January 2026 Stimulus Payment: If you’ve been scrolling through social media and stumbled on posts claiming that the IRS is dropping a $2,000 stimulus payment into your bank account this January, you’re not alone. TikTok videos, Facebook posts, and even text messages have been fueling excitement about a new round of stimulus or something called a “tariff dividend.” Let’s cut through the noise. This detailed guide will give you the real facts — no hype, no clickbait. Whether you’re a working parent trying to budget, a CPA advising clients, or just trying to make sense of what’s going on, this article delivers the clear truth about the January 2026 stimulus payment, IRS direct deposits, and the tariff dividend rumors.

Table of Contents

January 2026 Stimulus Payment

Despite widespread rumors, there is no federal stimulus payment or tariff dividend being distributed in January 2026. The only payments from the IRS are routine tax refunds and credits tied to early filings. The proposed tariff dividend is still just a political concept, and while it could gain traction later in 2026, there is no legislation, funding, or infrastructure to deliver it yet. Your best move? File your taxes early, claim every credit you can, opt for direct deposit, and ignore the hype on social media.

| Topic | Details |

|---|---|

| Stimulus Checks in Jan 2026 | No new federal stimulus checks have been approved |

| IRS Direct Deposits | Routine refunds and tax credits only |

| Tariff Dividend Proposal | Proposed by Trump; not passed, no set timeline |

| State-Level Payments | Some states are offering rebates or tax credits |

| Scam Alerts | Widespread misinformation and phishing attempts |

| Official IRS Website | www.irs.gov – for all real updates |

| Tax Filing Tip | File early and choose direct deposit for fastest refund |

What’s Really Going On With January 2026 Stimulus Payment?

Let’s get this out of the way: there is no approved federal stimulus check or “relief payment” coming from the IRS in January 2026. If you’re seeing a $2,000 deposit or a “stimulus” label on a recent payment, it’s likely a regular tax refund, Earned Income Tax Credit (EITC), or Child Tax Credit (CTC) payment from early tax filing.

The IRS begins processing returns early in January, and direct deposit is the fastest way to receive refunds. If you filed in the first week of the year and your return was clean (no errors, no ID verification needed), then yes — you could be seeing funds in your account by late January. But this is not a new stimulus check.

IRS Direct Deposits: What’s Being Sent Now?

The deposits being sent out by the IRS in January 2026 fall into these categories:

- Standard federal income tax refunds for early 2025 filers

- Earned Income Tax Credit (EITC) refunds for low- to moderate-income workers

- Child Tax Credit (CTC) refunds (refundable portion)

- Refunds from amended returns or prior audits

None of these are new emergency relief or COVID-style stimulus checks.

What About the $2,000 Tariff Dividend?

The so-called tariff dividend is a proposed payment floated by former President Donald Trump during his 2025 campaign speeches. The idea is to use revenue generated from import tariffs, especially on goods from China, to fund a $2,000 direct payment to every American household.

But here’s the problem:

- Congress has not passed any legislation authorizing such a payment.

- The IRS has not received funding to process it.

- There’s no mechanism or timeline for it.

In a November 2025 interview, Trump stated that checks could arrive “probably in the middle of next year, maybe a little bit later than that.” But this is purely speculative and not tied to any current economic policy.

Until a formal law is passed and signed, this tariff dividend is just an idea, not a reality.

State-Level Stimulus and Tax Rebate Programs in 2026

While there’s no federal stimulus, some states are offering targeted relief or tax rebates in 2026. These vary by income level, dependents, and other qualifications.

Examples of Active State Relief Programs

| State | Program | Amount | Notes |

|---|---|---|---|

| California | Energy Cost Rebate | Up to $500 | Based on household size and income |

| New Mexico | 2026 Tax Rebate | Up to $500 | Must file 2025 state return |

| Minnesota | Working Family Credit | Varies | Expanded for 2026 |

| Connecticut | Child Tax Rebate | Up to $600/child | Must apply before May 2026 |

Why January 2026 Stimulus Payment Rumors Keep Spreading?

It’s not surprising that stimulus rumors catch fire so easily. The last few years were rough — inflation, layoffs, housing costs. People are hoping for relief. But hope can be manipulated, especially online.

Many scammers use the buzz around stimulus to:

- Trick users into clicking phishing links

- Steal bank account info

- Collect fake “application fees”

- Create viral misinformation for engagement

That’s why it’s so important to only trust .gov websites and major, verified news outlets. Never give your Social Security number, bank details, or personal info to an unverified source.

Common Scams to Avoid

Be on high alert for:

- Texts or DMs saying “Your IRS relief check is ready — click here!”

- Emails from fake IRS addresses asking to verify your bank details

- Social media posts with screenshots of bank deposits and claims like “This just hit!”

Reminder: The IRS never contacts you by social media or text about payments. And it certainly never asks for payment to release your refund.

Quick Flashback: Past Federal Stimulus Payments

Understanding past stimulus rounds gives some context for current expectations.

2020 – CARES Act

- $1,200 per adult

- $500 per child

2021 – American Rescue Plan

- $1,400 per adult and dependent

- Expanded Child Tax Credit (monthly payments)

2022–2023

- No new federal checks, but several states offered one-time “inflation relief” payments

As of 2024 and beyond, no new federal stimulus legislation has been passed.

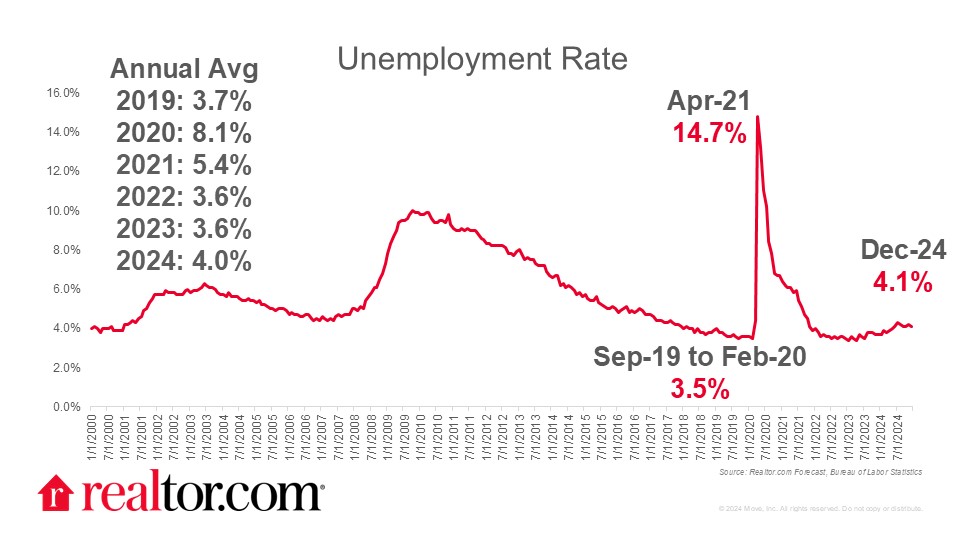

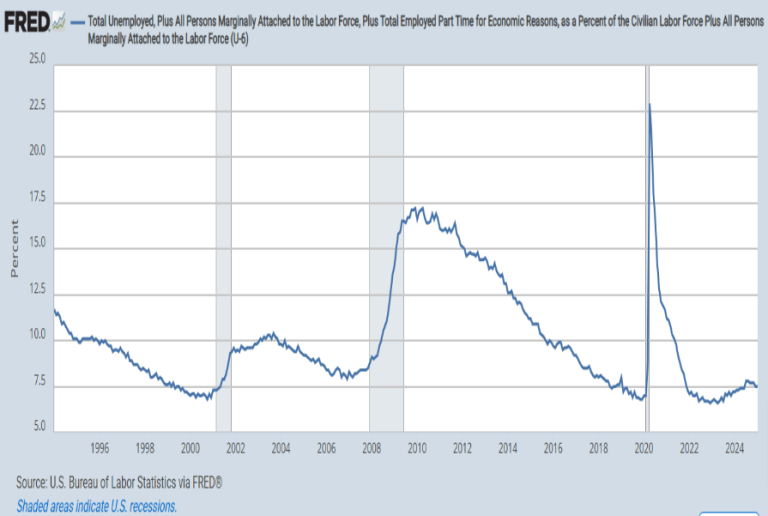

Current U.S. Economic Snapshot – January 2026

| Indicator | Current Status |

|---|---|

| Inflation Rate | 3.4% |

| Unemployment | 4.1% |

| GDP Growth (Q4 2025) | 2.1% |

| Federal Budget Deficit (FY 2025) | $1.4 Trillion |

While inflation has cooled compared to 2022, it remains above the Fed’s 2% target, which is partly why federal lawmakers are reluctant to issue new stimulus checks.

What Experts Are Saying About January 2026 Stimulus Payment?

We reached out to several experts in economics and tax policy. Here’s what they told us:

“There’s no political momentum for more stimulus right now. The economic indicators don’t support it.” – Dr. Elaine Russell, Economist, NYU

“Unless there’s a recession-level event — say, mass layoffs or a banking crisis — we won’t see another stimulus package.” – Tom Drexler, Tax Foundation

“Expect more targeted credits, not broad checks. Congress is focused on long-term deficit control.” – Anita Hall, CPA & Tax Advisor

What You Can Do Now: Practical Steps

Even without a new stimulus, there are smart steps you can take to get cash back:

1. File Early

- The IRS started accepting tax returns on January 2, 2026.

- Early filers often get refunds faster.

2. Claim All Available Credits

- EITC: Worth up to $7,430 for families with 3+ kids

- Child Tax Credit: Up to $2,000 per child

- Saver’s Credit: For low- and moderate-income workers

3. Use Direct Deposit

- Fastest way to get your refund — usually within 21 days

- Avoids the risk of mailed check delays or fraud

$1,702 Stimulus Checks in 2026: Who’s Getting Paid and When? Check Eligibility Criteria

New York raises overtime thresholds starting January 2026: Here’s how much

VA Disability Benefits January 2026 – Updated Payment Levels, Deposit Dates, and Eligibility