Social Security Stimulus Payment: The phrase “Social Security Stimulus Payment 2026” has been making the rounds online — popping up in news headlines, emails, and even casual conversations at the grocery store. But let’s get something straight from the start: there is no special stimulus check coming from Social Security in 2026. Instead, what millions of Americans will see — and feel — is the annual Cost-of-Living Adjustment (COLA). This adjustment means regular Social Security benefits are increasing to help keep up with rising prices. For many retirees, folks with disabilities, and survivors, this is the boost they count on each year to keep their heads above water.

In this guide, we’re going to unpack everything you need to know — in plain language — about the 2026 COLA, when the higher payments start, who qualifies, and how much more you can expect to get. We’ll also talk about how Medicare premiums, earning limits, and other policies affect your actual take-home amount. Whether you’re retired, still working, receiving disability, or helping a loved one figure it all out, we’ve got you covered.

Table of Contents

Social Security Stimulus Payment

In 2026, Social Security recipients will see their monthly benefits rise by 2.8%, thanks to the annual Cost-of-Living Adjustment (COLA). While it’s not a one-time stimulus payment, the increase provides a modest boost that can help cover higher costs for essentials. The first payments began as early as December 31, 2025, for SSI recipients, and most others saw their new checks by mid-to-late January 2026. That said, rising Medicare premiums, tax implications, and earning limits can reduce how much of that increase you actually keep. Knowing your benefit schedule, reviewing your Medicare plan, and understanding your work income impact can help you make the most of what Social Security provides. Whether you’re new to retirement or a seasoned pro at managing benefits, 2026 is a year to stay informed, plan ahead, and protect your income.

| Topic | 2026 Social Security Updates |

|---|---|

| COLA Increase | 2.8% boost in Social Security & SSI benefits starting January 2026 |

| First Payments | SSI: Dec 31, 2025; Social Security: Jan 2, Jan 14, Jan 21, Jan 28 |

| Average Monthly Increase | ~$56 more for retired workers (varies by benefit) |

| Medicare Part B Premiums | $202.90/month (up from $185.00 in 2025) |

| Earnings Limit (Pre-FRA) | $24,480 before benefits are reduced |

| Maximum Taxable Earnings | $184,500 for Social Security tax cap |

| Official SSA Site | www.ssa.gov |

Understanding the 2026 COLA — What It Is and Why It Matters

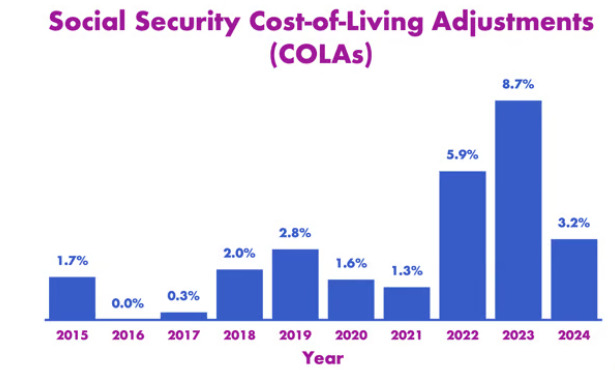

Let’s start with the basics. COLA stands for Cost-of-Living Adjustment. Every year, the Social Security Administration (SSA) reviews inflation data to decide whether to increase benefit amounts. They use the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to make that call.

If prices have gone up — and let’s face it, they usually do — your Social Security benefits go up too. This increase is automatic. You don’t need to apply, call, or fill out any paperwork.

For 2026, the COLA is set at 2.8%, a slight increase meant to help offset rising costs in essentials like food, gas, housing, and healthcare.

Here’s a simple example:

If you received $2,000 per month in 2025, a 2.8% increase means your new benefit will be around $2,056 in 2026 — that’s an extra $56 per month or $672 more for the year.

But remember, the COLA isn’t a windfall — it’s meant to keep your benefits in line with inflation, not get you ahead of it. For many, it’s the difference between making ends meet and falling behind.

When Will You See the Social Security Stimulus Payment?

You may be wondering when that extra money actually shows up in your bank account. The answer depends on which benefit you receive and when you started receiving it.

Here’s a quick breakdown:

- SSI recipients received their COLA-adjusted payment on December 31, 2025. Why early? Because January 1 is a federal holiday and banks are closed, so the payment was moved up a day.

- Social Security retirement, disability, and survivor benefit recipients will see their increased payments in January 2026, but the exact date depends on your birthdate:

- If you started receiving benefits before May 1997, you’ll be paid on January 2, 2026.

- If your birthday falls between the 1st and 10th, you’ll be paid on January 14.

- Birthdays between the 11th and 20th get paid January 21.

- Birthdays between the 21st and 31st are paid on January 28.

This staggered payment schedule helps the SSA manage the workload, but it also means your neighbor might see their bump before you do — even if you both qualify.

Who Qualifies for the COLA-Adjusted Payment?

You’re eligible for the COLA increase if you receive any of the following benefits:

- Retirement benefits (based on your work history)

- Disability benefits (SSDI)

- Survivor benefits (for spouses and children of deceased workers)

- Supplemental Security Income (SSI)

If you’re already receiving any of these benefits as of December 2025, the 2026 COLA is automatically applied to your January payment. You don’t need to take any action.

New applicants who begin receiving benefits in 2026 may not immediately receive the full COLA amount. Their benefit will be based on when they became eligible and other factors like earnings and age at the time of filing.

How Much Will You Actually Receive in 2026?

The 2.8% increase doesn’t apply equally to everyone. Your individual benefit increase depends on what type of benefit you receive and how much you were already receiving.

Here are some average increases:

- Retired workers: From about $2,015 in 2025 to $2,071 in 2026

- Disabled workers: From about $1,586 to $1,630

- Widowed mother and two children: From $3,792 to $3,898

- SSI individuals: Maximum federal payment goes from $943 to $994

- SSI couples: From $1,415 to $1,491

Now here’s where it gets tricky — Medicare Part B premiums.

Medicare Part B and How It Affects Your Check

Most retirees have Medicare Part B premiums automatically deducted from their Social Security checks. And in 2026, those premiums are going up.

The standard Part B premium is $202.90 per month, up from $185 in 2025. That’s a $17.90 increase, which could wipe out nearly a third of your COLA bump.

Let’s do the math for a retiree receiving $2,071 in 2026:

- COLA adds about $56

- Part B premium rises by $17.90

- Net gain? Around $38 per month

So yes, you’re getting more, but rising healthcare costs are eating into your increase.

This is a good time to review your Medicare Advantage or Part D plans to make sure you’re not overpaying. A simple annual plan review can help save hundreds over the course of the year.

What About Taxes, Earnings, and Work?

Many Social Security recipients still work part-time or full-time, especially those who file early (before full retirement age). The SSA has an earnings limit, which changes yearly.

For 2026, that limit is $24,480. If you earn more than that before reaching full retirement age, your Social Security benefits may be reduced.

Specifically, for every $2 you earn over the limit, $1 is withheld from your benefits.

Let’s say you earn $30,000 in 2026:

- That’s $5,520 over the limit

- SSA withholds $2,760 in benefits that year

After you reach full retirement age (currently 67 for those born in 1960 or later), the limit no longer applies — you can earn as much as you want without penalty.

There’s also the maximum taxable earnings cap, which is the amount of income subject to Social Security tax. In 2026, that cap is $184,500. If you earn more than that, you don’t pay Social Security taxes on the income above that level.

Practical Tips to Maximize Your Social Security Stimulus Payment

Whether you’re retired or still working, here are some practical ways to make the most of your 2026 Social Security income:

- Set up or review your “my Social Security” account: You can view your payment schedule, benefit statements, and verify payment status. It’s free and secure.

- Review Medicare coverage annually: Shop for better premiums or drug coverage. Don’t assume your current plan is the best one.

- Time your income wisely: If you’re working part-time and near the earnings limit, consider adjusting your hours to avoid benefit reductions.

- Use a budget planner: Incorporate your COLA increase into your 2026 household budget and plan for changes in healthcare and food prices.

- Consult with a financial advisor: Especially if you’re close to full retirement age or considering when to file. Strategic planning can increase your lifetime benefits.

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

Texas Social Security Schedule – Check January 2026 Payment Dates and Eligibility Criteria