Social Security COLA 2026: Social Security COLA 2026 is officially set at 2.8%, and it’s more than just a number on your statement—it’s a signal from Uncle Sam that inflation hasn’t taken a nap yet. For over 71 million Americans, including retirees, folks with disabilities, and SSI recipients, this modest raise means slightly more breathing room in 2026. But how much will you actually see? When will the increased check land in your account? And what about the fine print, like taxes and rising Medicare premiums? This article digs deep into the full picture with real examples, practical planning steps, and answers to questions that real Americans are asking. We break it down in a way your grandma could understand—but we keep it sharp and informed enough for pros managing retirement portfolios or advising clients. Let’s get into it.

Table of Contents

Social Security COLA 2026

The Social Security COLA for 2026 may not be as headline-grabbing as 2023’s 8.7% surge, but the 2.8% increase still matters. It reflects the ongoing cost pressures Americans face—and gives retirees a little more breathing room. But with Medicare premiums rising and taxes potentially taking a bite, it’s crucial to understand how the increase translates into real dollars. Use this opportunity to reassess your financial plan, check your statements, and consider healthcare costs. For many, a few well-placed decisions—like tweaking Medicare or withholding—can help you get the most out of your COLA.

| Topic | Details |

|---|---|

| 2026 COLA Rate | 2.8% benefit increase for Social Security & SSI. |

| Who Gets It? | About 71 million Americans across programs. |

| Average Monthly Benefit | Increase from $2,015 to ~$2,071 for retirees. |

| Annual Increase | ~$672 more per year for average recipients. |

| Medicare Part B Premium | Increasing to $202.90/month in 2026. |

| First Check with COLA | January 2026 (dates vary by birthday); SSI starts Dec 31, 2025. |

| Taxable Wage Base | Increases to $184,500 in 2026. |

| Official Source | https://www.ssa.gov/cola/ |

What Is COLA — And Why It Matters in 2026

COLA stands for Cost-of-Living Adjustment, and it exists to help Social Security benefits keep up with inflation. Each year, the government looks at how much everyday prices have gone up—things like food, rent, fuel, and clothing—and adjusts Social Security checks accordingly.

This 2.8% adjustment is based on the CPI-W, or Consumer Price Index for Urban Wage Earners and Clerical Workers. It’s not perfect—some experts argue that it doesn’t accurately reflect the expenses seniors face, like healthcare—but it’s what the law uses to calculate COLA. In short, it’s the government’s attempt to ensure your benefits don’t lose too much buying power as the cost of living rises.

The 2026 COLA increase is slightly above the 10-year average, which hovers around 2.6%–2.7%, but it’s a far cry from the historic 8.7% COLA in 2023 or the 5.9% hike in 2022 during peak post-pandemic inflation.

How Much More Money Will You Get?

Let’s put that 2.8% into context with real numbers. Here’s how the COLA boost breaks down across different beneficiaries:

Average Retired Worker:

- 2025 benefit: ~$2,015/month

- 2026 benefit after 2.8% increase: ~$2,071/month

- Increase: ~$56/month or ~$672/year

Aged Couple, Both Receiving Benefits:

- 2026 average: ~$3,208/month

Disabled Worker:

- 2026 average benefit: ~$1,630/month

SSI Maximum Monthly Payment:

- Individual: Up to $994

- Couple: Up to $1,491

Important: These are average numbers. If you’re getting more or less than the average now, your increase will still be 2.8% of your current benefit—unless you’re subject to deductions like Medicare Part B or taxes (more on that soon).

When Will You Receive Your First Increased Social Security COLA 2026?

The COLA increase becomes effective with the January 2026 payments, but the exact date you receive your check depends on your birthday.

Here’s the 2026 Social Security payment schedule for retirement and disability benefits:

- Birthdays 1st–10th: January 14, 2026

- Birthdays 11th–20th: January 21, 2026

- Birthdays 21st–31st: January 28, 2026

SSI recipients will see the COLA reflected on December 31, 2025, because the first of the month falls on a holiday in 2026. This early payment is technically your January SSI benefit.

This means that some folks will see their increased benefit before the new year officially begins, while others may wait until mid or late January to see that extra cash.

Don’t Spend It All Yet — Medicare Might Snatch a Piece

While it’s nice to see an extra $56 a month, many retirees won’t feel that full amount in their wallet because of Medicare premiums.

Medicare Part B Premiums in 2026:

- 2025: $185.00/month

- 2026: $202.90/month

That’s a $17.90 increase that’s automatically deducted from your Social Security check if you’re enrolled in Part B. So if you were excited about that $56 boost, subtract $17.90—now you’re looking at closer to $38 in net increase.

If you also have premiums for Part D (prescription drugs) or a Medicare Advantage plan, those will further reduce your take-home benefit.

What About Taxes?

Depending on your combined income, part of your Social Security benefits may be taxable at the federal level. Here’s the formula:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 50% of Your Social Security

If your combined income exceeds these thresholds:

- $25,000 for individuals or $32,000 for couples: up to 50% of your benefit is taxable

- $34,000 for individuals or $44,000 for couples: up to 85% is taxable

Unfortunately, these thresholds haven’t been adjusted for inflation in decades, which means more people get taxed each year—even with small COLAs.

A tax-savvy strategy might involve:

- Using Roth IRAs for tax-free withdrawals

- Managing distributions from 401(k)s or traditional IRAs

- Consulting a retirement tax advisor to minimize surprise bills

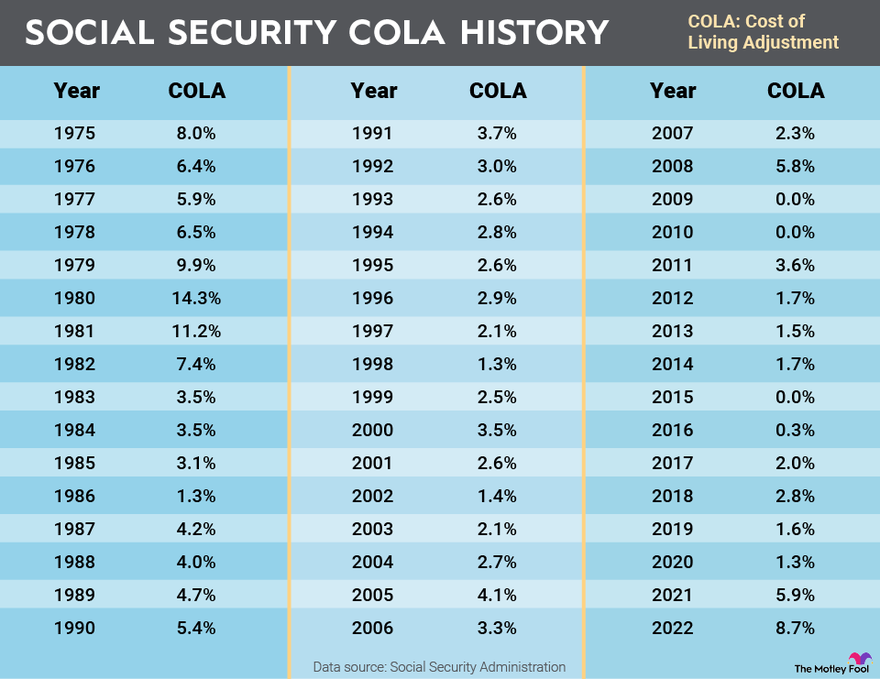

Historical Context: How Does the Social Security COLA 2026 Compare?

Let’s take a quick walk through COLA history:

| Year | COLA Increase |

|---|---|

| 2026 | 2.8% |

| 2025 | 2.5% |

| 2024 | 3.2% |

| 2023 | 8.7% |

| 2022 | 5.9% |

| 2021 | 1.3% |

| 2010–2011 | 0% (twice) |

So while 2026’s 2.8% isn’t huge, it’s still meaningful in a historical context. It reflects moderate inflation, which many economists expect to persist into 2026 but at lower levels than the pandemic era.

Planning Tips: How to Make the Most of the Social Security COLA 2026

Here’s how to turn that extra cash into real impact:

1. Revisit Your Monthly Budget

That extra $56 (or less) might not feel like much, but over the course of a year it adds up. Use it to cover:

- Prescription co-pays

- Utility increases

- Groceries

- Emergency savings

2. Adjust Your Withholding

If you’re facing taxability on your benefits, consider withholding a small amount from your check. The SSA can help you set this up via IRS Form W-4V.

3. Review Medicare Plans

With premiums on the rise, it’s a great time to shop for:

- Lower-cost Medicare Part D plans

- Advantage plans with no monthly premium

- Supplemental Medigap policies that could save you money on out-of-pocket expenses

4. Log into Your mySSA Account

Your Social Security account at ssa.gov lets you:

- View your exact COLA-adjusted benefit

- See payment history

- Manage direct deposit

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules

Social Security January 14 Payments – Who Qualifies and How the 2026 COLA Applies