Social Security 2026 Changes: What the New Maximum Benefit Looks Like Under Updated Rules is a hot topic — and for good reason. The changes this year aren’t just about numbers on a page. They’re about real money going into the pockets of over 70 million Americans. Whether you’re nearing retirement, already collecting benefits, or just planning ahead, knowing the ins and outs of these updates is crucial. In 2026, the Social Security Administration (SSA) announced updates to the maximum benefits, cost-of-living adjustments (COLA), taxable earnings limits, and rules that impact how much you receive based on your retirement age. But that’s not all. There are also changes to Medicare premiums, Supplemental Security Income (SSI), and the ever-important earnings test limits. This article breaks it all down into easy-to-digest parts — with clear examples, professional insights, and data-backed facts. Whether you’re 10 or 60, you’ll walk away with a solid understanding of what these changes mean for your wallet and your future.

Table of Contents

Social Security 2026 Changes

Social Security 2026 Changes – What the New Maximum Benefit Looks Like Under Updated Rules isn’t just a trending headline. It’s a reality that impacts how you live, budget, and plan your financial future. The COLA, maximum benefit, and tax rules in 2026 bring both good news and fresh challenges. Whether you’re already retired, still working, or helping others plan, now’s the time to review your strategy and make sure you’re set up to get the most out of your benefits.

| Topic | 2026 Update / Key Number |

|---|---|

| COLA Increase | 2.8% cost-of-living adjustment |

| Average Retired Worker Benefit | ~$2,071/month |

| Maximum Monthly Benefit at Full Retirement Age (FRA) | $4,152 |

| Maximum Monthly Benefit at Age 70 | ~$5,181 |

| Taxable Earnings Cap | $184,500 |

| Earnings Limit Before FRA | $24,480/year |

| Earnings Limit in Year of FRA | $65,160/year |

| Medicare Part B Premium | $202.90/month |

| SSI Federal Payment (Individual) | $994/month |

| Social Security Trust Fund Status | Projected depletion by 2033 |

Understanding the COLA: A Lifeline for Retirees

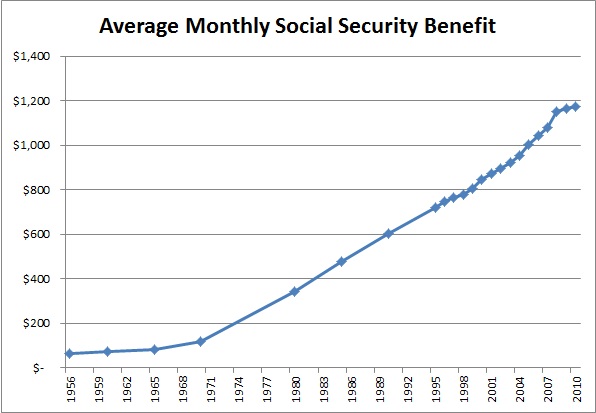

The 2.8% Cost-of-Living Adjustment (COLA) for 2026 might sound small, but for many retirees, it’s a much-needed boost in a time of rising prices. COLAs are calculated based on inflation trends tracked by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Let’s say you were receiving $2,015 per month in 2025. With the 2026 COLA, that goes up to approximately $2,071 per month — a modest but important increase of about $56 per month, or $672 more per year.

While that doesn’t sound like much, it’s meant to help you keep pace with rising costs on essentials like groceries, gas, and medical care. COLAs are applied automatically, meaning you don’t need to apply to receive the increase.

What’s the Maximum Benefit in 2026?

Here’s the scoop: the maximum possible monthly benefit for Social Security in 2026 depends on when you retire and how much you earned over your career.

- At Full Retirement Age (67): You could receive a max benefit of $4,152/month.

- At Age 70 (if you delay claiming): That max rises to around $5,181/month.

- At Age 62 (early claim): The benefit could drop as low as $2,569/month, even if you had a high-paying career.

To receive the maximum benefit, you must:

- Have worked at least 35 years.

- Earned the maximum taxable amount each of those years.

- Claimed benefits at or after full retirement age.

Delaying benefits boosts your payout thanks to delayed retirement credits, which grow your benefit by about 8% each year you wait past FRA, up to age 70.

Social Security 2026 Changes: Earnings Limits & How They Affect You

If you’re collecting Social Security but still working, listen up. There are earnings limits that affect how much you can receive before your full retirement age (FRA):

- Before FRA: You can earn up to $24,480/year before your benefits are reduced. If you go over, SSA withholds $1 for every $2 earned above the limit.

- In the year you reach FRA: You can earn up to $65,160/year. Above that, $1 is withheld for every $3 over the limit.

Once you hit full retirement age, you can earn as much as you like with no penalty.

These rules are critical for people who want to “double dip” — that is, receive benefits while working part-time or running a business.

Medicare Part B Premiums: The Hidden Deduction

Most retirees don’t realize this, but Medicare Part B premiums are deducted directly from your Social Security checks.

In 2026, the standard Part B premium is $202.90/month, up from $185.50 in 2025. That’s nearly $2,435 per year, subtracted from your Social Security income.

So even though your gross benefit is increasing due to the COLA, your net check could be smaller than expected once Medicare premiums are factored in.

People with higher incomes may pay even more due to Income-Related Monthly Adjustment Amounts (IRMAA). If your modified adjusted gross income (MAGI) is above $103,000 (individual) or $206,000 (married), you’ll owe higher monthly premiums.

Social Security 2026 Changes: Disability Benefits & SSI Updates

Social Security also provides Disability Insurance (SSDI) and Supplemental Security Income (SSI), and both saw increases for 2026:

- SSDI benefits also received the 2.8% COLA boost.

- SSI federal payment standards increased to:

- $994/month for individuals.

- $1,491/month for couples.

Keep in mind, SSI is needs-based, meaning your income and resources must fall below certain levels. It’s often a lifeline for individuals with disabilities, older adults, and children in low-income households.

Social Security Taxes: What’s the Cap?

Social Security is funded through payroll taxes. In 2026, the maximum amount of income subject to Social Security tax increased to $184,500. That means if you earn that much or more, you’ll pay:

- 6.2% as an employee.

- Your employer pays another 6.2%.

- If self-employed, you’re responsible for the full 12.4%.

This cap matters because only income up to this amount is used to calculate your benefit. High earners who exceed the cap stop paying Social Security tax on earnings above $184,500.

Should You Delay Claiming Benefits?

Many financial advisors recommend delaying your claim until full retirement age or later, if possible. Why?

Because:

- Claiming at 62 can reduce your benefits by up to 30%.

- Every year you delay past full retirement age up to 70, your benefits increase by ~8% per year.

So if you’re healthy, have other sources of income, and expect to live a long life, delaying benefits can mean a much higher monthly income later.

But delaying isn’t always the right answer. If you:

- Have health issues.

- Need the income now.

- Are concerned about the system’s future…

…then claiming earlier might make sense.

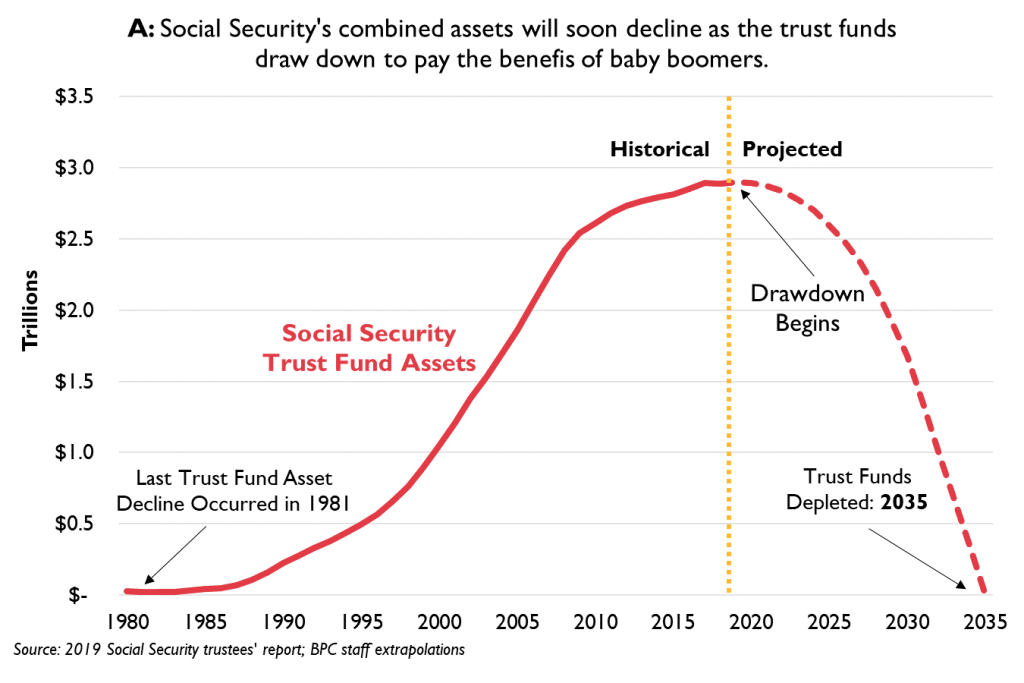

Trust Fund Worries: Is Social Security Going Broke?

It’s a fair question. The Social Security Trust Fund — which helps pay out benefits — is projected to run into funding issues by 2033 if no reforms are made.

What happens then?

Social Security wouldn’t vanish, but current law would require across-the-board benefit cuts of ~20%. Congress would need to step in to avoid this scenario — by raising taxes, increasing the retirement age, or changing benefit formulas.

Bottom line: Social Security is not going bankrupt, but changes are likely coming. Younger workers especially should not rely solely on Social Security for retirement planning.

Planning Tips for Maximizing Social Security

Here’s how to make the most of your benefits in 2026 and beyond:

- Work at least 35 years: SSA uses your top 35 earning years to calculate benefits.

- Earn more: Higher lifetime earnings = higher benefit.

- Delay if possible: Each year you delay past FRA = bigger check.

- Understand your taxes: Up to 85% of your benefit may be taxable.

- Watch for Medicare deductions: Factor in Part B and other premium costs.

- Create a plan: Use the My Social Security account tool to estimate benefits.

Social Security $994 Payment for February 2026 – Check Payment Dates and Who Qualifies

Social Security Stimulus Payment 2026 – First COLA-Adjusted Payment Date and Who Qualifies

Social Security 2026: How Much You Must Earn to Get the Highest Benefit