Social Security Payment Schedule 2026: Social Security Payment Schedule 2026 is front and center this year as millions of Americans brace for changes to their monthly benefit dates — and good news, those checks are getting bigger too. If you’re retired, living with a disability, receiving Supplemental Security Income (SSI), or caring for someone who does, you’ll want to know what’s happening in 2026 and how to prepare. We’re breaking it down in everyday language so it’s easy to understand, whether you’re 10 years old or a policy professional. The 2026 updates include larger monthly checks, calendar shifts in payment dates, and a few watch-outs like Medicare premium adjustments and tax thresholds that could affect your bottom line.

Table of Contents

Social Security Payment Schedule 2026

The Social Security Payment Schedule for 2026 brings critical updates every American should know: larger monthly checks, a 2.8% COLA, and birthdate-based payment schedules that can affect your financial flow. Add in rising Medicare costs and possible taxes, and there’s no doubt — 2026 is a planning year. The more you know, the better prepared you’ll be. Whether you’re a retiree, caregiver, or financial advisor, this information is your go-to guide for staying ahead of the curve.

| Feature | 2026 Details |

|---|---|

| COLA (Cost-of-Living Adjustment) | +2.8% increase, effective January 2026. No application required. |

| Avg. Monthly Increase | Around $56 more per month for retirees. |

| Birthdate-Based Schedule | 2nd, 3rd, or 4th Wednesday, depending on birthday. |

| SSI Dates | Typically 1st of the month, or earlier if it falls on a weekend/holiday. |

| Max Retirement Benefit | Up to $4,152 at full retirement, $5,251 if delayed to age 70. |

| Taxable Thresholds | Income above $25,000 (individuals) or $32,000 (couples) may be taxed. |

| Official SSA Info | https://www.ssa.gov/cola |

What Is Social Security and Why It Matters in 2026?

Social Security is a federal program that sends out monthly payments to qualifying Americans, including:

- Retired workers and spouses

- Disabled individuals (SSDI)

- Survivors of deceased workers

- Low-income seniors and individuals with disabilities (SSI)

Social Security touches the lives of 1 in 6 Americans. According to the Social Security Administration (SSA), more than 71 million Americans will receive benefits in 2026. It’s funded by payroll taxes — 6.2% from employees and 6.2% from employers. Over a lifetime of work, those taxes build toward your benefit.

Social Security is more than just a check. For many older adults and people with disabilities, it’s the main or only source of income.

Understanding the 2026 COLA Increase

What Is COLA?

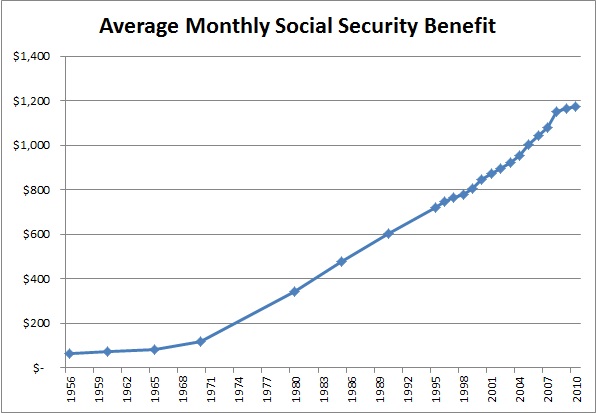

COLA stands for Cost-of-Living Adjustment. It’s an automatic raise built into Social Security to help your payments keep up with inflation. Every October, the SSA calculates the next year’s COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

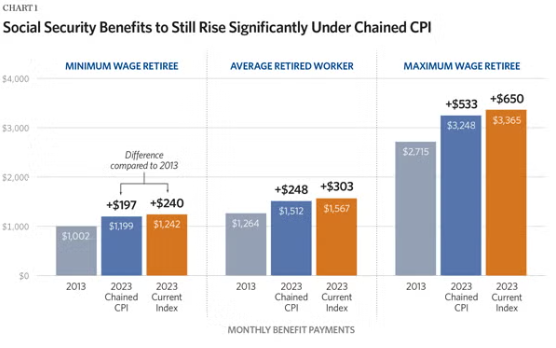

In October 2025, the SSA announced a 2.8% COLA for 2026, effective in January. This increase follows a 2.5% raise in 2025 and a 3.2% boost in 2024, showing how inflation pressures have continued to impact household budgets.

Real-World Examples

- Average Retiree Benefit: Increases from $2,015 to around $2,071/month

- SSI Individual: Grows from $943 to $994/month

- SSI Couple: Moves from $1,415 to $1,491/month

- Disability (SSDI): Average check increases from ~$1,630 to $1,675/month

- Max Benefit at FRA: Rises from $4,038 to $4,152/month

- Max Benefit at 70: Surges from ~$5,103 to $5,251/month

Your specific increase depends on your lifetime earnings, age, and when you filed. The COLA applies proportionally to every recipient.

Social Security Payment Schedule 2026

Retirement, Disability, and Survivor Benefits

Social Security payment dates for most beneficiaries are determined by the day of the month you were born.

| Birthday Range | Pay Date (Monthly) |

|---|---|

| 1st–10th | 2nd Wednesday |

| 11th–20th | 3rd Wednesday |

| 21st–31st | 4th Wednesday |

January 2026 example:

- Jan 14: born 1st–10th

- Jan 21: born 11th–20th

- Jan 28: born 21st–31st

If you started collecting before May 1997, you’ll be paid on the 3rd of the month, not on a Wednesday schedule.

SSI Payment Schedule

SSI benefits are paid on the 1st of each month. If that day is a holiday or weekend, payments are issued on the previous business day.

- Example: January 1, 2026 is a federal holiday, so SSI lands December 31, 2025.

Dual Recipients

If you receive both Social Security and SSI, you’ll usually get:

- SSI on the 1st

- Social Security on the 3rd

This remains unchanged in 2026.

What About Taxes on Social Security?

Yes, Social Security can be taxable, especially if you have other sources of income (like pensions, part-time work, or investments). The IRS sets “combined income” thresholds:

- Individuals: Benefits become taxable if combined income > $25,000

- Married couples filing jointly: Taxable if income > $32,000

As much as 85% of your benefit may be taxable depending on income level.

Tip: Use the IRS worksheet or consult a tax professional to determine how much of your Social Security will be taxed.

Watch Out: Medicare Premiums May Eat Into Your Raise

Social Security beneficiaries enrolled in Medicare Part B have their premiums automatically deducted from their checks.

- In 2026, estimates project a Part B premium increase of $5–$10 per month

- This may partially offset your COLA increase

If you qualify for Medicare Savings Programs, your state may pay your premium.

Early Retirement vs. Full Retirement Age (FRA) in 2026

If you’re planning to retire in 2026, you need to understand the impact of claiming early.

- FRA in 2026: Still 67 for those born in 1959

- Claiming at 62: You’ll only receive about 70% of your full benefit

- Delaying to 70: You’ll get 132% of your full benefit

The SSA encourages using their online tools at ssa.gov/myaccount to estimate the best claiming age based on your finances and health.

What If You’re on Disability (SSDI)?

The SSDI program supports people who’ve worked and paid into Social Security but can no longer work due to a qualifying disability.

- SSDI follows the same COLA rules as retirement

- You’ll also get the same Wednesday schedule as retirement benefits

- After 24 months on SSDI, you automatically qualify for Medicare

Is Social Security Going Broke?

Short answer: No.

Long-term, the SSA projects the Trust Funds can pay full benefits until 2034. After that, without reform, incoming payroll taxes could cover about 80% of scheduled benefits.

Several proposals are under debate in Congress, including:

- Raising the retirement age

- Increasing the wage cap on Social Security taxes

- Adjusting benefit formulas for high earners

While these discussions continue, your 2026 benefits are fully funded and secure.

State Programs: Additional Support for Low-Income Recipients

While Social Security is federal, some states offer additional supplements:

- California, New York, Massachusetts, and others add money on top of SSI.

- Programs like LIHEAP (energy assistance), SNAP (food stamps), and Medicaid can help stretch your benefits further.

Social Security Payment Schedule 2026: 2026 Action Plan

- Check Your Birthdate Payment Group

- Review COLA Impact in MySocialSecurity

- Update Direct Deposit Info

- Estimate Medicare Premium Deductions

- Review Whether You’ll Owe Taxes

- Consider Adjusting Bill Payment Dates

- Watch for Payment Shifts Around Holidays

Social Security 2026: How Much You Must Earn to Get the Highest Benefit

2026 Social Security Update: Check Important Changes to COLA, Medicare Costs, and Benefit Rules

Social Security Tax Rules by State – Where Benefits Are Still Taxed and Who Is Affected