$2,503 Stimulus Check Confirmed: You may have heard a buzz going around that the IRS is sending out a $2,503 stimulus check in January 2026. TikTok videos, YouTube thumbnails, and even some blogs are screaming it loud. But let’s pause for a reality check: Is this real or just another internet rumor? Spoiler alert — it’s a myth. There is currently no official federal stimulus payment of $2,503 approved or confirmed for January 2026. But don’t worry, this article is your no-nonsense guide to understanding where the rumor came from, what the actual facts are, and how you can still find real financial help if you need it. We’ll walk you through eligibility, scam prevention, and how to stay informed, while keeping it real and clear. If you’re hoping for another stimulus check or just want to make sense of the headlines, you’re in the right place.

Table of Contents

$2,503 Stimulus Check Confirmed

In short, the $2,503 stimulus check for January 2026 is not real — at least not today. It’s an internet rumor, not a verified government program. But that doesn’t mean there’s no help available. You can still file for past payments, explore state-specific aid, or tap into federal and nonprofit programs to ease the financial burden. The best thing you can do? Stay informed. Stay cautious. And stay proactive.

| Topic | Details |

|---|---|

| Claim | $2,503 stimulus check confirmed for January 2026 |

| Truth | No such payment confirmed by IRS or the U.S. Government |

| Source of Rumor | Viral social media posts, unverified news outlets |

| Last Federal Stimulus Check | 2021 American Rescue Plan – $1,400 per person |

| Current IRS Updates? | No official mention of a $2,503 check as of January 2026 |

| Where to check official info | https://www.irs.gov |

| Recommended Action | Avoid scams, file taxes properly, check for real credits |

Where Did the $2,503 Stimulus Check Rumor Come From?

This rumor seems to be one of those classic internet whispers that snowballed into a full-blown belief. It started with vague references to:

- A supposed “tariff dividend” plan (not passed by Congress)

- Misunderstandings about the 2021 Recovery Rebate Credit

- Confusion over tax refund updates or Child Tax Credit programs

- Fake screenshots or AI-generated videos mimicking IRS announcements

Let’s be clear: there has been no legislation, no IRS announcement, and no official proposal tied to a $2,503 stimulus check from the federal government in 2026.

A lot of this confusion comes from recycled posts and blogs that blend real past programs with fictional updates, often using clickbait phrases like “just confirmed” or “you may be eligible.”

What Are Real Stimulus Payments That Have Happened?

To put things in perspective, here’s a breakdown of the actual stimulus checks the government has issued in recent years:

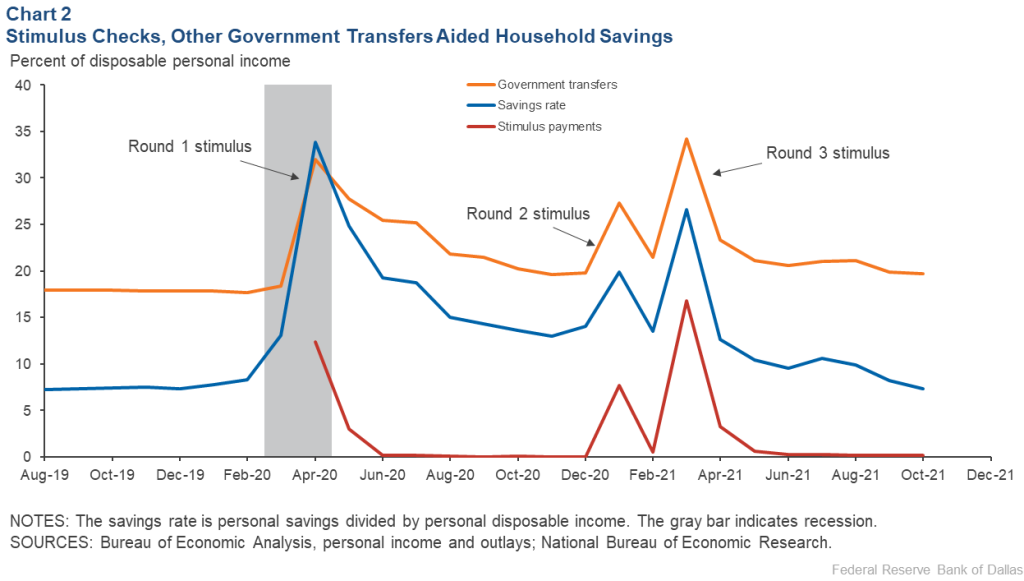

March 2020 – CARES Act

- $1,200 per adult + $500 per child

- First major COVID relief stimulus

December 2020 – Coronavirus Response and Relief Act

- $600 per person

- Automatically deposited to eligible taxpayers

March 2021 – American Rescue Plan

- $1,400 per person

- Included dependents of all ages

- Many still confuse this with current-year stimulus

2021–2022 – Child Tax Credit Advance

- Up to $3,600 per child (spread over monthly checks and tax credit)

- Not a stimulus check, but many referred to it as one

These were real payments. The $2,503 figure? It doesn’t appear in any government stimulus record or current IRS document.

The Problem with $2,503 Stimulus Check Scams

Whenever the economy gets tough, the internet gets louder with “news” of quick cash. Unfortunately, scammers know that folks are searching for help and they take advantage.

Common scams to watch for:

- Fake emails pretending to be the IRS asking for personal info

- Phishing texts that link to a “stimulus portal”

- Facebook pages promoting “early access” to payments

- Websites that promise “guaranteed approval” for a fee

Always remember: The IRS will never ask for your Social Security Number or banking details via email, text, or phone call.

Can You Still Claim Missed $2,503 Stimulus Check?

Yes — and this is where some confusion about current checks might come from.

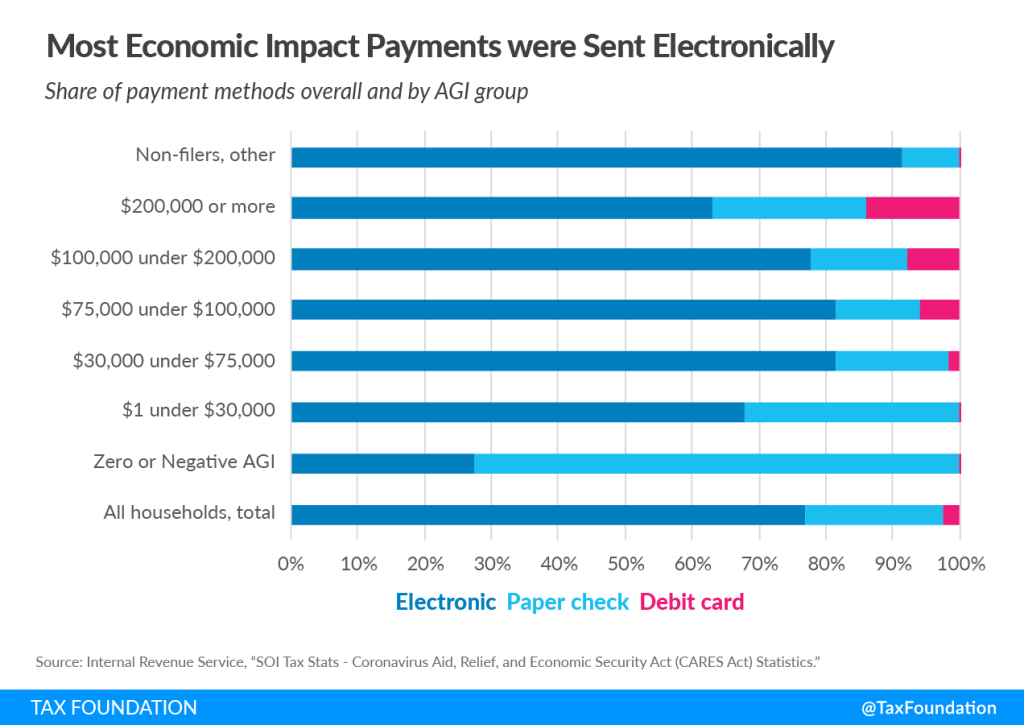

If you missed or didn’t receive one or more of the past Economic Impact Payments (aka stimulus checks), you might still be able to get it by claiming the Recovery Rebate Credit when you file your tax return.

How to check:

- Create or log into your IRS online account

- Review your Economic Impact Payment history

- If anything’s missing, file the relevant tax year and claim the Recovery Rebate Credit

Even if you don’t normally file taxes (e.g., you’re on Social Security), you might still be eligible — and filing can help you claim credits.

Who Might Be Eligible for Future Stimulus Payments?

Let’s say a new economic relief program does pass in the future. Based on past stimulus bills, here’s who usually qualifies:

- U.S. citizens and resident aliens

- Adjusted Gross Income (AGI) under certain limits (usually $75,000 for individuals, $150,000 for joint filers)

- Not claimed as a dependent on someone else’s return

- Filed a recent tax return or received federal benefits (like SSI or SSDI)

These are historical criteria. Any new program may come with different rules, but this gives a ballpark idea of how it typically works.

What Can You Do Instead of Waiting for Stimulus?

Waiting for stimulus that may never arrive isn’t a plan. But here are real, effective ways to get help or reduce financial pressure:

1. File Your Taxes Smart

Even if you’re not required to file, doing so can unlock credits like:

- Earned Income Tax Credit (EITC) – up to $7,430 for low/moderate-income families

- Child Tax Credit – up to $2,000 per child

- Saver’s Credit – for those contributing to retirement while earning low income

2. Check for State Programs

Some states — like California, New Mexico, and Maine — have offered their own “inflation relief” or “gas rebate” checks recently.

Check your state revenue department website for updates.

3. Use Benefits.gov

This federal portal helps you find all public assistance you might qualify for, including:

- SNAP (food stamps)

- Medicaid

- Housing vouchers

- Unemployment insurance

Visit https://www.benefits.gov and answer a few questions to get matched.

4. Explore Nonprofit Aid

Organizations like United Way (211.org) and Feeding America offer support ranging from rent help to food banks.

SSDI Payments 2026 Increase – New 2.8% Boost Explained, Check Updated Monthly Amounts

$1130 Stimulus Checks in December 2025: Check Payment Dates, Eligibility Criteria

$1,702 Stimulus Checks in 2026: Who’s Getting Paid and When? Check Eligibility Criteria