$1000 New York Child Tax Credit: If you’re a parent living in New York, the term “$1,000 Child Tax Credit 2026” might already be catching your ear — and for good reason. As part of a bold move to fight child poverty and ease the financial burden of parenting, New York State expanded its Empire State Child Credit, and this is the first year the new structure fully kicks in. Whether you’re a working parent juggling child care, a tax professional preparing client returns, or simply someone curious about how state-level tax credits work — this comprehensive guide has you covered. We’re breaking down who qualifies, how much you’ll get, when the payments come, and why this credit matters more than ever in 2026.

Table of Contents

$1000 New York Child Tax Credit

The New York $1,000 Child Tax Credit for 2026 is one of the most impactful financial tools available to families in the Empire State. With benefits of up to $1,000 per child, it’s not just a line on your tax return — it’s real money, aimed at easing the burden of raising kids in today’s economy. Whether you’re planning ahead or filing your taxes next spring, knowing how to maximize this credit is key. Don’t leave money on the table — file smart, file early, and make sure your family gets every dollar it deserves.

| Topic | Details |

|---|---|

| Official Name | Empire State Child Credit |

| Max Credit Amount | Up to $1,000 per child under age 4 |

| Older Children | Up to $500 per child ages 4–16 |

| Eligibility | Full-year NY resident with qualifying child under 17 |

| Filing Required | NYS Form IT-201 + IT-213 |

| Refundable Credit? | Yes — even if you owe no tax |

| When Paid | When you file your 2026 tax return (by April 2027) |

| Official Info | Empire State Child Credit – NY Tax |

What Is the Empire State Child Credit?

The Empire State Child Credit is a refundable tax credit offered to eligible families by New York State. Unlike deductions that reduce your taxable income, a credit reduces your tax bill dollar-for-dollar, and a refundable credit means you can get the money back even if you owe no tax at all.

The 2026 version reflects the largest expansion of the credit since its inception in 2006. Previously capped at a much lower amount (about $330 per child), the newly expanded credit is worth:

- Up to $1,000 per qualifying child under the age of 4, and

- Up to $500 per child aged 4–16

This change is designed to offer more support during the most expensive early years of raising children — a time when childcare alone can cost families $15,000 or more annually in many New York regions.

Who Qualifies for the $1000 New York Child Tax Credit in 2026?

Eligibility is straightforward but has a few key conditions.

1. You Must Be a Full-Year Resident of New York

To qualify for the full credit, you (or your spouse if filing jointly) must have lived in New York State for the entire year.

2. Your Child Must Meet Qualifying Rules

Each qualifying child must:

- Be under 17 years old by December 31, 2026

- Be claimed as a dependent on your New York state tax return

- Have a valid Social Security number

- Be a U.S. citizen, U.S. national, or resident alien

The key detail is age. Children under age 4 by December 31 qualify for the full $1,000 credit, while those ages 4 through 16 may receive up to $500, depending on other factors.

3. You Must File a State Return (Form IT-201) and Attach Form IT-213

No form = no refund. Always attach Form IT-213, which is the official “Claim for Empire State Child Credit.”

How Much Will You Get?

Up to $1,000 per child under age 4

Let’s say you have two kids, ages 2 and 5. Your 2-year-old qualifies for the full $1,000 credit, and your 5-year-old qualifies for up to $500. That’s $1,500 in refundable credit right there.

Up to $500 per child ages 4–16

While the focus is on younger kids, the partial credit for older children is still meaningful — especially for middle-income families.

Fully Refundable

This means you can still receive the credit even if you owe $0 in taxes to the state of New York. The state cuts you a refund check for the amount you qualify for.

This makes the credit particularly impactful for low-income families — many of whom may not have qualified for previous non-refundable versions of the credit.

When Do You Get Paid?

The Empire State Child Credit is claimed when you file your New York State income tax return for 2026 — due by April 15, 2027 (unless you file for an extension).

Payments are issued as part of your state tax refund. There are no monthly checks like in the 2021 federal CTC advance rollout. Instead, it’s a lump-sum payment, which some families prefer for paying off larger bills or making annual purchases.

Filing early — and opting for direct deposit — is the fastest way to receive your money.

Income Guidelines & Phaseouts

Unlike some federal credits, New York’s child credit does not use a sharply tiered income phaseout system. Instead, it gradually adjusts the benefit based on your federal adjusted gross income (AGI) and tax liability.

While there is no strict income cap, families earning over $110,000–$150,000 may see reduced credit amounts. The benefit is most generous for low- and moderate-income families, typically:

- Single filers: Under $75,000

- Married filing jointly: Under $110,000

However, even higher-income families may still qualify for partial benefits, depending on how many children they claim and their taxable income.

For precise planning, use New York’s online income tax estimator or speak with a certified tax preparer.

How to Claim the $1000 New York Child Tax Credit (Step-by-Step Guide)

Here’s a simple roadmap to make sure you don’t miss out:

Step 1: Collect Necessary Documents

- Social Security Numbers for all dependents

- Proof of residency (driver’s license, utility bill)

- Income documents (W-2s, 1099s, etc.)

Step 2: File Your State Tax Return

Use Form IT-201 (NYS income tax return). You can do this with tax software, through a tax pro, or by using free filing services if eligible.

Step 3: Attach Form IT-213

This form is essential — it claims the Empire State Child Credit. You’ll fill in the number of qualifying children and calculate your credit amount.

Step 4: File Electronically with Direct Deposit

E-filing speeds up processing. Enter your bank account info to get your refund directly deposited into your checking or savings account.

Step 5: Keep Your Records

Hold on to tax returns and supporting documentation for at least three years.

Real-Life Examples

Example 1: The Jackson Family

Married couple with three kids — ages 2, 6, and 15.

- $1,000 credit for the 2-year-old

- $500 credit each for the 6- and 15-year-olds

Total Refund: $2,000

Example 2: Maria, a Single Mom

Maria has one child, age 3. She makes $45,000 annually and owes no state income tax.

- She still qualifies for the full $1,000 credit

- Because it’s refundable, she gets the entire amount as a refund

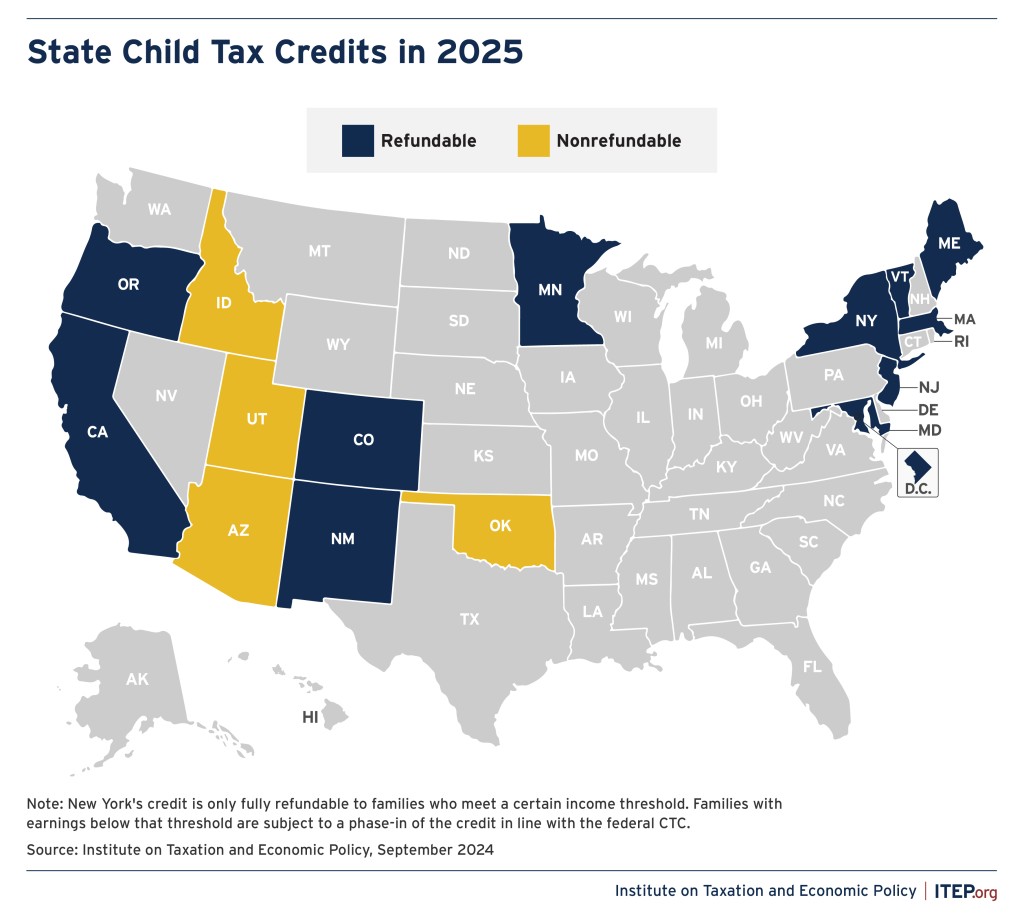

How This Credit Compares to Other States?

Many states are jumping on board with child tax credits, but few are as broad as New York’s.

| State | Max Credit | Refundable? | Notable Features |

|---|---|---|---|

| New York | $1,000 (age <4) | Yes | Covers ages 0–16, generous for low-income |

| California | $1,000 | Yes | Ages 0–5 only |

| Minnesota | $1,750 | Yes | Phases out quicker |

| Oregon | $1,000 | Yes | For children under 5 |

| Texas | None | N/A | No state income tax or credit |

New York stands out for its combination of broad eligibility and high refund potential for younger children.

Why $1000 New York Child Tax Credit Matters?

According to research by Columbia University’s Center on Poverty and Social Policy, refundable child tax credits reduce food insecurity by 26% and improve children’s school performance, health, and long-term earning potential.

In 2021, the temporary expansion of the federal CTC helped reduce child poverty by 46% nationwide. New York’s updated policy aims to carry that momentum forward at the state level. (Columbia University Poverty Center)

Top Mistakes to Avoid

- Forgetting to attach Form IT-213 — this is the most common error

- Entering the wrong SSN for a dependent

- Missing the filing deadline

- Assuming the credit applies automatically — it doesn’t. You must claim it.

Always double-check your forms before submitting, especially if you’re filing without a tax pro.

New York raises overtime thresholds starting January 2026: Here’s how much

It’s Official: New York Announces 2026 Minimum Wage Hike; Here’s Who Benefits Most

Social Security Payment Schedule 2026 – Why Millions Will See New Dates and Larger Checks