Social Security Payment Methods: Social Security payments are an essential lifeline for millions of Americans, ensuring financial stability in retirement or during periods of disability. With 2026 just around the corner, the Social Security Administration (SSA) has revealed its updated payment methods and schedules for January 14, 2026. Whether you’re waiting for a monthly benefit or planning your next steps, understanding when and how you’ll receive these funds can help you stay on top of your finances. In this guide, we’ll break down everything you need to know about Social Security payments, including the new methods, eligibility, and when you can expect to see your funds in your bank account.

Table of Contents

Social Security Payment Methods

Navigating the Social Security payment system can be overwhelming, but with the right information, it doesn’t have to be. Whether you’re waiting for your January 14, 2026 payment or trying to figure out the best payment method for you, the SSA provides clear and helpful resources to ensure you get your benefits on time and in a secure manner. Remember, direct deposit is the fastest and most reliable way to receive your payments. And if you don’t have a bank account, the Direct Express® debit card is a solid option. Stay informed by checking the official SSA website for updates and make sure your payment method is up to date to avoid any delays.

| Key Fact | Details |

|---|---|

| Who is Affected? | Social Security recipients born between the 1st and 10th. |

| First Payment Date | January 14, 2026 (for those born between the 1st-10th). |

| Payment Methods | Direct deposit, Direct Express® debit cards, and paper checks. |

| Staggered Payment Dates | Payments spread from January 14 to January 28, 2026. |

| Direct Deposit is Preferred | Faster, safer, and widely encouraged by the SSA. |

| Check the Official SSA Website | SSA Official Site for detailed info. |

Understanding Social Security Payments: A Quick Overview

What is Social Security?

Social Security is a federal program designed to provide financial assistance to individuals who are retired, disabled, or survivors of deceased workers. The program is funded by payroll taxes collected under the Federal Insurance Contributions Act (FICA). Payments are made monthly and are calculated based on your work history, earnings, and the age at which you start receiving benefits.

The SSA handles the distribution of these funds, ensuring that individuals across the United States can maintain financial security during challenging times. For many, Social Security is a crucial part of their monthly income, especially for retirees and individuals with disabilities.

When Will You Receive Your Social Security Payment in January 2026?

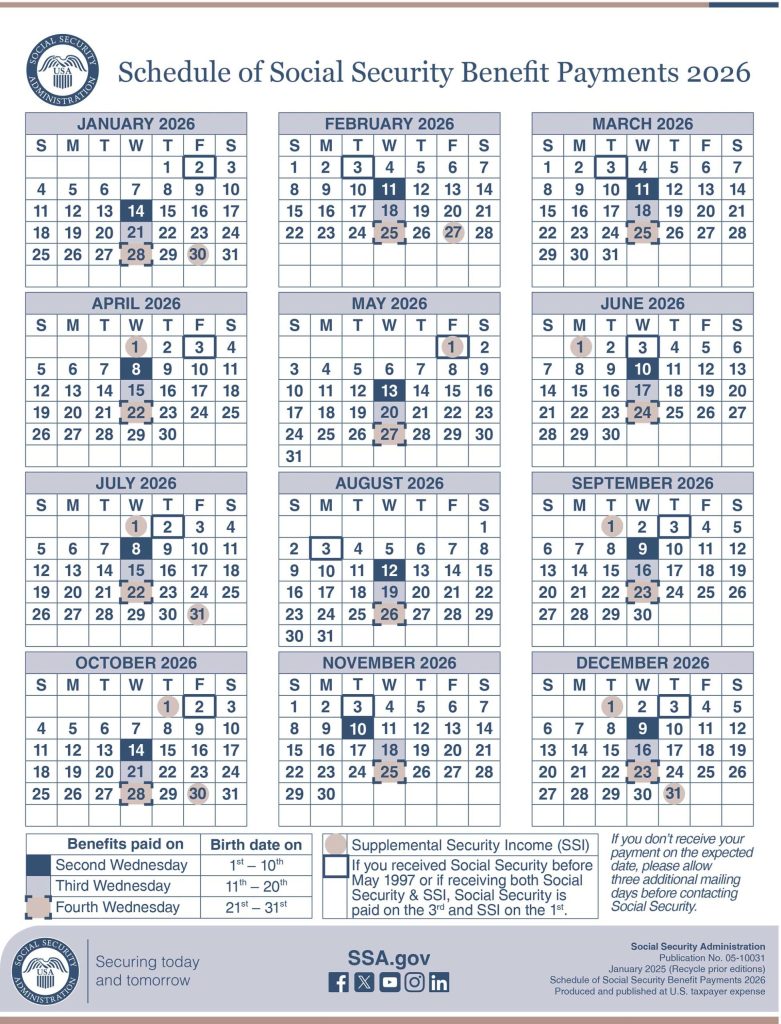

If you’re already receiving Social Security benefits, you probably know that payments are made on specific dates each month, based on your birthdate. The SSA follows a staggered schedule for payments, so not everyone receives their funds on the same day.

In January 2026, if your birthday falls between the 1st and 10th, you’ll receive your payment on January 14, 2026. For those with birthdays between the 11th and 20th, your payment will come on January 21, 2026, and if you were born between the 21st and 31st, your payment will be made on January 28, 2026.

Why Does the SSA Stagger Payments?

The SSA staggers payments throughout the month to manage the high volume of transactions. It helps the agency maintain a smooth flow of funds while preventing any delays or issues caused by processing large numbers of payments all at once. This system is particularly helpful when dealing with millions of Social Security recipients across the United States.

Social Security Payment Methods: How Will You Get Paid?

Social Security payments are made through various methods, and the SSA encourages all recipients to choose direct deposit for the fastest, safest, and most convenient way to receive their benefits.

1. Direct Deposit: The Fastest and Safest Option

Direct deposit is the preferred payment method for Social Security recipients. With direct deposit, your funds are automatically transferred into your bank or credit union account on the scheduled payment date. This method ensures that your payments are timely and secure, reducing the risk of lost or stolen checks.

To sign up for direct deposit, you’ll need to provide your bank account information to the SSA. This can be done during the application process or updated later.

2. Direct Express® Debit Cards: An Option for Those Without Bank Accounts

Not everyone has a bank account, and that’s where Direct Express® debit cards come in. This payment method allows recipients to receive their Social Security benefits on a prepaid debit card. The card works just like a regular debit card, enabling you to make purchases, pay bills, and withdraw cash from ATMs. You can sign up for a Direct Express® card if you don’t have a bank account or prefer not to use one.

To sign up for a Direct Express® card, visit the Direct Express® website or call their customer service line.

3. Paper Checks: A Thing of the Past?

While paper checks are still available for some beneficiaries, the SSA strongly encourages recipients to switch to direct deposit or a debit card. Paper checks are slower, more prone to loss or theft, and less secure compared to electronic payments.

In fact, the SSA has been phasing out paper checks for several years now, so if you still receive your payments by check, it’s time to consider switching to a safer, faster method. You can easily update your payment method through your my Social Security account.

How to Check Your Social Security Payment Status?

If you’re unsure when your next payment will arrive, it’s easy to check. The SSA website provides tools to track your payments and manage your benefits online. Here’s how you can keep tabs on your payments:

- Create a my Social Security account: Go to the SSA website and create an account to access your payment history and other important information.

- Use the SSA’s payment calendar: The SSA offers a payment calendar that outlines exactly when payments are scheduled based on your birthdate.

- Check with your bank: If you have direct deposit, your bank or credit union can tell you when funds have been deposited into your account.

Social Security Benefits January 2026: How Much Will Your Payments Increase?

Social Security Stimulus Payment 2026 – First COLA-Adjusted Payment Date and Who Qualifies

Social Security and Medicare 2026 – What Retirees and Savers Should Prepare for Now