Social Security Payments: The third Wednesday of the month — January 21, 2026 — is an important payday for millions of Americans. If you rely on Social Security benefits, you probably already know the system doesn’t just hand out payments randomly. It’s on a fixed schedule tied to your birth date or the birth date of the person whose work record your benefits are based on. This article offers a deep dive into the Social Security payment schedule for January 2026, especially focused on the January 21 payment group. We’ll break down who gets paid, why, how to verify your payment, and what to expect if your check is late or short. Whether you’re planning a grocery run, paying rent, or budgeting your entire retirement around this check, this guide is for you.

Table of Contents

Social Security Payments

If you or someone you love is on Social Security and their birthday falls between the 11th and 20th, then January 21, 2026, is your payday. This check will include your 2.8% COLA increase, and it may be impacted by Medicare or taxes — so know what to expect and double-check your “my Social Security” account. Being informed helps you stay in control of your money — whether you’re planning for retirement or just trying to keep the lights on.

| Key Info | Details |

|---|---|

| Payment Date | Wednesday, January 21, 2026 |

| Who Gets Paid | Birthdays between 11th–20th of any month |

| Benefit Types | Social Security Retirement, SSDI, Survivor Benefits |

| COLA Increase | 2.8% for 2026 (applied to January benefits) |

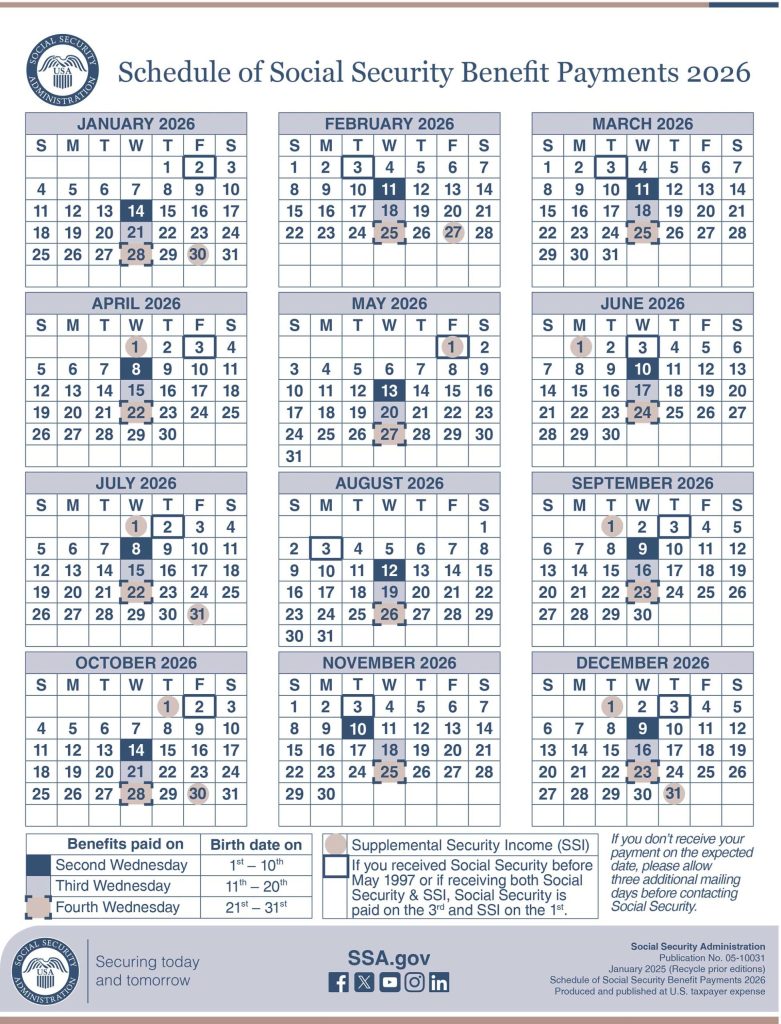

| Other January Pay Dates | Jan 14 (1st–10th), Jan 28 (21st–31st), Jan 2 (pre-1997), Dec 31, 2025 (SSI) |

| Check Payment Status | ssa.gov/myaccount |

| Official Payment Schedule | SSA PDF Schedule |

Understanding the Social Security Payment System

The Social Security Administration (SSA) organizes payments around a Wednesday-based schedule that splits beneficiaries into three groups based on birth dates:

- 1st–10th birthdays: Paid the second Wednesday of the month (Jan 14)

- 11th–20th birthdays: Paid the third Wednesday of the month (Jan 21)

- 21st–31st birthdays: Paid the fourth Wednesday of the month (Jan 28)

This staggered system helps manage the distribution process and avoid overloading banking systems. It applies to most people who began receiving benefits after May 1997.

However, if you’ve been getting benefits before May 1997, you’re typically paid on the 3rd of the month, but if that date falls on a weekend or holiday, payments may arrive earlier. For example, in January 2026, since Jan 3 falls on a Saturday, pre-1997 beneficiaries were paid on Friday, Jan 2 instead.

Who Gets Social Security Payments January 21, 2026?

If your birth date is between the 11th and 20th of any month, and you receive Social Security Retirement, Disability Insurance (SSDI), or Survivor benefits, then January 21 is your payment day this month.

You might also be receiving benefits based on someone else’s record — such as a spouse or parent. In those cases, your payment date is tied to the original worker’s birth date, not yours.

Example:

- Maria, born on June 17, gets her retirement benefits on January 21.

- Tom, receiving survivor benefits from his late wife (born Feb 13), also gets paid on January 21, even though he was born on the 5th.

This system makes it easier to predict payments and helps you plan your monthly budget accordingly.

SSI Payments: Already Sent

If you receive Supplemental Security Income (SSI) — a separate program for low-income seniors and disabled Americans — you didn’t get paid in January at all. Instead, you were paid early, on December 31, 2025, because January 1 was a federal holiday.

Many dual recipients (those getting both SSI and standard Social Security benefits) got their SSI on Dec 31 and their Social Security payment on Jan 2.

What’s New in 2026: COLA and Other Changes

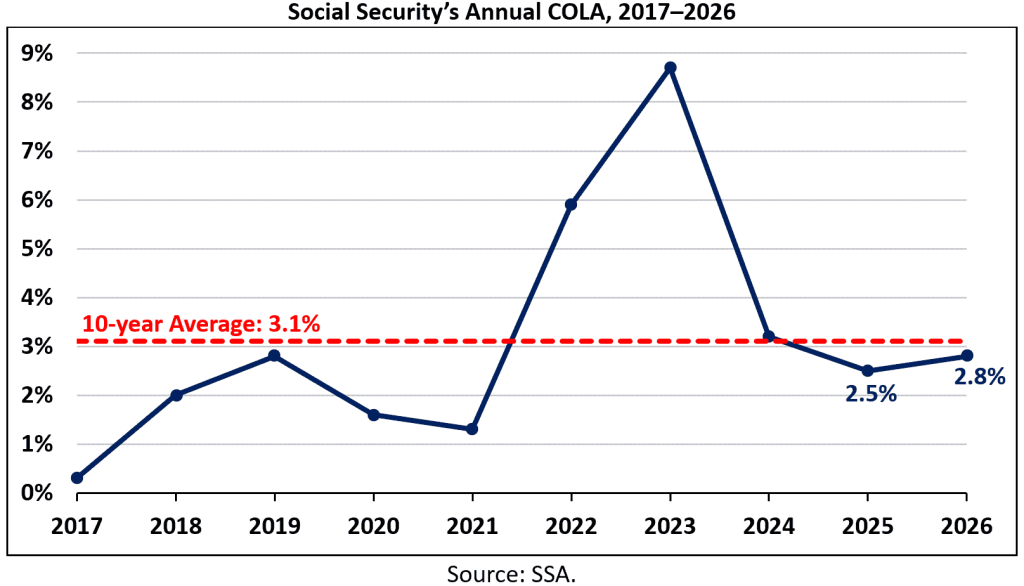

The Cost-of-Living Adjustment (COLA) for 2026 is 2.8%. This increase is based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Every October, the SSA calculates COLA to help benefits keep up with inflation.

How It Affects You:

- If you were getting $1,500/month in 2025, you’ll now receive around $1,542/month in 2026.

- This change kicked in with your January payment — meaning your January 21 check includes the 2.8% boost.

Where Did the Extra Money Go?

Some folks might be surprised to see smaller-than-expected increases, and here’s why:

Medicare Part B Premiums

If you’re enrolled in Medicare, your Part B premium is likely taken out of your Social Security payment automatically. For 2026, premiums increased slightly. This could reduce your net monthly deposit.

Income Tax Withholding

Depending on your total income (from pensions, part-time work, or investments), the IRS may withhold federal taxes from your benefits. You can choose to opt in or out of this, but many people forget they set this up.

Debt Repayment

SSA can deduct money if you’re repaying an overpayment, or if you’re subject to wage garnishment (from things like unpaid child support or federal debts).

Step-by-Step: How to Check Social Security Payments Date and Amount

You don’t have to guess — the SSA provides online tools to help you stay informed.

Step 1: Create or Log Into Your “my Social Security” Account

Visit: ssa.gov/myaccount

Step 2: Click “Benefits & Payment Details”

This shows your next payment date, amount, and bank deposit method.

Step 3: Update Your Direct Deposit

Want to switch banks or move to direct deposit? You can do that right in your account. No paperwork needed.

What If Your Check Doesn’t Arrive?

Most payments are sent via direct deposit, so delays are rare. But here’s what to do if you run into trouble:

- Wait 3 Mailing Days

SSA recommends waiting three business days before contacting them about a late payment. - Check with Your Bank

Sometimes, the issue is with your bank, not SSA. - Contact SSA

Call 1-800-772-1213 or visit your local Social Security office. You can locate yours at secure.ssa.gov/ICON

January 2026 Payment Calendar (Full Breakdown)

| Date | Who Gets Paid | Benefit Type |

|---|---|---|

| Jan 2, 2026 | Pre-May 1997 beneficiaries | Retirement, SSDI |

| Jan 14, 2026 | Birthdays 1st–10th | Retirement, SSDI, Survivors |

| Jan 21, 2026 | Birthdays 11th–20th | Retirement, SSDI, Survivors |

| Jan 28, 2026 | Birthdays 21st–31st | Retirement, SSDI, Survivors |

| Dec 31, 2025 | All SSI recipients | SSI only |

Why This Matters to Professionals and Families?

For financial planners, accountants, and elder care managers, understanding Social Security timing is critical to forecasting client income. These dates also help families coordinate caregiver pay, rent payments, and medical costs for elderly parents or clients.

A delay in Social Security isn’t just inconvenient — it can lead to missed medication pickups, late fees, or even evictions for low-income seniors.

Extra Tips to Get the Most from Social Security

- Use Direct Deposit: It’s safer and faster than paper checks.

- Review Your Annual Statement: Look for errors in work history — it could impact future payments.

- Know the Impact of Working While Collecting: You might have part of your benefit withheld if you’re under full retirement age and working.

- Explore Spousal & Survivor Benefits: Even divorced spouses can qualify for Social Security on their ex’s record under certain conditions.

Five Social Security Changes in 2026 Could Affect Your Monthly Check

Working While Collecting Social Security 2026 – The Earnings Limit That Keeps Your Benefits Safe