Which States Tax Social Security Benefits: Social Security benefits are a lifeline for many Americans. These payments are crucial for seniors, disabled workers, and their families. But one question that often arises is whether or not Social Security benefits are subject to state taxes. The rules vary by state and can impact how much you owe come tax season. If you’re retired or planning for retirement, it’s essential to know which states tax Social Security benefits in 2026 and how much you might pay.

Table of Contents

Which States Tax Social Security Benefits?

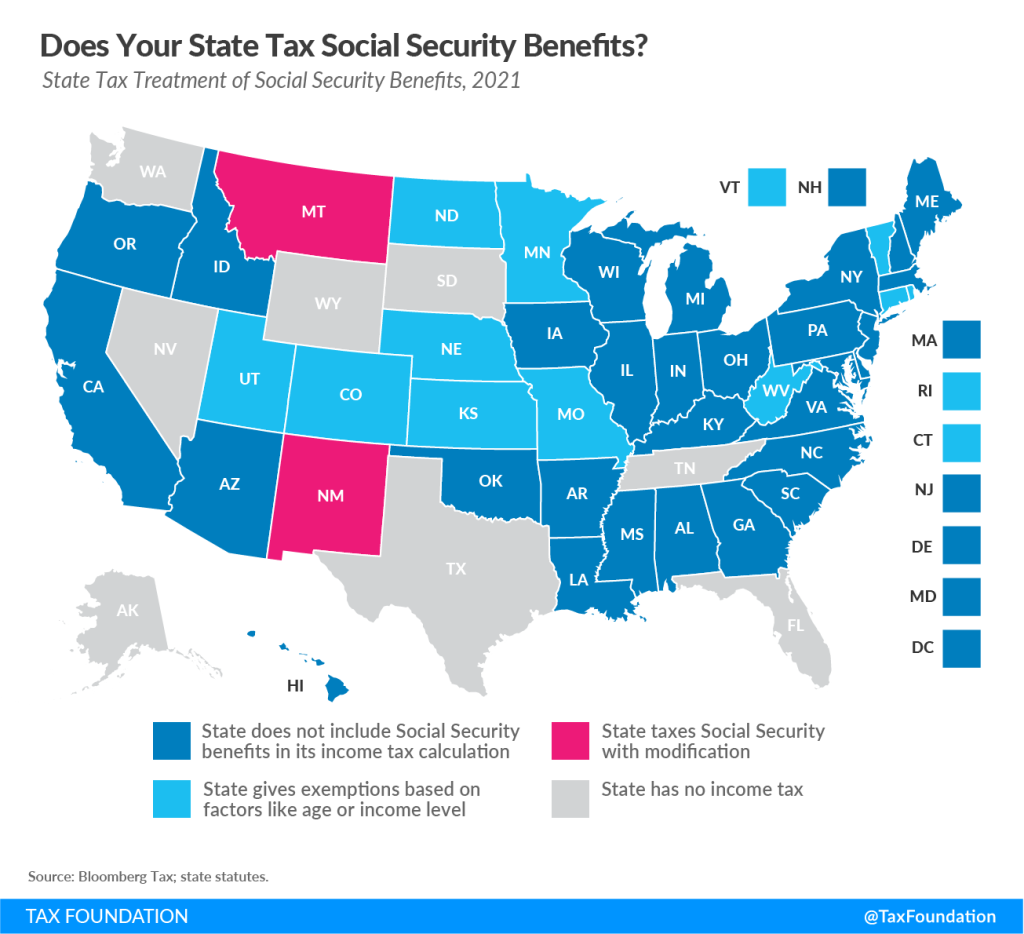

In 2026, navigating Social Security tax laws will be crucial for retirees planning their financial future. Understanding which states tax Social Security benefits and how those taxes are applied can make a big difference in your retirement plans. Some states, like Florida and Texas, offer tax-free Social Security benefits, while others, such as Minnesota and Vermont, tax these benefits based on income thresholds. Make sure to stay informed about these tax laws, as they could significantly impact your retirement budget.

| Key Information | Details |

|---|---|

| States that tax Social Security | 8 states still tax Social Security benefits in 2026. |

| States with no Social Security tax | 41 states + D.C. do not tax Social Security benefits. |

| States with full exemptions | States like Florida, California, and Texas offer full exemptions. |

| Income thresholds | Most taxing states have income thresholds that determine when Social Security is taxed. |

| Federal tax status | Federal tax on Social Security can range from 50% to 85% based on your combined income. |

| Reference link | Kiplinger for the latest updates. |

The Basics: What Is Social Security and How Is It Taxed?

Social Security is a federal program that provides financial assistance to retired individuals, disabled workers, and their families. In 2026, Social Security benefits will still be a significant part of your retirement income — especially for those relying solely on these benefits.

How Social Security Benefits Are Taxed?

At the federal level, Social Security benefits can be taxed depending on your combined income. This income includes half of your Social Security benefits plus any other income you have, such as wages or pension payments. Up to 85% of your Social Security benefits can be taxable at the federal level.

However, not all states follow the same rules. While most states do not tax Social Security benefits, some states tax a portion of those benefits based on your income and filing status.

Which States Tax Social Security Benefits?

If you’re considering retirement in 2026, you need to know the states that still tax Social Security benefits. Eight states impose some sort of tax on Social Security benefits, but the details can vary. Let’s break it down:

1. Colorado

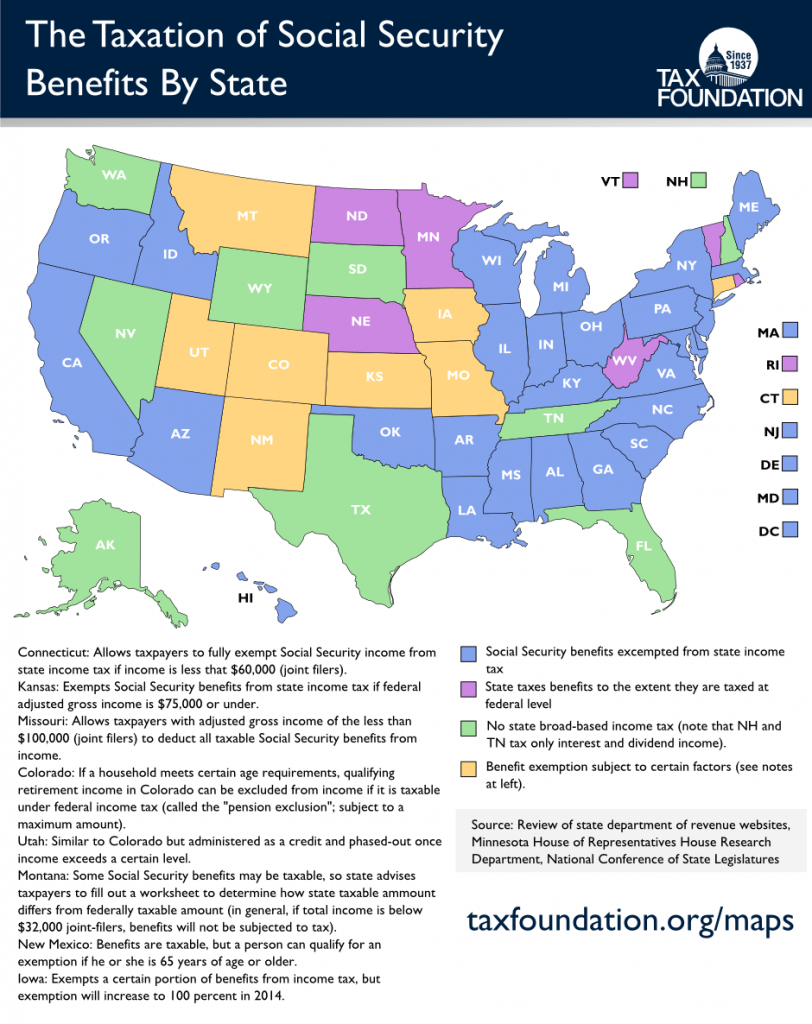

Colorado taxes Social Security benefits for higher earners. If your federal taxable income exceeds a certain threshold, part of your benefits may be taxed. Colorado offers exemptions and deductions depending on your age and income, which means not all retirees will pay.

2. Connecticut

Connecticut has a progressive tax system for Social Security benefits. If your income exceeds $75,000 (single) or $100,000 (married filing jointly), part of your Social Security benefits could be taxed.

3. Minnesota

Minnesota taxes Social Security benefits only if your combined income exceeds certain thresholds. The state has exemptions based on age and other factors, making it possible for seniors to avoid tax on their benefits altogether.

4. Montana

Montana also imposes taxes on Social Security benefits depending on income thresholds. The maximum taxable portion of Social Security benefits is subject to the state’s income tax rates.

5. New Mexico

New Mexico taxes Social Security benefits based on your income. However, some exemptions and deductions apply, which may help reduce the amount you owe.

6. Rhode Island

Rhode Island follows a similar approach, taxing Social Security benefits for higher-income retirees. There are specific thresholds to meet before these taxes kick in.

7. Utah

In Utah, Social Security benefits are subject to state income tax if your income exceeds certain thresholds. However, the state offers deductions and exemptions that might lower or eliminate this tax for many retirees.

8. Vermont

Vermont taxes Social Security benefits, though you may qualify for exemptions if you are over a certain age or meet specific income requirements. The state provides an income-based exemption to help offset the cost.

41 States and Washington D.C. Don’t Tax Social Security Benefits

On the flip side, 41 states and Washington D.C. don’t tax Social Security benefits, including major retirement destinations like Florida, Texas, and California. These states offer retirees a chance to save more of their benefits, so you won’t need to worry about these additional taxes. Here’s a snapshot of some states that offer tax breaks:

States with No Social Security Tax

- Florida

- California

- Texas

- Illinois

- New York

- Ohio

- South Carolina

- Tennessee

Retirees in these states enjoy the benefit of keeping their Social Security tax-free, which could significantly lower your overall tax burden during retirement.

Understanding How Social Security Taxes Are Calculated

Income Thresholds and How They Impact You

Most of the states that tax Social Security benefits do so based on income thresholds. For example, in Connecticut, Social Security benefits are only taxed if your federal taxable income exceeds $75,000 for a single filer or $100,000 for joint filers.

Some states, like Minnesota and Rhode Island, use a gradual approach, meaning your Social Security benefits are only taxed in part depending on your income. The more income you have, the higher the percentage of your Social Security benefits that are taxed.

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Social Security Benefits January 2026: How Much Will Your Payments Increase?

How Much Might You Pay in 2026?

If you live in a state that taxes Social Security benefits, you could be paying up to 5-6% of your benefits in state taxes, depending on your state’s tax rate and your income level. Some states will apply gradual increases based on your combined income. For instance, in Minnesota, only those with a combined income over $30,000 (single) or $50,000 (married) are subject to tax.

But don’t fret! Most of these taxes are gradual, so it’s less about paying all at once and more about managing how much of your income gets taxed at higher rates.