What’s Behind the Slow CPP Payments: If you’re a Canadian retiree living on around $850 per month from the Canada Pension Plan (CPP) in 2026, you’re probably wondering, “Why is my payment so low?” or “Why are these payments feeling slower than ever?” These aren’t just casual concerns — they’re real-life financial challenges affecting thousands of seniors. From limited cost-of-living adjustments to how much you contributed during your working years, a lot goes into what you receive. In this article, we’ll break it all down in simple, everyday language — without skimping on the facts. You’ll walk away with practical tips, insight into CPP’s structure, and strategies to improve your financial picture in retirement.

Table of Contents

What’s Behind the Slow CPP Payments?

Receiving $850 a month from CPP in 2026 isn’t uncommon — it’s actually the average. But it doesn’t mean your retirement has to be limited. By understanding how CPP works, applying for supplements, and planning carefully, you can make the most of what you have. CPP alone may not be enough — but with smart strategies, you can still retire with dignity and control. Whether you’re already retired or planning ahead, the keys are knowledge, timing, and access to support.

| Topic | Details |

|---|---|

| Average CPP Payment (2026) | ~$850/month |

| Maximum CPP Payment (2026) | $1,507.65/month |

| Inflation Adjustment (2026) | 2.0% cost-of-living increase |

| Why Payments Are Low | Contribution history, early retirement, lower average income |

| Common Payment Delays | Bank holidays, Service Canada backlog, postal delays |

| CPP Administration | My Service Canada Account |

| Contact for Issues | 1-800-277-9914 |

| Retirement Boosting Tips | Delay CPP, apply for OAS/GIS, check your records, get financial advice |

What Is the CPP and How Does It Work?

The Canada Pension Plan is a contributory, earnings-based public pension program. It’s not a handout. It’s something you’ve likely paid into during your working years, with a portion deducted directly from your paycheck.

But here’s the kicker: CPP payments are not fixed for everyone. They’re determined by three main factors:

- How much you contributed to the plan

- How many years you contributed

- The age at which you start receiving benefits

If you retire early or worked part-time or in low-paying jobs, your benefit is going to be lower — plain and simple. That’s why the average monthly CPP in 2026 is only about $850, even though the maximum is over $1,500.

Why Are There Slow CPP Payments?

Let’s talk about what’s really happening behind the scenes.

Modest Inflation Adjustments

Every January, CPP benefits are increased based on the Consumer Price Index (CPI). In 2026, the adjustment was 2.0% — which technically helps maintain your purchasing power.

But here’s the problem: For most seniors, actual living costs are rising faster than that.

Think about groceries, rent, medications, gas, and electricity. Those prices have surged faster than inflation statistics suggest. So even though your CPP got a 2% boost, it might feel like you’re falling behind.

Rising Cost of Essentials

A recent survey from CARP (Canadian Association of Retired Persons) revealed that:

- 42% of seniors reported cutting back on food to pay rent

- 60% say CPP alone doesn’t cover their monthly basic expenses

When rent is up by 7%, and groceries by 5%, a 2% increase doesn’t stretch very far.

Payment Delays and Administrative Backlogs

While CPP is usually paid on the last Wednesday of every month, many seniors are reporting delays. These are often due to:

- Banking holidays falling near payment dates

- Postal service slowdowns for cheque recipients

- Technical issues in direct deposits or account updates

Why You Might Not Be Getting the Maximum CPP

Contrary to popular belief, most people don’t qualify for the maximum CPP amount. To do so, you must:

- Contribute the maximum annual amount for at least 39 years

- Earn over the Year’s Maximum Pensionable Earnings (YMPE) for most of your career

- Start CPP at age 65, not earlier

Let’s break it down:

| Retirement Scenario | Approx. Monthly CPP (2026) |

|---|---|

| Max contributor for 39+ years, retire at 65 | $1,507.65 |

| Moderate earnings for 25–30 years, retire at 65 | ~$850 |

| Early retirement at 60 | ~$650 |

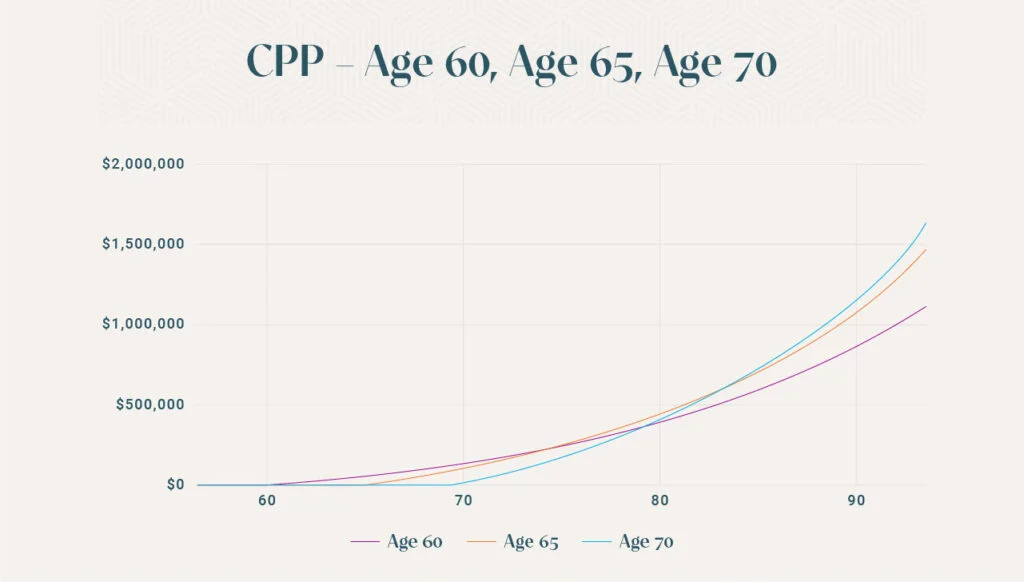

| Delay retirement to 70 | ~$1,750 or more |

Recent CPP Enhancements — Are They Helping?

Starting in 2019, the federal government began a CPP enhancement plan, aimed at increasing retirement income for future retirees.

Key Changes:

- Gradual increases to contribution rates for employees and employers

- Aiming to replace up to 33% of average earnings instead of 25%

- Full benefits from enhancement won’t be felt until 2045 and beyond

So what does this mean for you in 2026? If you’re already retired, you’re not going to see much change. Most of the benefit goes to people currently in their working years.

In short: you’re paying more, but not necessarily getting more — at least not right away.

How Canada’s CPP Compares Globally?

Let’s zoom out and look at how Canada stacks up to other developed nations:

| Country | Public Pension (Average) | Comments |

|---|---|---|

| Canada | $850–$1,100 (CPP + OAS) | Requires OAS/GIS to supplement |

| United States | ~$1,800 (Social Security) | Based on top 35 earning years |

| UK | ~$1,000 (State Pension) | Requires full National Insurance record |

| Australia | ~$1,500 (Age Pension) | Means-tested, more generous for low-income retirees |

While CPP is sustainable and well-managed, it’s not designed to be your only retirement income. You’ll need additional income from savings, private pensions, or government supplements.

What’s Behind the Slow CPP Payments: Real-Life Stories from Retirees

Sometimes, the best way to understand a system is to hear directly from people experiencing it.

Margaret, 72, Toronto:

“I worked as a receptionist for over 30 years, but never earned big. I started CPP at 60 and now I get about $720 a month. With rent and bills, I’ve had to dip into my savings more than I expected.”

Tom, 68, Calgary:

“I delayed CPP until 67, which bumped my payment to about $1,050. It helps, but I still rely on OAS and a part-time gig to make ends meet.”

These stories are all too common — and they underscore the need for realistic retirement planning.

Retirement Planning: How to Stretch That $850 Further

Here’s how to boost your retirement income — or at least make it go further:

Delay CPP if Possible

Waiting until age 70 could increase your monthly CPP payment by up to 42%. If you can afford to wait, it’s often worth it.

Combine CPP with Other Benefits

You may qualify for:

- Old Age Security (OAS): Available to most Canadians over 65

- Guaranteed Income Supplement (GIS): Extra support for low-income seniors

- Provincial support programs: Vary by province (BC Seniors Supplement, Ontario GAINS, etc.)

Use Tools to Track Your Benefits

Use the CPP Retirement Calculator to estimate your benefits. And log in to My Service Canada to:

- Review your contribution history

- Check your payment schedule

- Update your direct deposit information

Common Pitfalls to Avoid the Slow CPP Payments

Avoid these costly mistakes when managing your CPP:

- Taking CPP too early when you don’t need to

- Not checking your earnings/contribution history for errors

- Assuming OAS and GIS will “automatically” apply (you have to file separately)

- Overlooking private pension or RRSP withdrawal strategies

Canada Housing Benefit 2026: Exact Payment Dates, Eligibility, and Payment Date

Canada Grocery Rebate December 2025: Check Eligibility, Amount & Payment Date

Canada Scraps Mandatory Retirement at 65: How the New CPP & OAS Rules Change Everything