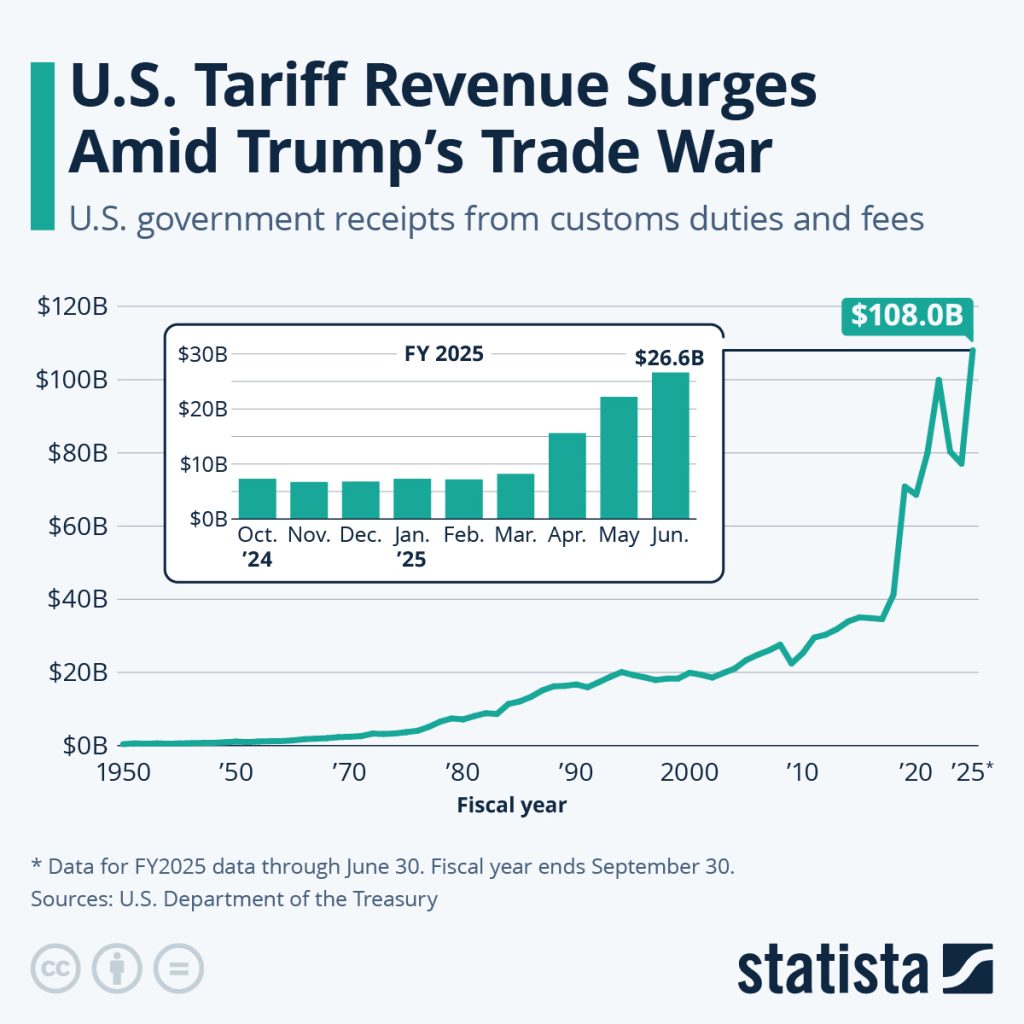

The U.S. Customs and Border Protection (CBP) agency reported around $98.3 billion in total tariff revenue for 2025.

Meanwhile, if 250 million Americans received $2,000 each, that would cost $500 billion.

That leaves a gap of over $400 billion — and that’s before any administrative costs are included.

Real-World Example

- Revenue from tariffs = ~$98 billion

- Cost of checks for all adult Americans = $2,000 × 250 million = $500 billion

- Shortfall = At least $402 billion

Unless Congress comes up with the extra cash or limits who gets the checks, tariff revenue alone cannot foot the bill.

$2,000 Tariff Checks 2026: What Needs to Happen First

For the $2,000 tariff checks to become a reality, here’s the step-by-step process that must happen:

1. Congress Must Pass a Law

Congress needs to write, introduce, and pass a law that outlines:

- Who qualifies for the payment

- How the money will be distributed

- Where the funds are coming from

Without Congressional approval, the Executive Branch can’t send checks — even if it wants to.

2. The President Must Sign the Bill

Once passed, the President has to sign the bill into law — sealing the deal.

3. Agencies Must Implement the Program

This usually involves the IRS and U.S. Treasury, which would manage eligibility, processing, and distribution — likely via direct deposit and paper checks.

Is There a Timeline?

Not yet.

Although Trump and some advisers hinted at “late 2026” as a potential timeframe, there is no law or infrastructure to guarantee that. The idea has not been turned into a formal plan, let alone one with deadlines or dates.

So if you’re hearing rumors like “checks are coming this summer,” be careful — that’s speculation, not fact.

Legal & Political Hurdles

Court Challenges

A significant challenge comes from legal debates over whether some of Trump’s previous tariffs were even constitutional. A case heading to the U.S. Supreme Court could change how tariffs are defined or collected — and impact whether future revenue could be legally used for public payouts.

If the Court strikes down these tariffs or requires refunds, that tariff money could disappear, making checks impossible.

Political Gridlock

Even within the Republican Party, support for the checks is mixed. Fiscal conservatives worry the plan would:

- Increase the national deficit

- Drive inflation

- Set a precedent for using trade tools for political giveaways

Democrats are also skeptical, especially without clear eligibility requirements or a funding model.

Potential Economic Impacts of $2,000 Checks

Pros:

- Short-term economic boost through higher consumer spending

- Relief for low- and middle-income families

- Political goodwill among voters

Cons:

- Could worsen inflation if demand increases too fast

- Potential retaliation from trade partners (China, Mexico, EU)

- Undermines long-term fiscal stability if deficit grows

Economists at the Brookings Institution and Heritage Foundation agree: using tariffs for direct payments is “economically novel” and may blur the line between trade policy and welfare policy.

What the Experts Are Saying About $2,000 Tariff Checks 2026?

Maya MacGuineas, President of the Committee for a Responsible Federal Budget:

“There’s no such thing as free money. Even if it comes from tariffs, someone — often consumers — is still paying the price.”

Ben Harris, former Treasury official:

“These kinds of proposals may sound appealing, but they need real-world vetting. Tariffs often raise prices on everyday goods like electronics, clothing, and groceries.”

Tips for Americans: How to Stay Informed & Prepared

Even though the program isn’t real yet, here’s how you can be ready if it ever does become law.

1. File Your Taxes on Time

Just like with COVID stimulus checks, the IRS will likely use your most recent tax return to determine eligibility and payment method.

2. Update Your Banking Info

Ensure your direct deposit info is current with the IRS via the IRS.gov portal.

3. Watch Out for Scams

If you get texts, emails, or phone calls claiming you’ve “been approved” for a $2,000 tariff check — it’s fake.

The IRS will never ask for personal info by phone or email.

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

Tariff Dividend Payments January 2026 – Reality Check on New Federal Payment Claims

Stimulus Check Update 2026: Is the $2,000 Payment Actually Coming?