4th Stimulus Check Coming: If you’ve been scrolling through Facebook, listening to talk radio, or catching up on the news, you’ve probably heard it: “A 4th stimulus check is on the way in January 2026!” But is it true, or is it just another case of social media hype? The reality? As of January 16, 2026, there is no federal stimulus check officially scheduled or approved. However, there’s plenty of discussion — particularly around the proposed Tariff Dividend plan linked to former President Donald Trump. Let’s break it all down: the facts, the fiction, the economic climate, and what smart Americans should be doing next.

Table of Contents

4th Stimulus Check Coming

Let’s recap:

- There is no official 4th stimulus check in January 2026.

- The Tariff Dividend is a political idea, not a law or government program.

- Congress hasn’t approved funding, and the IRS has no payment schedule.

- The economic picture shows need, but there’s no federal relief… yet.

- Scam activity is high — stay cautious and informed.

- States may still offer support, and tax credits can bridge the gap.

Your best move right now? Stay informed, protect your personal data, and budget smart in case no help comes — but be ready to act if a proposal does move forward.

| Topic | Details |

|---|---|

| Check Status | No official 4th stimulus check as of January 2026 |

| Rumor Source | Tariff Dividend proposal tied to former President Trump |

| IRS Confirmation | No guidance or payment schedule released |

| Payment Amount (Rumored) | $2,000 (proposed, not confirmed) |

| Congressional Action | No legislation passed |

| Next Possible Window | Mid-to-late 2026 if approved |

| Economic Climate | High inflation, moderate unemployment, increased household debt |

| Scam Risk | Surge in phishing texts, fake portals |

| Official Sources | IRS.gov, Congress.gov |

Quick Recap: Stimulus Checks from 2020 to 2021

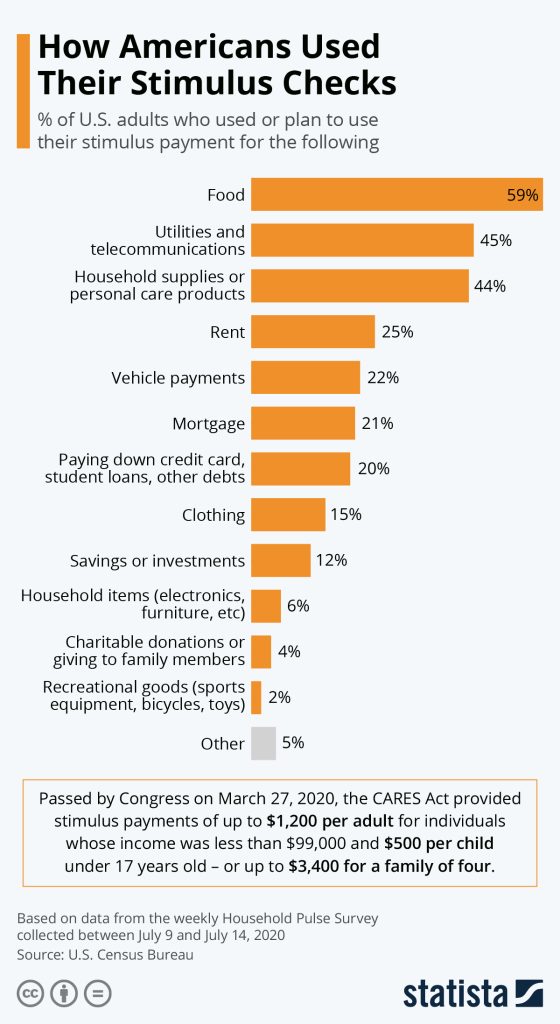

The U.S. government issued three major stimulus checks during the COVID-19 pandemic:

- March 2020 (CARES Act): $1,200 per adult

- December 2020 (Relief Bill): $600 per adult

- March 2021 (American Rescue Plan): $1,400 per adult

Combined, these direct payments pumped over $850 billion into the U.S. economy. According to the U.S. Census Bureau, poverty in the U.S. dropped by 2.6 percentage points in 2021 thanks to these payments. Source

The checks were lifelines — covering rent, groceries, car payments, and emergency healthcare costs — especially for lower and middle-income families.

What’s Driving the 4th Stimulus Check Coming Talk in 2026? The “Tariff Dividend”

What Is the Tariff Dividend?

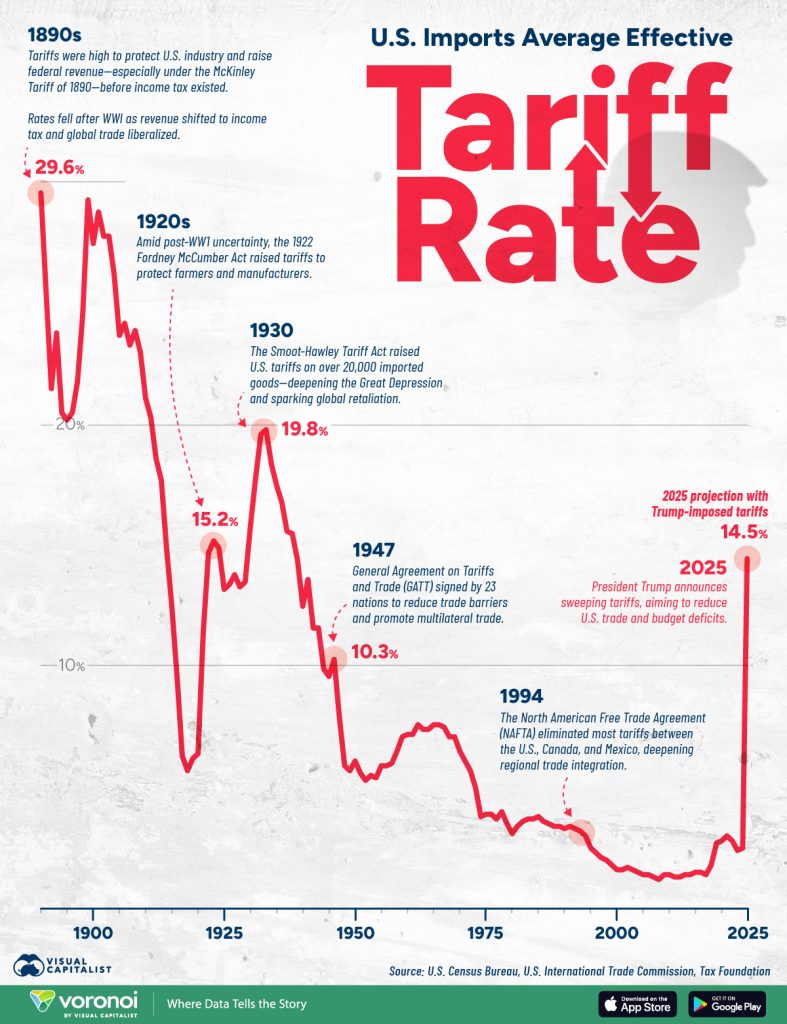

The Tariff Dividend is an economic proposal suggesting that revenue from tariffs imposed on imported goods — particularly from China — could be redistributed to U.S. citizens as a form of stimulus. In simple terms: Tax money collected at the border would be paid out to Americans, potentially in the form of a $2,000 check.

The term is linked to former President Donald Trump’s economic platform, especially as campaign season builds up for the upcoming 2026 elections. Some media outlets and political commentators have floated this concept as a possible source of direct relief for Americans in the near future.

“It’s not legislation. It’s not even a real program yet. But it’s getting attention — and that alone sparks confusion.”

— Kiplinger, January 2026

Why It’s Not Happening (Yet)

- No bill has been introduced or passed in Congress.

- The IRS hasn’t created any portals or issued any letters.

- The U.S. Treasury has not allocated any funds or offered public comments.

- It is not included in the 2026 federal budget.

Economic Snapshot: Is a Stimulus Even Justified Right Now?

Let’s look at where things stand economically in January 2026:

| Indicator | Current Status |

|---|---|

| Inflation Rate | 4.1% (down from 8.3% in 2022) |

| Unemployment Rate | 4.2% (slightly above pre-COVID levels) |

| Average Rent (National) | Up 27% from pre-pandemic baseline |

| Credit Card Debt | $1.27 trillion (highest on record) |

| Wage Growth | 3.2% YoY (lagging behind inflation) |

While the job market is relatively stable, high inflation and stagnant wages are squeezing the middle class. Many economists argue that if economic conditions worsen in Q2 or Q3, additional stimulus could return to the table.

Election Year Pressure: Will Politics Play a Role?

2026 is a midterm election year, and history shows politicians are more willing to propose relief packages or financial aid when trying to win voter support. Both Democrats and Republicans have used stimulus promises to curry favor.

The Tariff Dividend, even if it’s not implemented, may pressure other lawmakers to offer alternative proposals, like:

- Expanded Child Tax Credits

- Federal Gas Rebates

- Earned Income Credits

- Student Loan Interest Forgiveness

Bottom line: Don’t expect a check this month, but keep your eyes open after primaries wrap up mid-year.

How Financial Pros Should Be Advising Clients Right Now?

If you’re a CPA, financial planner, or enrolled agent, you’re probably fielding the same question again and again:

“Should I expect another check this year?”

Here’s the guidance you should give clients:

- Don’t count on it. Plan your 2026 budget as if no check is coming.

- Use official sources only. Direct clients to IRS.gov for real-time info.

- Stay educated on credits. Emphasize the benefits of EITC, CTC, and local housing subsidies.

- Warn about scams. People are being tricked via texts and DMs asking for personal information.

How to Prepare — With or Without a 4th Stimulus Check Coming

Even if no check comes in 2026, here’s how you can financially bulletproof your year:

1. Create a Cushion

Build a 3–6 month emergency fund, even if it’s small at first. Apps like Chime or Capital One 360 can help you automate savings.

2. Review Tax Benefits

- File early and leverage Earned Income Tax Credit (EITC)

- If you have kids, claim the Child Tax Credit (CTC)

- Explore local property tax credits or renter refunds in your state

3. Use State Programs

Several states have independent relief programs:

- California: Inflation Relief Checks (up to $1,050 in 2025)

- Colorado: TABOR refund expected in Q3 2026

- New Mexico: Income-based rebates under review

SSDI Payments 2026 Increase – New 2.8% Boost Explained, Check Updated Monthly Amounts

$1,800 One-Time Payment – Which Families Qualify and When Funds Are Sent

$2,503 Stimulus Check Confirmed for January 2026 – Check Eligibility & Payment Date

Avoiding Scams: Red Flags and What to Watch Out For

In the last two months, the Federal Trade Commission (FTC) has issued multiple scam alerts related to fake stimulus claims.

Common tactics include:

- Text messages claiming “your $2,000 check is ready”

- Emails with IRS-looking logos asking you to “update your banking info”

- Social media posts from “government relief agents”

Don’t fall for it. The IRS does not communicate via text, direct message, or unsolicited email.