America’s New Energy Bill Credits: If you’ve been wondering, “Can I still get federal energy tax credits in 2026?”, you’re not alone. After a flurry of changes from the Inflation Reduction Act (IRA) to the newly enacted One Big Beautiful Bill Act (OBBBA) in mid-2025, Americans are facing a brand-new energy credit landscape—and it’s a bit tricky to navigate. Here’s the straight truth: while many popular energy credits expired at the end of 2025, a few valuable options are still available in 2026. This article gives you a clear, detailed, and easy-to-understand breakdown of what you can still claim, who qualifies, how to file, and where to find additional help.

Table of Contents

America’s New Energy Bill Credits

While the golden era of massive residential energy credits may be behind us, 2026 still offers smart opportunities—especially if you:

- Installed energy-efficient systems in 2025

- Are building new energy-efficient homes

- Are upgrading commercial buildings

- Install an EV charger before July 2026

Don’t leave money on the table. Track down your paperwork, consult a tax professional, and file the right forms. Even if the federal credits are narrower than before, there’s still value to be had. And remember: your state or utility company might still offer benefits the feds don’t.

| Feature | Details |

|---|---|

| Federal Credits Still Available | EV Charger Credit (through June 30, 2026), Section 45L for new home builders, 179D deduction for commercial buildings |

| Expired Credits | Solar (30%), windows, insulation, heat pumps, new EV tax credits (all ended in 2025) |

| Average Tax Savings | $2,500–$5,000 depending on system and eligibility |

| Claim Process | Use IRS Forms 5695, 8911, 8908, or 7205 depending on credit |

| Installation Deadlines | Most credits apply only to work completed by Dec 31, 2025, except EV chargers and builder/commercial credits |

| More Info | irs.gov |

What Are Energy Bill Credits?

Energy tax credits are incentives that allow homeowners, builders, and businesses to save money on federal taxes when they make qualified energy-efficient improvements or purchases.

Unlike a deduction (which lowers your taxable income), a tax credit directly reduces the amount of taxes you owe. So if your tax bill is $3,000 and you earn a $1,000 energy tax credit, you only owe $2,000.

These credits have helped millions of Americans:

- Invest in clean energy like solar and geothermal

- Make their homes more energy efficient

- Offset the costs of electric vehicles and chargers

In short, they reward people for making choices that benefit the environment and reduce long-term energy costs.

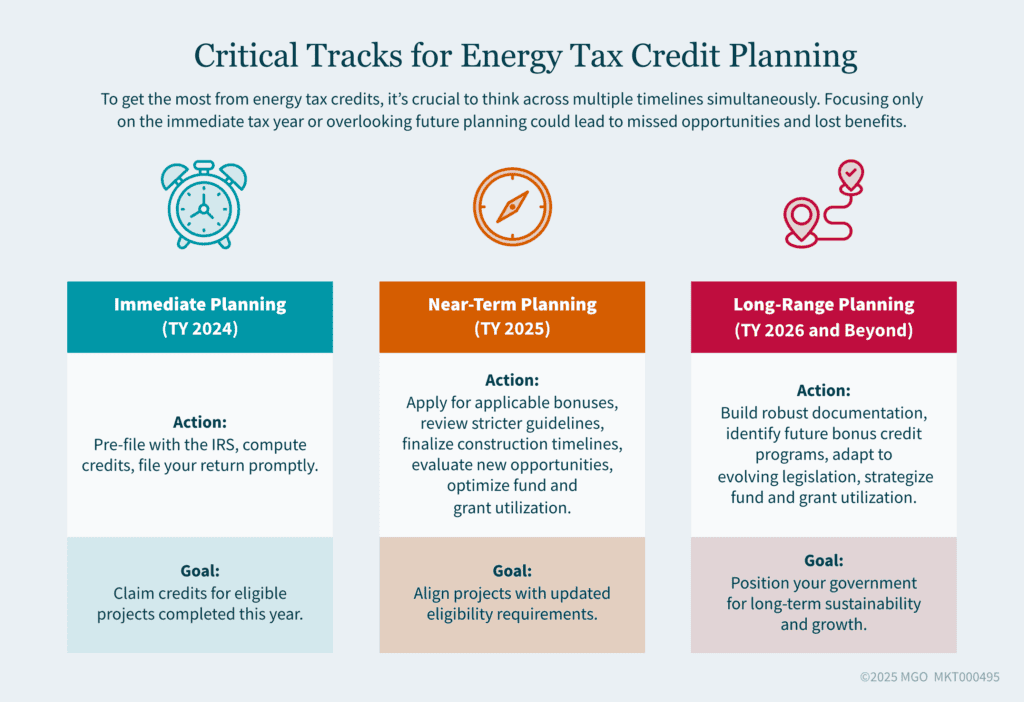

Why 2026 Looks Different: The One Big Beautiful Bill Act

In July 2025, Congress passed the One Big Beautiful Bill Act (OBBBA)—a sweeping tax reform law that revised, replaced, and in many cases, ended previous energy-related incentives.

Here’s what it did:

- Sunset major residential energy credits (like solar, heat pumps, windows) on December 31, 2025.

- Phased out new EV purchase tax credits for vehicles acquired after September 30, 2025.

- Extended only a few credits, notably for EV chargers and builder/commercial projects.

If your energy upgrade was installed and operational before those cutoff dates, you can still claim the credit on your 2025 tax return filed in 2026.

What America’s New Energy Bill Credits Can You Still Claim in 2026?

Even though most federal homeowner credits expired at the end of 2025, there are still three key credits that remain in effect in 2026:

1. EV Charger Credit (Form 8911)

- What it covers: 30% of the cost of purchasing and installing an EV charger at your home or business

- Max value: Up to $1,000 for residential installations

- Deadline: Charger must be placed in service by June 30, 2026

Example: If you spend $800 on an EV charger and $200 on installation (total $1,000), you could receive a $300 tax credit (30%).

Note: Only certain chargers and locations qualify.

2. Section 45L New Energy Efficient Home Credit (Form 8908)

- Who qualifies: Homebuilders and developers who construct new energy-efficient homes

- Credit value: $2,500–$5,000 per qualifying home

- Deadline: Home must be sold or leased before June 30, 2026

This credit helps incentivize green construction, encouraging the use of higher insulation standards, ENERGY STAR appliances, and advanced HVAC systems.

3. Section 179D Commercial Building Deduction (Form 7205)

- Applies to: Commercial building owners and designers of government-owned buildings

- Credit value: Up to $5.00 per square foot

The 179D deduction can cover improvements to lighting, HVAC, building envelope, and other energy systems. This deduction is especially valuable to architects, engineers, and design firms.

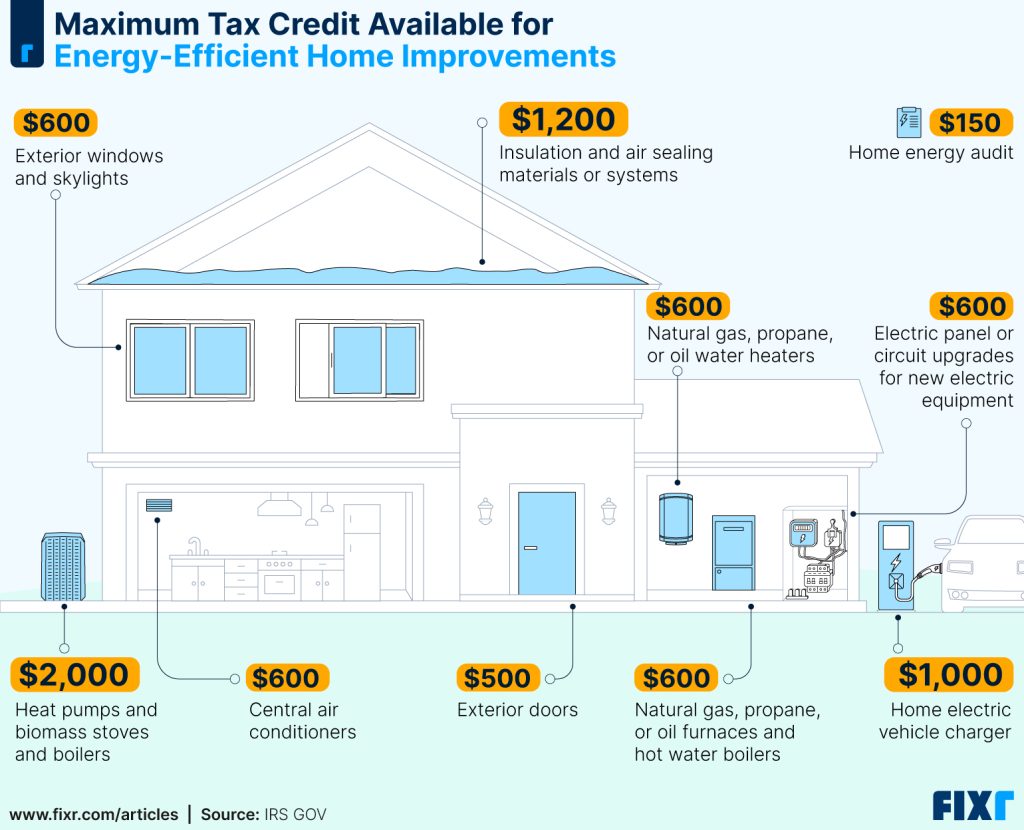

Credits You Can’t Claim for 2026 Installs

If you’re planning home upgrades this year, know that the following no longer apply for 2026 installs:

- Residential Solar Energy Credit (30%)

- Heat Pump Credit

- Insulation, Doors, Windows

- Energy Audit Credit

- New Clean Vehicle Credit

These all expired at the end of 2025. If your system was not fully installed and in service by December 31, 2025, you unfortunately cannot claim them on your 2026 taxes.

State and Local Incentives Still Available

Don’t give up just yet. While federal programs may be limited, many states and utility companies still offer powerful incentives.

These may include:

- Cash rebates for energy-efficient appliances

- State income tax credits for solar or wind systems

- Grants and loans for low-income weatherization

- Time-of-use billing incentives for EV charging

Some utility providers also offer zero-interest financing or rebates—worth checking your electric or gas company’s website.

Energy Audits: Still Worth It?

Yes—even though the federal tax credit for energy audits has ended, getting an audit done can:

- Reveal hidden energy leaks

- Identify your home’s most cost-effective upgrades

- Help qualify for local incentives or rebates

How to Claim America’s New Energy Bill Credits?

Step 1: Confirm Eligibility

Was the system installed and in service by the required deadline?

Step 2: Gather Documentation

- Receipts and invoices

- Certification labels (e.g., ENERGY STAR)

- Installation date records

- Contractor license info

Step 3: Choose the Correct IRS Form

| Credit Type | IRS Form |

|---|---|

| Home Energy (2025 installs) | Form 5695 |

| EV Chargers | Form 8911 |

| Builder Energy Efficient Home | Form 8908 |

| Commercial Building Deduction | Form 7205 |

Step 4: File With Your 2025 Return

Most of these credits apply to 2025 actions, so they are claimed on the return you file in early 2026.

Real-Life Example: Tax Credit in Action

Let’s say the Gomez family in Arizona completed these in 2025:

- Installed solar panels: $20,000

- Added attic insulation: $2,000

- Installed an EV charger in March 2026: $1,000

Their estimated credits:

- Solar credit: $6,000 (30%)

- Insulation: $600 (30%)

- EV charger (2026): $300

Total savings: $6,900, all claimed on their 2025 return (filed in 2026), with the EV charger on Form 8911.

Which States Tax Social Security Benefits? Check the Full Map and What You Might Pay in 2026!

$4,983 Direct Payment Coming Soon — Eligibility and Full January 2026 Schedule Revealed

Social Security 2026 Changes – What the New Maximum Benefit Looks Like Under Updated Rules