January 2026 California Social Security Payments: January 2026 Social Security Payments are a big deal this year — and knowing exact payment dates, eligibility rules, how much you can expect, and what factors affect your benefits matters whether you’re a retiree living on a fixed income, a caregiver helping a loved one, a financial advisor planning with clients, or anyone tracking government benefit policy. Every U.S. state — including California — follows the federal Social Security payment schedule because Social Security and Supplemental Security Income (SSI) are nationwide programs run by the Social Security Administration (SSA). This guide breaks down the January 2026 timetable and the rules behind it in plain English, with practical examples, official sources, and helpful planning tips. We’ll cover:

- The exact January 2026 payment dates for Social Security and SSI

- How eligibility works and what could affect your paycheck

- How the 2026 cost‑of‑living adjustment (COLA) changes amounts

- Other trends in 2026 including taxes, Medicare, earnings limits, and calendar quirks

- Strategies to plan around deadlines and maximize your benefits

Table of Contents

January 2026 California Social Security Payments

January 2026 Social Security Payments bring more than just a calendar — they reflect how SSA balances public policy, inflation, tax rules, and the U.S. calendar to deliver benefits to millions. With clear payment dates on Jan 14, 21, and 28, a 2.8% cost‑of‑living increase, and specific SSI quirks like early Dec 31 payments, this year’s schedule deserves attention. Knowing how eligibility works, how Medicare and taxes can affect your net check, and how to plan for potential double SSI payments or no checks in some months helps you stay financially stable and confident through 2026.

| Topic | Details |

|---|---|

| Social Security Payment Dates (Retirement/Disability/Survivor) | Payments on Jan 14, 21, 28, 2026 depending on birth date |

| SSI January Payment | Issued on Dec 31, 2025 due to New Year’s Day |

| 2026 COLA Increase | 2.8% increase for Social Security and SSI |

| SSI Annual Maximum (2026) | $994 individual / $1,491 couple |

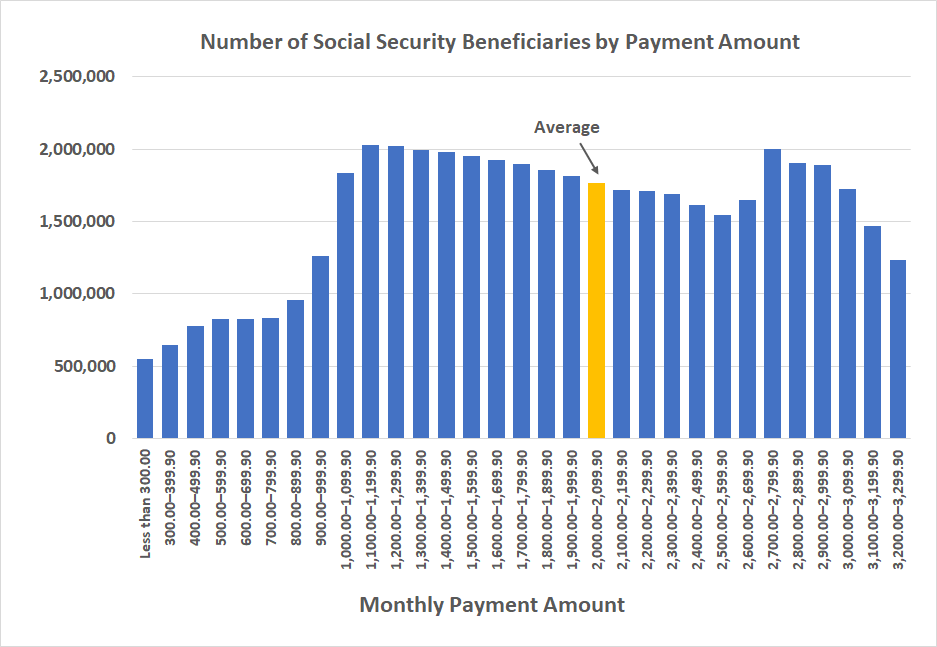

| Average Social Security Payment (Jan 2026) | ~$2,071 for retired workers |

| Wage Base for 2026 | Social Security taxable wage base $184,500 |

This table gives you the quick baseline of what’s changing and what matters most for Americans and California residents alike.

January 2026 California Social Security Payments Dates Explained

Social Security Retirement, Disability, and Survivor Benefits

SSA distributes monthly Social Security benefits based on the birth date of the primary wage earner on the record. Here’s how the schedule works in January 2026:

- Birthdays 1–10 → Payment on Wednesday, Jan 14, 2026

- Birthdays 11–20 → Payment on Wednesday, Jan 21, 2026

- Birthdays 21–31 → Payment on Wednesday, Jan 28, 2026

This pattern (second, third, and fourth Wednesday) is standard for most beneficiaries who began receiving benefits after May 1997. When the scheduled date lands on a weekend or federal holiday, the SSA moves it to the previous business day so you don’t miss your money.

There’s an important exception: people who started Social Security before May 1997 — and those who get both retirement benefits and SSI — may still be on a legacy schedule where payments fall around the third of the month. This can give you slightly different timing, and it’s worth checking your own payment history or SSA account for confirmation.

Supplemental Security Income (SSI)

Supplemental Security Income (SSI) helps people who have limited income and resources, such as older adults, blind individuals, or people with disabilities. SSI normally pays on the first of each month. But when the 1st falls on a weekend or federal holiday, payments go out on the prior business day. That’s why SSI recipients saw their January 2026 payment on Dec 31, 2025 — because Jan 1, 2026 was New Year’s Day.

Because of quirks in the calendar next year — like weekends and holidays — some months will feature two SSI payments, and others might feature none when you look purely inside the calendar month. This is totally normal and just how the schedule lines up with weekends and holidays.

How Much Will Your Payments Be in January 2026?

2026 Cost‑of‑Living Adjustment (COLA)

Every January, Social Security benefits are adjusted for inflation using the Cost‑of‑Living Adjustment (COLA). For 2026, the COLA is 2.8% — meaning most beneficiaries will see their monthly amount up by that percentage compared with 2025.

The COLA is tied to inflation data reported by the government. An AP News analysis found that the average monthly Social Security benefit increase will be about $56 more per month starting January 2026.

Here’s a sense of what that looks like:

| Type of Benefit | Before COLA | After 2.8% COLA |

|---|---|---|

| All retired workers | ~$2,015 | ~$2,071 |

| Aged couple, both receiving | ~$3,120 | ~$3,208 |

| Widowed parent with two kids | ~$3,792 | ~$3,898 |

| Aged widow(er) alone | ~$1,867 | ~$1,919 |

These averages give you a realistic picture of what most recipients are seeing.

SSI Maximum Monthly Amounts

For SSI recipients in 2026, federal maximum rates are:

- $994 per month for an individual

- $1,491 per month for a couple

These are federal limits before state supplements — some states add money on top of what the feds pay, which can make a meaningful difference in budgeting.

Understanding Eligibility — Simplified

Retirement Benefits

To qualify for Social Security retirement benefits, you generally must:

- Have earned enough work credits by paying Social Security taxes on earnings over your career

- Be at least 62 years old to start claiming (though claiming early reduces your monthly benefit)

- File a claim with the Social Security Administration before payments begin

Waiting until your full retirement age (FRA) or beyond increases the monthly amount you receive because you’ve postponed benefit claims and allowed your benefit to grow.

Disability Benefits (SSDI)

Social Security Disability Insurance (SSDI) pays income when someone is disabled and unable to work. Eligibility depends on:

- Having a qualifying medical condition that meets the SSA’s standard of disability

- Having enough recent work credits tied to your age

Supplemental Security Income (SSI)

SSI eligibility is based on need, not work history:

- Must be 65 or older, blind, or disabled

- Must have very limited income and assets

- Must meet citizenship or qualified alien requirements

If you meet these — you may qualify for SSI even if you’ve never worked or paid Social Security taxes.

Other 2026 Social Security Rules & Money Matters

Earnings Limits and Your Benefit Amount

If you work while receiving Social Security before reaching full retirement age, and you haven’t yet hit FRA, your benefits could be reduced if your earnings exceed a limit. For 2026, that limit is $24,480 for people under FRA, rising to $65,160 for those reaching FRA in the year.

The good news? Those withheld benefits are not lost. Once you hit full retirement age, the SSA recalculates and typically credits you back for months you missed.

Taxes on Social Security in 2026

Depending on your total income, up to 50% or even 85% of your Social Security benefits may be subject to federal income tax. This depends on your combined income (adjusted gross income + nontaxable interest + 50% of Social Security benefits). Some states also tax Social Security, but others do not.

Understanding your tax exposure early can help you plan withdrawals from other accounts and potentially reduce your overall tax bill.

Medicare Premiums & Hospital Costs

Medicare costs — like Part B premiums and Part A deductibles — continue to rise. For 2026, the Medicare Part B premium range depends on income, rising as high as about $689.90/month for high earners, though many pay the base rate. The Medicare Part A deductible for hospital care also increased. (rrb.gov)

Some beneficiaries see Medicare premiums deducted from their Social Security checks. A “hold‑harmless” rule can protect many retirees from seeing a net benefit reduction even when Medicare premiums go up — but it’s important to check your individual situation.

Calendar Quirks: Planning Around the Payment Schedule

Because SSA avoids weekends and federal holidays, next year’s calendar is a bit funky:

- SSI had double payments in December 2025 — Dec 1 and Dec 31 for January’s benefit — because Jan 1 was a holiday.

- SSI will also make up for Feb 1 falling on a Sunday by paying on Jan 30, 2026, meaning two SSI payments close together.

- Other months in 2026 will have months with no SSI payment followed by two in another month, simply because of how the calendar and SSA rules line up.

Knowing these quirks helps you plan bills, rent, and budgeting more accurately.

Top Tips to Get the Most From Your January 2026 California Social Security Payments

1) Use Direct Deposit or Direct Express

SSA has phased out paper checks, so having direct deposit set up with your bank or a Direct Express card is essential. This ensures payment arrives quickly, safely, and without delay.

2) Create Your “my Social Security” Account

Go to https://www.ssa.gov/myaccount to:

- See exact dates and amounts

- Update your direct deposit info

- Track your benefits over time

This tool is free and prevents confusion about payment timing.

3) Plan Around Medicare Enrollment Periods

Medicare has rules and deadlines just like Social Security. Understanding the Initial Enrollment Period, General Enrollment, and Open Enrollment windows can save you money and avoid late penalties.

Social Security Rules 2026 Explained – COLA Changes, Payment Updates, and New Maximums

January Social Security Payment Timeline – When the First 2026 Checks Will Be Deposited

Social Security January 2026 Payment Dates – Who Gets Paid First and Which Checks Arrive Early