January 21, 2026 Social Security Payment: The January 21, 2026 Social Security payment is more than just a deposit. For millions of Americans—retirees, disabled workers, survivors, and spouses—it represents financial security. But in 2026, with changing costs, inflation, and healthcare premiums, it’s more important than ever to understand not just when you’re getting paid, but how much and why. This article breaks down everything you need to know in simple, straight-shooting language: who gets paid on this date, how the 2026 Cost-of-Living Adjustment (COLA) affects your check, how rising Medicare premiums impact your take-home, and practical tips to help you keep more of your money. Whether you’re 10 or 70, or guiding others through retirement planning, this guide will help you grasp what’s really going on with your 2026 Social Security payment.

Table of Contents

January 21, 2026 Social Security Payment

The January 21, 2026 Social Security payment brings more than a monthly deposit. With a 2.8% COLA, higher Medicare premiums, and growing tax implications, it’s vital to understand what’s coming and how to prepare. Whether you’re a retiree, a spouse, or someone helping others, knowing when your money’s coming in — and how much of it you’ll actually keep — helps you plan your month, your year, and your future. Smart planning around work, taxes, and benefits can stretch your Social Security further. And with reforms on the horizon, staying informed has never mattered more.

| Topic | Key 2026 Details |

|---|---|

| January 21 Payment | Scheduled for people born 11th–20th of any month |

| COLA Increase | 2.8% raise for most benefits beginning in January 2026 — average boost ~$56/mo for retirees |

| Medicare Part B Premium | $202.90/month (up from $185) — deducted from Social Security checks |

| Earnings Limit (Under Full Age) | $24,480/year before benefit reductions |

| Maximum Benefit at Age 70 | Around $5,251/month |

| Taxable Benefits | Up to 85% of benefits may be taxed depending on income |

| Official SSA Resource | SSA COLA Info |

Who Gets January 21, 2026 Social Security Payment?

Social Security follows a birthday-based payment schedule for retirement, disability, and survivor benefits. Here’s how January 2026 lines up:

- January 14: People born 1st–10th of any month

- January 21: People born 11th–20th

- January 28: People born 21st–31st

So, if your birthday is on June 17, October 11, or February 13—your check lands on January 21, 2026.

This schedule only applies to people who started receiving benefits after May 1997. If you started before then, or you get Supplemental Security Income (SSI), your payment date is different.

SSI recipients typically receive their payments on the first of the month, unless it falls on a weekend or holiday—then it’s sent earlier.

How Much Is the COLA in 2026?

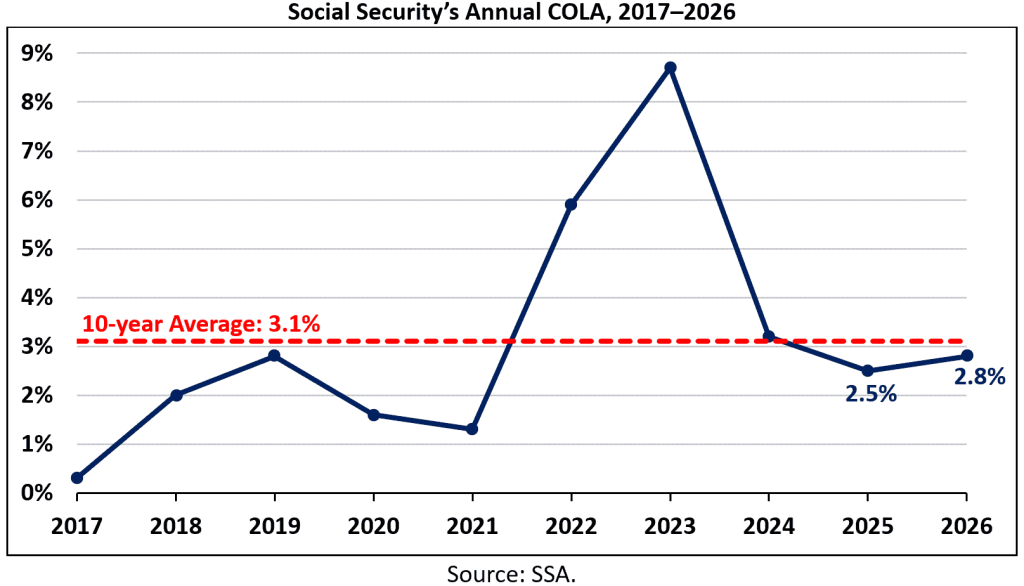

The Cost-of-Living Adjustment (COLA) is designed to help your benefits keep pace with inflation. In 2026, beneficiaries saw a 2.8% increase, which is slightly higher than the 10-year average.

What this means:

- If you were receiving $2,000/month in 2025, you now get around $2,056/month in 2026.

- The average retired worker saw a raise of about $56/month, or $672 per year.

- SSI payments rose to $994/month for individuals and $1,491 for couples.

How COLA is calculated:

COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The SSA compares the CPI-W for the third quarter (July, August, September) of the previous year to the same period a year before. If the index goes up, so does your benefit.

How Medicare Premiums Cut Into Your Check?

Let’s be real: Your gross Social Security benefit isn’t what hits your bank account.

That’s because most beneficiaries are enrolled in Medicare Part B, which covers things like doctor visits and outpatient care. The 2026 Part B premium is $202.90/month, up from $185 in 2025. This increase of $17.90/month is automatically deducted from your check.

So if your COLA gave you an extra $56, you’re really only seeing about $38 in extra money after Medicare is taken out.

Some folks—especially those with higher incomes—pay even more through Income-Related Monthly Adjustment Amounts (IRMAA).

For example, if your adjusted gross income is above:

- $103,000 (individual)

- $206,000 (married couple)

…you’ll likely pay a higher premium for Part B.

It’s critical to understand how COLA and Medicare premiums interact, because one can cancel out the other in your wallet.

How Is Your January 21, 2026 Social Security Payment Calculated?

Your monthly benefit is based on your top 35 earning years, adjusted for inflation. Here’s how it works:

- SSA calculates your Average Indexed Monthly Earnings (AIME) based on your highest-paid 35 years.

- They apply a benefit formula that replaces a percentage of that AIME.

- The age you claim affects the amount — earlier claims reduce, delayed claims increase benefits.

For 2026:

- Full Retirement Age (FRA) is 67 for those born in 1960 or later.

- Claiming at 62 reduces benefits by up to 30%.

- Delaying to age 70 can increase benefits by up to 24% over FRA.

So if you’re thinking of retiring early, weigh that carefully — you may lock in a lower check for life.

Spousal and Survivor Benefits

You may qualify for spousal benefits even if you never worked a day in your life.

- Spouses can receive up to 50% of the working spouse’s benefit at full retirement age.

- If your spouse gets $2,000/month, you could get up to $1,000/month.

- If you start early, your spousal benefit is reduced.

- If you’re divorced but the marriage lasted 10 years, you might still qualify.

For survivors, the benefit depends on the deceased worker’s record. A widow or widower can:

- Receive reduced benefits as early as age 60

- Wait until full retirement age for the full amount

- Continue receiving their own benefit or switch to the higher survivor benefit

Can You Work and Still Receive Benefits?

Yes — but there are income limits.

If you’re under full retirement age, the SSA sets an earnings limit. For 2026, that limit is $24,480. Earn more, and Social Security will withhold $1 for every $2 over the limit.

The year you reach full retirement age, the limit jumps to $65,160, and SSA withholds $1 for every $3.

Once you reach full retirement age, you can earn as much as you want — no reductions apply.

Working while receiving benefits may result in temporary reductions, but your permanent monthly benefit may increase due to continued earnings.

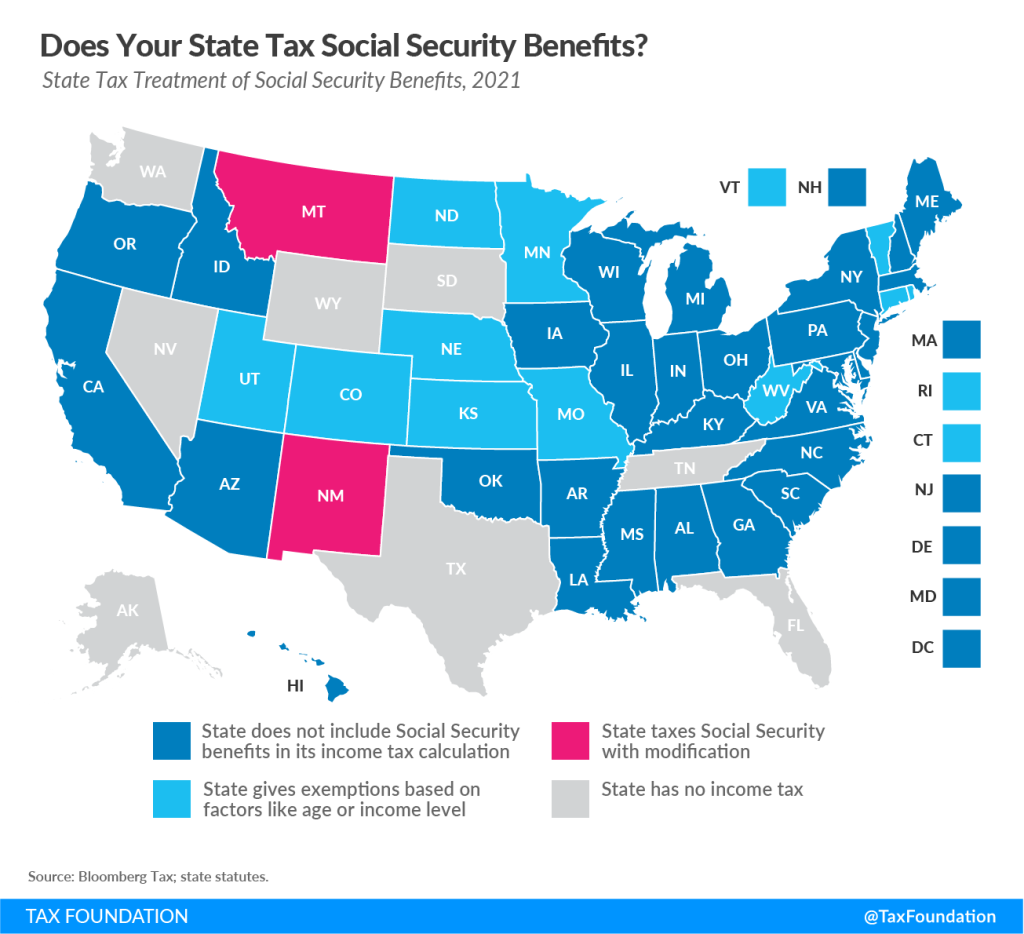

Are Your January 21, 2026 Social Security Payments Taxed?

Unfortunately, yes — Social Security can be taxable.

The IRS looks at your combined income, which includes:

- Your adjusted gross income (AGI)

- Nontaxable interest

- Half your Social Security benefits

If that total exceeds:

- $25,000 (single) or $32,000 (joint) → up to 50% of benefits taxed

- $34,000 (single) or $44,000 (joint) → up to 85% of benefits taxed

These thresholds aren’t indexed to inflation, so more people are taxed each year.

You can request tax withholding by filing Form W-4V or making estimated payments.

How Much Is the Maximum Monthly Benefit in 2026?

If you wait until age 70 to claim and have a high earnings history, you could receive up to $5,251/month in 2026.

This is the maximum possible benefit, and it requires:

- Working 35 years

- Earning at or above the taxable maximum each year

- Waiting until age 70 to file

Most people receive $1,500 to $2,500/month, depending on their earnings and claim age.

Will Social Security Run Out?

That’s a hot topic.

According to the Social Security Board of Trustees, the trust fund that pays retirement benefits could be depleted by 2034, at which point only 80% of promised benefits could be paid.

However, Social Security won’t “go bankrupt.” It’ll continue receiving income from:

- Payroll taxes

- Interest on trust fund investments

- Taxes on benefits

Still, Congress must act to restore long-term solvency. Options on the table include:

- Raising the payroll tax cap

- Increasing retirement age

- Adjusting the benefit formula

Staying informed matters, especially for younger workers.

Social Security 2026 Changes – What the New Maximum Benefit Looks Like Under Updated Rules

Social Security Benefit Boost 2026 – 3 Simple Moves That Can Increase Your Monthly Check