Social Security Tax Proposal: The Social Security tax proposal – why many Americans oppose a $2,600 increase and what it means for future benefits — isn’t just some technical policy tucked into a government report. It’s real, and it’s personal. It’s about your paycheck, your retirement, your future. Whether you’re 25 and building your career, or 60 and counting down to retirement, what happens next could shape your financial security for decades.

This proposal would mean the average American worker might pay an extra $2,600 per year — that’s about $216 a month, out of every paycheck. For some, it’s the cost of groceries for the month. For others, it’s daycare or a car payment. So, yeah, folks are paying attention — and many aren’t happy. Let’s break it all down, from how we got here to what this tax change could mean for your bottom line and retirement plan.

Table of Contents

Social Security Tax Proposal

The Social Security tax proposal and the $2,600 annual increase is a hard pill to swallow — but so is losing a quarter of your retirement income. While most Americans agree the system needs saving, there’s no one-size-fits-all solution. Whether the answer lies in tax hikes, retirement age increases, or benefit adjustments, it’s clear that time is running out for a painless fix. Stay informed, stay prepared, and make your voice heard. Social Security may have been born nearly a century ago — but its future depends on what we do now.

| Topic | Data / Fact |

|---|---|

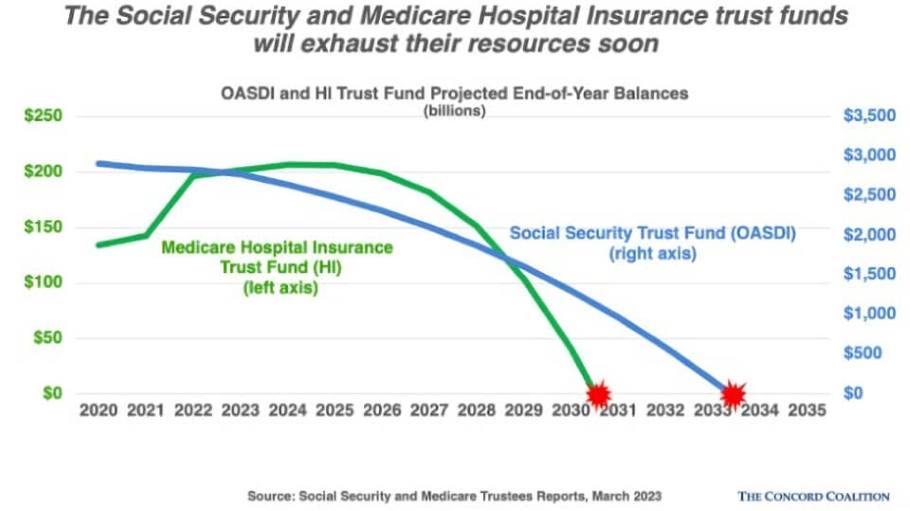

| Projected Solvency Date | Social Security trust funds could run out by ~2034–2035 |

| Benefit Coverage After Shortfall | Without reform, Social Security can pay only ~77% of scheduled benefits |

| Opposed to $2,600 Tax Hike | 79% of Americans oppose the increase |

| Payroll Tax Rate | Currently 12.4% total, split between employers and workers |

| Wage Cap for Taxation | $168,600 in 2024 — earnings above that aren’t taxed for Social Security |

| Number of Beneficiaries | Over 67 million Americans rely on Social Security |

| Official Resource | ssa.gov/oact/solvency |

How Did We Get Here?

The Social Security program was born in 1935, right in the middle of the Great Depression. The idea was simple but powerful: give folks a safety net in their old age, especially when jobs dried up or savings ran thin.

Back then, the system worked great — a few workers supported each retiree, and people didn’t live nearly as long. Fast-forward to today, and we’ve got millions of Boomers retiring, people living into their 80s and 90s, and fewer younger workers paying into the system.

In 1960, there were 5.1 workers per retiree. Today, that number has dropped to 2.8 — and it’s projected to fall to 2.3 by 2035.

What’s the Social Security Tax Proposal All About?

To keep Social Security fully funded beyond 2034, one idea floated by analysts and some lawmakers is to raise the payroll tax — the money taken directly from your paycheck — by enough to generate the needed cash.

That extra tax would cost the average full-time worker roughly $2,600 more per year. That’s not chump change, especially when people are already juggling inflation, student loans, healthcare costs, and rent.

This increase would likely come in the form of raising the 12.4% payroll tax to around 15.6%, phased in over time. Employers and workers would both contribute more.

While technically feasible, it’s a hard sell politically. People hate seeing smaller paychecks, even if the trade-off is long-term financial stability.

Why Are So Many Americans Against Social Security Tax Proposal?

Here’s the thing — most Americans want Social Security to survive. But when you put the solution in dollar terms, support drops fast.

According to a 2024 Cato Institute survey, nearly 8 out of 10 Americans oppose a $2,600 payroll tax increase. Yet, smaller hikes — like $200 to $600 per year — get more support.

So why the resistance?

- Rising Cost of Living: Folks are already stretched thin. Adding another monthly expense feels overwhelming.

- Mistrust of Government: People worry that even if they pay more now, benefits might still be cut later.

- Unclear Benefits: Most workers don’t know how much they’ll get back from Social Security — and that uncertainty breeds doubt.

- Short-Term Pain vs Long-Term Gain: Americans often focus on today’s costs, not tomorrow’s savings — especially when the fix is invisible for decades.

What Happens If We Do Nothing?

If Congress doesn’t act, here’s what we’re looking at:

- By 2034 or 2035, the trust fund runs dry.

- After that, Social Security can only pay out what it takes in via payroll taxes — about 77% of scheduled benefits.

- For the average retiree, that could mean a drop from $1,800/month to about $1,385/month.

And this isn’t just retirees. Disabled workers, survivors, widows, and orphans who rely on the program would be affected too.

We’re not talking about a complete collapse — but a 23% pay cut in retirement is no joke.

Who Would the Tax Hike Hit the Hardest?

Let’s break it down with a couple of real-life scenarios:

Maria, 35, is a single mom earning $52,000/year.

A $2,600 annual tax hike = 5% of her take-home income. That’s school supplies, car repairs, or half her rent.

James, 62, earns $150,000 and is nearing retirement.

He’ll pay the max Social Security tax already. A hike might not hit him as hard — but he’s wondering if he’ll even see the benefits after paying more.

Aliyah, 24, just entered the workforce.

She’s told Social Security might be gone when she retires. That tax feels like throwing money into a black hole.

Other Solutions Being Debated

The $2,600 tax increase is just one idea. Here are others:

Raise the Retirement Age

Some proposals suggest bumping the full retirement age from 67 to 68 or 70, especially as people live longer. This spreads out payments and lowers lifetime benefits.

Lift the Payroll Tax Cap

Right now, earnings above $168,600 (2024) aren’t taxed for Social Security. Removing that cap would mean wealthier Americans pay more — which many polls show people support.

Means Testing Benefits

This would reduce or eliminate benefits for high-income retirees, redirecting funds to middle- and low-income folks.

Create a Commission

Some want a non-partisan “fix-it” commission to recommend changes — like what Congress did with military base closures. It takes the heat off politicians and may get better results.

How This Affects Different Generations

Each generation sees this issue through a different lens:

- Boomers are mostly retired or retiring — they’re defending current benefits.

- Gen X is next in line, and feeling left out of the debate.

- Millennials fear they’re paying into a system that won’t be there.

- Gen Z often believes they’ll never benefit from Social Security, even though they’ll likely pay the most into it.

That makes reform complicated — because every fix feels unfair to someone.

What the Experts Are Saying About Social Security Tax Proposal?

Think tanks like the Urban Institute, Cato, and Brookings all agree:

Waiting makes the problem worse.

Fixing Social Security now could mean:

- Smaller tax increases

- More gradual retirement age changes

- Less disruption

But the longer Congress delays, the fewer tools will be left in the toolbox.

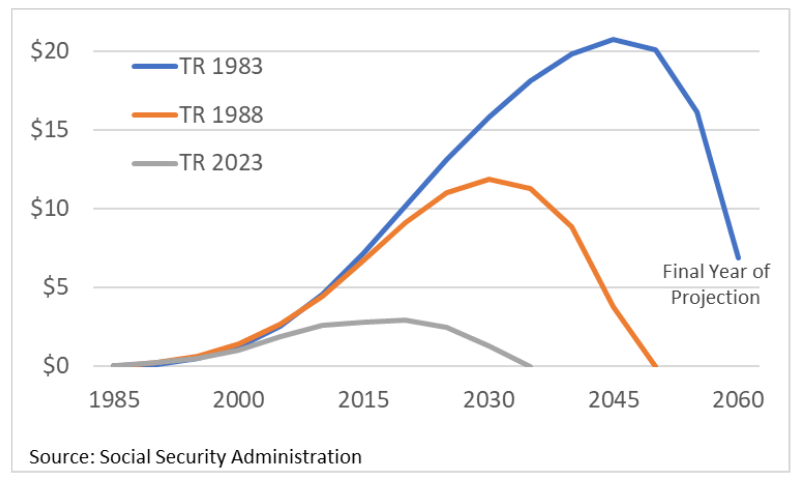

According to the 2023 Social Security Trustees Report, immediate action could restore solvency for 75 years — but political gridlock makes progress slow.

What You Can Do Now?

Even if you’re not a policymaker, you’re not powerless. Here’s what you can do:

1. Check Your Social Security Statement:

Go to ssa.gov and set up your “my Social Security” account. See your estimated benefits and earnings history.

2. Start Saving More Now:

If you can, max out your 401(k), contribute to a Roth IRA, and build a rainy-day fund.

3. Diversify Retirement Income:

Think beyond Social Security. Rental income, side hustles, investment dividends — every bit helps.

4. Contact Your Representatives:

Your voice matters. Tell Congress how you feel about tax hikes, benefit changes, or retirement age increases.

5. Talk to a Financial Advisor:

Get a plan tailored to your goals, especially if you’re nearing retirement.

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Social Security Benefits January 2026: How Much Will Your Payments Increase?