$5251 Social Security Payment: The $5,251 Social Security payment in 2026 is one of the biggest updates to the Social Security program in recent years, and it’s turning heads across the country — from retirees and working professionals to financial planners and policy makers. Whether you’re years from retirement or ready to claim your first check, it’s essential to understand how this amount came to be, who qualifies, and what steps you can take to maximize your Social Security benefits. In this in-depth guide, we’ll break down everything you need to know: the maximum monthly benefit, the Cost-of-Living Adjustment (COLA), how benefits are calculated, and when payments are distributed. We’ll also include real-life examples, frequently asked questions, and expert tips to help you make the most of your benefits.

Table of Contents

$5251 Social Security Payment

The $5,251 Social Security benefit in 2026 represents a milestone in retirement income — but it’s more of a ceiling than a floor. Understanding the rules, calculations, and payment structure is the key to getting the most out of Social Security. Whether you’re a young worker planning ahead, a retiree adjusting to new payments, or a financial advisor helping clients, the Social Security landscape in 2026 offers both opportunities and challenges.

| Topic | 2026 Figures & Facts |

|---|---|

| Max Monthly Benefit (at age 70) | Up to $5,251 |

| Average Monthly Benefit | $2,071 |

| Cost-of-Living Adjustment (COLA) | 2.8% increase |

| Maximum Taxable Earnings | $184,500 |

| SSI Maximum for Individuals | $994 |

| Retirement Claiming Age Range | 62–70 |

| Payment Schedule | Based on birth date (Wed. cycle) |

| Official Source | ssa.gov |

What’s New in Social Security for 2026?

Every year, the Social Security Administration (SSA) adjusts benefits to keep pace with inflation. This is called the Cost-of-Living Adjustment, or COLA. For 2026, beneficiaries will see a 2.8% COLA increase. This is a response to rising consumer prices — like gas, groceries, and health care — that affect fixed-income seniors and disabled individuals the most.

As a result of the COLA, the maximum possible benefit at age 70 has increased to $5,251 per month, a record high.

But here’s the truth: most people won’t receive that much. The average Social Security retirement check in 2026 is expected to be around $2,071, which still represents a healthy increase from 2025’s average of $2,015.

These changes are not just numbers on paper. For millions of Americans, these adjustments help maintain dignity, independence, and financial security.

How to Qualify for the $5251 Social Security Payment?

To receive the full $5,251/month in 2026, you must meet all of the following criteria:

- Work for at least 35 years — Social Security calculates benefits based on your highest 35 years of earnings.

- Earn the maximum taxable income every year — For 2026, that threshold is $184,500. That’s the most income subject to Social Security tax.

- Wait until age 70 to claim benefits — This is key. For each year you delay after your full retirement age (FRA), your benefit increases by up to 8% per year.

Very few people hit all three of these milestones. According to SSA data, fewer than 10% of retirees qualify for the max payout.

Example:

Maria worked for 40 years in a high-paying medical profession. She earned at or above the taxable maximum most years and waited until her 70th birthday to claim. She qualifies for the full $5,251 in 2026.

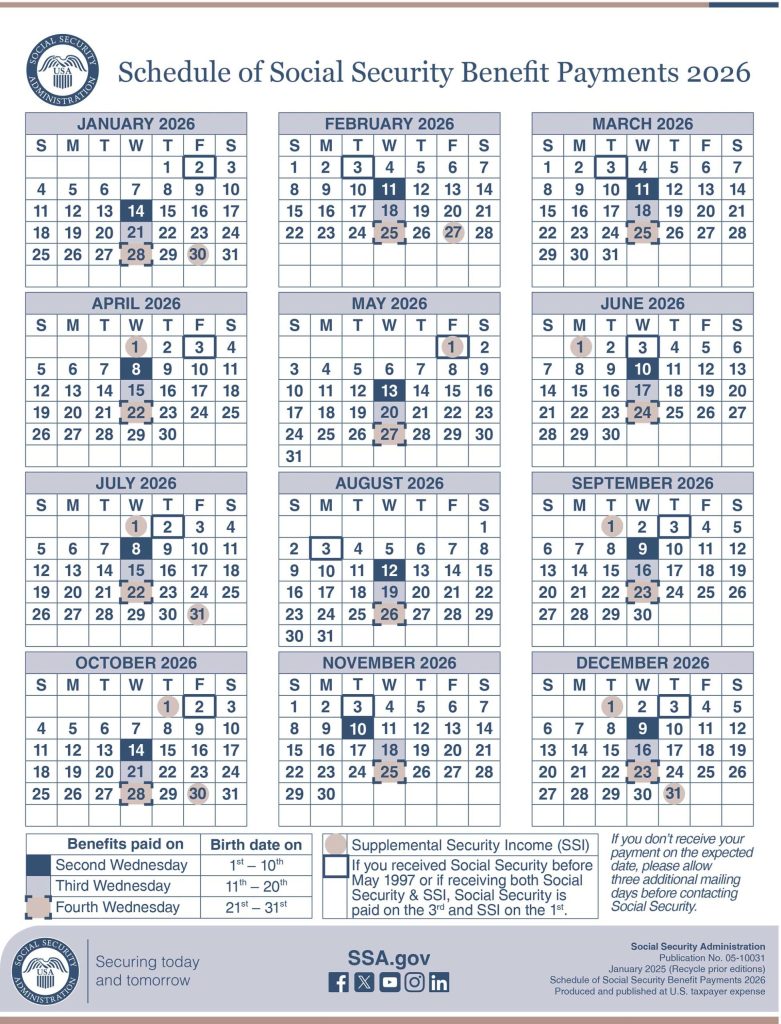

2026 Payment Schedule: When Do You Get Paid?

Social Security checks are issued based on your birth date. Here’s how the payment calendar works:

| Birth Date Range | 2026 Payment Day |

|---|---|

| 1st–10th | Second Wednesday of the month |

| 11th–20th | Third Wednesday |

| 21st–31st | Fourth Wednesday |

This rolling schedule helps reduce delays and banking congestion.

For January 2026, payment dates would be:

- January 14 for birthdays on the 1st–10th

- January 21 for 11th–20th

- January 28 for 21st–31st

If you receive Supplemental Security Income (SSI) or started receiving benefits before May 1997, you’ll usually be paid on the 1st of the month.

Direct deposit is the preferred method by SSA, ensuring faster, more secure payments.

A Closer Look: Average Social Security Benefits in 2026

Not everyone will receive the max. Here’s what the average monthly benefits look like for various groups in 2026:

| Beneficiary Group | Average Monthly Benefit |

|---|---|

| Retired Worker | $2,071 |

| Retired Couple (both receiving) | $3,208 |

| Disabled Worker | $1,630 |

| Widowed Mother + 2 Children | $3,654 |

| SSI Individual Max | $994 |

| SSI Couple Max | $1,491 |

These increases are automatically applied to all recipients, and they help combat the rising costs of essentials like rent, prescriptions, and transportation.

How Social Security Benefits Are Calculated?

Many people don’t realize that when you claim and how much you earned are two of the biggest factors in how much you receive.

Here’s a simplified step-by-step overview:

- SSA indexes your past earnings to adjust for inflation.

- It calculates your Average Indexed Monthly Earnings (AIME) based on your 35 highest-earning years.

- The SSA applies a formula with “bend points” to determine your Primary Insurance Amount (PIA) — your benefit at full retirement age.

- If you claim early (as early as 62), your benefit is reduced.

- If you delay (up to age 70), your benefit is increased via Delayed Retirement Credits.

The system is progressive — meaning lower-income workers replace a higher portion of their pre-retirement income.

Claiming early can cut your monthly payment by as much as 30%.

Delaying to 70 can increase it by as much as 32%.

Tax Implications: Will You Owe Taxes on Your Benefits?

Yes, in some cases. Social Security benefits may be taxable, depending on your total income.

Here’s how it works:

- If you file as a single and have combined income over $25,000, up to 50–85% of your benefits may be taxed.

- For married couples filing jointly, the threshold is $32,000.

Combined income = Adjusted gross income + Nontaxable interest + ½ of your Social Security benefits

While your benefits aren’t taxed at 100%, this is still something to plan for — especially if you have retirement account withdrawals or part-time income.

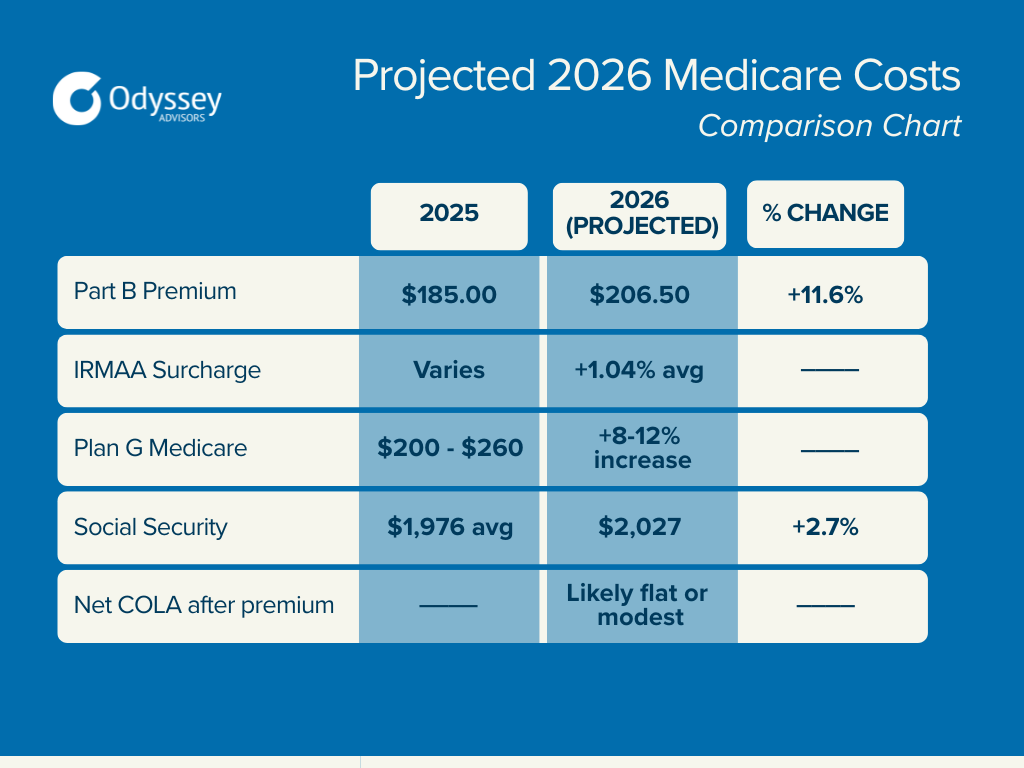

Medicare Deductions: Watch Out for Net Benefit Reductions

If you’re enrolled in Medicare Part B, the premium is automatically deducted from your Social Security benefit.

In 2026, the standard Part B premium is projected to be around $185/month (subject to confirmation by CMS).

This means if your gross benefit is $2,071/month, your net deposit after Medicare might be closer to $1,886.

Also, if you have higher income, you may be subject to Income-Related Monthly Adjustment Amounts (IRMAA), which can significantly increase your premium.

Long-Term Planning Tips to Maximize Your Benefits

Whether you’re 25 or 65, there are things you can do now to boost your Social Security payout in the future.

- Work at least 35 years — More years = more money.

- Delay claiming if possible — Every year past FRA earns you more.

- Track your earnings — Use the my Social Security portal to verify your record.

- Minimize zero-income years — A single year of no income can lower your benefit average.

- Stay below tax thresholds — Strategically manage withdrawals to reduce taxation on your benefits.

Real-Life Case Studies

Case 1 – Early Claiming:

Jerry retired at 62 after a career in retail. His monthly benefit in 2026 is about $1,450 — reduced for early claiming.

Case 2 – Full Retirement Age:

Lisa and David, both teachers, claimed benefits at age 66 and 67. Their combined monthly payout is $3,300.

Case 3 – Delayed Claiming:

Charles worked as an engineer and waited until age 70. He earned maximum taxable wages for years and now collects the full $5,251/month in 2026.

These examples highlight how retirement timing and earnings history shape your future income.

Average Social Security Benefit for Retirees 2026 – What Monthly Payments May Look Like

Social Security 2026 Changes – What the New Maximum Benefit Looks Like Under Updated Rules

Social Security $1,850 Monthly Check – How the 2026 Update Changes This Benefit Amount