$4983 Direct Deposit 2026: If you’ve come across viral posts claiming the IRS or Social Security Administration is sending $4,983 direct deposit payments to everyone in 2026, you’re not alone. Social media, clickbait blogs, and shady emails are circulating this number like it’s the next big stimulus check. Let’s set the record straight — with real facts, clear explanations, and a deep dive into how Social Security works, who really gets $4,983 (if anyone), and how you can find out what you’re truly eligible for.

Table of Contents

$4983 Direct Deposit 2026

The $4,983 direct deposit for everyone in 2026 is a misleading rumor, not an official government program. The truth? Only a small number of retirees receive benefits close to that amount, and it’s the result of decades of work, high earnings, and delayed retirement. Millions of Americans will see Social Security payments adjusted for inflation in 2026, thanks to the 2.8% COLA. But no “universal payout” is coming. Check your personal benefits, and don’t fall for online gimmicks. Your financial future is too important to trust to rumors.

| Topic | Verified Information |

|---|---|

| $4,983 Payment Rumor | No official stimulus; based on high-end Social Security benefits |

| Social Security COLA 2026 | 2.8% cost-of-living increase |

| Max Monthly Benefit (Age 70) | ~$5,251 (with high earnings history) |

| Average Monthly Retirement Benefit | ~$2,071 |

| Federal Stimulus in 2026 | None announced or planned |

| Source for Benefits | U.S. Social Security Administration – www.ssa.gov |

What’s the Real Deal Behind the $4983 Direct Deposit 2026?

To be clear from the get-go:

There is no federal program that gives $4,983 to every American in 2026.

No new law has passed. No new IRS stimulus program has been announced. There is no nationwide $4,983 direct deposit for all U.S. citizens.

This number is being misused online. In reality, $4,983 is a rough estimate of what a few Social Security recipients — those who qualify for the maximum retirement benefit — might receive per month in 2026.

That’s right. It’s a monthly Social Security benefit — not a one-time, across-the-board check.

And here’s the kicker: very few people qualify for that amount. Let’s break down how that number came to be, and what you can realistically expect in 2026.

Why Are People Talking About $4983 Direct Deposit 2026?

Online content often focuses on headlines that get attention, and nothing grabs eyeballs like the promise of “free money.” The $4,983 number likely comes from:

- Social Security maximum monthly benefits estimated for high earners who delay benefits until age 70.

- Some sources rounding this down from updated projections of up to $5,251/month.

- Misinterpretation or clickbait-style presentation of standard Social Security updates.

This is not new. Similar misinformation circulated around “$1,400 stimulus checks” long after those payments ended. The difference here? $4,983 isn’t a special one-time relief. It’s tied to a lifetime of work, high earnings, and delayed retirement.

What Is the Maximum Social Security Benefit in 2026?

Let’s get into the numbers. According to the Social Security Administration, in 2026:

- The maximum monthly Social Security retirement benefit is expected to be around $5,251, depending on final inflation adjustments.

- To qualify, you must:

- Have earned the maximum taxable income (which was $160,200 in 2023) for at least 35 years.

- Delay claiming benefits until age 70.

In some projections, adjusting for COLA and wage base increases, this could push slightly above $5,400 — but this is the ceiling. Most retirees receive much less.

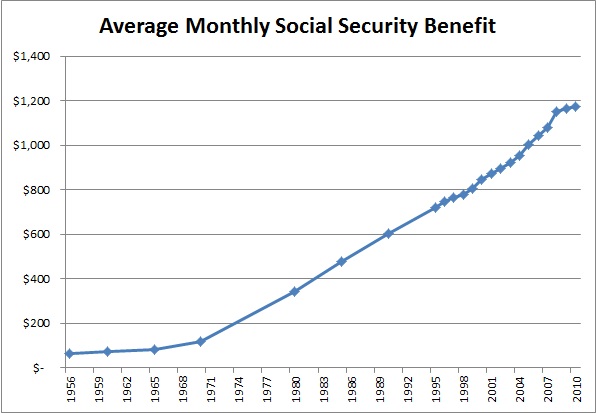

In fact, the average Social Security check in 2026 is projected at about $2,071/month. That’s less than half the rumored $4,983 figure.

How Social Security Benefits Are Actually Calculated?

Understanding Social Security is key to understanding this $4,983 claim. Social Security is a federal insurance program that provides retirement, disability, and survivor benefits based on:

- Your 35 highest-earning working years

- When you claim your benefits

- Whether you qualify through work credits

Here’s a step-by-step look:

Step 1: Work & Pay into Social Security

You earn one work credit for every $1,730 in wages (2024 figure). You can earn up to four credits per year. Most people need at least 40 credits (10 years) to qualify.

Step 2: Highest 35 Years of Earnings Count

The SSA uses your top 35 years of earnings (adjusted for inflation) to calculate your “Average Indexed Monthly Earnings” (AIME).

Step 3: Apply the Benefit Formula

Your AIME is applied to a progressive formula, replacing a percentage of your income. The more you earned, the more you may receive — but benefits cap out based on annual limits.

Step 4: Retirement Age Matters

The later you claim, the more you get:

- Age 62: Receive reduced benefits

- Full Retirement Age (FRA, 66-67): Get full standard benefit

- Age 70: Receive maximum delayed credits (up to 32% more)

So, unless you wait and earned at high levels consistently, you won’t hit that $4,983/month figure.

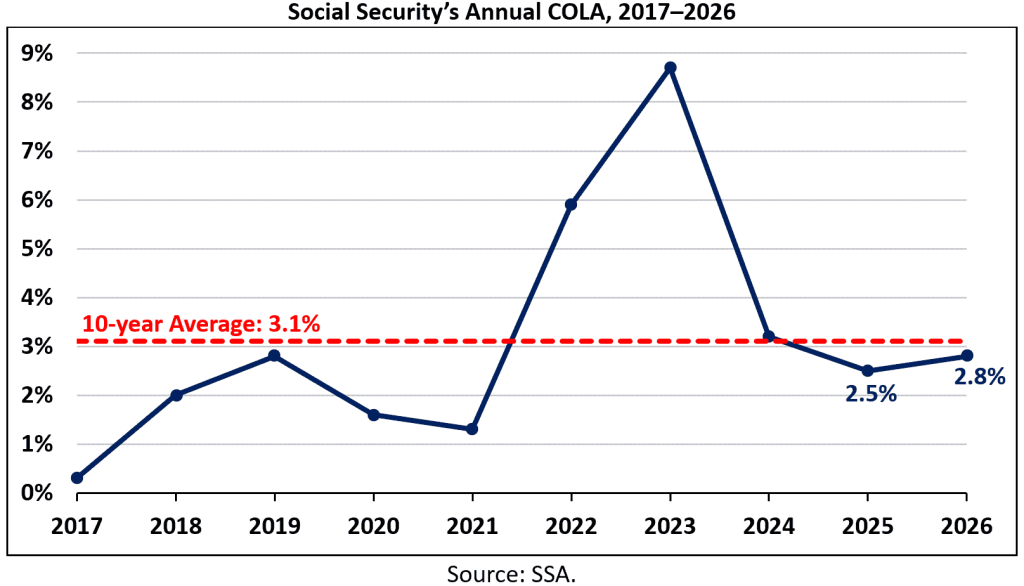

Cost-of-Living Adjustments (COLA) in 2026

Each year, the Social Security Administration adjusts benefits to account for inflation. This is called the COLA — Cost-of-Living Adjustment.

In 2026, the COLA is:

- 2.8% increase from 2025 levels

- Applied to all types of Social Security — retirement, disability, survivor, and SSI

For example:

- A retiree earning $2,000/month in 2025 would now receive $2,056 in 2026.

- Someone with a $4,983 benefit would see an increase of roughly $139/month (totaling ~$5,122/month).

COLAs are automatic and begin in January. No need to apply.

Why There’s No $4983 Direct Deposit 2026 from the IRS?

Let’s talk stimulus checks.

The last major round of IRS Economic Impact Payments (EIPs) — known as stimulus checks — were issued in 2020 and 2021 under pandemic relief laws. The IRS has clearly stated:

- There is no new stimulus check scheduled or authorized for 2025 or 2026.

- No legislation is pending in Congress for a new round of EIPs.

- The deadline to claim missed stimulus payments for 2020 and 2021 was May 17, 2024, via tax filing.

If someone tells you “The IRS will direct deposit $4,983 to everyone” — it’s either misinformation or a scam.

Watch Out for Scams

Scammers are crafty. They often mimic real announcements to trick people into:

- Clicking phishing links

- Sharing personal or banking information

- Paying to “claim” non-existent benefits

The IRS and SSA do not email, text, or DM you about direct deposits. Real notices come by U.S. mail or via official portals (like your SSA account).

If it sounds too good to be true, it probably is.

How to Check Your Real Benefits?

Want to know what you might receive in 2026?

Follow these simple steps:

Step 1: Create a mySocialSecurity Account

- Visit www.ssa.gov/myaccount

- Securely log in or sign up

- Verify your identity with your SSN and email

Step 2: View Your Personal Statement

- See your lifetime earnings

- Check how much you’ll get at age 62, FRA, or 70

- Track your yearly contributions

Step 3: Use SSA Calculators

- Explore the Retirement Estimator

- Plug in projected income and claiming age

- Get personalized estimates

This gives you a real picture — not fake news from the internet.

How to Increase Your Social Security Benefit?

Want a higher benefit check? Here’s how:

- Work at least 35 years

The SSA averages your highest 35 years — fewer years = lower average. - Earn more (above inflation)

Boost your income over time, especially early in your career. - Wait until age 70

You’ll earn delayed retirement credits — up to 8% per year beyond FRA. - Avoid early filing (age 62)

You could lose up to 30% of your full benefit if you claim early. - Coordinate with a spouse

You may qualify for spousal or survivor benefits, depending on the situation.

Social Security Abroad Rules – Countries Where Payments Are Restricted in 2026

Social Security Benefit Notices 2026 – What Changes to Expect in Your Letter Next Year