IRS Filing Deadline Extension: Every year, as tax season rolls around, a lot of us start sweating over whether we’ll be ready to file on time. Whether it’s your first time filing, you’re a busy small business owner, or you just can’t find all your forms yet — knowing your options when it comes to an IRS filing deadline extension can help you breathe a little easier. A tax extension is the IRS’s way of saying, “It’s okay, you’ve got some extra time to file — but don’t forget to pay.” That’s right: you can extend your time to file your tax return, but not your time to pay what you owe. So let’s break it all down, step by step, in a clear, practical way. We’ll go over important dates, who qualifies, how to apply, what happens if you miss a deadline, and how to avoid common mistakes.

Table of Contents

IRS Filing Deadline Extension

Filing an IRS deadline extension is a smart, simple move if you need more time to do your taxes right — but it comes with responsibility. You still have to pay what you owe by April 15, even if your paperwork isn’t done. And if you ignore the deadlines altogether, you could get hit with steep penalties and growing interest. So do it the right way:

- File Form 4868 on time.

- Estimate and pay what you owe.

- Use the extra months to file a thorough, accurate return.

Tax season doesn’t have to be stressful — with the right info, it’s just another to-do list item. You’ve got this.

| Topic | Details |

|---|---|

| Regular Tax Filing Deadline | April 15, 2026 |

| Extended Filing Deadline (via Form 4868) | October 15, 2026 |

| Form to Request Extension | Form 4868 (filed electronically or by mail) |

| Tax Payment Deadline | April 15, 2026 (unchanged even with extension) |

| Failure-to-File Penalty | 5% per month (max 25%) |

| Failure-to-Pay Penalty | 0.5% per month (max 25%) |

| Disaster Relief Exception | May 1, 2026 for affected Washington counties |

What Is a IRS Filing Deadline Extension?

A tax filing extension gives you six more months to file your federal income tax return, no questions asked. But the keyword here is file. The IRS still expects you to pay any taxes you owe by April 15.

This extra time is especially helpful if:

- You’re waiting for complex income forms like Schedule K-1s or 1099s.

- You’re a freelancer or small business owner tracking down deductions.

- You’ve had a big life event — marriage, divorce, death in the family, new business, or sold property.

- You just need more time to get organized and accurate.

Why an IRS Filing Deadline Extension Makes Sense?

Let’s say you’re still gathering receipts for business expenses or trying to figure out deductions. Rushing can lead to costly errors — like misreporting income or missing out on tax credits.

In fact, one in seven Americans file for an extension, and not because they’re lazy. Many tax professionals recommend extensions to ensure:

- All documents are in hand.

- Numbers are double-checked.

- You avoid an audit-triggering mistake.

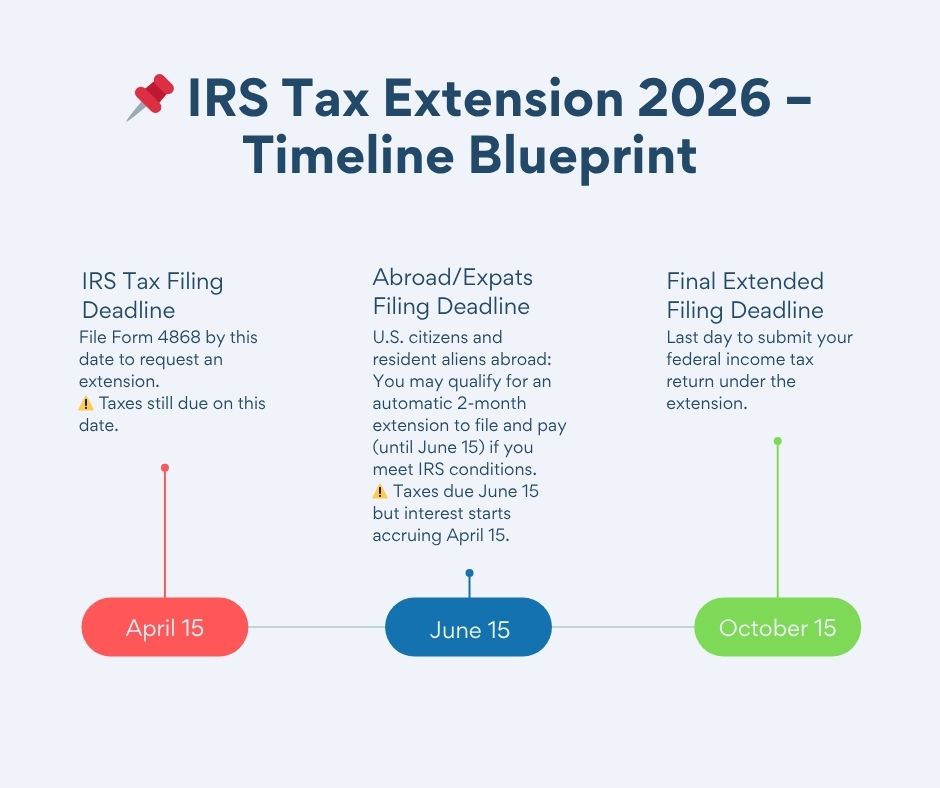

If you file Form 4868 by April 15, you’ll automatically receive a 6-month extension — giving you until October 15 to file your return. You don’t even have to give a reason. But don’t forget: you still need to estimate and pay what you owe by April 15.

How to File a IRS Filing Deadline Extension (Step-by-Step Guide)

Step 1: Estimate Your Tax Bill

Start by calculating how much tax you think you owe. Even if you don’t have your final numbers, do your best to estimate based on your W-2s, 1099s, or last year’s income.

Use the IRS’s Tax Withholding Estimator or work with tax prep software like TurboTax, H&R Block, or TaxSlayer.

Step 2: Pay What You Can

You can pay part or all of your estimated taxes using:

- IRS Direct Pay (free online)

- Electronic Federal Tax Payment System (EFTPS)

- Credit/debit card (fees may apply)

- Check or money order mailed with a payment voucher (Form 4868-V)

Step 3: Submit Form 4868

This is the official IRS form to request a filing extension. You have a few ways to submit it:

- E-File using IRS Free File or commercial tax software.

- Mail it to the IRS with a check, if you’re also paying taxes.

- Pay electronically and select “extension” when prompted — this counts as filing Form 4868.

Once the IRS accepts your Form 4868, you’re all set until October 15 to file your actual tax return.

Who Automatically Gets More Time?

Some folks don’t need to file Form 4868 — the IRS already gives them extra time:

- U.S. citizens living abroad get an automatic 2-month extension to file (June 15), but still must pay by April 15.

- Active duty military stationed overseas or in combat zones may get up to 180 days after leaving the zone to file and pay.

State Taxes: Separate Deadlines May Apply

Your state return isn’t always on the same schedule. Many states follow the federal calendar, but not all of them. For example:

- California grants automatic extensions without paperwork.

- New York requires a separate extension form.

Always check your state’s department of revenue website.

Disaster Relief: Special Exceptions

If you live in a federally declared disaster area, you may get more time to file and pay. In 2026, for example, residents of certain counties in Washington state affected by storms have until May 1, 2026 to file and pay. The IRS frequently updates these locations, so check their Tax Relief in Disaster Situations page.

What Happens If You Don’t File or Pay on Time?

Here’s where things get costly.

- Failure to File Penalty: 5% of unpaid tax per month late — up to 25%.

- Failure to Pay Penalty: 0.5% of unpaid tax per month — also max 25%.

- Interest: Based on the federal short-term rate plus 3% (averaging 7% in early 2026).

Real example:

If you owe $5,000 and file 3 months late without an extension, you could face:

- $750 in failure-to-file penalties

- $75 in failure-to-pay penalties

- $87+ in interest (estimated)

That’s $900+ — and it grows monthly. Filing an extension helps avoid most of that.

Common Mistakes to Avoid

- Thinking an extension gives you more time to pay – It doesn’t. Pay by April 15.

- Underpaying your estimate – The closer your estimate is to the real tax owed, the better.

- Forgetting about state taxes – File an extension there too, if needed.

- Assuming it’s automatic – You must actively file Form 4868 (unless you’re overseas/military).

- Missing the October deadline – Extensions don’t extend forever.

IRS Tax Deadline 2026 – Why This Date Is a Second Chance to Catch Up on Filing

$1,776 Warrior Dividend – IRS Confirms Tax-Free Payment: Check Eligibility Criteria

Fact Check- January 2026 IRS Relief Deposits, Tariff Dividend & Stimulus Payment

Tips to Make the Most of Your Extension

- Use the extra time wisely: Gather all records, double-check math, and maximize deductions.

- Work with a professional: Especially if you’ve had big life changes or complicated finances.

- Set up IRS Online Account: You can view your balance, make payments, and track history.

- Start now: Don’t wait until October 14 to begin.