First Social Security Stimulus Payment: The First Social Security Stimulus Payment 2026 with COLA Adjustment is finally rolling out — and it’s more than just a buzzword. For millions of retirees, disability beneficiaries, and families who rely on Supplemental Security Income (SSI), the 2.8% Cost-of-Living Adjustment (COLA) in 2026 brings some much-needed relief amid rising inflation. Whether you’re already collecting benefits or planning for retirement, understanding how this increase works, when it hits your account, and what it really means for your budget is essential. This article breaks down everything you need to know — in plain English — from a seasoned policy expert’s perspective. You’ll find real examples, actionable advice, and links to trusted government resources for peace of mind.

Table of Contents

First Social Security Stimulus Payment

The First Social Security Stimulus Payment 2026 with COLA Adjustment isn’t a bonus check — it’s a structured inflation boost that ensures millions of Americans can still afford basics like food, medicine, and rent. With a 2.8% increase officially in effect, most beneficiaries will see $30–$60 more per month, depending on their personal situation. Although modest, this change should serve as a reminder to re-evaluate budgets, double-check deductions, and think longer-term about how Social Security fits into your retirement strategy.

| Topic | 2026 Details |

|---|---|

| COLA Increase | 2.8%, based on CPI-W inflation tracking |

| First COLA-Affected Payments | SSI: Dec 31, 2025; Social Security: Jan 14, 21, 28, 2026 |

| Average Retiree Benefit | $2,071/month, up from $2,015 in 2025 |

| Maximum SSI Benefit (Individual) | $994/month |

| Maximum Retired Worker Benefit | Up to $5,251/month (if claiming at age 70) |

| Medicare Part B Premium | $202.90/month, up ~$18 from 2025 |

| Official Info Source | https://www.ssa.gov/cola |

What Is the COLA, and Why Does It Exist?

The Cost-of-Living Adjustment (COLA) is an annual increase to Social Security and SSI benefits designed to keep pace with inflation. COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — a key federal indicator measuring inflation.

When inflation rises, the government boosts benefits to make sure older Americans and others on fixed incomes don’t lose purchasing power.

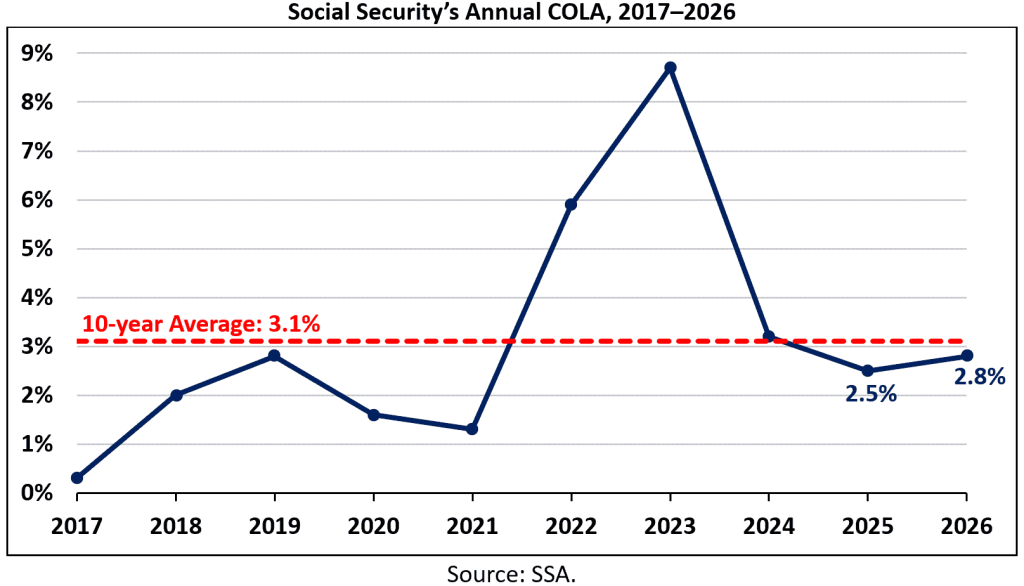

This year’s 2.8% increase reflects moderate inflation experienced in 2025. While it’s not as high as the 5.9% bump seen in 2022, it’s still a meaningful boost that impacts more than 71 million people receiving benefits.

How Much More Will You Actually Receive?

Let’s break down what the 2.8% increase actually means for different types of beneficiaries.

Examples (Before Taxes or Deductions):

- A retired worker receiving $2,015/month in 2025 will now receive around $2,071/month

- A couple receiving $3,120/month will receive approximately $3,208/month

- An SSI individual maxes out at $994/month, up from $943

- A maximum benefit (claimed at 70) could be as high as $5,251/month

While the increase sounds decent on paper, your net benefit may feel smaller if you have Medicare Part B premiums deducted from your monthly check. Those went up in 2026 to $202.90, up nearly $18 from 2025.

Estimated Net Increase for Retired Worker:

- Gross COLA bump: ~$56/month

- Medicare premium hike: -$18

- Net gain: ~$38/month

When Will You Receive the COLA Increase?

Social Security benefit payment dates depend on your birthday. Here’s when your check hits in January 2026:

- Jan 14 – If you were born between the 1st and 10th

- Jan 21 – If born between the 11th and 20th

- Jan 28 – If born between the 21st and 31st

For SSI recipients, the January payment was issued on December 31, 2025, due to New Year’s Day being a federal holiday.

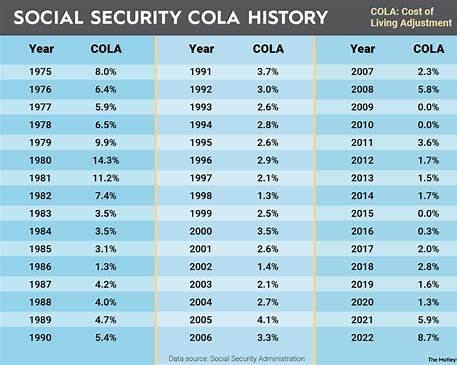

A Bit of History: How Does This Year’s COLA Compare?

Here’s a look at recent COLA percentages for historical context:

| Year | COLA % |

|---|---|

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.4% |

| 2026 | 2.8% |

While 2026’s increase is modest, it’s higher than 2025’s, showing that inflation hasn’t vanished — it’s just cooling off.

What Is — and Isn’t — a “Stimulus Payment”?

A common myth online is that this 2026 COLA is a special stimulus check. It’s not.

The truth:

- The increase is automatically applied to your monthly benefit — there’s no separate payment.

- This is not like the COVID-19 Economic Impact Payments.

- You don’t need to apply to receive it.

- It doesn’t reduce future benefits.

Many social media posts and YouTube videos have spread confusing language, calling it a “$2,000 check” or “stimulus payment” — that’s just clickbait.

Common Mistakes People Make After COLA Updates

Even seasoned retirees overlook a few key things every year when COLA season hits. Avoid these common mistakes:

- Not Checking Your Net Increase:

Your gross increase isn’t what lands in your bank account — be sure to factor in tax withholding and Medicare deductions. - Not Updating Your Budget:

Even a $30/month bump can change what you can afford — but only if you track it. - Ignoring Tax Changes:

If you collect Social Security and have other income (like retirement accounts or part-time work), you may face new tax liabilities in 2026. - Forgetting to Check Spousal or Survivor Benefits:

If your spouse passed away, you may be eligible for survivor benefits — and those received the COLA too.

How COLA Affects Your Long-Term Retirement Planning?

While a 2.8% boost is helpful, it’s not a guaranteed safety net against inflation over decades. That’s why retirement experts advise:

- Building diversified retirement income — such as 401(k)s, IRAs, and annuities

- Using Social Security as a foundation, not your entire income plan

- Delaying Social Security claims when possible — claiming at 70 gives you the maximum monthly benefit, often 30%–75% higher than claiming at 62

- Factoring in Medicare premium growth, which typically outpaces COLA

According to the Center on Budget and Policy Priorities, Social Security provides over 90% of income for one-third of elderly beneficiaries — meaning COLA adjustments are a lifeline, not a luxury.

Is Social Security Still Financially Secure?

With headlines constantly questioning the future of Social Security, it’s fair to ask: Will these COLA increases keep coming?

Here’s what we know:

- As of the latest SSA Trustees Report, full funding is expected through 2033

- After 2033, scheduled benefits would be reduced by ~20% unless Congress acts

- Most experts expect lawmakers to adjust taxes, retirement age, or benefit formulas before major cuts occur

Bottom line: Social Security is not “going broke,” but younger workers may see changes down the line.

Tips to Make the Most of First Social Security Stimulus Payment

Even if your increase is modest, a few savvy strategies can help you stretch every dollar:

- Set aside 10% of your COLA increase in savings for emergencies

- Use the bump to pay off small debts or cover prescription costs

- Review your Medigap or Medicare Advantage Plan — premiums may have shifted

- Consider using your increase to cover dental, vision, or hearing care — which traditional Medicare doesn’t cover

Every year’s COLA can be a chance to adjust and optimize your spending.

Social Security 2026 Changes – What the New Maximum Benefit Looks Like Under Updated Rules

Social Security Benefit Boost 2026 – 3 Simple Moves That Can Increase Your Monthly Check