Social Security Changes 2026: are shaping up to be big news for millions of Americans — whether you’re already receiving benefits, planning your retirement, or still putting in hours at your job. From cost-of-living increases to changes in work income rules and Medicare deductions, 2026 brings a fresh set of updates that impact what’s coming into your bank account.

This article is your one-stop, in-depth guide — written in clear, friendly, everyday American English — that explains everything you need to know, no matter if you’re 68, 38, or just trying to help Mom and Dad understand their finances. You’ll find practical advice, accurate numbers, examples, and official resources so you can make smart decisions today and tomorrow. Let’s dive in and get you fully updated.

Table of Contents

Social Security Changes 2026

The Social Security Changes for 2026 bring modest benefit increases through the 2.8% COLA, but also higher Medicare premiums and evolving work-income limits. Whether you’re collecting checks now or planning to soon, this year’s updates highlight the importance of reviewing your benefits regularly, understanding deductions, and planning for taxes and longevity. Stay ahead of the curve. Monitor your benefits. And remember — Social Security is one of your most valuable retirement assets. Treat it with the attention it deserves.

| Topic | 2026 Update | Key Data |

|---|---|---|

| Cost-of-Living Adjustment (COLA) | 2.8% Increase | ~$56/month average raise |

| Average Monthly Benefit | Up to $2,071 | Based on COLA |

| Maximum Benefit | $5,251/month at age 70 | High earners only |

| Medicare Part B Premium | $202.90/month | Deducted from benefits |

| SSI Individual Benefit | $994/month | COLA-adjusted |

| Work Income Limit | $24,480 before deductions | Applies under full retirement age |

| Wage Base for Payroll Tax | $184,500 | Up from $176,200 in 2025 |

| Payment Dates | Birthdate-based | Monthly deposits |

Understanding the Social Security Cost-of-Living Adjustment (COLA)

Each year, the Social Security Administration (SSA) uses data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to determine if benefits should go up. This is called the Cost-of-Living Adjustment, or COLA.

For 2026, the COLA is 2.8%. This means monthly benefits will rise to help offset inflation — the higher prices you’re likely seeing at the grocery store, gas pump, or pharmacy.

Here’s what that means in dollars:

- The average retired worker will go from about $2,015/month in 2025 to around $2,071/month in 2026.

- Married couples where both spouses receive benefits will average over $3,300/month.

- Those on Supplemental Security Income (SSI) will see their individual monthly payment rise to $994, while couples receive about $1,491.

It’s not a massive increase, but it is automatic — you don’t need to apply. The adjustment begins with the January 2026 payment (or December 31, 2025, for SSI).

Medicare Part B Premiums — Why You Might Not Feel the Full Raise

Now here’s the catch: while your gross benefit goes up, your net payment — what actually lands in your account — might not go up as much.

That’s because Medicare Part B premiums are deducted from your Social Security check if you’re enrolled. And in 2026, those premiums are rising again.

- The standard Part B premium in 2026 is $202.90/month, up from about $185 in 2025.

- That’s a roughly $17/month increase, which can eat up 30% or more of your COLA raise.

Higher-income beneficiaries may pay even more due to Income-Related Monthly Adjustment Amounts (IRMAA). This affects individuals earning more than $103,000 and couples earning more than $206,000.

Bottom line: Check your Medicare Summary Notice or SSA notice to see your exact deduction.

Work and Social Security — Know the Earnings Limits

If you’re collecting Social Security before full retirement age and still earning a paycheck, there are rules that could reduce your benefits temporarily.

2026 Earnings Limits:

- Under Full Retirement Age:

You can earn up to $24,480 annually before your benefits are reduced.

For every $2 earned over the limit, $1 is withheld. - Year You Reach Full Retirement Age:

The limit increases to $65,160.

SSA withholds $1 for every $3 you earn over the limit, but only until your birthday month. - At Full Retirement Age and beyond:

There are no earnings limits — you can work as much as you want with no benefit reductions.

These withheld benefits aren’t lost forever. Once you hit full retirement age, your monthly benefit is recalculated to give you credit for months you didn’t get full payment.

Example: If you’re 63 in 2026 and earn $28,000, you’ll be $3,520 over the limit. SSA could withhold about $1,760 in total benefits.

Social Security Changes 2026: Taxes on Social Security

You might be surprised to learn that your Social Security benefits could be taxable, depending on your total income.

Here’s how it works:

- If you’re single and your combined income is:

- $25,000 to $34,000 → up to 50% of benefits taxable

- Over $34,000 → up to 85% taxable

- If you’re married filing jointly:

- $32,000 to $44,000 → up to 50% taxable

- Over $44,000 → up to 85% taxable

Combined income = AGI + nontaxable interest + half of your Social Security benefits

Example: If you’re married with $30,000 in pension and $20,000 in Social Security, you may owe taxes on half of your benefits. That could mean hundreds of dollars in taxes if not planned for.

Tip: Consider speaking with a tax advisor or using IRS Form 1040 Worksheet to estimate your taxable portion.

Social Security Payroll Taxes and the Wage Base

If you’re still working and paying into the system, 2026 also brings a change to the Social Security wage base — the maximum earnings subject to payroll tax.

- In 2025, the cap was $176,200.

- In 2026, it jumps to $184,500.

That means you and your employer will each pay the 6.2% Social Security tax on the first $184,500 of your wages. Medicare tax (1.45%) continues on all earnings, with an extra 0.9% on income above $200,000.

For self-employed individuals, you’re on the hook for the full 12.4% Social Security and 2.9% Medicare taxes — though you can deduct half of it when filing taxes.

Understanding the Full Retirement Age (FRA) and Delayed Retirement Credits

Social Security is flexible in terms of when you can start collecting benefits:

- You can claim as early as age 62, but your benefits are reduced.

- Full Retirement Age (FRA) is 67 for those born in 1960 or later.

- If you delay past FRA, you earn Delayed Retirement Credits up to age 70.

These credits increase your benefit by about 8% per year past FRA.

Example: If your full benefit is $2,000/month at age 67, waiting until 70 could raise it to around $2,480/month — a significant lifetime boost if you expect to live into your 80s or beyond.

Tip: Use the SSA Retirement Estimator tool to model your options at different ages: ssa.gov/estimator

Payment Schedule – When Will You Get Your Money?

Social Security payments are issued based on your birth date:

- 1st–10th → Second Wednesday of each month

- 11th–20th → Third Wednesday

- 21st–31st → Fourth Wednesday

SSI payments typically arrive on the 1st of the month, unless that day falls on a weekend or holiday — then it may come early.

Keep in mind, federal holidays and office closures can affect phone and in-person services, but direct deposit is rarely delayed.

What You Can Do Right Now About Social Security Changes 2026?

1. Review your My Social Security account:

See your full earnings history, benefit statements, and Medicare premiums. ssa.gov/myaccount

2. Get your Medicare cost breakdown:

If you’re enrolled in Parts B and D, check how much you’ll be deducted monthly.

3. Talk with a financial advisor:

Retirement planning isn’t one-size-fits-all. Consider taxes, healthcare, timing, and income.

4. Consider spousal and survivor benefits:

Married? Widowed? Divorced after 10+ years? You may be eligible for additional benefits based on your spouse’s or ex’s work history.

5. Monitor for scams:

SSA will never call you asking for money or your full Social Security number.

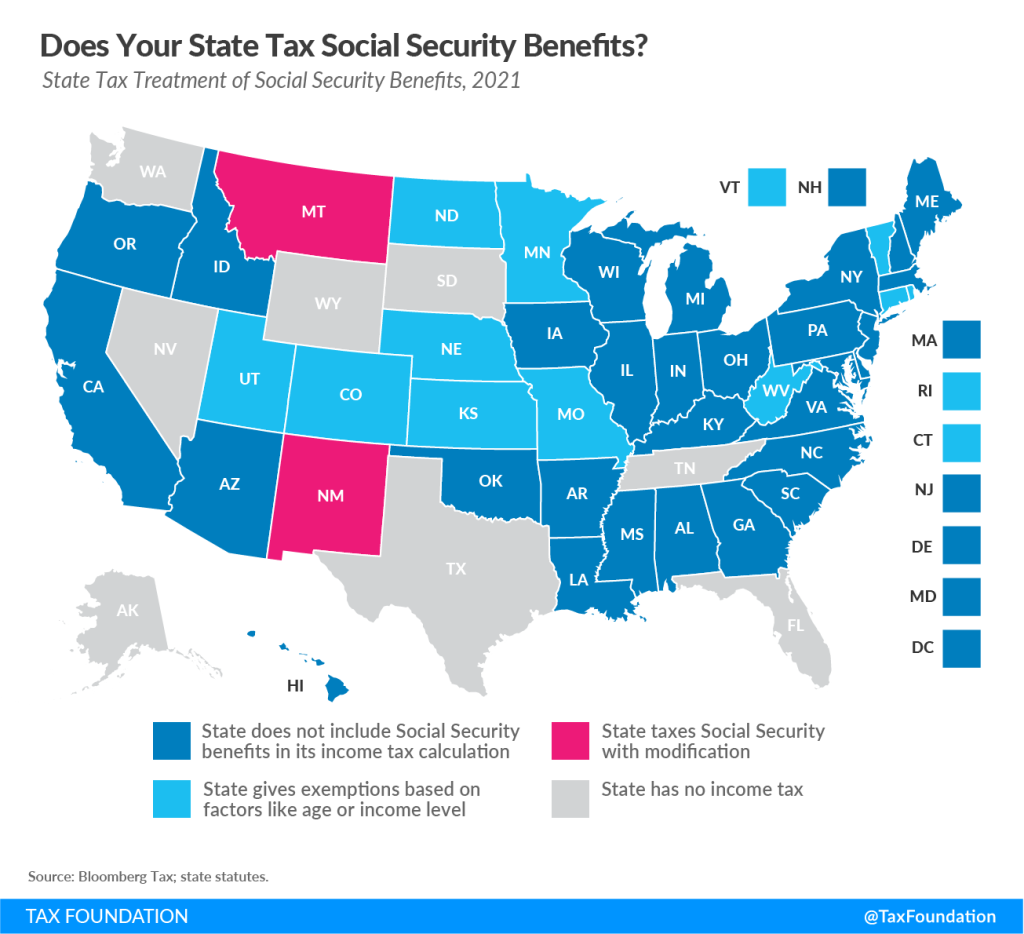

Which States Tax Social Security Benefits? Check the Full Map and What You Might Pay in 2026!

Social Security Check at $1,850 – How Much Your Monthly Payment Could Increase in 2026

Social Security Benefit Boost 2026 – 3 Simple Moves That Can Increase Your Monthly Check