Medicare Open Enrollment: If you or a loved one is on Medicare, then Medicare Open Enrollment 2026–27 is one of the most important times of the year. It’s more than just updating insurance — it’s about making sure your healthcare coverage actually meets your needs and doesn’t cost you more than it should. Whether you’re navigating it for yourself, helping out a parent or grandparent, or advising clients professionally, this guide will walk you through everything you need to know, in everyday language with expert-level clarity. This annual event is your opportunity to review, compare, and switch Medicare health and drug plans for coverage that begins on January 1, 2026. Even if you’re happy with your current plan, it’s smart to double-check what’s changing — because plans, premiums, provider networks, and drug formularies can shift from year to year.

Table of Contents

Medicare Open Enrollment

Medicare Open Enrollment 2026–27 is your once-a-year opportunity to get the healthcare you need — at a cost that works for your budget. With changes to premiums, drug cost caps, and shifting plan offerings, this year is especially important for staying informed. Whether you’re looking to save money, keep your doctor, or get better coverage, the tools are out there. All it takes is a bit of review, comparison, and action.

| Topic | Details for 2026–27 |

|---|---|

| Open Enrollment Dates | October 15 – December 7, 2025 |

| Coverage Effective Date | January 1, 2026 |

| Medicare Advantage OEP | January 1 – March 31, 2026 |

| Standard Part B Premium | $202.90/month (2026) |

| Part B Deductible | $283/year (2026) |

| Part D Out-of-Pocket Cap | $2,100/year max drug costs |

| Drug Plan Availability | Shrinking in some areas; average 8–12 choices per region |

| MA Plan Average Premium | Projected at ~$14/month (down from 2025) |

What Is Medicare Open Enrollment?

Every year, Medicare offers a chance for people to re-evaluate their health and drug plans during a window called the Annual Enrollment Period (AEP). It runs from October 15 to December 7 each year, and any changes you make during this time will go into effect on January 1 of the following year.

During this period, you can:

- Switch from Original Medicare to a Medicare Advantage Plan

- Switch from one Medicare Advantage Plan to another

- Drop Medicare Advantage and return to Original Medicare

- Join, drop, or switch a Medicare Part D drug plan

If you don’t take action, your current plan will usually auto-renew — but this could mean higher premiums or fewer benefits than you realize. That’s why it’s worth taking time to compare.

What’s New for Medicare Open Enrollment 2026-27?

1. Drug Cost Caps Under the Inflation Reduction Act

In 2026, Medicare will begin implementing one of the biggest changes in decades: a $2,100 annual cap on out-of-pocket prescription drug costs for those enrolled in Part D. This is part of the Inflation Reduction Act of 2022, which aims to make medications more affordable for seniors and people with disabilities.

This means:

- No more donut hole surprise costs

- No more paying thousands for high-cost specialty drugs

- Predictable budgeting for people with chronic conditions

While the cap won’t cover every out-of-pocket cost, it will greatly ease the burden on those who rely on long-term prescriptions like insulin, inhalers, or cancer drugs.

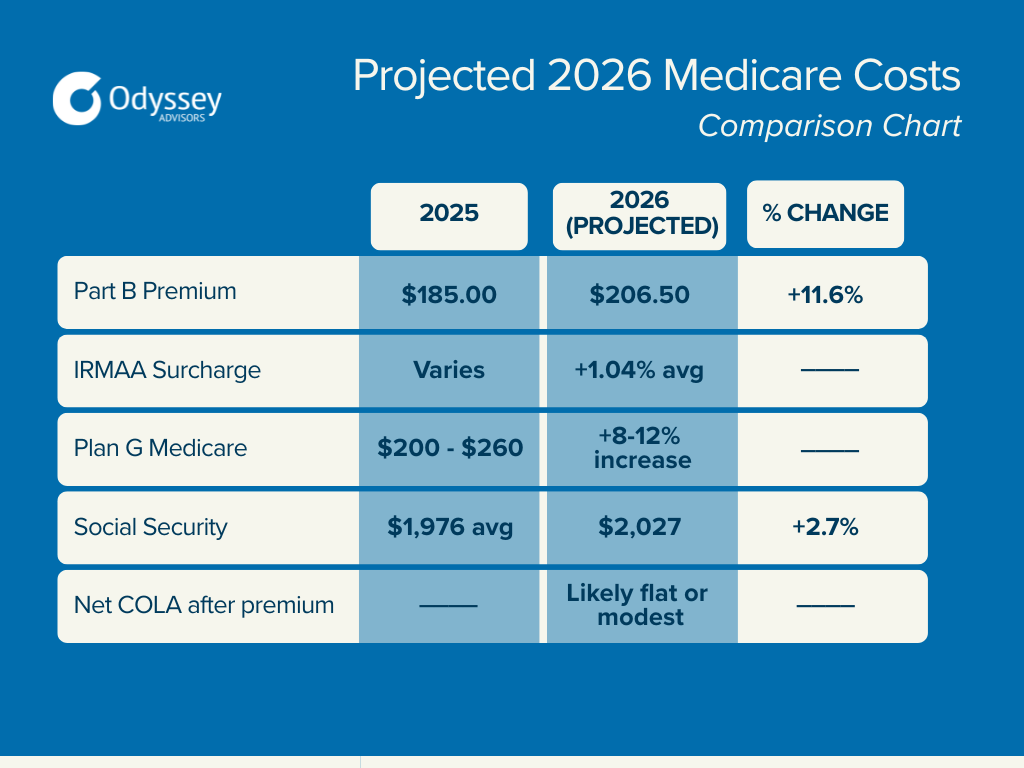

2. Part B Premium and Deductible Increases

The monthly Part B premium is expected to rise to $202.90 for 2026, up from $185 in 2025. The Part B deductible will also increase to $283, meaning you’ll pay more upfront before Medicare starts covering services like doctor visits, outpatient care, and preventive screenings.

These increases are driven by rising healthcare spending and reflect the general inflation across the healthcare industry. Beneficiaries with higher incomes will also face increased IRMAA surcharges, so make sure to check your 2024 or 2025 tax return to estimate costs.

3. Narrowing Drug Plan Options

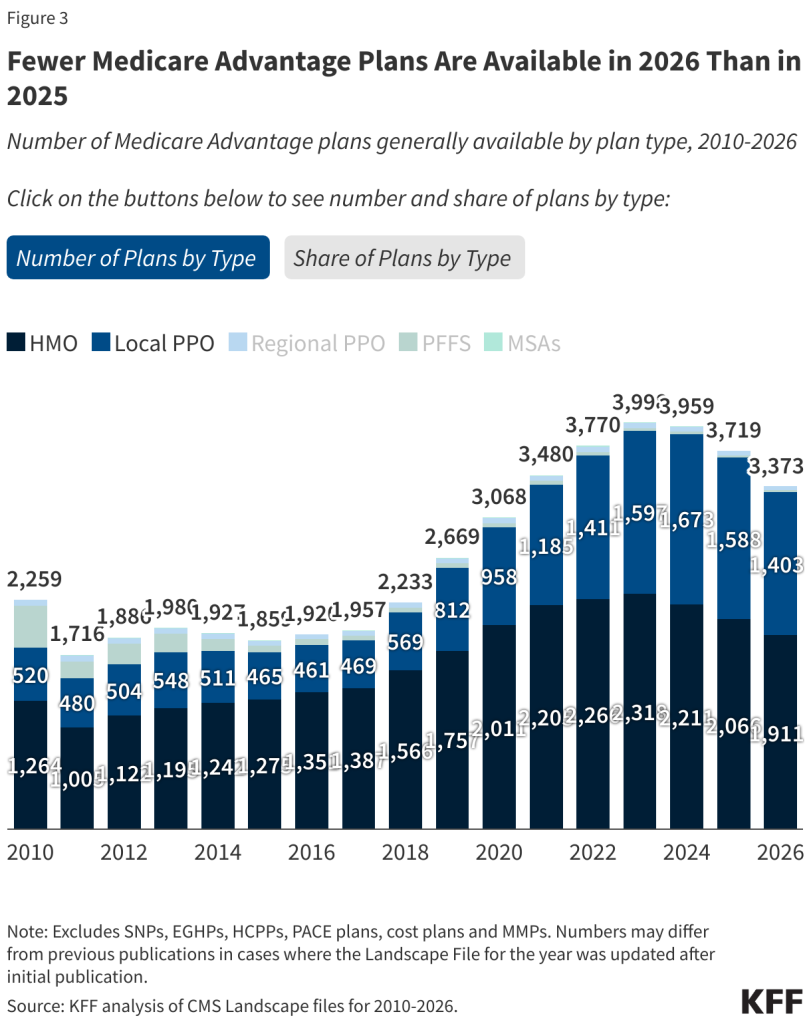

As more insurers consolidate their offerings, standalone Medicare Part D plans are becoming fewer. Many regions will see only 8 to 12 plans available, compared to 15–20 just a few years ago.

This means:

- Less competition between drug plans

- Potential changes in formulary (which drugs are covered)

- The importance of checking if your pharmacy is in-network

Even if your premium stays the same, your medication list might not — so it’s critical to check your Annual Notice of Change (ANOC).

4. Extra Benefits Are Shifting

Medicare Advantage Plans often offer perks beyond what Original Medicare provides — like vision, dental, transportation, and over-the-counter (OTC) benefits. But for 2026, some of these extras are being reduced in value, or are now offered only on specific plans.

Expect:

- Fewer plans offering meal delivery or transportation

- Changes to vision and hearing aid benefits

- Reduced dental coverage caps in some MA plans

This reinforces why it’s smart to compare even if you’ve been loyal to a specific MA provider for years.

How to Make the Most of Medicare Open Enrollment?

Here’s a step-by-step guide to make this process painless and powerful:

Step 1: Review Your Current Coverage

Start with the ANOC your plan mails you every September. It explains:

- Any changes to your premium

- New co-pays or cost-sharing

- Changes in provider networks or drug coverage

This is your heads-up alert — don’t skip it.

Step 2: Make a List of Your Healthcare Needs

Write down:

- The doctors you regularly see

- All prescriptions (include dosage and frequency)

- Preferred pharmacy

- Frequency of specialist visits, dental care, or durable medical equipment

This info will help you compare real-world costs, not just shiny ads or TV offers.

Step 3: Use the Medicare Plan Finder Tool

Go to Medicare.gov/plan-compare to:

- View plans in your ZIP code

- Compare based on cost, drug coverage, and quality

- Filter by plans that cover your doctors and prescriptions

This tool is updated every fall with the latest plan data for the upcoming year.

Step 4: Don’t Be Fooled by “$0 Premium” Plans

Some Medicare Advantage plans boast zero monthly premiums, but this doesn’t mean they’re free. These plans may:

- Have higher co-pays for office visits or ER

- Limit hospital networks or specialists

- Not include your preferred pharmacy or drug list

Compare the total cost of care — premiums, co-pays, and drug costs — not just the sticker price.

Step 5: Check Plan Ratings and Customer Reviews

Medicare assigns star ratings (1–5 stars) to each plan based on:

- Customer service

- Member satisfaction

- Management of chronic conditions

Plans with 4 or more stars are considered high-performing.

Real-Life Example: Meet Harold and Betty

Harold and Betty live in Oklahoma and both take multiple medications. Last year, they didn’t switch plans — but their 2025 premiums jumped by $40/month. For 2026, they used Medicare.gov’s tool and found a new plan with:

- $0 premium

- Better prescription coverage

- $300/year savings overall

Their total effort? One hour online and a quick phone call.

Additional Tips for Professionals and Caregivers

If you’re helping someone with Medicare — as a family member, caregiver, or benefits advisor — here are extra pointers:

- Attend a local SHIP counseling session for unbiased advice (Find yours here)

- Keep all Medicare letters and notices organized by date

- Set a calendar reminder for October 1 (when plan data goes live) and another for December 1 (your last chance to enroll or switch)

- Watch for Medicare scam calls; real Medicare never asks for personal info via phone unless you call them first.

Medicare Update 2026: Some Prescription Drug Costs Expected to Drop by Half

Social Security and Medicare 2026 – What Retirees and Savers Should Prepare for Now

It’s Official: Medicare Will Cover Telehealth Through January 2026 Amid Federal Shutdown Fallout