Stimulus Check Update 2026: In early 2026, Americans are once again buzzing about the possibility of a new stimulus check—this time for $2,000. With everything from groceries to rent still eating up more of our paychecks, the promise of relief has folks from coast to coast asking, “Is it real or just political chatter?” This proposal, labeled a “Tariff Dividend” by its backers, comes from former President Donald Trump, who claims the federal government can use tariff revenues to send every American a one-time $2,000 rebate. But before you count on that check to cover your car note or credit card bill, you need to know where things actually stand.

Table of Contents

Stimulus Check Update 2026

The proposed 2026 $2,000 stimulus check, promoted as a Tariff Dividend, is generating buzz—but at the moment, it’s not a done deal. With no bill introduced, no funds allocated, and legal challenges still unresolved, Americans should remain cautious and informed. While it’s smart to stay alert for updates, don’t fall for scams or make financial decisions assuming this money is on the way. Watch for developments in Congress, Supreme Court rulings, and official statements from the Treasury and IRS. Until Congress puts pen to paper, this stimulus plan remains just that—a plan.

| Feature | Details |

|---|---|

| Proposal | $2,000 one-time “Tariff Dividend” payment |

| Status (as of Jan 2026) | Not passed by Congress, no official approval |

| Source of Funds | U.S. tariff revenue (from imported goods) |

| Proposed By | Former President Donald Trump |

| Estimated Cost | ~$450–$600 billion |

| Legal Concerns | Pending Supreme Court rulings on tariffs |

| Potential Timeline | Late 2026 or later (if passed) |

| Eligibility | Likely income-based, like previous stimulus checks |

| Official Info | WhiteHouse.gov |

What Is the Stimulus Check Update 2026 Proposal?

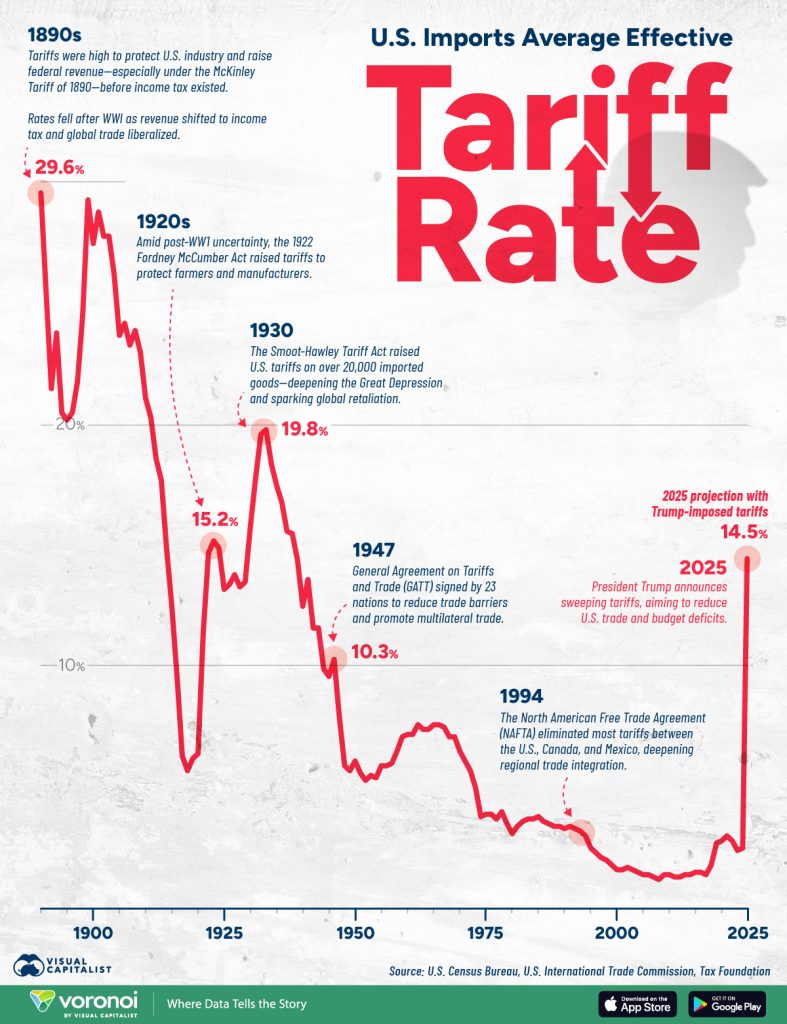

The 2026 stimulus proposal isn’t the kind of emergency pandemic relief Americans received in 2020 and 2021. Instead, it’s being pitched as a “dividend” from the money the U.S. allegedly collected from import tariffs, especially those imposed during Trump’s administration.

The former president argues that tariffs on countries like China have brought in hundreds of billions in revenue, and that it’s time to share the wealth with hardworking Americans. The idea? Give every citizen a $2,000 rebate, funded not by borrowing or debt, but by the profits from trade penalties.

But while the sales pitch sounds patriotic and generous, the reality behind it is far more complicated.

Historical Context: Past Stimulus Checks

This wouldn’t be the first time Uncle Sam cut checks to Americans:

- CARES Act (March 2020): $1,200 per adult

- December 2020 Relief: $600 per adult

- American Rescue Plan (March 2021): $1,400 per adult

Those payments were backed by congressional legislation and were tied directly to the COVID-19 public health and economic crises. The checks helped keep families afloat, reduced poverty, and temporarily boosted consumer spending.

But the 2026 proposal has no crisis attached to it, no active legislation, and no bipartisan support—yet.

Does Congress Need to Approve It?

Yes, without a doubt.

Even if a president wants to send checks, Congress holds the keys to the federal wallet. That means both the House and Senate would need to:

- Introduce and pass a bill

- Assign funding and eligibility rules

- Pass it through budget and appropriations committees

- Send it to the president for signature

Right now, no such bill has been introduced, and there’s no indication that one is on the way anytime soon. As of January 2026, there’s no official legislation filed, and lawmakers on both sides of the aisle remain skeptical.

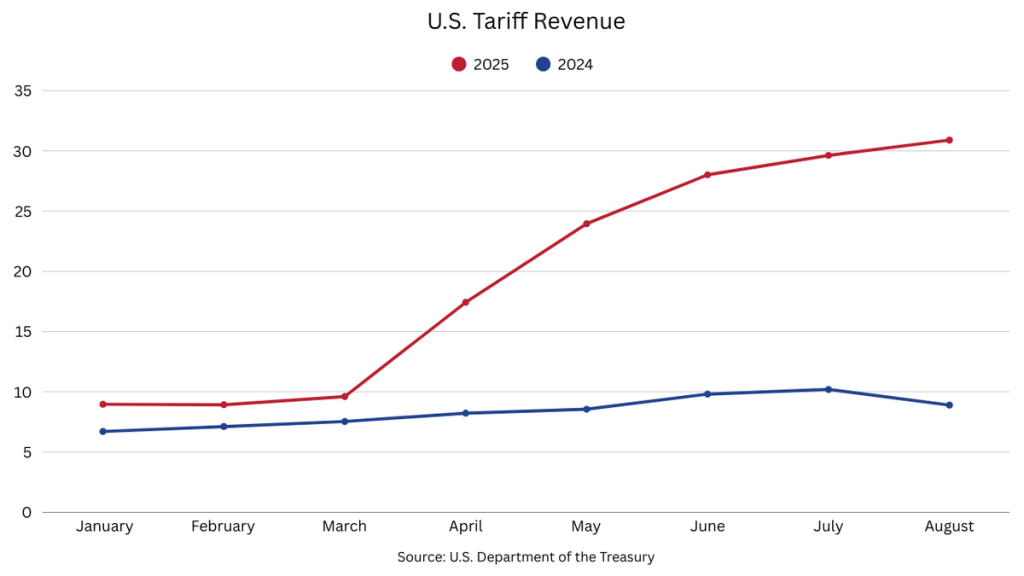

Where Would the Money Come From?

Supporters say the U.S. can use revenue from tariffs to pay for this new round of stimulus. Tariffs are taxes the government places on imported goods—like electronics, steel, clothing, and more.

But there are problems with this claim:

- U.S. tariff revenue in 2025: ~$270 billion

(Source: U.S. Treasury) - Estimated cost of $2,000 per eligible adult: $450–$600 billion

(Based on U.S. Census and IRS data)

That’s a huge funding shortfall, unless the government slashes eligibility or supplements the funding through deficit spending.

Plus, tariffs are often paid by American businesses, not foreign governments. Those costs usually get passed to consumers through higher prices—so we’re essentially paying for it anyway.

Legal Trouble: Supreme Court Cases

To make matters trickier, there are pending legal challenges at the Supreme Court related to how previous tariffs were imposed. Critics argue that certain executive actions bypassed proper congressional authority.

If the Court strikes down those tariffs, it could:

- Invalidate the funding source

- Open the door to refund lawsuits from importers

- End the rebate program before it starts

So, until there’s a ruling, the legal foundation of the stimulus proposal is shaky at best.

Who Might Qualify for Stimulus Check Update 2026?

Although no official eligibility requirements have been released, most analysts expect income limits similar to past stimulus checks. Here’s what likely qualification could look like:

| Filing Status | Likely Income Threshold for Full Amount |

|---|---|

| Single | Up to $75,000 AGI |

| Married Filing Jointly | Up to $150,000 AGI |

| Head of Household | Up to $112,500 AGI |

| Dependents | May receive additional rebate (possibly $500–$1,400) |

Above those income thresholds, the amount would likely phase out, tapering to zero at around $99,000 for individuals or $198,000 for married couples—again, similar to past checks.

When Could It Happen?

Even under the most optimistic scenario, no checks are going out anytime soon. Here’s a rough timeline—if the plan moves forward:

- Proposal introduced: Mid 2026 (at best)

- Congressional debate & passage: Fall 2026

- Implementation by IRS: Late 2026 or early 2027

So, if you were hoping for a spring windfall, you’re out of luck. The earliest realistic delivery would be around the end of the year, but again, only if everything goes smoothly—which is rare in Washington.

Economic Impact: What Experts Are Saying

Some economists say the idea has merit in theory—redistributing trade-related revenue back to citizens. But others raise red flags.

Pros:

- Could temporarily boost consumer spending

- Offers relief amid lingering inflation

- Popular among low- and middle-income families

Cons:

- Might worsen inflation in short term

- Lacks a stable long-term funding source

- Sets a precedent for politically-timed cash payouts

According to a Brookings Institution analysis, any large-scale cash transfer must be carefully managed to avoid spurring another inflation spike, especially when the Fed is still trying to stabilize prices.

Social Buzz and Public Reaction

Online platforms have exploded with reactions:

- “If Trump really sends $2,000 checks, I’ll vote for him again,” one Facebook commenter wrote.

- “This feels like the old dog-and-pony show,” said a Reddit user in r/personalfinance.

- TikTok videos tagged #stimulus2026 have garnered over 22 million views, with influencers speculating about check arrival dates and eligibility.

While social media spreads awareness, it also fuels misinformation. Remember: as of now, there is no application and no approved payment.

What Professionals and Employers Should Know?

If you’re an HR leader, accountant, or business owner, it’s smart to prepare for potential questions from employees or clients.

- Communicate clearly that nothing is approved.

- Advise clients to avoid scammers or unofficial portals.

- Encourage employees to file their taxes promptly, as eligibility is likely based on 2024 or 2025 returns.

- Watch IRS guidance for any changes in withholding or benefits.

Practical Advice: What You Can Do Now

- Stay Informed. Sign up for updates from IRS.gov and reputable news outlets.

- Don’t Fall for Scams. There is no application or pre-registration form.

- File Taxes Promptly. Your AGI will likely determine eligibility.

- Avoid Financial Overcommitment. Don’t rely on stimulus income until it’s officially confirmed.

$1,800 One-Time Payment – Which Families Qualify and When Funds Are Sent

$2,503 Stimulus Check Confirmed for January 2026 – Check Eligibility & Payment Date

SSDI Payments 2026 Increase – New 2.8% Boost Explained, Check Updated Monthly Amounts