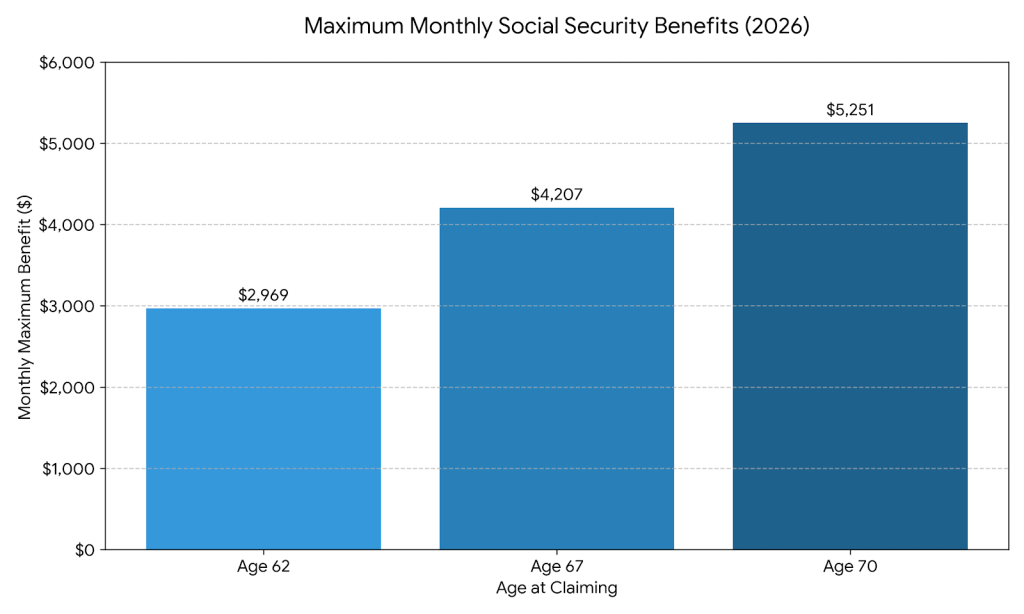

Social Security Maximum Benefit: Social Security is more than a safety net—it’s a critical part of retirement income for most Americans. And in 2026, the maximum possible benefit someone can receive from Social Security is expected to rise to $5,251 per month. That’s over $63,000 per year—a substantial amount that could drastically improve one’s quality of life during retirement. But here’s the deal—not everyone gets that much. In fact, very few people will. So who qualifies for the maximum Social Security benefit in 2026? What steps can you take today to increase your future payout? In this guide, we’ll walk you through the eligibility criteria, calculation methods, strategies to boost your benefit, and some common mistakes that can cost you thousands over time. Whether you’re a 30-year-old planning ahead or in your 60s getting ready to claim, you’ll find real, practical information here to make informed decisions.

Table of Contents

Social Security Maximum Benefit

The Social Security maximum benefit in 2026—$5,251 per month—isn’t just handed out to everyone. It requires decades of high earnings, smart timing, and a strong work history. But even if you don’t qualify for the maximum, understanding how the system works gives you the power to maximize what’s available to you. Start early. Plan smart. Check your earnings. Delay if you can. Whether you’re five years from retirement or just getting started in your career, the decisions you make now can pay off for decades to come.

| Topic | Details |

|---|---|

| Maximum Monthly Benefit in 2026 | $5,251/month (age 70, with max earnings) |

| Average Monthly Benefit in 2026 | About $2,000/month |

| Required Work History | 35 years of high earnings |

| Maximum Taxable Earnings (2026) | $184,500 |

| Best Age to Claim for Maximum Benefit | Age 70 |

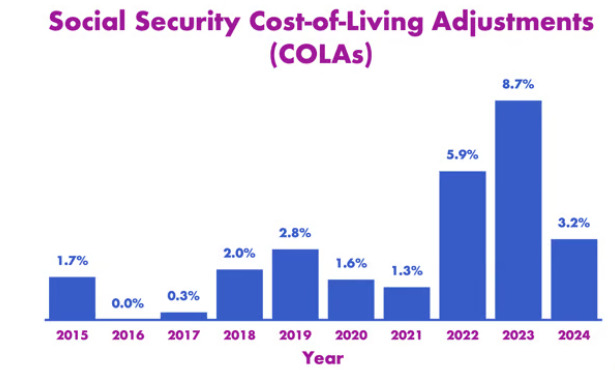

| COLA Increase (2025 → 2026) | 3.2% increase adjusts 2026 payouts |

| Tax on Benefits | Yes—federally, and in some states |

| Official Source | SSA.gov – Social Security Administration |

What Is the Social Security Maximum Benefit?

The maximum benefit is the largest monthly payment the Social Security Administration (SSA) will pay to any individual based on the formula they use to calculate benefits. In 2026, this amount rises to $5,251 per month, up from $4,873 in 2024.

But to reach that number, you’d have to satisfy three strict requirements:

- Work at least 35 years

- Earn at or above the maximum taxable amount for each of those years

- Delay claiming your benefit until age 70

That’s right—it’s not enough just to work hard. You also need high, consistent income and strategic timing to hit the maximum.

How Is Your Social Security Benefit Calculated?

Your Social Security benefit is based on your Average Indexed Monthly Earnings (AIME)—which is the average of your 35 highest-earning years, adjusted for inflation. That figure is then run through a formula to determine your Primary Insurance Amount (PIA), which is your monthly benefit if you retire at your Full Retirement Age (FRA).

For people born in 1960 or later, FRA is 67. If you delay taking benefits past this age, you earn Delayed Retirement Credits—about 8% more per year, until you hit age 70.

The Three Key Requirements for the Social Security Maximum Benefit

Let’s dive into each requirement in more detail:

1. 35 Years of Work History

The SSA calculates your benefit using the top 35 years of your earnings history. If you worked less than 35 years, the SSA adds zero-income years to the calculation, which drags down your average and reduces your benefit.

Example:

- Worked 35+ years? Good.

- Worked 28 years? You’ll have 7 years of $0 factored into your average.

Action Step: If you’ve had gaps in your career (due to caregiving, illness, or other reasons), consider working longer to replace those zeros with income.

2. Earn the Maximum Taxable Amount Each Year

In 2026, the maximum taxable income for Social Security will be $184,500. This number changes annually, adjusted for inflation.

To qualify for the maximum benefit, you must earn at or above this threshold for 35 years straight. It’s a high bar—only about 6% of workers earn this much consistently.

Professions like surgeons, senior engineers, successful entrepreneurs, lawyers, or executives often hit this threshold. If your earnings fall short of this mark, you’ll receive less than the maximum—even if you meet the other two conditions.

3. Delay Benefits Until Age 70

The earliest you can claim Social Security is age 62, but doing so can reduce your monthly benefit by up to 30%. By waiting until Full Retirement Age (67), you get your full Primary Insurance Amount. And if you delay until age 70, you can earn up to 32% more through delayed retirement credits.

Age 62 Claim: 70% of full benefit

Age 67 Claim (FRA): 100% of full benefit

Age 70 Claim: 132% of full benefit

Waiting may not work for everyone—especially those with serious health issues or shorter life expectancies. But if you expect to live well into your 80s or beyond, the delayed strategy can more than pay off.

COLA: Cost-of-Living Adjustment

Each year, Social Security benefits are adjusted to keep up with inflation. This is called the Cost-of-Living Adjustment (COLA). In 2025, retirees saw a 3.2% COLA, which affects the 2026 benefit levels.

This means even if you’re already receiving Social Security, your check could increase each year without any action on your part.

Average vs Maximum: What Most People Get

While the $5,251 benefit is the headline number, most retirees receive far less. According to the SSA:

- Average monthly benefit (2026): About $2,000

- Spousal average: ~$900–$1,300

- Disability average: ~$1,500

Don’t be discouraged! Even if you don’t qualify for the maximum, there are still ways to increase your benefit over time.

State Taxes: Will My Benefits Be Taxed?

Social Security benefits may be subject to federal income tax if your combined income exceeds:

- $25,000 (individuals)

- $32,000 (married couples)

In addition, 11 states tax Social Security benefits, though many offer exemptions for lower-income seniors.

States that tax benefits in 2026 include:

- Colorado

- Kansas

- Minnesota

- Montana

- Nebraska

- New Mexico

- Rhode Island

- Vermont

- Utah

- Missouri

- Connecticut

Practical Steps to Increase Your Social Security Maximum Benefit

- Create a “My Social Security” Account

Check your earnings record for errors and track your projected benefits. - Work More Years (if needed)

Fill in any zero-income years with new earnings to boost your average. - Increase Your Income (if possible)

Pursue promotions, side hustles, or career shifts that offer higher pay. - Delay Claiming

Each year you delay after FRA adds about 8% to your benefit—worth the wait if you’re healthy. - Coordinate Spousal Benefits

Married? You might be eligible for up to 50% of your spouse’s benefit if higher than yours.

Common Mistakes That Lower Benefits

- Claiming too early (at 62) and locking in a lower benefit for life

- Not checking your SSA earnings record for errors

- Assuming benefits alone will be enough—they were designed to replace only about 40% of pre-retirement income

- Failing to consider survivor/spousal benefits if you’re married or widowed

Real-Life Example: Two Different Outcomes

Example 1: Daniel, Age 70

- 35 years of earnings at or above the maximum taxable limit

- Delays claiming until age 70

- Receives $5,251/month in 2026

Example 2: Lisa, Age 62

- 30 years of moderate income

- Claims at age 62

- Receives $1,250/month in 2026

The choices made during your career and when you claim make a massive difference over your retirement.

Social Security Benefit Notices 2026 – What Changes to Expect in Your Letter Next Year

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

Average Social Security Benefit for Retirees 2026 – What Monthly Payments May Look Like