Social Security Payment Rules: If you rely on Social Security for retirement, disability, or supplemental income, losing those benefits can be devastating. Most Americans think once the money starts coming in, it’s guaranteed for life. But here’s the truth: Social Security benefits can be reduced, suspended, or even stopped altogether in certain situations. That’s why understanding the rules around Social Security payments is absolutely critical. Whether you’re 62 and thinking about retiring early, on SSDI due to a disability, or receiving SSI, this guide will walk you through real scenarios, legal limits, and practical steps to keep your benefits safe.

Table of Contents

Social Security Payment Rules

Losing your Social Security benefits can be financially catastrophic—but most situations are preventable. Whether it’s early retirement, disability, or supplemental income, staying educated and proactive is your best defense. Report changes. Know the income limits. Stay in touch with SSA. And when in doubt, ask for help. Social Security is a safety net, but only if you follow the rules and stay ahead of the curve.

| Topic | Details |

|---|---|

| At-Risk Groups | Early retirees, SSDI/SSI recipients, incarcerated individuals, overpayment cases |

| Top Causes | Earnings over the limit, medical recovery, overpayments, unreported changes, incarceration |

| 2026 Earnings Limit (Under FRA) | $24,480/year; $1 withheld for every $2 over the limit |

| Overpayment Recovery | SSA can legally withhold 100% of future benefits until the full amount is repaid |

| SSI Resource Limit | $2,000 (individual), $3,000 (married couple) |

| Disability Triggers | Medical improvement, exceeding monthly income thresholds, non-compliance with SSA requests |

| SSA Official Site | https://www.ssa.gov |

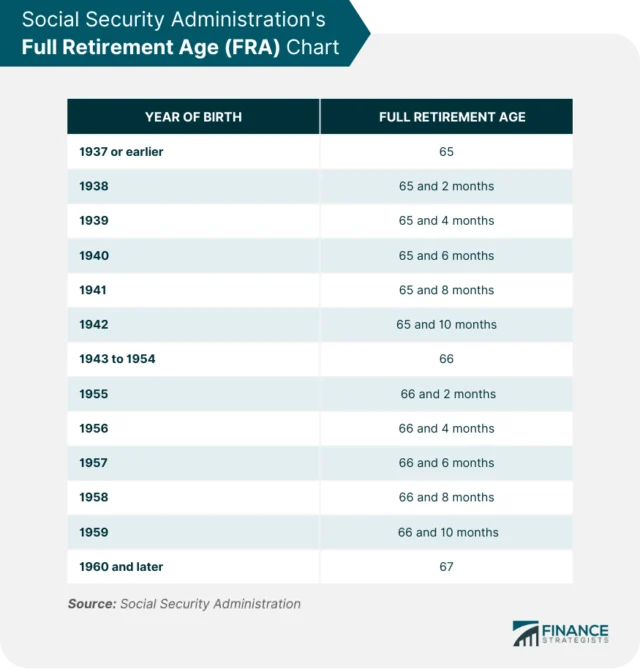

Working Before Full Retirement Age (FRA)

One of the most common ways people unknowingly lose part or all of their Social Security retirement benefits is by working before they reach Full Retirement Age (FRA).

What’s the issue?

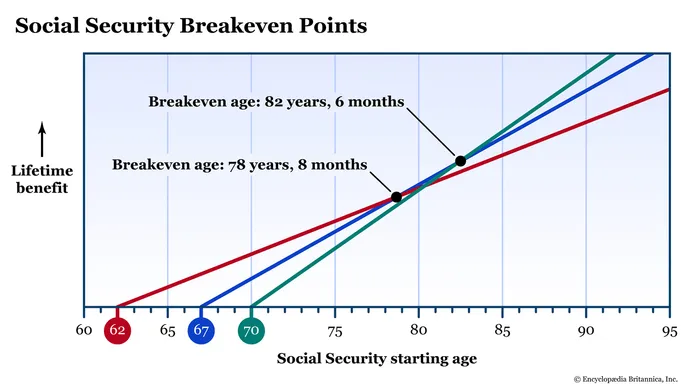

Social Security allows you to claim retirement benefits as early as age 62, but if you do and continue working, there’s an earnings limit.

2026 Earnings Limits (Projected)

- Before FRA: You can earn up to $24,480/year.

- Go over that? SSA withholds $1 for every $2 you earn above the limit.

- Year you reach FRA: You can earn up to $56,520. After that, the penalty reduces to $1 for every $3.

- Once you hit FRA: There’s no earnings cap—you can earn as much as you want, penalty-free.

Example:

John, age 63, receives $1,600/month in Social Security but also works part-time earning $35,000/year. That’s $10,520 over the limit, meaning SSA could withhold $5,260 of his benefits that year.

Important Notes:

- You don’t lose the money forever—SSA recalculates and adjusts your benefit at FRA.

- The withheld money is credited back to you slowly over time.

Losing SSDI or SSI Due to Disability Reviews or Work

Many people who collect SSDI (Social Security Disability Insurance) or SSI (Supplemental Security Income) assume their benefits are permanent. But that’s not always the case.

SSDI: Triggers for Loss

- Medical Improvement: SSA conducts Continuing Disability Reviews (CDRs) every 3–7 years depending on your condition.

- If they find you’re no longer medically disabled, benefits stop.

- Substantial Gainful Activity (SGA): If you’re earning more than $1,550/month (non-blind, 2024), SSA may consider you capable of working and cancel your SSDI.

- Trial Work Period (TWP): You’re allowed to test work without losing benefits—for 9 months over a 60-month period.

- After that, earning over SGA could terminate your benefits.

SSI: Stricter Limits

- Resource limit: $2,000 individual / $3,000 couple

- If your bank account or property goes over this, SSI can be terminated.

- Unreported income, changes in household size, or marriage can all affect eligibility.

SSA also counts “in-kind support” like living rent-free with a relative as income, reducing or ending SSI.

Social Security Payment Overpayments: The Silent Benefit Killer

Overpayments are when SSA pays you more than you’re owed—often due to misreporting, system errors, or unreported changes. And when it happens, they want the money back.

What’s shocking is:

- SSA can withhold 100% of your monthly checks until the overpayment is paid back.

- Some people have gone months with no income because of aggressive overpayment collections.

Common Causes:

- Not reporting income increases (part-time job, gig work, spouse’s income).

- SSA clerical errors (they admit overpaying $20 billion in 2023 alone).

- Delayed income updates not processed on time.

What You Can Do:

- Request a Waiver: If it’s not your fault and paying back causes hardship.

- Appeal the Overpayment: Especially if you disagree with the calculation.

- Negotiate a Payment Plan: Avoid full garnishment by working with SSA.

Social Security Payment Rules: Incarceration Leads to Automatic Suspension

If you or a loved one ends up incarcerated, your Social Security benefits are at serious risk.

SSA Rules:

- SSDI or Retirement: Benefits are suspended after 30+ days of incarceration.

- SSI: Benefits are terminated after 12 months in jail or prison.

What Happens After Release:

- You may need to reapply, especially for SSI.

- Reinstatement can take 30–90 days, depending on processing time.

- It’s important to notify SSA of your release quickly.

Failing to Report Life Changes

SSA requires all recipients to report certain changes that affect their benefit eligibility. Failure to do so can result in overpayments, reduced benefits, or even termination.

You Must Report:

- Changes in income

- Marriage, divorce, or death of a spouse

- Moving in or out of someone’s house

- Traveling or living outside the U.S. (especially for SSI)

- Receiving other government benefits (VA, workers’ comp, etc.)

Real-Life Case Study: How One Man Lost $36,000

Michael, a 57-year-old from Ohio, was on SSDI for a back injury. He began driving for a rideshare company to make extra money but didn’t report the earnings, assuming it was “just side cash.”

Two years later, SSA conducted a review and determined he’d earned over the SGA threshold. His SSDI was terminated, and he was sent a bill for $36,000 in overpayments.

Michael had to appeal, hire a lawyer, and set up a repayment plan. His benefits were stopped for months.

Step-by-Step Guide: What to Do If You’re at Risk

- Read All SSA Notices Carefully

- Look for codes, appeal deadlines, and explanations.

- Call SSA Immediately

- Be respectful, ask for names and document your call.

- Set Up or Access Your MySSA Account

- Create an account here

- Submit Paperwork On Time

- Appeals, waivers, and updates all have strict deadlines.

- Get Help

- Contact Legal Aid or Social Security advocacy groups like NOSSCR

Tools and Resources

| Resource | Purpose |

|---|---|

| My Social Security | View earnings, update info, track payments |

| Work Incentives | Learn how work affects benefits |

| Overpayment Waiver Form | Request waiver if not your fault |

| Legal Aid Directory | Free legal help by region |

| NOSSCR | Find disability lawyers |

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Social Security Benefits January 2026: How Much Will Your Payments Increase?

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums