Mortgage Rates January 18, 2026: If you’re in the market for a new home or considering a refinance, January 18, 2026, might just be your golden ticket. After a wild few years of economic uncertainty, interest rate hikes, and inflation spikes, mortgage rates are finally cooling off — and that’s music to the ears of buyers and homeowners everywhere. Let’s break this down in plain language. Whether you’re a seasoned real estate investor or just starting your journey toward homeownership, understanding what’s happening with mortgage rates today can help you make smarter, more financially sound decisions.

Table of Contents

Mortgage Rates January 18, 2026

Mortgage rates on January 18, 2026, are sitting at the most affordable levels we’ve seen since before the post-pandemic inflation surge. With 30-year fixed loans around 6.06% and 15-year options below 5.4%, buyers and homeowners have a rare opportunity to make a move. If you’re ready to buy, build, or refinance, now is the time to act confidently. Shop around, secure a pre-approval, and lock in a rate that aligns with your long-term goals. The housing market may still be competitive, but knowledge is your power — and right now, the numbers are finally in your favor.

| Feature | Details |

|---|---|

| 30-Year Fixed Mortgage | ~6.06% average – lowest since late 2022 |

| 15-Year Fixed Mortgage | ~5.38% average – strong option for equity growth |

| 30-Year Refinance Rate | ~6.52% to 6.63% depending on lender |

| Why Rates Are Falling | Fed interest rate cuts, inflation slowdown, increased market stability |

| Best Time to Lock In? | Right now, before rates potentially increase |

| Useful Tool | CFPB Mortgage Rate Checker |

What Are Mortgage Rates January 18, 2026?

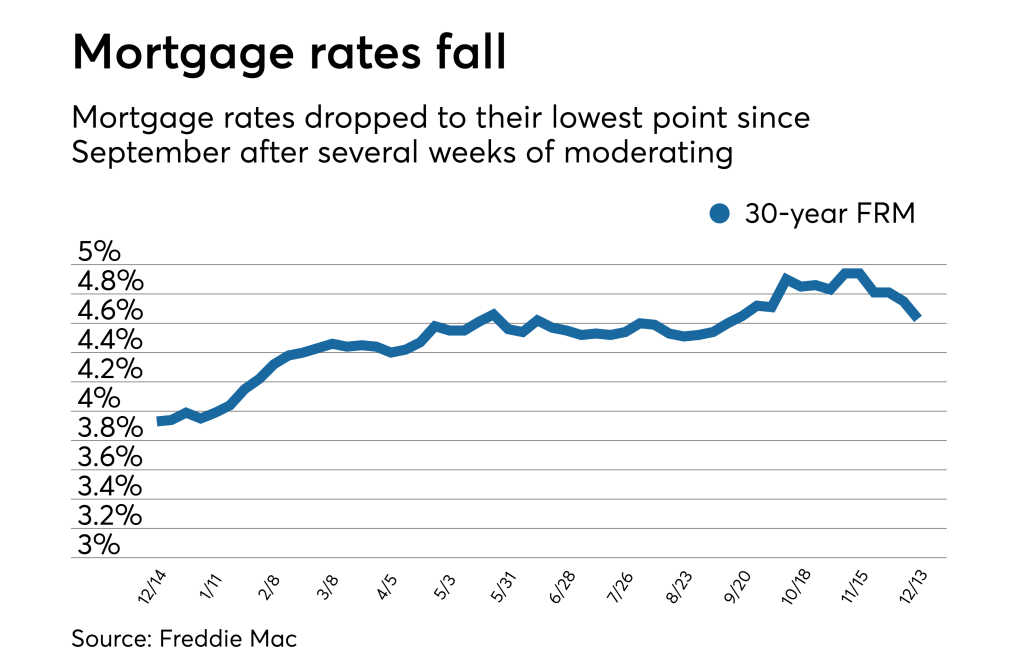

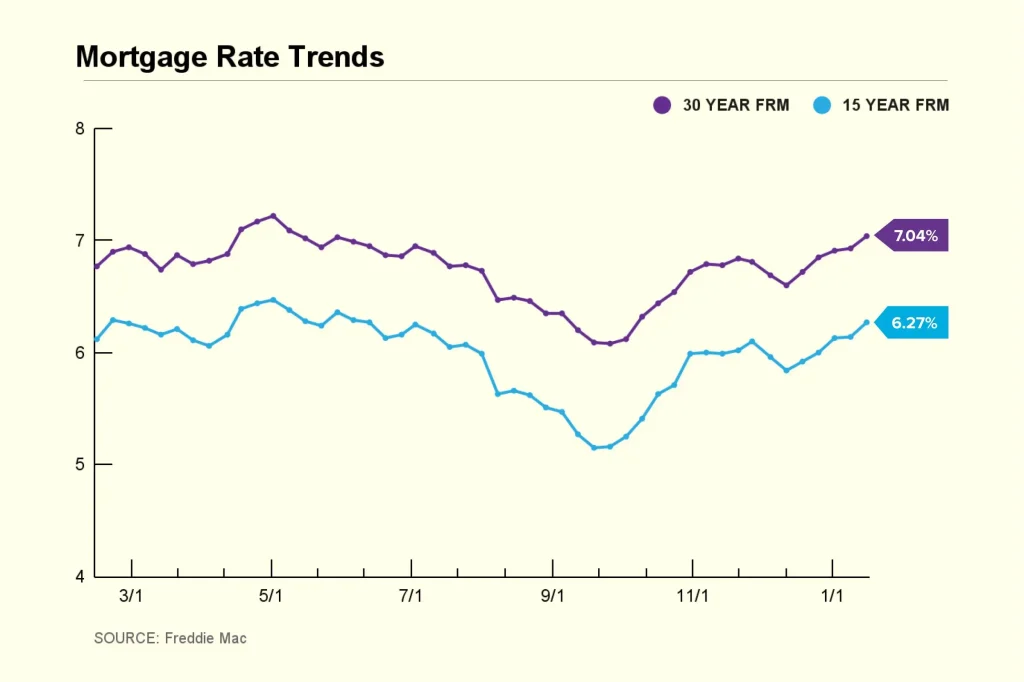

Here’s the scoop as of January 18, 2026. According to Freddie Mac and other financial analysts, mortgage rates are falling to their lowest point in over three years. Here’s a snapshot of today’s average national mortgage rates:

- 30-Year Fixed: 6.06%

- 15-Year Fixed: 5.38%

- 5/1 ARM: 5.93%

- FHA Loan (30-Year): 5.88%

- Jumbo Loan (30-Year): 6.10%

Keep in mind, these are averages. Your actual rate could be higher or lower depending on your credit score, loan type, income, and lender policies.

Rates can change daily — even hourly — so if you’re serious about buying or refinancing, it’s a good idea to get quotes from multiple lenders and ask them to provide Loan Estimates to compare.

Why Are Mortgage Rates Dropping in 2026?

There’s no single reason why rates are dropping — it’s more like a combination of financial dominoes that started falling in 2025 and picked up momentum into early 2026.

1. The Fed Has Shifted Its Tone

Throughout 2025, the Federal Reserve was laser-focused on fighting inflation, keeping interest rates high. But by Q4 2025, inflation was under control, and the Fed began gradually cutting interest rates to stimulate the economy.

Lower federal funds rates don’t directly control mortgage rates, but they influence market sentiment and lower borrowing costs across the board.

2. Inflation Is Stabilizing

At the height of the pandemic-era stimulus and supply chain chaos, inflation soared to over 8%. Today, inflation is closer to the Fed’s 2% target. That gives lenders and investors more confidence, which in turn brings down mortgage interest rates.

3. Mortgage-Backed Securities Are Back in Demand

Government involvement in mortgage-backed securities (MBS) has returned — not quite at 2020 levels, but enough to stabilize the housing market. Increased MBS purchases drive up demand, which pushes yields down and helps lower mortgage rates.

What Mortgage Rates January 18, 2026 Means for Buyers, Owners, and Investors?

For First-Time Homebuyers

Lower rates mean lower monthly payments, plain and simple. A mortgage rate drop of even 1% can reduce your payment by hundreds of dollars per month. That opens up more homes in your price range and helps you compete in a still-tight housing market.

For example, a $400,000 mortgage at:

- 7.25% (2025 average): ~$2,730/month (principal and interest)

- 6.06% (today): ~$2,416/month

That’s a monthly savings of $314 — or over $113,000 across 30 years.

For Homeowners with Older Mortgages

If you financed your home at a higher rate anytime in the past 18–24 months, you might be sitting on a golden opportunity to refinance. Even if you’ve only shaved off 0.75% to 1.0% from your current interest rate, the long-term savings can be substantial.

Real-Life Case Study: A Smart Refinance

Let’s look at the Johnsons, a couple from Charlotte, North Carolina. They bought their home in mid-2025 with a 30-year fixed loan at 7.4%. This month, they refinanced into a 6.1% mortgage. Their savings?

- Monthly mortgage payment dropped by $325

- They also switched to a 20-year mortgage, cutting 10 years off their loan term

- Net savings over the life of the loan: over $98,000

Even after accounting for closing costs and fees, the refinance was worth every penny.

Expert Forecast: What’s Next for Mortgage Rates?

Most economists agree we may not see the 2–3% mortgage rates of 2020 again anytime soon — those were historically low. But current conditions suggest that rates will stay in the 5.75% to 6.25% range for much of 2026, barring any major economic disruptions.

According to the Mortgage Bankers Association (MBA), refinance activity is expected to rise by 15% in Q1 and Q2 of 2026, with first-time homebuyer demand returning as affordability improves.

Step-by-Step Guide to Getting the Best Mortgage Rate

Step 1: Know Your Credit Score

Lenders reward higher credit scores. Aim for 700+, and 760+ for the best rates.

Step 2: Shop Around

Don’t just go to your bank. Compare at least three lenders — including online banks and credit unions.

Step 3: Understand Points and Fees

A low rate isn’t always the cheapest. Look at the APR, which includes fees, not just the interest rate.

Step 4: Consider Loan Types

If you’re buying a starter home, FHA or USDA loans could be better options. If you’re a veteran, check out VA loans with no down payment.

Step 5: Lock in Your Rate

When rates dip and you’re happy with your lender, lock in your rate. Lenders usually offer locks from 30 to 60 days.

Common Mistakes to Avoid

- Not comparing APRs

- Assuming your bank offers the best deal

- Ignoring closing costs

- Waiting too long to lock your rate

- Overestimating what you can afford

Mortgage Glossary – Simple Terms for All Readers

APR (Annual Percentage Rate): Includes interest rate + fees

PMI (Private Mortgage Insurance): Extra cost if your down payment is under 20%

Points: Fees you pay to lower your interest rate

ARM (Adjustable Rate Mortgage): Loan with a changing rate

Pre-Approval: A lender checks your credit and income to estimate what you can borrow

Tariff Dividend Payments January 2026 – Reality Check on New Federal Payment Claims

Federal vs. Private Student Loans in 2026; Which One Should You Pick?

It’s Official: Federal Employees Are Getting a Pay Raise in 2026 — Here’s How Much