Social Security Benefits: When it comes to planning for retirement in the U.S., one of the most crucial decisions you’ll make is when to claim Social Security benefits. Whether you’re thinking about retiring early, aiming for the sweet spot at 65, or holding out until 70 for that maximum monthly check, the timing of your claim has a long-term impact on your financial well-being. In this detailed guide, we’ll break down Social Security benefits at 62, 65 & 70, explain how monthly checks differ, and help you make sense of the numbers with real-life examples, government-backed data, and practical advice. Whether you’re an average worker or a financial advisor helping clients, this article gives you the full picture.

Table of Contents

Social Security Benefits

Claiming Social Security at 62, 65 & 70 isn’t just about when you want to retire — it’s about long-term income, lifestyle planning, and optimizing your money. There’s no perfect age, but understanding the trade-offs can help you make an informed choice.

- 62: You get money earlier, but it’s reduced forever.

- 65: Medicare starts, and benefits are better than at 62.

- 70: Delaying = bigger checks, more security if you live long.

Get the facts. Use official tools. Talk to an expert. Your future self will thank you.

| Topic | Age 62 | Age 65 | Age 70 |

|---|---|---|---|

| Average Monthly Benefit (2024) | ~$1,300–$1,480 | ~$1,600–$1,610 | ~$2,000–$2,250 |

| % of Full Benefit (FRA) | ~70–75% | ~86–90% | ~124–132% |

| Earliest Claim Option | Yes | No | No |

| Delayed Retirement Credit | No | No | Yes (+8%/yr after FRA) |

| Typical Use Case | Early retirement or need | Medicare access point | Maximize benefit |

| Official SSA Estimator | ssa.gov/benefits/retirement/estimator.html |

What are Social Security Benefits?

Social Security is a federal insurance program designed to provide a stable income after retirement. Funded through payroll taxes (FICA), the system supports retirees, disabled individuals, and survivors of deceased workers. You qualify by working at least 10 years in jobs that paid into the system.

The monthly benefit you receive in retirement is based on your 35 highest-earning years, and adjusted for inflation. However, the age you begin collecting determines how much of that benefit you actually get.

Understanding Full Retirement Age (FRA)

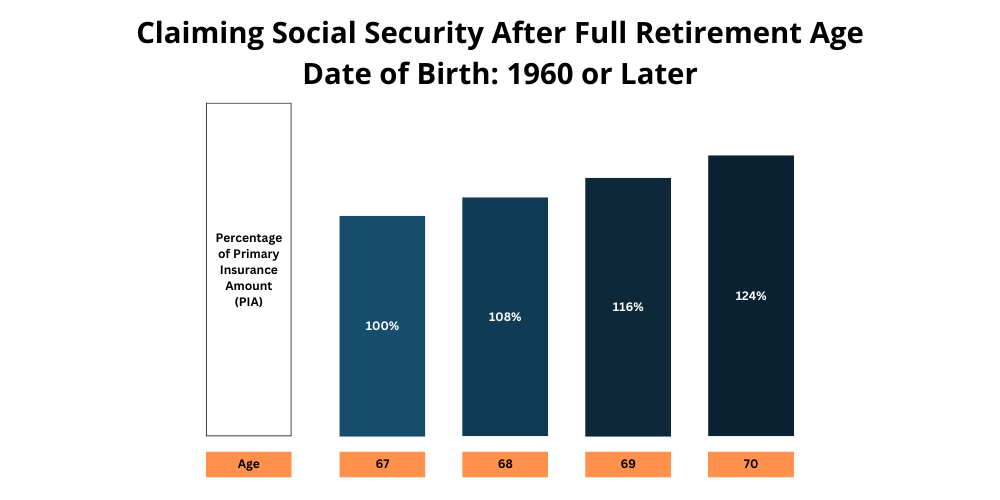

Your Full Retirement Age (FRA) is the age at which you’re entitled to receive your full, unreduced Social Security benefit. For people born in 1960 or later, the FRA is 67. Claiming before this age means your benefits are reduced permanently. Delaying beyond FRA increases your benefits due to delayed retirement credits.

The government uses actuarial math to make sure that no matter when you start, the total paid over an average lifetime is roughly the same. But the amount you get each month — that’s where it makes a big difference.

Claiming Social Security Benefits at Age 62: The Early Bird Trade-Off

Pros:

- You can retire earlier, even if you haven’t reached FRA.

- Ideal for people with health issues or those laid off near retirement.

Cons:

- Monthly benefits are reduced by around 25% to 30%.

- If you continue working, benefits may be temporarily withheld due to earnings limits.

Example:

If your FRA benefit is $2,000/month and you claim at 62, your check could be reduced to around $1,400/month — a lifetime reduction.

This option is commonly chosen by individuals who need access to funds early, but it’s important to note that those reduced payments are permanent. They won’t jump up once you reach FRA.

Claiming Social Security Benefits at Age 65: The Medicare Milestone

While not your FRA (unless you were born before 1943), age 65 is a popular claiming age because it aligns with Medicare eligibility. Many people plan their retirement around access to government health insurance.

Pros:

- Benefit is higher than at 62, but still below 100% of your FRA amount.

- Strategic for those who retire when Medicare becomes available.

Cons:

- You’re still accepting a benefit reduction (~13% less than FRA).

Example:

If your FRA benefit is $2,000, you might receive $1,740/month if you claim at age 65.

Professional Insight:

Some financial advisors recommend using other retirement savings (like a 401(k)) to bridge the income gap from 65 to 67, allowing you to delay Social Security and claim your full benefit later.

Claiming at Age 70: Maximum Monthly Benefit

This is the highest age at which you can delay claiming Social Security. For every year you delay past FRA (67), your monthly benefit grows by approximately 8% per year. That’s a 24% increase if you wait until 70.

Pros:

- Maximize your monthly benefit.

- Useful if you expect to live into your 80s or 90s.

Cons:

- You delay access to benefits for three years.

- Not beneficial if your life expectancy is shorter or you need the income sooner.

Example:

A $2,000 FRA benefit could increase to over $2,480/month at age 70.

Professional Note:

If you’re healthy, have longevity in your family, and other income sources, waiting until 70 can significantly increase your total lifetime income.

How Monthly Benefits Stack Up – Real Examples

Let’s say Maria qualifies for a $2,000/month benefit at her full retirement age of 67.

| Claim Age | Monthly Benefit |

|---|---|

| 62 | ~$1,400 |

| 65 | ~$1,740 |

| 67 | $2,000 (FRA) |

| 70 | ~$2,480 |

That’s over $1,000/month difference between claiming at 62 and 70 — or $12,000 more per year, which is significant when budgeting for retirement.

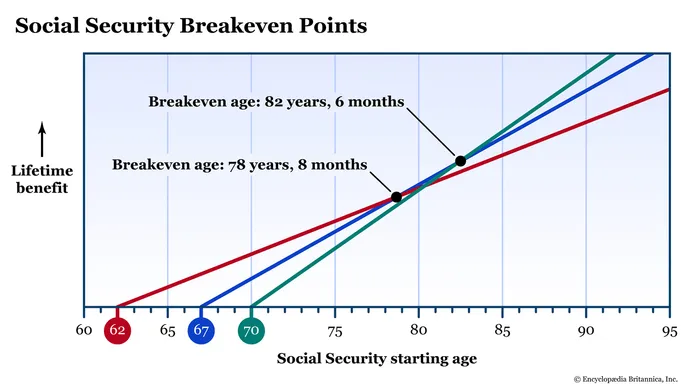

Break-Even Analysis: When Waiting Pays Off

The big question is: At what age does delaying benefits actually pay off?

- If you claim early (62), you start getting checks right away.

- If you delay (say to 70), your monthly check is bigger, but you missed out on years of income.

Break-even age:

- Usually around 78–80 years old.

- If you live beyond that, delaying typically results in more total money over your lifetime.

How Work and Income Affect Your Benefits?

If you take Social Security before FRA and keep working, your benefits may be temporarily reduced:

- In 2024, if you’re under FRA, Social Security withholds $1 for every $2 you earn above $21,240.

- Once you reach FRA, no income limits apply, and withheld benefits are recalculated and paid back over time.

This is important for part-time workers or people easing into retirement.

Social Security Taxes: What You Should Know

Social Security benefits may be taxable based on your income level:

- If your combined income (Social Security + other income) exceeds $25,000 (individual) or $32,000 (married), up to 85% of your benefits could be taxed.

- These taxes apply on the federal level. Some states also tax benefits, while others don’t.

Real-Life Retirement Personas

Diane, Age 62 – Nurse:

She retired early due to burnout and started benefits immediately. Though her checks are smaller, she doesn’t mind because she’s debt-free and wants to travel early in retirement.

Rob, Age 65 – Consultant:

He phased out of work and chose to delay benefits while using savings. Now he’s claiming Medicare and starting Social Security to avoid tapping his 401(k).

Mike, Age 70 – Engineer:

He kept working part-time and waited to claim. He now enjoys the maximum monthly benefit, which covers most of his expenses without needing to dip into retirement savings.

Strategic Tips for Claiming Smart

- Use the SSA Estimator Tool to calculate your actual benefit at each age.

- ssa.gov/benefits/retirement/estimator.html

- Consider your health and family history.

If longevity runs in your family, waiting could give you better long-term value. - Balance Social Security with other income sources.

Delaying your claim while drawing from retirement savings can boost total income later. - Talk to a financial advisor.

Especially if you have pensions, investments, or high net worth — they can help you optimize tax and income strategies.

Is a 4th Stimulus Check Coming in January 2026? Latest Updates

Social Security Boost by State 2026 – Five States Where Benefits Could Rise by Up to $2,000